PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836508

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836508

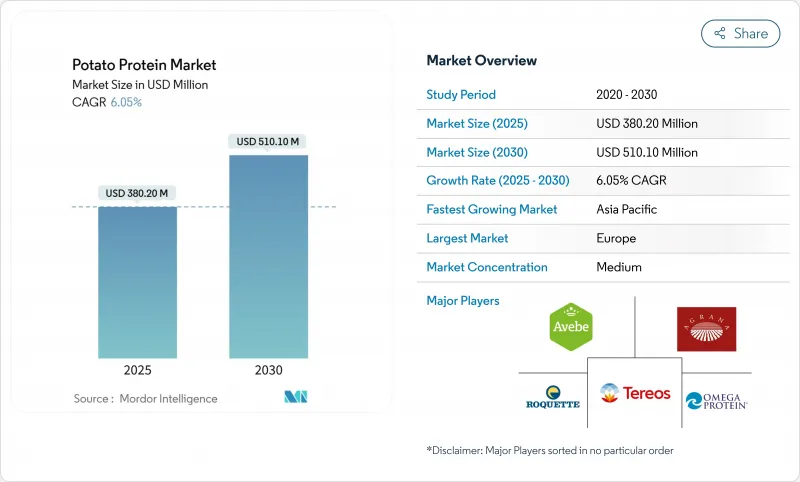

Potato Protein - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The potato protein market reached USD 380.20 million in 2025 and is projected to grow to USD 510.10 million by 2030, with a compound annual growth rate (CAGR) of 6.05%.

The market growth is driven by increasing adoption of plant-based diets, demand for clean-label ingredients, and efficient processing methods that utilize potato-starch by-products. Food manufacturers use potato protein in various applications, including meat alternatives, dairy substitutes, baked goods, beverages, and sports nutrition products, contributing to higher selling prices and expanded end-use applications. Recent procurement data indicates that small and medium-sized brands are increasing their bulk purchases, demonstrating a wider distribution of product development activities. This diversification of customer base helps suppliers maintain stable revenue streams during economic fluctuations.

Global Potato Protein Market Trends and Insights

Increasing Consumer Preference for Vegan Products

The growth of flexitarianism is transforming the potato protein market by generating significant demand for plant-based proteins. The rise in veganism has increased consumer awareness regarding the environmental and ethical implications of food choices. In response, food manufacturers are developing alternative protein sources to meet the expanding demand for plant-based products. In January 2023, approximately 707,000 people participated in Veganuary, a global campaign by a British non-profit organization that encourages participants to adopt a vegan diet during January. The 2023 participation represents a fourfold increase from 2018 levels . This significant application versatility increase demonstrates the growing consumer interest in plant-based diets and sustainable food choices.

Potato protein offers manufacturers a neutral flavor profile and functional properties, making it an ideal choice for meat alternative products. Its complete amino acid profile and high digestibility rating (PDCAAS score of 0.99) establish it as an effective ingredient for companies seeking differentiation in the plant-based market. Consumer preferences are shifting from meat-mimicking products toward natural plant-based alternatives that highlight authentic flavors and textures, expanding potato protein applications beyond traditional meat substitutes. This application's versatility has positioned potato protein as a valuable ingredient in the evolving plant-based food industry.

Surging Demand for Non-Allergenic Gluten-Free Ingredients

Potato protein's allergen-free profile is emerging as a key market differentiator amid the global increase in food allergies and intolerances. Consumer demand for potato protein has grown as they seek transparent, minimally processed food products without common allergens such as gluten and lactose. In 2022, the Food and Beverage Journal reported that 68% of consumers preferred clean-label products with simplified ingredient lists containing recognizable, natural components. Potato protein contains no gluten, lactose, or common allergens, making it suitable for manufacturers targeting the free-from market segment. This characteristic is essential in formulations for specialized diets and sensitive consumer groups, including children and individuals with multiple food sensitivities.

Several countries show high rates of lactose intolerance, influencing global dietary trends and ingredient preferences. According to World Population Review, South Korea, Yemen, Ghana, and Malawi report 100% lactose intolerance among their populations, while the Solomon Islands show a 99% intolerance rate as of 2025 . This widespread lactose intolerance drives the food and beverage industry's demand for non-allergenic, gluten-free ingredients. Potato protein's functional versatility enables it to replace allergenic ingredients in various applications while maintaining desired textural and nutritional properties, creating opportunities for innovation in categories previously challenging for allergen-sensitive consumers.

Presence of Low Protein Content

The inherently low protein content in raw potatoes (typically 2-2.5%) presents a significant challenge for the potato protein industry, creating multiple technical and economic challenges across the value chain. This percentage is significantly lower compared to other plant protein sources such as soybeans (35-40%) and peas (20-25%). The fundamental limitation creates a cascading effect of technical and economic challenges throughout the production process.

The extraction process compounds this challenge, with yields typically achieving only 30-40% recovery of the available protein content. This low recovery rate affects the industry's ability to compete on price with other plant proteins, particularly in price-sensitive markets like animal feed. In these markets, potato protein must demonstrate superior functional or nutritional benefits to justify its premium pricing and overcome competitive disadvantages.

In response to these challenges, biotechnology companies are developing innovative solutions. In 2024, ReaGenics introduced cell culture techniques that can increase potato protein content to 31%, with the potential to reach 40%. Additionally, PoLoPo's molecular farming technology aims to produce protein-rich potato tubers by the end of 2024, targeting the USD 26.6 billion egg protein market. However, the industry continues to face yield inefficiencies that affect its ability to compete with naturally protein-rich alternatives like pea and soy, requiring ongoing technological advancements to improve extraction efficiency and protein content.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Aquafeed Production and Animal Feed Industries

- Rising Use in Snacks and Ready to Eat Products

- High Production Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Geography Analysis

Europe holds a dominant 45.22% share of the potato protein market in 2024, supported by its extensive potato processing infrastructure and extraction technologies. The region's market strength stems from established companies like Royal Avebe, Roquette Freres, and Emsland Group, which operate vertically integrated facilities from potato cultivation to protein extraction. The European Food Safety Authority's (EFSA) updated guidance for novel food applications, effective February 2025, simplifies the approval process for innovative protein products. This regulatory framework, combined with increasing consumer demand for plant-based alternatives, creates a conducive environment for continued market expansion and development.

Asia-Pacific exhibits the highest growth rate at 8.39% CAGR (2025-2030), attributed to food processing industrialization and growing consumer interest in protein-enriched products. The region's development is supported by strategic production investments, as demonstrated by the joint venture between Tummers Food Processing Solutions and Kiron Food Processing Technologies in India to improve potato processing infrastructure. China and Japan are the primary market drivers, while South Korea shows increased adoption in sports nutrition applications. The growth of animal feed and aquaculture sectors across Asia-Pacific generates additional demand for potato protein, particularly in developing economies where meat and fish consumption increases with rising disposable incomes.

North America maintains a substantial potato protein market share, driven by strong demand for plant-based proteins and gluten-free ingredients. The United States leads regional consumption, supported by growing consumer preference for alternative proteins. The USDA's USD 300 million organic transition initiative from 2022 indirectly benefits the organic potato protein segment by increasing organic potato supply. The region's food innovation capabilities and robust consumer purchasing power support continued growth, especially in premium applications like sports nutrition and specialized dietary products.

- Royal Avebe U.A.

- Roquette Freres S.A.

- Tereos Group

- Emsland Group

- KMC A.m.b.A

- Agrana Beteiligungs-AG

- Meelunie B.V.

- AKV Langholt Amba

- Sudstarke GmbH

- Omega Protein Corp.

- Pepees S.A.

- Kemin Industries Inc.

- Lyckeby Culinar AB

- PPZ Niechlow SA

- The Scoular Company

- Finnamyl Oy

- Grupa Lubon

- DUYNIE GROUP

- PPZ Trzemeszno Sp. z o.o.

- Spix Protein

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Consumer Preference for Vegan Products

- 4.2.2 Surging Demand for Non-Allergenic Gluten-Free Ingredients

- 4.2.3 Expansion of Aquafeed Production and Animal Feed Industries

- 4.2.4 Growing Demand for Sustainable and Clean Label Ingredients

- 4.2.5 Increasing Application in Plant-based Meat Products

- 4.2.6 Rising Use in Snacks and Ready to Eat Products

- 4.3 Market Restraints

- 4.3.1 Presence of Low Protein Content

- 4.3.2 High Production Costs

- 4.3.3 Limited Consumer Awareness

- 4.3.4 Functional Limitations in Some Applications

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory or Technological Outlook

- 4.5.1 Regulatory Landscape

- 4.5.2 Technological Advancements

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Protein Type

- 5.1.1 Potato Protein Concentrate

- 5.1.2 Potato Protein Isolate

- 5.1.3 Potato Protein Hydrolysate

- 5.2 By Nature

- 5.2.1 Conventional

- 5.2.2 Organic

- 5.3 By Application

- 5.3.1 Food and Beverages

- 5.3.1.1 Bakery and Confectionery

- 5.3.1.2 Meat Analogues

- 5.3.1.3 Dairy Alternatives

- 5.3.1.4 Sports Nutrition and Bars

- 5.3.1.5 Others

- 5.3.2 Animal Nutrition

- 5.3.2.1 Livestock Feed

- 5.3.2.2 Pet Food

- 5.3.2.3 Aquafeed

- 5.3.3 Pharmaceuticals

- 5.3.1 Food and Beverages

- 5.4 By Distribution Channel

- 5.4.1 B2B

- 5.4.2 B2C

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 France

- 5.5.2.3 United Kingdom

- 5.5.2.4 Spain

- 5.5.2.5 Netherlands

- 5.5.2.6 Italy

- 5.5.2.7 Sweden

- 5.5.2.8 Poland

- 5.5.2.9 Belgium

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Indonesia

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Chile

- 5.5.4.4 Colombia

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 South Africa

- 5.5.5.3 Nigeria

- 5.5.5.4 Saudi Arabia

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Royal Avebe U.A.

- 6.4.2 Roquette Freres S.A.

- 6.4.3 Tereos Group

- 6.4.4 Emsland Group

- 6.4.5 KMC A.m.b.A

- 6.4.6 Agrana Beteiligungs-AG

- 6.4.7 Meelunie B.V.

- 6.4.8 AKV Langholt Amba

- 6.4.9 Sudstarke GmbH

- 6.4.10 Omega Protein Corp.

- 6.4.11 Pepees S.A.

- 6.4.12 Kemin Industries Inc.

- 6.4.13 Lyckeby Culinar AB

- 6.4.14 PPZ Niechlow SA

- 6.4.15 The Scoular Company

- 6.4.16 Finnamyl Oy

- 6.4.17 Grupa Lubon

- 6.4.18 DUYNIE GROUP

- 6.4.19 PPZ Trzemeszno Sp. z o.o.

- 6.4.20 Spix Protein

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK