PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836456

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836456

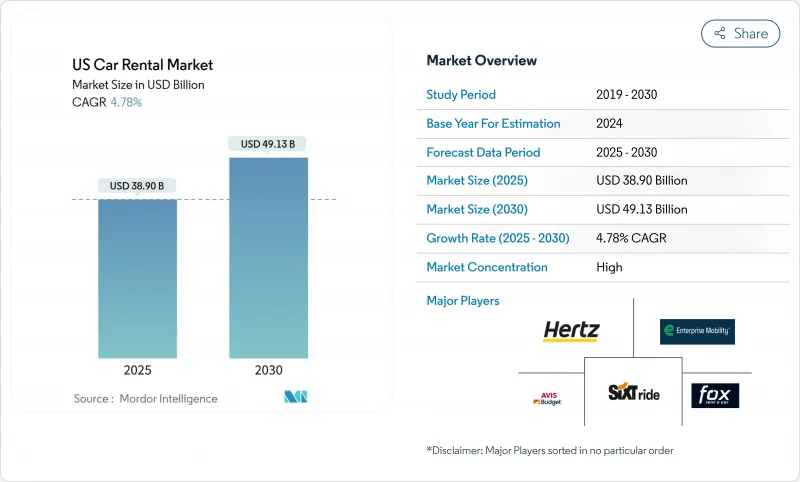

US Car Rental - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The US Car Rental market is valued at USD 38.90 billion in 2025 and is projected to reach USD 49.13 billion by 2030, expanding at a 4.78% CAGR.

The trajectory underscores the sector's resilience as domestic road-trip culture, hybrid-work patterns, and a swing back toward in-person meetings restore steady rental demand. Growth is reinforced by the 72.23% penetration of online booking channels, the South region's outsized traveler volumes, and accelerated fleet electrification programs that draw leisure and corporate customers. At the same time, persistent vehicle supply constraints and rising capital costs temper near-term expansion, prompting operators to optimize fleet mix and pursue data-driven pricing. Heightened competition from peer-to-peer marketplaces and ride-hailing services is nudging incumbents to invest in contactless experiences, predictive analytics, and diversified service models.

US Car Rental Market Trends and Insights

Surge in Domestic Road-Trip Leisure Demand

Pent-up wanderlust and cost-sensitive travelers have made cars the preferred mode for leisure trips, lifting the leisure segment. In response, operators are broadening their inventories to include more SUVs and crossovers, which command higher daily rental rates and cater better to family travel needs. The South and West remain hotspots, with national parks and scenic coastal routes driving consistent demand. Enhanced fuel efficiency in these larger vehicles, coupled with enticing loyalty program benefits, is making rentals more appealing than ownership for leisure trips.

Rapid Growth of Online & Mobile Booking Channels

Digital convenience now underpins all reservations, confirming a lasting pivot toward app-based experiences. Fast-acting firms introduced contactless pick-up, AI chatbots, and one-tap payment flows, driving repeat usage and higher ancillary-service attachment rates. Hertz's rollout of Apple Pay across US locations shows how streamlined payment options reduce counter time and boost customer satisfaction. Mobile-first interfaces also enable dynamic pricing that reacts to localized events, bolstering yield management. The data captured from user journeys feeds predictive models that reposition fleet units in near real time, lifting utilization ratios and moderating capital intensity.

Persistent New-Vehicle Supply Constraints & High CAPEX

Financing rates for fleet purchases surged during 2024 as monetary tightening raised borrowing costs, squeezing cash flows for operators. Chip shortages and OEM allocations that favor retail buyers have limited fleet deliveries, forcing rental firms to extend holding periods or compete for late-model used cars at premium prices. Elevated acquisition costs compress margins and complicate pricing strategies, especially when customers remain price sensitive. The scarcity of economy trims-OEMs have prioritized higher-margin variants-nudges renters toward bigger vehicles, driving higher daily rates and reducing depreciation. Fleet managers now dedicate more resources to remarketing execution, acknowledging that resale timing can determine profitability in a volatile wholesale market.

Other drivers and restraints analyzed in the detailed report include:

- OEM-Backed Electrification of Rental Fleets

- Flexible Fleet-Leasing Demand from Hybrid-Work Corporations

- Residual-Value Risk from Low-Priced Chinese EV Imports

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Leisure rentals captured 58.32% of 2024 revenue, generating the largest US car rental market income slice and posting a 5.32% CAGR outlook through 2030. Road trip culture, national park tourism, and flexible vacation timing under hybrid work policies lengthen rental durations and boost average daily rate (ADR) performance.

Leisure travel is adding momentum as professionals extend work trips for personal recreation, lengthening contracts and enhancing profitability. For incumbents, packaging loyalty benefits such as free class upgrades encourages customers to stay within the brand ecosystem while reinforcing occupancy during shoulder periods. The resulting utilization gains support capital-return targets even as acquisition outlays rise.

Economy models still dominate fleet counts with a 59.87% share. Yet the SUV and crossover category, noted for 12.48% CAGR, is redefining revenue mix as customers prioritize space and perceived safety. Operators capitalize on higher ADRs for larger vehicles, offsetting inflationary costs in fleet procurement.

OEM production shifts toward premium trims constrain economy-car supply, forcing rental companies to balance customer budgets against availability. Telematics now guides micro-fleet allocation, positioning SUVs where family vacation demand peaks. The strategy maximizes utilization and lowers repositioning miles, contributing to reduced operating expenses even as statutory insurance premiums climb.

The US Car Rental Market Report is Segmented by Application (Leisure and Tourism and Business and Corporate), Vehicle Type (Economy and Budget Cars, and More), Booking Channel (Online and Offline), Rental Duration (Short-Term, and More), Propulsion (ICE Vehicles, and More), Service Model (Traditional Corporate Fleets and Peer-To-Peer Platforms), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Enterprise Holdings Inc.

- Hertz Global Holdings Inc.

- Avis Budget Group Inc.

- Sixt SE

- Fox Rent A Car

- Ace Rent A Car

- Advantage Rent A Car

- U-Save Car & Truck Rental

- Turo Inc.

- Getaround Inc.

- Kyte

- HyreCar Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in domestic road-trip/leisure demand

- 4.2.2 Rapid growth of online & mobile booking channels

- 4.2.3 OEM-backed electrification of rental fleets

- 4.2.4 Flexible fleet-leasing demand from hybrid-work corporates

- 4.2.5 Peer-to-peer supply expansion & price discovery

- 4.2.6 Telematics-driven OPEX optimisation

- 4.3 Market Restraints

- 4.3.1 Persistent new-vehicle supply constraints & high CAPEX

- 4.3.2 Residual-value risk from low-priced Chinese EV imports

- 4.3.3 Escalating airport concession & local taxation costs

- 4.3.4 Modal substitution by ride-hailing & subscription MaaS

- 4.4 Value / Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Application

- 5.1.1 Leisure and Tourism

- 5.1.2 Business and Corporate

- 5.2 By Vehicle Type

- 5.2.1 Economy and Budget Cars

- 5.2.2 Luxury and Premium Cars

- 5.2.3 SUVs and Crossovers

- 5.3 By Booking Channel

- 5.3.1 Online (Web & App)

- 5.3.2 Offline (Counter & Phone)

- 5.4 By Rental Duration

- 5.4.1 Short-Term (less than 30 days)

- 5.4.2 Long-Term and Subscription (more than 30 days)

- 5.5 By Propulsion

- 5.5.1 ICE Vehicles

- 5.5.2 Hybrid-Electric Vehicles

- 5.5.3 Battery-Electric Vehicles

- 5.6 By Service Model

- 5.6.1 Traditional Corporate Fleets

- 5.6.2 Peer-to-Peer Platforms

- 5.7 By Geography

- 5.7.1 Northeast

- 5.7.2 Midwest

- 5.7.3 South

- 5.7.4 West

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves & Partnerships

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Enterprise Holdings Inc.

- 6.4.2 Hertz Global Holdings Inc.

- 6.4.3 Avis Budget Group Inc.

- 6.4.4 Sixt SE

- 6.4.5 Fox Rent A Car

- 6.4.6 Ace Rent A Car

- 6.4.7 Advantage Rent A Car

- 6.4.8 U-Save Car & Truck Rental

- 6.4.9 Turo Inc.

- 6.4.10 Getaround Inc.

- 6.4.11 Kyte

- 6.4.12 HyreCar Inc.

7 Market Opportunities & Future Outlook