PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836462

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836462

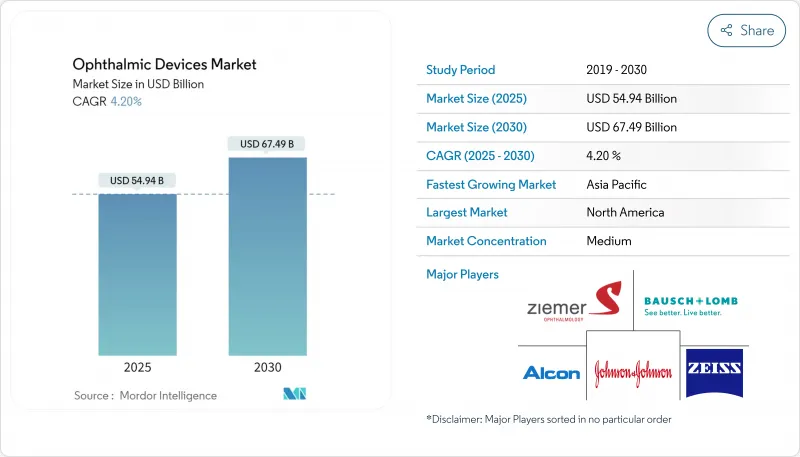

Ophthalmic Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The ophthalmic devices market stands at USD 50.35 billion in 2025 and is forecast to reach USD 68.98 billion by 2030, advancing at a 6.53% CAGR.

Global demand shows resilience because rising cataract procedure volumes, growing myopia in children, and steady upgrades to diagnostic suites outweigh price caps and supply shocks. Manufacturers now maintain dual-sourcing contracts for optics and electronics to curb single-supplier risk while protecting margins in tender-driven regions such as Latin America. Leading companies also align product design with outpatient priorities-smaller footprints, faster turnover, and integrated analytics-so that care settings can move more cases through constrained operating schedules. New reimbursement models that reward refractive outcomes over list price further encourage hospitals to specify premium intraocular lenses, accelerating revenue migration from one-time capital sales to annuity-style consumables and service contracts across the ophthalmic devices market.

Global Ophthalmic Devices Market Trends and Insights

Growing Demand Driven by Increased Myopia Prevalence and Aging Populations

Presbyopia now affects an estimated 1.8 billion people, while childhood myopia climbs sharply, creating a broad and sustained demand curve for optical interventions. National health budgets are shifting from episodic outreach to permanent surgical infrastructure, prompting suppliers to bundle phaco consoles with per-case consumables and lock in recurring revenue. Simultaneously, parents fund premium myopia-control lenses such as ZEISS MyoCare, pushing innovation even in the absence of formal reimbursement. The strategy reshapes pricing discussions around preventive optics and gives the ophthalmic devices market durable growth momentum.

Increased Adoption of Advanced Cataract Surgery Techniques

Roughly 40% of cataract patients now self-pay for premium intraocular lenses, nudging payers to revisit monofocal reimbursement ceilings. Hospitals negotiate value-based purchasing contracts tied to refractive outcomes, setting benchmarks like Johnson & Johnson's TECNIS Odyssey, which reports minimal visual disturbances in 93% of recipients. As femtosecond platforms find additional corneal applications, providers accelerate depreciation recovery, enlarging capital budgets for complementary devices. These dynamics strengthen premium lens upselling, expand procedure profitability, and deepen product stickiness in the ophthalmic devices market.

Increased Litigation and Regulation Impacting Refractive Procedures

The USD 75 million contact-lens antitrust settlement highlights tougher oversight of consumer pricing. Distributors now demand dynamic online pricing clauses, complicating manufacturers' ability to sustain global minimum resale thresholds. Parallel drug-device approvals, triggered by recent legal interpretations, extend timelines, forcing smaller innovators to license proven delivery platforms at the cost of royalties. Compliance teams implement adaptive pricing software and regulatory-affairs investments, siphoning capital from R&D and tempering near-term gains across the ophthalmic devices market.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Access to Eye Care through Tele-ophthalmology

- Private Equity Investment Driving Infrastructure Upgrades

- Volatile Economic Conditions and Price Controls in Latin America

For complete list of drivers and restraints, kindly check the Table Of Contents.

List of Companies Covered in this Report:

- Alcon

- Johnson & Johnson Vision Care

- Lumibird Medical

- Bausch + Lomb

- Carl Zeiss

- HOYA

- Topcon

- Nidek

- HAAG-Streit

- Ziemer Group

- Glaukos

- STAAR Surgical

- Lumenis

- The Cooper Companies

- Heidelberg Engineering, Inc.

- Visionix

- Danaher

- Volk Optical

- Oculus

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand Driven by Increased Myopia Prevalence and Aging Populations

- 4.2.2 Increased Adoption of Advanced Cataract Surgery Techniques

- 4.2.3 Expansion of Access to Eye Care through Tele-ophthalmology

- 4.2.4 Private Equity Investment Driving Infrastructure Upgrades

- 4.2.5 Government-Reimbursed Pediatric Vision Screening Programs Worldwide

- 4.2.6 Uptake of FLACS in Western Europe

- 4.3 Market Restraints

- 4.3.1 Increased Litigation and Regulation Impacting Refractive Procedures

- 4.3.2 Volatile Economic Conditions and Price Controls in Latin America

- 4.3.3 High Import Duties and Limited Profitability in Emerging Markets

- 4.3.4 Stringent MDR Documentation Costs for Class-IIb Ophthalmic Implants in Europe

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Device Type

- 5.1.1 Diagnostic & Monitoring Devices

- 5.1.1.1 OCT Scanners

- 5.1.1.2 Fundus & Retinal Cameras

- 5.1.1.3 Autorefractors & Keratometers

- 5.1.1.4 Corneal Topography Systems

- 5.1.1.5 Ultrasound Imaging Systems

- 5.1.1.6 Perimeters & Tonometers

- 5.1.1.7 Other Diagnostic & Monitoring Devices

- 5.1.2 Surgical Devices

- 5.1.2.1 Cataract Surgical Devices

- 5.1.2.2 Vitreoretinal Surgical Devices

- 5.1.2.3 Refreactive Surgical Devices

- 5.1.2.4 Glaucoma Surgical Devices

- 5.1.2.5 Other Surgical Devices

- 5.1.3 Vision Care Devices

- 5.1.3.1 Spectacles Frames & Lenses

- 5.1.3.2 Contact Lenses

- 5.1.1 Diagnostic & Monitoring Devices

- 5.2 By Disease Indication

- 5.2.1 Cataract

- 5.2.2 Glaucoma

- 5.2.3 Diabetic Retinopathy

- 5.2.4 Other Disease Indications

- 5.3 By End-user

- 5.3.1 Hospitals

- 5.3.2 Specialty Ophthalmic Clinics

- 5.3.3 Ambulatory Surgery Centers (ASCs)

- 5.3.4 Other End-users

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Alcon Inc.

- 6.4.2 Johnson & Johnson Vision Care

- 6.4.3 Lumibird Medical

- 6.4.4 Bausch + Lomb

- 6.4.5 ZEISS Group

- 6.4.6 HOYA

- 6.4.7 Topcon Corporation

- 6.4.8 Nidek Co., Ltd.

- 6.4.9 HAAG-Streit Group

- 6.4.10 Ziemer Ophthalmic Systems AG

- 6.4.11 Glaukos Corporation

- 6.4.12 STAAR Surgical

- 6.4.13 Lumenis Be Ltd.

- 6.4.14 CooperVision

- 6.4.15 Heidelberg Engineering, Inc.

- 6.4.16 Visionix

- 6.4.17 Leica Microsystems

- 6.4.18 Volk Optical

- 6.4.19 OCULUS

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment