PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836523

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836523

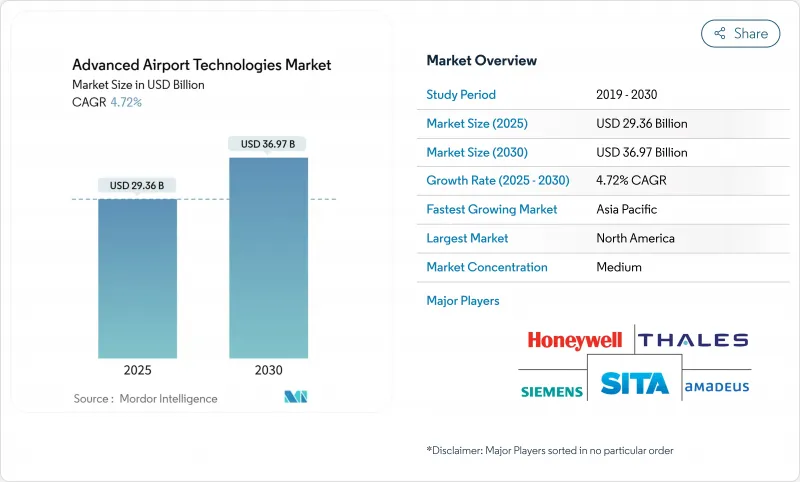

Advanced Airport Technologies - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The advanced airport technologies market stands at USD 29.36 billion in 2025, and forecasts indicate expansion to USD 36.97 billion by 2030 at a 4.72% CAGR.

Robust passenger-traffic recovery, mandatory security upgrades, and digital transformation spending continue to anchor purchasing decisions. Airports favor deployments that raise throughput and cut operating costs, giving security and screening platforms a stable revenue base, while cloud platforms and biometrics generate the steepest growth curves. Budget-constrained regional facilities lean on SaaS models and vendor financing, whereas hub airports refresh legacy systems to satisfy sustainability and resilience targets. Competitive dynamics remain moderate, with diversified conglomerates acquiring niche innovators to secure AI and automation expertise.

Global Advanced Airport Technologies Market Trends and Insights

Growing Air-Passenger Volumes and Green-Field Airport Projects

According to ACI-World, global passenger traffic surpassed pre-pandemic levels in 2024 and reached 9.4 billion journeys, generating urgent capacity needs. Mega projects such as Singapore's Changi Terminal 5, launched in May 2025, embed automated baggage flows, smart building controls, and solar power from day one. This design-phase integration lets operators bypass costly retrofits and elevates baseline technology expectations for every subsequent expansion. Emerging-market governments fund similar builds, driving the advanced airport technologies market toward integrated, cloud-ready platforms that scale with traffic.

Stringent Global Aviation-Security Mandates (ICAO, TSA, EASA)

The European Union's (EU's) computed-tomography deadline and TSA's capital plan through 2029 lock in the procurement of advanced screening equipment. ICAO's 2024 Security Week endorsed AI-enhanced threat detection, creating a common playbook across jurisdictions. Harmonized rules lower customization costs, enlarge addressable volumes, and encourage bulk purchasing, lifting the advanced airport technologies market in every region. Smaller airports, however, face timetable pressure, accelerating partnerships with equipment vendors that offer pay-as-you-go models.

High CAPEX and Long Payback Periods

Revenues at many airports remain below 2019 peaks, tightening discretionary budgets. Class C facilities struggle to finance CT scanners that exceed USD 3 million per lane, slowing penetration. ESG-linked bonds and airport-as-a-service contracts soften upfront outlays, illustrated by Vienna Airport's CO2-neutral financing pathway. Nevertheless, extended payback horizons temper the advanced airport technologies market, especially where service fees cannot be raised.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Biometrics Roll-Outs for Seamless Passenger Journey

- Demand for Real-Time Data to Cut Turnaround Times

- Escalating Cybersecurity and Data-Privacy Risks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Security and screening systems accounted for 29.21% of the advanced airport technologies market share in 2024, underpinned by EU-wide CT mandates that guarantee equipment placement. This segment supplies reliable recurring service revenues and replacement cycles that stabilize vendor pipelines. The advanced airport technologies market size for security and screening reached USD 8.8 billion in 2025 and is forecast to post mid-single-digit gains through 2030.

Though smaller in 2025, biometric passenger identification platforms expanded at a 6.25% CAGR as airports link seamless ID to duty-free conversion rates. Hybrid solutions that fuse biometrics with threat-detection analytics attract bundled contracts, edging incumbent X-ray suppliers toward software partnerships. Baggage, cargo, and passenger-flow management software, embedding analytics into formerly hardware-only workflows, rides the same adoption wave. Ground-handling electrification also reshapes procurement; Shenzhen Airport's 100% new-energy vehicle goal signals that environmental targets now influence specification sheets.

Terminal-side systems represented 44.19% of the advanced airport technologies market size in 2024, reflecting concentrated passenger touchpoints. Checkpoint biometrics, digital signage, and smart retail software deliver throughput and ancillary revenue, making terminals the first investment priority.

Air-side applications, while smaller, recorded a 5.84% CAGR and increasingly integrate with terminal platforms via digital twins. Saab's cloud-based runway-safety system at Nashville provides real-time alerts in line with FAA surface-awareness goals. Air-side gains are amplified by AI-driven gate allocation that trims taxi times, lowering Scope 1 emissions. Landside mobility systems, including smart parking PARCS installed at Charleston, unlock last-mile monetization and data capture, rounding out holistic airport-wide platforms.

The Advanced Airport Technologies Market Report is Segmented by Technology Type (Airport Communications Systems, and More), Operation Area (Air-Side, and More), Application (Asset and Facility Management, and More), Airport Size/Class (Class A, and More), Deployment Mode (On-premises/Proprietary, and More), and Geography (North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 34.58% of 2024 revenue, supported by TSA's multiyear capital plan prioritizing biometrics and vetting systems. US hub airports pioneer frictionless ID pilots, and Vancouver's digital-innovation push shows similar momentum. However, saturation tempers growth to low single digits. Canada's airports leverage climate-resilience funds for energy-efficient retrofits, accelerating LED lighting and electrified ground fleets.

Europe sustains sizable demand through harmonized regulation and ESG imperatives. The EU CT scanner mandate secures new installs, while Vienna Airport's net-zero roadmap channels spending into photovoltaic and electric ground service equipment. Passenger traffic rose 9% year-on-year in the first half of 2024, yet 47% of airports remain below 2019 levels, highlighting uneven recovery. Sustainability-linked financing and Fit-for-55 infrastructure rules drive conversion to smart-grid-ready assets.

Asia-Pacific is the fastest-growing theater at 7.15% CAGR, energized by India's 174 million travelers in 2024 and a massive portfolio of new airports. Changi Terminal 5's USD 3.5 billion build embeds robotics and AI, setting a regional benchmark. Incheon aims for 100% renewable electricity by 2040, boosting orders for smart-energy management systems. China's multi-city expansions and South Korea's RE100 commitments amplify opportunity, making the region the fulcrum of the advanced airport technologies market through 2030.

- Honeywell International, Inc.

- Cisco Systems, Inc.

- Thales Group

- Siemens AG

- SITA

- TAV Airports Holding

- ADB SAFEGATE

- NEC Corporation

- Smiths Detection (Smiths Group)

- Leidos Holdings, Inc.

- Analogic Corporation

- L3Harris Technologies, Inc.

- TK Elevator GmbH

- Rapiscan Systems, Inc.

- Amadeus IT Group, S.A.

- International Business Machines Corporation (IBM)

- Vanderlande Industries B.V.

- Indra Sistemas, S.A.

- Frequentis AG

- Collins Aerospace (RTX Corporation)

- Daifuku Co., Ltd.

- Oshkosh Corporation

- Johnson Controls International plc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing air-passenger volumes and green-field airport projects

- 4.2.2 Stringent global aviation-security mandates (ICAO, TSA, EASA)

- 4.2.3 Rapid biometrics roll-outs for seamless passenger journey

- 4.2.4 Demand for real-time data to cut turnaround-times

- 4.2.5 Digital-twin adoption for remote ops and predictive maintenance

- 4.2.6 ESG-linked airport-financing favouring low-carbon tech

- 4.3 Market Restraints

- 4.3.1 High CAPEX and long payback periods

- 4.3.2 Escalating cybersecurity and data-privacy risks

- 4.3.3 Legacy-IT integration complexity

- 4.3.4 Passenger-consent bottlenecks for biometrics

- 4.4 Value Chain Analysis

- 4.5 Regulatory or Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology Type

- 5.1.1 Airport Communications Systems

- 5.1.2 Airport Management Software

- 5.1.3 Passenger/Baggage/Cargo Handling

- 5.1.4 Security and Screening Systems

- 5.1.5 Ground and Airside Handling Equipment

- 5.1.6 Landing Aids, Guidance and Lighting

- 5.1.7 Airport Digital Signage Systems

- 5.1.8 Smart Parking and Landside Mobility Solutions

- 5.2 By Operation Area

- 5.2.1 Terminal-side

- 5.2.2 Air-side

- 5.2.3 Land-side

- 5.3 By Application

- 5.3.1 Passenger Processing and Experience

- 5.3.2 Aeronautical Operations and ATC/ATM

- 5.3.3 Asset and Facility Management

- 5.3.4 Smart Retail and Non-Aeronautical Revenue Solutions

- 5.4 By Airport Size/Class

- 5.4.1 Class A (Greater than 25 mppa) Large Hubs

- 5.4.2 Class B (5 to 25 mppa) Medium Airports

- 5.4.3 Class C (Less than 5 mppa) Small and Regional Airports

- 5.5 By Deployment Mode

- 5.5.1 On-premise/Proprietary

- 5.5.2 Cloud and SaaS

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Egypt

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Honeywell International, Inc.

- 6.4.2 Cisco Systems, Inc.

- 6.4.3 Thales Group

- 6.4.4 Siemens AG

- 6.4.5 SITA

- 6.4.6 TAV Airports Holding

- 6.4.7 ADB SAFEGATE

- 6.4.8 NEC Corporation

- 6.4.9 Smiths Detection (Smiths Group)

- 6.4.10 Leidos Holdings, Inc.

- 6.4.11 Analogic Corporation

- 6.4.12 L3Harris Technologies, Inc.

- 6.4.13 TK Elevator GmbH

- 6.4.14 Rapiscan Systems, Inc.

- 6.4.15 Amadeus IT Group, S.A.

- 6.4.16 International Business Machines Corporation (IBM)

- 6.4.17 Vanderlande Industries B.V.

- 6.4.18 Indra Sistemas, S.A.

- 6.4.19 Frequentis AG

- 6.4.20 Collins Aerospace (RTX Corporation)

- 6.4.21 Daifuku Co., Ltd.

- 6.4.22 Oshkosh Corporation

- 6.4.23 Johnson Controls International plc

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment