PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836463

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836463

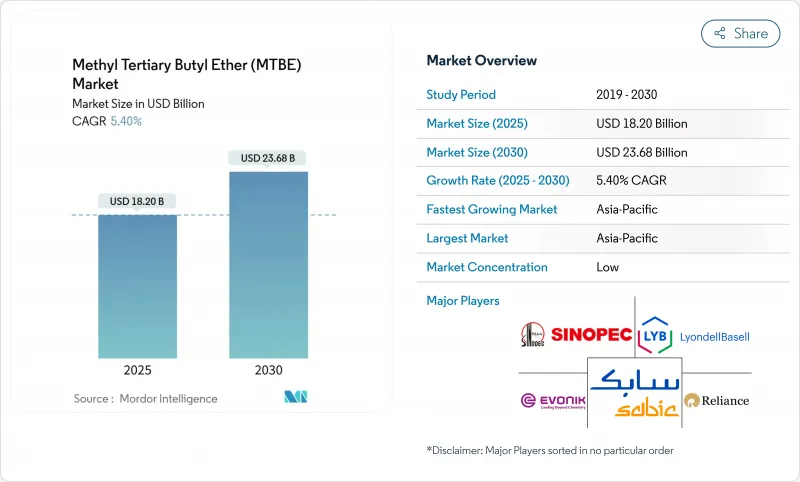

Methyl Tertiary Butyl Ether (MTBE) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Methyl Tertiary Butyl Ether Market size is estimated at USD 18.20 billion in 2025, and is expected to reach USD 23.68 billion by 2030, at a CAGR of 5.40% during the forecast period (2025-2030).

Demand is rooted in the shift toward cleaner-burning, high-octane gasoline, mounting petro-refinery expansion in the Middle East, and steady uptake in pharmaceutical extraction processes. Integrated refinery-petrochemical complexes give producers flexibility to balance gasoline additive volumes with rising requirements for high-purity isobutylene used in synthetic rubber. Asia Pacific emission standards, such as China-6, continue to lift average MTBE blend rates in premium fuel grades, while methanol-to-gasoline projects across China extend the addressable pool for MTBE as an intermediate.

Global Methyl Tertiary Butyl Ether (MTBE) Market Trends and Insights

Surging Low-Aromatic, High-Octane Gasoline Mandates in Asia Pacific

China-6 regulations require lower tail-pipe ammonia emissions; controlled studies show MTBE blends deliver measurable reductions during cold-start cycles at low ambient temperatures. Refiners in China and India are lifting blend ratios from 8% to 15% in premium grades. Robust passenger-car sales and steady urban fleet renewal further support demand. Regional fuel marketers prefer MTBE because it raises research octane at a lower cost than alkylate or ethanol under vapour-pressure limits. These mandates underpin sustained investment in dedicated MTBE trains adjacent to catalytic reformers, giving Asian producers scale economies that offset raffinate supply variance.

Petro-refinery Expansion in the Middle East Integrated with On-purpose MTBE Units

Producers in the Gulf are embedding MTBE loops within mixed-feed crackers to maximise butenes utilisation. SABIC's 1 million-tpa project at Petrokemya will reach mechanical completion in late 2025, reinforcing the region's role as a swing supplier. Similar schemes in Jubail allocate on-purpose isobutylene and methanol streams to safeguard margin through feedstock optimisation. Integration improves operating rates when gasoline or butyl rubber demand softens, thereby adding resilience to the methyl tertiary butyl ether market. Logistically, the Gulf's proximity to Asia shortens lead times for spot cargoes during seasonal blend swings.

Availability of Substitutes

Ethanol retains a firm foothold in US gasoline because regulators permit up to 10 vol% blends under the federal Renewable Fuel Standard. California Air Resources Board modelling assumes E10 remains dominant through 2046, with scenarios for E15 expansion. The US refining system eliminated MTBE from reformulated gasoline by 2007, lowering baseline demand and exerting a persistent negative pull on global growth. Similar policy currents in parts of Europe could temper long-run uptake, although energy density and vapour-pressure differences hinder full substitution in warmer climates

Other drivers and restraints analyzed in the detailed report include:

- Methanol-to-Gasoline Route Adoption in Asia Elevating MTBE Demand

- Growing Use of MTBE as Co-solvent in Specialty Extraction for Pharma APIs

- Classification as Pollutant and Consequent Ban of Use in Gasoline Blending in North America

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Industrial grade accounted for 90% of tonnage in 2024, driven by bulk gasoline additive demand and large-scale chemical intermediates. Material typically carries a purity of 98.50% and is routed through dedicated tank infrastructure at coastal terminals. Pharmaceutical grade, although just 10% by volume, is set to climb faster on a 5.98% CAGR as continuous drug manufacturing plants adopt MTBE for controlled crystallisations.

Direct contracts covered 70% of 2024 shipments as refineries and major chemical companies source barge or railcar lots via long-term agreements. This structure reduces logistical handoffs and aligns quality control with blend-stock specifications. Distributors supply mid-sized paint, rubber, and pharma firms that purchase pallet quantities, accounting for 25% of volumes. Online portals exhibit a 6.40% CAGR as buyers leverage digital tenders and compliance documentation tools. The methyl tertiary butyl ether market is thus moving gradually toward hybrid fulfillment models that integrate e-commerce ordering with regional tank farm delivery.

The Global Methyl Tertiary Butyl Ether (MTBE) Market Report Segments the Industry by Grade (Industrial Grade and Pharmaceutical Grade), Distribution Channel (Direct Sales, Distributors, and Online Sales), Application (Gasoline Additives, Isobutene, and More), End-User Industry (Automotive, Oil and Gas, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa).

Geography Analysis

Asia Pacific held 42% of global revenue in 2024, and is forecast to grow at 6.23% CAGR to 2030. China's expanded Euro-VI equivalent fuel standard mandates, coupled with domestic MTG projects, raise structural demand for octane boosters. India follows a similar trajectory as Bharat Stage VI norms widen nationwide.

North America reflects subdued consumption after state-level bans, yet the US Gulf Coast retains substantial export capacity. Europe presents a mixed picture. While partial restrictions exist, certain Mediterranean blenders still use MTBE in premium unleaded formulations, maintaining niche demand.

Meanwhile, Middle Eastern producers continue to target European summer demand gaps with competitive FOB pricing. South America and Africa remain smaller but growing as Brazil and Nigeria widen unleaded gasoline pooling that benefits MTBE over aromatics in terms of vapour pressure compliance.

- BP plc

- Chevron Phillips Chemical Company LLC

- China Petrochemical Corporation

- CNPC

- Eni S.p.A

- ENOC Company

- Enterprise Products Partners L.P.

- ETRONAS Chemicals Group Berhad

- Evonik Industries AG

- Exxon Mobil Corporation

- Formosa Plastics Corporation, U.S.A.

- Gazprom

- Huntsman International LLC

- LUKOIL

- LyondellBasell Industries Holdings B.V.

- QAFAC

- Reliance Industries Limited

- SABIC

- Shell plc

- Vinati Organics Limited

- Wanhua

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Low-Aromatic, High-Octane Gasoline Mandates in Asia Pacific

- 4.2.2 Petro-refinery Expansion in Middle-East Integrated with On-purpose MTBE Units

- 4.2.3 Methanol-to-Gasoline (MTG) Route Adoption in Asia Elevating MTBE Demand

- 4.2.4 Rising Demand for Iso-octene (via MTBE Dehydrogenation) in High-performance Tires

- 4.2.5 Growing Use of MTBE as Co-solvent in Specialty Extraction for Pharma APIs

- 4.3 Market Restraints

- 4.3.1 Availability of Substitutes

- 4.3.2 Classification as Pollutant and Consequent Ban of Use in Gasoline Blending in North America

- 4.3.3 Volatility in C4 Raffinate Availability from Steam Crackers

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Grade

- 5.1.1 Industrial Grade

- 5.1.2 Pharmaceutical Grade

- 5.2 By Distribution Channel

- 5.2.1 Direct Sales

- 5.2.2 Distributors

- 5.2.3 Online Sales

- 5.3 By Application

- 5.3.1 Gasoline Additives

- 5.3.2 Isobutene

- 5.3.3 Solvents

- 5.3.4 Other Applications

- 5.4 By End-user Industry

- 5.4.1 Automotive

- 5.4.2 Oil and Gas

- 5.4.3 Chemicals

- 5.4.4 Pharmaceuticals

- 5.4.5 Other End-user Industries

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 Italy

- 5.5.3.4 France

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Qatar

- 5.5.5.4 Turkey

- 5.5.5.5 South Africa

- 5.5.5.6 Nigeria

- 5.5.5.7 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 BP plc

- 6.4.2 Chevron Phillips Chemical Company LLC

- 6.4.3 China Petrochemical Corporation

- 6.4.4 CNPC

- 6.4.5 Eni S.p.A

- 6.4.6 ENOC Company

- 6.4.7 Enterprise Products Partners L.P.

- 6.4.8 ETRONAS Chemicals Group Berhad

- 6.4.9 Evonik Industries AG

- 6.4.10 Exxon Mobil Corporation

- 6.4.11 Formosa Plastics Corporation, U.S.A.

- 6.4.12 Gazprom

- 6.4.13 Huntsman International LLC

- 6.4.14 LUKOIL

- 6.4.15 LyondellBasell Industries Holdings B.V.

- 6.4.16 QAFAC

- 6.4.17 Reliance Industries Limited

- 6.4.18 SABIC

- 6.4.19 Shell plc

- 6.4.20 Vinati Organics Limited

- 6.4.21 Wanhua

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 Innovation in Bio-based MTBE for Gasoline