PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836444

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836444

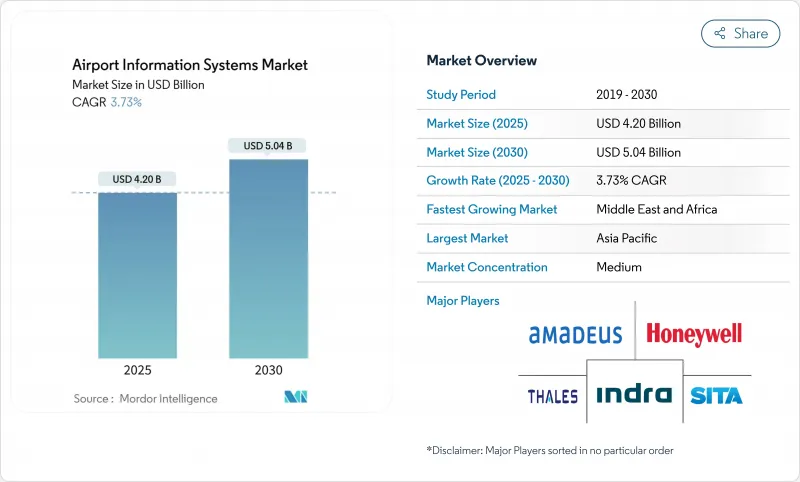

Airport Information Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The airport information systems market size is valued at USD 4.20 billion in 2025 and is forecasted to reach USD 5.04 billion by 2030, advancing at a 3.73% CAGR.

Passenger volumes are stabilizing after pandemic-era contractions, enabling airports to shift capital toward modern data platforms, biometric checkpoints, and collaborative decision-making tools rather than large physical expansions. Cloud-native software replaces siloed legacy hardware as operators pursue zero-touch processing mandates and tighter integration of airside and terminal functions. Spending accelerates in regions that view aviation as a strategic economic lever, notably the Gulf states and fast-growing Southeast Asian hubs. North American and European facilities channel budgets into life-cycle extensions and cybersecurity hardening. Competitive activity centers on multiyear infrastructure contracts that bind airports to vendors able to bundle networks, analytics, biometrics, and baggage automation into one service stack.

Global Airport Information Systems Market Trends and Insights

Sustained Recovery in Global Air Passenger Traffic

Passenger numbers have rebounded to 2019 levels in several large domestic markets, prompting airports to recalibrate long-range fleet-mix forecasts, gate-allocation algorithms, and baggage-sorter capacities. FAA Airport Infrastructure Grants totaling USD 289 million across 129 US facilities in 2024 signal policy confidence that demand will remain upward. Rather than reverting to square-footage expansions, operators are implementing predictive-demand engines that shift gates and staff in real time, a lesson distilled from pandemic-era volatility. Brussels Airport's AI forecasting suite cut standby resource buffers while maintaining service-level targets. In Asia-Pacific, Chinese domestic traffic surpassed pre-pandemic highs in late 2024, accelerating orders for automated boarding bridges and dynamic check-in counters. These patterns collectively push the airport information systems market toward platforms that can flex passenger journeys hour by hour.

Accelerated Airport Modernization and Expansion Programs

Large-scale capital programs have compressed timelines from decades to single plan cycles as authorities couple physical rebuilds with full digital twins. Sacramento International Airport's USD 1.3 billion SMForward initiative aligns seven concurrent projects on one data backbone scheduled for completion in 2028. O'Hare's USD 9 billion plan uses a common cloud database so concrete contractors, systems integrators, and airlines upload milestone updates in near real time. The FAA flagged 51 unsustainable air-traffic-control subsystems, unlocking accelerated procurement windows for turnkey modernization packages. In the Gulf, Saudi Arabia bundles terminal construction contracts with mandatory integration of biometric corridors and AI ground-handling robots under Vision 2030 guidelines. These programs raise baseline functionality expectations, pulling smaller airports toward similar architectures through government grant stipulations, and expanding the airport information systems market deeper into mid-tier facilities.

Significant Capital Investment and Integration Complexity

End-to-end overhauls often combine runway upgrades, seismic retrofits, and IT refreshes, producing multi-layered interface maps that inflate project risk. The FAA estimates several tower-automation replacements could take eight years due to safety-case validations. San Francisco International's USD 2.6 billion Terminal 3 West rebuild intertwines structural steel sequencing with cybersecurity baselines, demonstrating how non-IT tasks can delay system cut-overs. Small airports lack in-house integration architects, leaving them dependent on turnkey vendors whose bundled offers may exceed budget caps. Financing constraints, therefore, postpone many deployments until grant cycles align, keeping portions of the airport information systems market locked behind capital hurdles.

Other drivers and restraints analyzed in the detailed report include:

- Passenger-Experience Focus on Self-Service and Biometrics

- Airport Collaborative Decision-Making (A-CDM) Adoption Surge

- Rising Concerns Over Cybersecurity Vulnerabilities and Data Privacy

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Security platforms will expand at a 5.89% CAGR through 2030 as airports counter rising cyber and physical threats. Passenger Information Technology still accounts for 35.41% of 2024 revenue, cementing its role as the public-facing backbone of the airport information systems market. Biometric border-crossing gates, perimeter-intrusion systems, and AI-enhanced video analytics dominate new investments, while traditional flight-status displays migrate to cloud dashboards. The airport information systems market size allocated to Security platforms is expected to climb sharply once zero-trust architectures become mandatory under forthcoming US and EU regulations.

Ground Handling software integrates with Passenger Information feeds to mitigate staffing gaps, reducing turnaround times amid persistent labor shortages. Finance and operations modules pick up momentum from cloud migrations that compress report-generation cycles at hubs such as Hartsfield-Jackson Atlanta. Maintenance applications grow as predictive analytics engines like Honeywell Ensemble convert engine-health data into automated work orders, shrinking unplanned downtime.

Terminal-Side suites led the airport information systems market with 52.78% revenue in 2024, thanks to widespread adoption of common-use self-service kiosks and departure control systems. Yet, Airside solutions are outpacing with a 6.12% CAGR as capacity-constrained airports lean on remote-tower feeds, collaborative surveillance, and routable data lakes.

Flight information display systems and airport operations databases now share real-time streams with Airside Resource Management modules, enabling data-driven gate allocation and pushback sequencing. Adopting the IATA CUSS Toolkit continues to anchor interoperability, while the biometric kiosks at Tokyo's Haneda Airport signal the next leap toward queueless terminals. On the Airside, point-merge arrival procedures at Lisbon Airport have lowered cumulative delays by 200,000 minutes, proving the ROI of digital rather than physical expansion.

The Airport Information Systems Market Report is Segmented by Application (Maintenance, Ground Handling, Finance and Operations, Security, and Passenger Information), System Area (Airside Systems, and Terminal-Side Systems), Deployment Mode (On-Premise and Cloud/SaaS), Airport Size (Class A, Class B, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific holds 28.90% of revenue in 2024, powered by sovereign investment programs exceeding USD 240 billion through 2035, including Singapore Changi Terminal 5 and Vietnam's Long Thanh megaproject. These green-field builds integrate biometric immigration, AI-based baggage handling, and renewable-powered data centers from the blueprint stage, embedding digital resiliency into long-term capacity forecasts.

The Middle East and Africa lead growth at a 5.30% CAGR. Dubai's USD 35 billion Al Maktoum International expansion targets 260 million annual passengers, while Abu Dhabi installs tarmac-wide guidance lighting and advanced surface-movement radars. Saudi Arabia's Vision 2030 funnels multi-billion-dollar funds toward new terminals at Riyadh and NEOM. As a result, the airport information systems market in the Gulf is skewing toward large integrated contracts that combine baggage robots, AI-driven command centers, and biometric border-control corridors.

North America invests in life-extension and digital retrofits for aging assets. FAA analysis shows 37% of 138 tower systems as unsustainable, unlocking billion-dollar modernization tranches earmarked for open-architecture surveillance and virtual tower modules. O'Hare and Dallas-Fort Worth each run USD 9 billion projects that align concrete overhauls with cloud analytics. Europe standardizes on the Entry/Exit System (EES), prompting rapid uptake of biometric enrollment kiosks and automated passport eGates to comply with pan-EU regulations. South America adopts a piecemeal approach: Brazil's top five airports install baggage-tracking RFID and self-bag-drop units to handle traffic rebounds linked to domestic tourism booms.

- SITA N.V.

- Amadeus IT Group, S.A.

- Honeywell International Inc.

- THALES Group

- Indra Sistemas, S.A.

- RTX Corporation

- Airport Information Systems

- IBM Corporation

- NEC Corporation

- Samsung Electronics Co., Ltd.

- T-Systems International GmbH

- Siemens AG

- VISION BOX - SOLUCOES DE VISAO POR COMPUTADOR, S.A.

- Materna IPS GmbH

- Beumer Group

- INFORM Institut fur Operations Research und Management GmbH

- ADB SAFEGATE

- Frequentis AG

- Damarel Systems International Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Sustained recovery and growth in global air passenger traffic

- 4.2.2 Accelerated airport modernization and expansion programs

- 4.2.3 Passenger-experience focus driving self-service and biometrics

- 4.2.4 Airport Collaborative Decision-Making (A-CDM) adoption surge

- 4.2.5 Deployment of 5G/private networks enabling real-time analytics

- 4.2.6 Health-driven zero-touch processing mandates

- 4.3 Market Restraints

- 4.3.1 Significant capital investment and integration complexity

- 4.3.2 Rising concerns over cybersecurity vulnerabilities and data privacy

- 4.3.3 Proprietary legacy systems limiting cross-platform interoperability

- 4.3.4 Shortage of advanced analytics and IT expertise among airport operators

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Application

- 5.1.1 Maintenance

- 5.1.2 Ground Handling

- 5.1.3 Finance and Operations

- 5.1.4 Security

- 5.1.5 Passenger Information

- 5.2 By System Area

- 5.2.1 Airside Systems

- 5.2.1.1 Flight Information Display Systems (FIDS)

- 5.2.1.2 Airport Operations Database (AODB)

- 5.2.1.3 Resource Management Systems (RMS)

- 5.2.1.4 Air Traffic Management (ATM) Integration

- 5.2.2 Terminal-Side Systems

- 5.2.2.1 Departure Control Systems (DCS)

- 5.2.2.2 Common-Use Passenger Processing (CUPPS/CUTE)

- 5.2.2.3 Self-Service Kiosks and Digital Signage

- 5.2.1 Airside Systems

- 5.3 By Deployment Mode

- 5.3.1 On-premise

- 5.3.2 Cloud/SaaS

- 5.4 By Airport Size

- 5.4.1 Class A

- 5.4.2 Class B

- 5.4.3 Class C

- 5.4.4 Class D

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 SITA N.V.

- 6.4.2 Amadeus IT Group, S.A.

- 6.4.3 Honeywell International Inc.

- 6.4.4 THALES Group

- 6.4.5 Indra Sistemas, S.A.

- 6.4.6 RTX Corporation

- 6.4.7 Airport Information Systems

- 6.4.8 IBM Corporation

- 6.4.9 NEC Corporation

- 6.4.10 Samsung Electronics Co., Ltd.

- 6.4.11 T-Systems International GmbH

- 6.4.12 Siemens AG

- 6.4.13 VISION BOX - SOLUCOES DE VISAO POR COMPUTADOR, S.A.

- 6.4.14 Materna IPS GmbH

- 6.4.15 Beumer Group

- 6.4.16 INFORM Institut fur Operations Research und Management GmbH

- 6.4.17 ADB SAFEGATE

- 6.4.18 Frequentis AG

- 6.4.19 Damarel Systems International Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment