PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836500

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836500

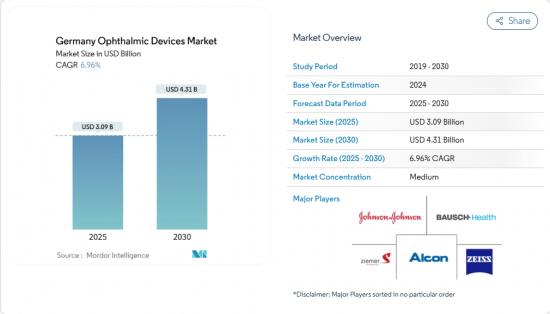

Germany Ophthalmic Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Germany ophthalmology devices market size is valued at USD 3.09 billion in 2025 and is projected to reach USD 4.31 billion by 2030, expanding at a 6.96% CAGR over the forecast period.

A rapidly ageing population, high digital literacy among clinicians, and the migration of cataract and refractive surgery to ambulatory settings collectively underpin sustained demand across diagnostic, vision-care, and surgical product lines. Device makers are pouring capital into data-enabled platforms that compress diagnostic pathways and into minimally invasive tools that trim operating-room time, insulating order volumes even during macro-economic slow-downs. Payer alignment around DRG incentives and clearer reimbursement for technology add-ons is shortening payback horizons, which attracts small innovators seeking niche opportunities. Although the Germany ophthalmology devices market remains fragmented, suppliers that can bundle consumables, capital equipment, and software are positioned to capture superior margins.

Germany Ophthalmic Devices Market Trends and Insights

Demographic Shift - Rising Myopia and Hyperopia Patterns

Studies tracking refractive errors show prevalence rates rising sharply from primary-school age to young adulthood, while hyperopia accelerates in older cohorts. Retailers respond with gender-specific frames and ortho-k lenses that increase repeat purchases without aggressive price hikes. Screen-time proliferation and reduced outdoor activity amplify demand for spectacles, contact lenses, and emerging myopia-control solutions. Vision-care vendors that pair product launches with mobile apps monitoring wear-time see stronger brand loyalty, validating a data-driven upsell strategy. The Germany ophthalmology devices market consequently enjoys a broad, resilient consumer base.

Statutory Health Insurance Reimbursement for Premium IOLs

The October 2024 DRG update added three ophthalmology codes that broaden coverage for advanced IOLs. While monofocal models remain fully reimbursed, multifocal and toric lenses still entail co-payments, tempering immediate uptake. Hospitals therefore pilot adjustable IOLs that can be fine-tuned post-operatively, demonstrating cost-effective visual outcomes. Early adopters report lower re-operation rates, a metric expected to influence future tariff negotiations. Manufacturers using real-world evidence to prove these benefits reinforce the Germany ophthalmology devices market narrative that premium technology aligns with payer value frameworks.

Price Pressure from Public Sickness Funds on Refractive Devices

Statutory sickness funds apply tight reference pricing to premium spectacles and accommodative IOLs, compressing manufacturer margins. The looming EU Health Technology Assessment regulation, mandating joint clinical evaluations for high-risk devices from 2025, could elongate market-entry timelines for small firms. Companies equipped with robust real-world evidence may convert the regulatory hurdle into a competitive moat. Nonetheless, persistent cost caps weigh on ASPs, limiting the pricing latitude of the Germany ophthalmology devices market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Uptake of AI-Enabled Diagnostic Platforms

- Expansion of Ambulatory Ophthalmic Surgery Centers

- Shortage of Ophthalmologists in Rural Bundeslander

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Vision-care products accounted for the largest slice of Germany ophthalmology devices market size in 2024, reflecting entrenched purchasing habits and the steady introduction of higher-margin continuous-wear lenses. Retail chains integrating on-site refraction services increase store traffic and boost ancillary accessory sales, further protecting the segment's 62% share. Suppliers deploying myopia-management lenses accompanied by mobile-app compliance trackers raise replacement frequency and reinforce brand stickiness. The coexistence of high-volume spectacles and premium contact-lens materials underscores a dual-track opportunity: volume stability alongside ASP expansion.

Diagnostic and monitoring equipment, though smaller in absolute terms, is forecast to post a high single-digit CAGR from 2025-2030, making it the fastest-growing category. Hospital administrators cite preventive-care guidelines and chronic-disease surveillance targets as drivers for OCT and fundus-camera purchases. A leading lens maker's acquisition of a Heidelberg-based imaging specialist illustrates how vertical integration pairs screening hardware with personalised lens solutions, enabling seamless data flow from scan to prescription. By closing this loop, vendors sharpen competitive moats and lift wallet share within the Germany ophthalmology devices market.

The Germany Ophthalmic Devices Market Report is Segmented by Device Type (Diagnostic & Monitoring Devices, Surgical Devices, and Vision Care Devices), Disease Indication (Cataract, Glaucoma, Diabetic Retinopathy, Other Disease Indications), End-User (Hospitals, Specialty Ophthalmic Clinics, Ambulatory Surgery Centers (ASCs), and Other End-Users). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Alcon

- Carl Zeiss

- EssilorLuxottica

- Johnson & Johnson Vision Care

- Bausch + Lomb Corp.

- Topcon

- HOYA

- Nidek

- Ziemer Group

- Heidelberg Engineering

- CooperVision Inc.

- Oculus Optikger?te GmbH

- Lumenis

- Glaukos

- STAAR Surgical

- Lumibird Medical

- BVI Medical

- Rayner Intraocular Lenses Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Demographic Shift ? Rising Myopia & Hyperopia in Urban Germany

- 4.2.2 Statutory Health Insurance Reimbursement for Premium IOLs

- 4.2.3 Rapid Uptake of AI-Enabled Diagnostic Platforms

- 4.2.4 Expansion of Ambulatory Ophthalmic Surgery Centers

- 4.2.5 Germany's Photonics Manufacturing Cluster Accelerating Innovation

- 4.2.6 Post-COVID Backlog of Cataract Procedures

- 4.3 Market Restraints

- 4.3.1 Price Pressure from Public Sickness Funds on Refractive Devices

- 4.3.2 Shortage of Ophthalmologists in Rural Bundesl?nder

- 4.3.3 High Out-of-Pocket Cost for Premium Contact Lenses

- 4.3.4 MDR 2017/745 Certification Delays for SMEs

- 4.4 Regulatory Outlook

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Device Type

- 5.1.1 Diagnostic & Monitoring Devices

- 5.1.1.1 OCT Scanners

- 5.1.1.2 Fundus & Retinal Cameras

- 5.1.1.3 Autorefractors & Keratometers

- 5.1.1.4 Corneal Topography Systems

- 5.1.1.5 Ultrasound Imaging Systems

- 5.1.1.6 Perimeters & Tonometers

- 5.1.1.7 Other Diagnostic & Monitoring Devices

- 5.1.2 Surgical Devices

- 5.1.2.1 Cataract Surgical Devices

- 5.1.2.2 Vitreoretinal Surgical Devices

- 5.1.2.3 Refreactive Surgical Devices

- 5.1.2.4 Glaucoma Surgical Devices

- 5.1.2.5 Other Surgical Devices

- 5.1.3 Vision Care Devices

- 5.1.3.1 Spectacles Frames & Lenses

- 5.1.3.2 Contact Lenses

- 5.1.1 Diagnostic & Monitoring Devices

- 5.2 By Disease Indication

- 5.2.1 Cataract

- 5.2.2 Glaucoma

- 5.2.3 Diabetic Retinopathy

- 5.2.4 Other Disease Indications

- 5.3 By End-user

- 5.3.1 Hospitals

- 5.3.2 Specialty Ophthalmic Clinics

- 5.3.3 Ambulatory Surgery Centers (ASCs)

- 5.3.4 Other End-users

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Alcon Inc.

- 6.4.2 Carl Zeiss Meditec AG

- 6.4.3 EssilorLuxottica SA

- 6.4.4 Johnson & Johnson Vision Care

- 6.4.5 Bausch + Lomb Corp.

- 6.4.6 Topcon Corporation

- 6.4.7 HOYA Corporation

- 6.4.8 Nidek Co., Ltd.

- 6.4.9 Ziemer Ophthalmic Systems AG

- 6.4.10 Heidelberg Engineering GmbH

- 6.4.11 CooperVision Inc.

- 6.4.12 Oculus Optikger?te GmbH

- 6.4.13 Lumenis Be Ltd.

- 6.4.14 Glaukos Corporation

- 6.4.15 STAAR Surgical Company

- 6.4.16 Lumibird Medical

- 6.4.17 BVI Medical

- 6.4.18 Rayner Intraocular Lenses Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment