PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1835663

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1835663

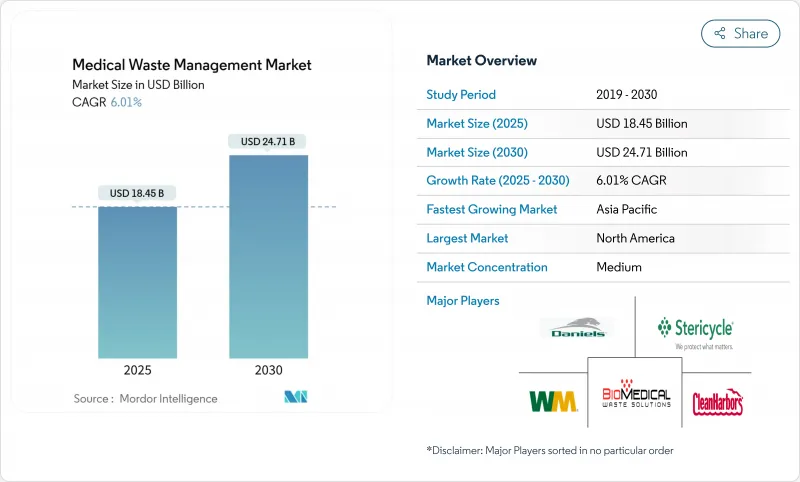

Medical Waste Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Medical Waste Management Market size is estimated at USD 18.45 billion in 2025, and is expected to reach USD 24.71 billion by 2030, at a CAGR of 6.01% during the forecast period (2025-2030).

Rapid growth stems from post-pandemic capacity building, wider tele-health adoption, and stricter multi-region regulations that raise the technical bar for safe disposal. Thermal treatment retains a leadership position, yet on-site modular systems, data-driven segregation, and circular-economy recovery services are scaling quickly across hospitals, clinics, and home-care channels. Service providers that blend compliance expertise with automation and emissions-cutting technologies are capturing premium contracts as payers and regulators tie reimbursement to environmental performance. At the same time, global supply constraints for chlorine-based chemicals and shifting incinerator permitting rules compel operators to diversify treatment portfolios and hedge regulatory risk especially in fast-growing Asian and Latin American markets.

Global Medical Waste Management Market Trends and Insights

Rising Government Funding & Public-Health Campaigns

Federal, state, and supranational programs are injecting new capital into sustainable waste infrastructure. The U.S. EPA awarded USD 58 million in 2024 under its Solid Waste Infrastructure for Recycling Grants, earmarking funds for medical waste segregation equipment and disadvantaged-community access. Similarly, the FY 2025 HHS budget requests USD 1.1 billion for environmental health initiatives that indirectly finance facility tracking and audit systems. These injections accelerate equipment upgrades, spur local treatment pilots, and prioritize vendors able to document emissions cuts and equitable service access. Providers that align proposals with environmental justice metrics and verifiable community health outcomes gain preferred-supplier status across public tenders.

Increasing Healthcare-Generated Waste Volumes

The care continuum is widening as home infusions, self-injectables, and remote diagnostics proliferate, placing regulated sharps and infectious waste in residential streams that municipal haulers are ill-equipped to manage. Health networks now juggle decentralized pick-ups, patient-education initiatives, and supply-chain redesigns for safe retrieval. Vendors offering subscription-based sharps mail-backs, IoT-enabled fill-level sensors, and tamper-proof containers are scaling quickly, especially in congested urban corridors where multi-unit dwellings complicate segregation. The distributed waste model also magnifies liability exposure, making traceability software and digital manifests a critical purchase criterion for hospital groups.

High CAPEX/OPEX For Treatment Infrastructure

Next-generation facilities require flue-gas scrubbers, energy-recovery turbines, and AI-driven feedstock controls that can push project budgets past USD 100 million, as Stericycle's Nevada plant illustrated in 2024. Operating costs climb further with skilled-labor premiums and continuous emissions monitoring. Smaller generators therefore outsource to third-party specialists, but those providers still must finance upgrades as permits sunset older units. Leasing consortia and green-bond financing are emerging to spread the investment burden, yet interest-rate volatility may slow deployments in lower-margin geographies.

Other drivers and restraints analyzed in the detailed report include:

- Tighter Multi-Region Compliance Penalties

- Healthcare Infrastructure Expansion in Emerging Markets

- Limited Staff Training in Developing Economies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hazardous waste captures a modest 17.44% volume share yet commands higher pricing and posts a 7.75% CAGR, making it the core profit engine of the medical waste management market. Pharmaceutical, chemotherapy, and radioactive categories require molecular-level destruction, secure transport, and long-term recordkeeping, creating barriers small haulers rarely breach. Conversely, non-hazardous streams maintain the bulk 82.56% share through high procedure volumes and standardized sterilization practices. Combined, these patterns signal that future winners will master categorical differentiation while leveraging scale in routine collections.

Infectious and pathological sub-streams remain the largest hazardous slice, demanding incineration or high-pressure steam autoclave cycles. Sharps volumes balloon as tele-health expands, necessitating reverse-logistics networks and tamper-proof mail-back kits. Chemical and cytotoxic disposals hinge on precise compatibility profiles, driving adoption of lab-grade segregation software. Radioactive isotope decay storage extends holding times, reducing annual throughput yet offering premium margins. Operators that offer full-spectrum handling deepen client stickiness and unlock cross-selling opportunities in audit services and training.

Thermal methods account for 59.83% revenue today, anchoring the medical waste management market via proven incinerator capacity and upgraded autoclave fleets. Energy-recovery retrofits are cutting net fuel use 10-12%, aligning with ESG goals and stabilizing operating costs as fossil-fuel prices fluctuate. Polymer and metals reclamation from ash further monetize waste streams. However, microwave, plasma, and oxidative-steam systems are scaling rapidly, turning hospitals into micro-treatment hubs with smaller environmental footprints.

Microwave units achieve 6-log reductions within five minutes and suit space-constrained clinics. Plasma gasification neutralizes chemical toxins without chlorine reagents, appealing where chemical shortages or emissions caps bite hardest. High-temperature steam systems developed in Korea process 30% of national medical waste, promising USD 54 million in annual savings if adopted nationwide. Competitive differentiation increasingly hinges on technology mix, remote monitoring, and adaptive processing recipes tuned to real-time feedstock data.

The Medical Waste Management Market Report Segments the Industry Into by Waste Type (Non-Hazardous Waste and More), Treatment Technology (Thermal, Chemical and Biological, and More), Service Type (Collection, Transportation, and Storage, and More), Treatment Site, and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America, with a 39.86% revenue share in 2024, remains the benchmark for regulation and technology. Federal rules now require e-manifests, driving IT spend on interoperable compliance platforms. Large multistate hospital chains leverage scale to adopt plastics recycling and energy-recovery technologies faster than peers elsewhere. Consolidation following Waste Management's acquisition of Stericycle produces integrated offerings spanning municipal and regulated waste streams and creates procurement clout when negotiating equipment leases.

The Asia-Pacific medical waste management market is forecast to grow 7.18% annually, fueled by hospital construction, universal health-coverage rollouts, and tightening rules. China's Zero-Waste City pilots pioneer municipal-hospital partnerships that share treatment infrastructure, while India's under-segregation rates invite foreign expertise packaged with robust training and digital tracking. Japan's dense urban clusters rely on incineration, yet recycling mandates will push adoption of plastics sorting and chemical depolymerization. Flexibility in technology choice and local-language staff certification give multinational providers an edge.

Europe follows a harmonized legal framework that continues to elevate sustainability thresholds. Extended Producer Responsibility schemes coming in 2026 place direct cost on non-recyclable healthcare packaging, incentivizing design-for-recycling and boosting demand for material recovery services. Emissions caps narrow incinerator margins, spurring investment in microwave and plasma units, especially in smaller EU member states where permitting pathways are shorter.

Middle East & Africa combine high per-capita healthcare spending in Gulf Cooperation Council states with rising infrastructure builds in Sub-Saharan Africa. Population growth and infectious-disease burdens accelerate waste volumes, yet regulatory guidelines lag, creating white-space for turnkey solutions. South America witnesses resilient investment in hospital modernization amid currency volatility, with Brazil and Chile piloting decentralized autoclave networks. Across these emerging regions, donor-funded green-hospital initiatives create entry doors for providers that emphasize ESG reporting and local-skills transfer.

- Stericycle Inc.

- Veolia Environnement Services

- Waste Management Inc.

- Clean Harbors Inc.

- SUEZ SA

- Republic Services Inc.

- Daniels Sharpsmart

- Triumvirate Environmental

- Remondis Medison GmbH

- Sharps Compliance

- Biomedical Waste Solutions LLC

- MedWaste Management

- BWS Inc.

- Gamma Waste Systems

- Inciner8 Ltd.

- Assure Waste Management

- GIC Medical Disposal

- Bio-Serve Biotechnologies

- MW Healthcare Waste Solutions

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Government Funding & Public-Health Campaigns

- 4.2.2 Increasing Healthcare-Generated Waste Volumes

- 4.2.3 Tighter Multi-Region Compliance Penalties

- 4.2.4 Healthcare Infrastructure Expansion in Emerging Markets

- 4.2.5 Tele-Health Driven At-Home Sharps Surge

- 4.2.6 Adoption of Compact Microwave Disinfection Units

- 4.3 Market Restraints

- 4.3.1 High CAPEX/OPEX For Treatment Infrastructure

- 4.3.2 Limited Staff Training in Developing Economies

- 4.3.3 Volatile Emissions Rules Curbing Incinerator Permits

- 4.3.4 Chlorine-Based Chemical Supply Bottlenecks

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Waste Type

- 5.1.1 Non-hazardous

- 5.1.2 Hazardous

- 5.1.2.1 Infectious & Pathological

- 5.1.2.2 Pharmaceutical

- 5.1.2.3 Chemical

- 5.1.2.4 Radioactive

- 5.1.2.5 Sharps

- 5.2 By Treatment Technology

- 5.2.1 Thermal (Incineration, Autoclave, Microwave)

- 5.2.2 Chemical & Biological

- 5.2.3 Irradiation & Other Emerging

- 5.3 By Service Type

- 5.3.1 Collection, Transportation & Storage

- 5.3.2 Treatment and Disposal

- 5.3.3 Recycling and Material Recovery

- 5.3.4 Compliance and Audit Services

- 5.4 By Treatment Site

- 5.4.1 Off-site

- 5.4.2 On-site

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.5.4 South Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Stericycle Inc.

- 6.3.2 Veolia Environnement Services

- 6.3.3 Waste Management Inc.

- 6.3.4 Clean Harbors Inc.

- 6.3.5 SUEZ SA

- 6.3.6 Republic Services Inc.

- 6.3.7 Daniels Sharpsmart Inc.

- 6.3.8 Triumvirate Environmental

- 6.3.9 Remondis Medison GmbH

- 6.3.10 Sharps Compliance Inc.

- 6.3.11 Biomedical Waste Solutions LLC

- 6.3.12 MedWaste Management

- 6.3.13 BWS Inc.

- 6.3.14 Gamma Waste Systems

- 6.3.15 Inciner8 Ltd.

- 6.3.16 Assure Waste Management

- 6.3.17 GIC Medical Disposal

- 6.3.18 Bio-Serve Biotechnologies

- 6.3.19 MW Healthcare Waste Solutions

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment