PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848066

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848066

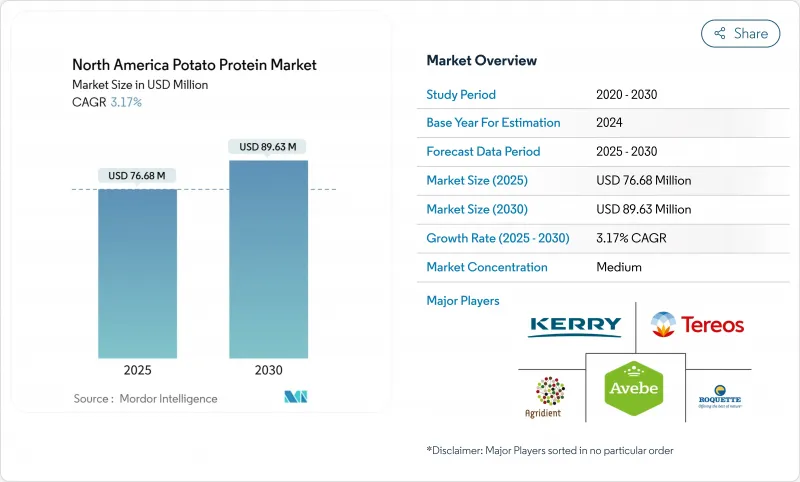

North America Potato Protein - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The North American potato protein market, valued at USD 76.68 million in 2025, is projected to reach USD 89.63 million by 2030, growing at a CAGR of 3.17%.

The market growth stems from improved extraction efficiency, premium product positioning, and clear regulatory frameworks rather than volume expansion. The market stability is maintained through concentrate formats and established processing partnerships, while technological advancements in cost management and functional improvements enable applications in higher-margin segments. The FDA's Generally Recognized as Safe (GRAS) framework and stricter labeling requirements strengthen potato protein's position as a clean-label substitute for whey, soy, and egg proteins. The market growth is driven by increased demand from premium pet food, aquafeed, gluten-free baking, and meat alternative sectors, where manufacturers optimize taste, texture, and cost-effectiveness. The industry is experiencing a fundamental transformation toward efficient, low-energy production systems through investments in molecular farming, enzyme-assisted extraction, and cell-culture technologies, helping protect profit margins against commodity price fluctuations.

North America Potato Protein Market Trends and Insights

Accelerated Shift of Processors toward Clean-Label Proteins

Food processors are prioritizing ingredient transparency as consumers increasingly scrutinize synthetic additives and processing aids. Potato protein offers advantages in clean-label formulations due to its minimal processing requirements and recognizable source, particularly in meat alternatives and dairy analogues. The FDA's GRAS approvals for plant proteins, including pea protein fermented by shiitake mycelia, indicate regulatory support for protein processing methods that maintain clean-label status. Manufacturers use potato protein's neutral taste profile to replace synthetic emulsifiers and stabilizers. Processing companies report higher demand for potato protein concentrates in premium food applications due to formulation flexibility and consumer acceptance. The clean-label trend drives adoption in organic and natural product categories, where potato protein's non-GMO status and low allergenicity support premium positioning.

Surging Demand for Non-Allergenic Gluten-Free Ingredients

The rising prevalence of celiac disease and increased awareness of gluten sensitivity create consistent demand for alternative protein sources in gluten-free formulations. Potato protein offers a complete amino acid profile and strong binding properties, making it essential in gluten-free baking where wheat proteins are unsuitable. Its emulsification and foaming properties help improve texture in gluten-free products, addressing quality issues in this segment. Patent developments, such as VEG OF LUND AB's potato-based emulsion technology, showcase advancements in texture enhancement for gluten-free applications. Food manufacturers now incorporate potato protein in gluten-free formulations to match the texture of conventional products. This adoption extends beyond traditional gluten-free products as manufacturers reformulate to appeal to flexitarian consumers seeking simpler ingredients.

High Production Costs

The production costs of potato protein remain high compared to established plant proteins such as soy and pea. The protein extraction process from potato processing streams requires specialized equipment, resulting in high capital investments that restrict new market entrants and limit pricing flexibility. The complex extraction technology and processing methods further add to operational expenses, making economies of scale difficult to achieve. Manufacturers of alternative proteins indicate that their production costs continue to exceed conventional meat prices by 30-50%, making it difficult to achieve price parity. Additionally, the energy-intensive nature of potato protein extraction and the need for continuous equipment maintenance contribute to elevated production costs, impacting overall market competitiveness .

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Aquafeed Production and Animal Feed and Pet Food Industries

- Advancements in Protein Extraction and Processing Technologies

- Taste, Texture, and Sensory Challenges

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Concentrates accounted for 63.35% of the North American potato protein market share in 2024. Their popularity stems from providing a cost-effective balance of functional properties, including emulsification, water binding, and foaming capabilities. These attributes drive their consistent use in plant-based meat alternatives, bakery products, and instant soups. The steady supply of potato raw materials through integrated starch processors ensures reliable concentrate production.

Hydrolyzed potato proteins are projected to grow at a CAGR of 4.27% through 2030. This growth is driven by food manufacturers, nutraceutical companies, and geriatric nutrition providers seeking products with enhanced absorption rates and reduced allergenicity. The enzymatic hydrolysis process improves digestibility, expanding applications in sports beverages and medical nutrition. While isolates maintain a presence in specialized performance products requiring high protein density, their production remains constrained by high capital requirements. The market structure continues to rely on concentrates for volume sales, with hydrolysates capturing premium market segments.

The North America Potato Protein Market is Segmented by Type (Concentrate, Isolate, and Hydrolyzed), Nature (Conventional, and Organic), Application (Meat/Poultry/Seafood and Meat Alternative Products, and Animal Nutrition), and Geography (United States, Canada, Mexico, and Rest of North America). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Royal Avebe

- Kerry Group plc

- Tereos Group

- Agridient B.V.

- Roquette Freres SA

- Meelunie B.V.

- Emsland Group

- KMC Ingredients

- Planture Group

- Sudstarke GmbH

- PPZ Niechlow Sp. z o.o.

- Lyckeby Starch AB

- Bioriginal Food & Science Corp.

- Idaho Pacific Holdings

- Kemin Industries, Inc.

- STDM Food and Beverage Private Limited

- RootExtracts Ltd

- Ingredion Inc.

- American Key Food Products (AKFP

- Solanic B.V.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated Shift of Processors toward Clean-Label Proteins

- 4.2.2 Surging Demand for Non-Allergenic Gluten-Free Ingredients

- 4.2.3 Expansion of Aquafeed Production and Animal Feed and Pet Food Industries

- 4.2.4 Advancements in Protein Extraction and Processing Technologies

- 4.2.5 Growing Demand for Plant-Based Proteins

- 4.2.6 Rising Availability and E-Commerce Growth

- 4.3 Market Restraints

- 4.3.1 Presence of Low Protein Content

- 4.3.2 High Production Costs

- 4.3.3 Availability of Alternative High Proteins

- 4.3.4 Taste, Texture, and Sensory Challenges

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Advancements

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Concentrate

- 5.1.2 Isolate

- 5.1.3 Hydrolyzed

- 5.2 By Nature

- 5.2.1 Conventional

- 5.2.2 Organic

- 5.3 By Application

- 5.3.1 Meat/Poultry/Seafood and Meat Alternative Products

- 5.3.2 Animal Nutrition

- 5.3.2.1 Animal Feed

- 5.3.2.2 Pet Food

- 5.3.2.3 Aquafeed

- 5.4 By Geography

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Mexico

- 5.4.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Royal Avebe

- 6.4.2 Kerry Group plc

- 6.4.3 Tereos Group

- 6.4.4 Agridient B.V.

- 6.4.5 Roquette Freres SA

- 6.4.6 Meelunie B.V.

- 6.4.7 Emsland Group

- 6.4.8 KMC Ingredients

- 6.4.9 Planture Group

- 6.4.10 Sudstarke GmbH

- 6.4.11 PPZ Niechlow Sp. z o.o.

- 6.4.12 Lyckeby Starch AB

- 6.4.13 Bioriginal Food & Science Corp.

- 6.4.14 Idaho Pacific Holdings

- 6.4.15 Kemin Industries, Inc.

- 6.4.16 STDM Food and Beverage Private Limited

- 6.4.17 RootExtracts Ltd

- 6.4.18 Ingredion Inc.

- 6.4.19 American Key Food Products (AKFP

- 6.4.20 Solanic B.V.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK