PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842633

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842633

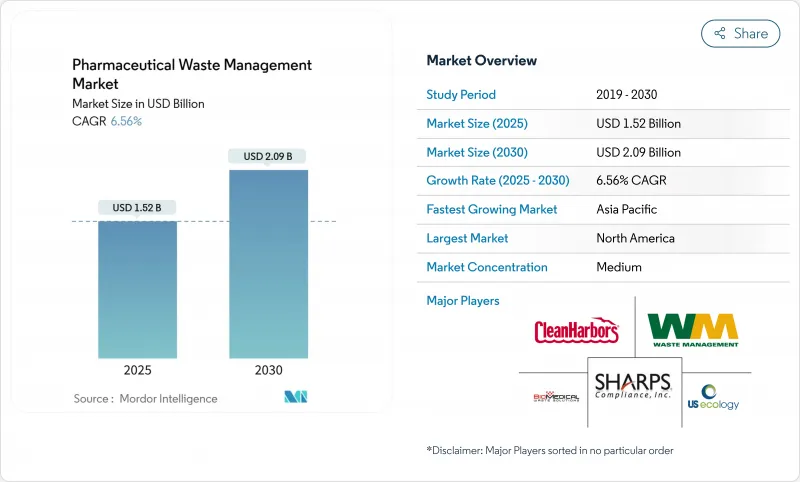

Pharmaceutical Waste Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Pharmaceutical Waste Management Market size is estimated at USD 1.52 billion in 2025, and is expected to reach USD 2.09 billion by 2030, at a CAGR of 6.56% during the forecast period (2025-2030).

Rising enforcement of EPA Subpart P rules, the European Union's Urban Wastewater Treatment Directive, and similar measures in Asia-Pacific are pushing healthcare facilities to adopt comprehensive disposal programs rather than reactive fixes. Expansion of biopharmaceutical manufacturing, rapid consumer take-back initiatives, and sustained investment in advanced oxidation, microwave, and supercritical water technologies further reinforce demand. Intensifying environmental scrutiny and public transparency expectations motivate hospitals and manufacturers to link waste stewardship with broader climate and ESG objectives, while market consolidation allows large players to spread compliance costs across wider networks and invest in innovation that smaller competitors cannot easily replicate.

Global Pharmaceutical Waste Management Market Trends and Insights

Increasing Pharmaceutical Production

Global drug output continues to climb, and biologics add complex cytotoxic residues that require specialized containment and high-temperature destruction. Single-use bioprocessing lowers cross-contamination risk but raises plastic volumes that many recyclers cannot handle. Manufacturers pursuing zero-liquid-discharge have cut biological and chemical oxygen demand by up to 90%, showing clear operational savings alongside compliance gains. Emerging production hubs in India, Vietnam, and the Philippines deepen the pharmaceutical waste management market as these regions race to match disposal infrastructure with capacity expansion. Full-service providers able to integrate solid, liquid, and cytotoxic waste solutions now enjoy a competitive edge.

Stringent Regulatory Compliance

The EPA ban on sewering hazardous pharmaceuticals, the DEA review of non-incineration destruction options, and Europe's Extended Producer Responsibility cost-recovery model shift disposal costs upstream. Hospitals in jurisdictions adopting Subpart P now maintain detailed cradle-to-grave manifests, and very small quantity generators face sharper training mandates. German drug makers alone expect EUR 36 billion in micropollutant removal fees over three decades, underscoring why pharmaceutical waste management market participants with robust compliance consulting departments win larger contracts. Cross-border operators also navigate differing take-back, labeling, and reverse-logistics rules, reinforcing the value of global scale.

High Disposal & Compliance Costs for Hazardous Pharma Waste

Regulated medical waste often costs USD 0.20-0.50 per pound versus USD 0.03-0.08 for general trash, straining small clinics that spend USD 160-360 monthly on disposal. CMS refund rules on discarded single-dose drugs add further administrative burden. Misclassification remains rampant-studies show education programs can boost correct segregation by 65%, but facilities lacking budget postpone training. Price pressure pushes buyers to competitive bids, compressing margins even as operators shoulder higher capital outlays for new kilns or advanced oxidation units.

Other drivers and restraints analyzed in the detailed report include:

- Growing Environmental Concerns

- Advancements in Waste Treatment Technologies

- Resistance to Adoption of New Technologies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Prescription drugs represented 40.26% of pharmaceutical waste management market size in 2024. Hospitals, long-term care facilities, and retail pharmacies treat these as mixed hazardous streams demanding incineration or advanced oxidation for safe destruction. Meanwhile, controlled substances comprise the fastest-growing slice, logging a 7.63% CAGR as regulators tighten diversion controls.

Heightened DEA oversight fuels mail-back envelope schemes for opioids, and pilot chemical degradation systems now deliver complete molecular breakdown without incineration. The pharmaceutical waste management market increasingly prizes vendors capable of preserving chain-of-custody integrity through tracked containers, monitored vaults, and blockchain logs. Cytotoxic chemotherapy agents form a smaller yet high-margin segment requiring closed-system transfer devices, while veterinary pharmaceuticals and OTC products round out the mix with simplified protocols under updated EPA nicotine exclusion rules.

The Pharmaceutical Waste Management Market Report Segments the Industry Into Type of Waste (Prescription Drugs, Controlled Substances, and More), Waste Generator (Hospitals & Clinics, Retail Pharmacies, and More), Treatment Site (Onsite Treatment and Offsite Treatment), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the pharmaceutical waste management market with 39.91% share in 2024, anchored by mature regulatory enforcement and capital-intensive infrastructure. Recent investments include a USD 110 million Nevada incinerator that couples waste-to-energy with water reuse, plus a planned Arkansas facility that guarantees incineration capacity for another five years. Cross-border harmonization under the Basel Convention streamlines shipments between the United States, Canada, and Mexico, enabling nationwide service networks to optimize routing and reduce emissions.

Asia-Pacific is the fastest-growing region at an 8.83% CAGR through 2030. China's anti-espionage rules complicate API exports and raise domestic disposal demand, while India's draft Liquid Waste Management Rules 2024 impose extended responsibility on high-volume water users. Japan's push for membrane-based water-for-injection systems underscores the region's tilt toward energy-efficient treatment methods. Southeast Asian countries continue to attract contract manufacturing, creating sizeable yet infrastructure-limited demand for advanced destruction services.

Europe is undergoing a regulatory overhaul that links pharmaceutical packaging, wastewater micropollutant removal, and producer responsibility. Germany's EUR 36 billion compliance tab over 30 years epitomizes the financial magnitude of forthcoming upgrades. European Medicines Agency guidelines now embed persistence, bio-accumulation, and toxicity criteria in environmental risk assessments, compelling manufacturers to support downstream treatment costs. Providers with pan-EU compliance platforms and specialized high-temperature capacity stand to consolidate market share as smaller collectors exit due to capital constraints.

- Stericycle

- Waste Management Inc.

- Clean Harbors Inc.

- Veolia Environnement SA

- Suez

- Sharps Compliance

- BioMedical Waste Solutions LLC

- Covanta Holding

- US Ecology Inc.

- Daniels Health

- Triumvirate Environmental

- Remondis Medison GmbH

- GIC Medical Waste Disposal

- PharmWaste Technologies Inc.

- Republic Services Inc.

- MedPro Disposal LLC

- GRP & Associates

- Sterimed Medical Waste Solutions

- Ecocycle Inc.

- Heritage Environmental Services

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Pharmaceutical Production

- 4.2.2 Stringent Regulatory Compliance

- 4.2.3 Growing Environmental Concerns

- 4.2.4 Advancements in Waste Treatment Technologies

- 4.2.5 Public Awareness and Corporate Responsibility

- 4.2.6 Expansion of Healthcare and Biopharma Manufacturing Capacity

- 4.3 Market Restraints

- 4.3.1 High Disposal & Compliance Costs for Hazardous Pharma Waste

- 4.3.2 Resistance to Adoption of New Technologies

- 4.3.3 Limited Infrastructure in Developing Regions

- 4.3.4 Fragmented Reverse Logistics Regulations Across Borders

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Type of Waste

- 5.1.1 Prescription Drugs

- 5.1.2 Over-The-Counter (OTC) Waste

- 5.1.3 Controlled Substances

- 5.1.4 Chemotherapy Drugs

- 5.1.5 Veterinary Pharmaceuticals

- 5.1.6 Other Waste Type

- 5.2 By Waste Generator

- 5.2.1 Hospitals & Clinics

- 5.2.2 Retail Pharmacies

- 5.2.3 Biopharma Manufacturing Sites

- 5.2.4 Long-term Care & Nursing Homes

- 5.2.5 Research Laboratories

- 5.3 By Treatment Site

- 5.3.1 Onsite Treatment

- 5.3.2 Offsite Treatment

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Stericycle

- 6.3.2 Waste Management Inc.

- 6.3.3 Clean Harbors Inc.

- 6.3.4 Veolia Environnement SA

- 6.3.5 Suez SA

- 6.3.6 Sharps Compliance Inc.

- 6.3.7 BioMedical Waste Solutions LLC

- 6.3.8 Covanta Holding Corporation

- 6.3.9 US Ecology Inc.

- 6.3.10 Daniels Health

- 6.3.11 Triumvirate Environmental

- 6.3.12 Remondis Medison GmbH

- 6.3.13 GIC Medical Waste Disposal

- 6.3.14 PharmWaste Technologies Inc.

- 6.3.15 Republic Services Inc.

- 6.3.16 MedPro Disposal LLC

- 6.3.17 GRP & Associates

- 6.3.18 Sterimed Medical Waste Solutions

- 6.3.19 Ecocycle Inc.

- 6.3.20 Heritage Environmental Services

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment