PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836535

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836535

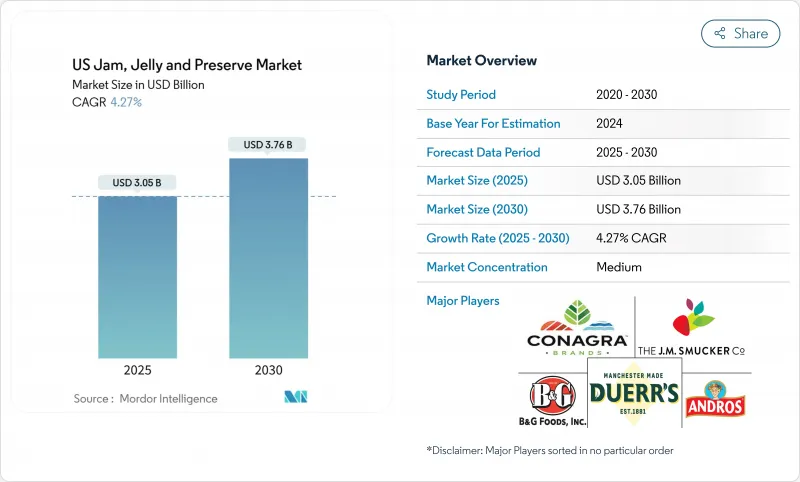

US Jam Jelly And Preserves - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The US jam, jelly, and preserves market is valued at USD 3.05 billion in 2025 and is projected to reach USD 3.76 billion by 2030, growing at a CAGR of 4.27%.

The market growth is driven by increasing demand for convenient breakfast options, product innovation in flavors, and expanded distribution networks, including e-commerce platforms. Manufacturers are implementing advanced shelf-life extension technologies, enhanced packaging solutions, and reduced-sugar formulations to meet the preferences of approximately two-thirds of American consumers who actively monitor their sugar consumption. The market sees upward price movement through premium and artisanal offerings, which helps buffer against fluctuating raw material costs due to seasonal fruit availability. The market structure remains concentrated, with three major companies - Smucker's, KraftHeinz, and B&G Foods - maintaining their market positions through economies of scale and extensive distribution networks, despite increasing competition from specialty brands and private-label products.

US Jam Jelly And Preserves Market Trends and Insights

Rising Consumption of Spreads for Convenience

Fast-paced lifestyles in the U.S. are driving the demand for food spreads, especially in dual-income households seeking convenience. The U.S. Census Bureau reported a 4.0% rise in real median household income to USD 80,610 in 2023 from USD 77,540 in 2022, supporting this trend . Time-constrained households in the United States increasingly use fruit spreads as quick flavor enhancers for bread, yogurt, and baking, driving demand in the jam, jelly, and preserves market. Squeeze-bottle formats experienced growth during the recent period, particularly among parents seeking convenient breakfast options. Portion-control caps support calorie monitoring, while positioning fruit spreads as a nutritious alternative to meet recommended fruit servings. Manufacturers emphasize real-fruit content on packaging to maintain sales volumes, even as fresh fruit consumption per capita decreases. This trend is prominent in metropolitan areas and extends across all socioeconomic groups, indicating its significance as a national market driver.

Product Innovation In Flavors, Textures, And Packaging Boosting Sales

The US jam, jelly, and preserves market is evolving through product innovation. Brands are introducing unique flavor combinations like mango-pineapple, blueberry-lavender, and pepper-infused variants, which command premium prices in specialty retail stores. The integration of oxygen sensors in smart jars extends product freshness throughout multiple seasons, reducing dependency on seasonal berry harvests. Manufacturers are also developing various texture options, including chunky pulp, low-sugar gel, and chia-seed gelling alternatives, to address consumer concerns about sugar content before the upcoming FDA "healthy" label regulations. These developments enhance the market's appeal to both premium consumers and health-conscious buyers.

Rising Health Concerns Over High Sugar Content

Two-thirds of American adults actively avoid sugar consumption, significantly impacting products that traditionally contain 45-65% sugar solids. While no federal sugar tax currently exists in the United States, potential WHO-influenced fiscal measures could substantially affect the jam, jelly, and preserves market. Manufacturers utilizing stevia and monk fruit as sugar alternatives encounter complex technical challenges in masking bitter flavors, which increases production costs and affects product development. Consumer acceptance of these reformulated products remains a critical factor in market success, particularly among affluent Millennials who carefully examine nutritional information and demand ingredient transparency.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Availability Across Supermarkets, Online, and Specialty Stores

- Increasing Popularity of Artisan and Gourmet Varieties

- Strong Competition from Nut Butters and Healthier Spread Options

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Jam and Jelly maintains market dominance, accounting for 66.11% of 2024 take-home sales in the US jam, jelly, and preserves market. The segment's success stems from established flavor profiles, family-oriented packaging, and competitive price points. This market position enables manufacturers to expand their product lines, particularly in the reduced-sugar category. The Preserves segment, while smaller, demonstrates robust growth potential with a projected 4.91% CAGR through 2030, driven by its whole-fruit composition that commands higher retail prices. Limited-edition preserves featuring regional fruits, such as Pacific-coast peaches and New England cranberries, demonstrate strong sales performance, reflecting consumer interest in product origin and visible fruit content.

The preserves category performs particularly well in online specialty retail, where premium multi-jar gift sets generate higher margins for direct-to-consumer manufacturers. Marmalade maintains its market presence, particularly in the Northeast region, where traditional British culinary influences persist. Manufacturers are incorporating sugar-reduction technologies and alternative ingredients like chia-seed pectin to enhance their core products while maintaining familiar taste profiles. These developments support the projected growth of the preserves segment in the US jam, jelly, and preserves market, as consumers increasingly value products with visible fruit content as an indicator of quality.

Glass bottles and jars maintain 84.87% of category turnover, supported by their recyclability, product visibility, and established retail infrastructure. Flexible pouches and sachets demonstrate significant growth potential with a 6.22% CAGR, driven by consumer demand for convenient, portable packaging suitable for children's lunchboxes. The integration of squeeze cap technology enables precise portion control, supporting reduced sugar consumption while maintaining spread coverage, aligning with public health initiatives. The reduced weight of flexible packaging, approximately half that of glass containers, results in lower transportation emissions and costs, appealing to environmentally conscious consumers.

The expanded surface area of pouches accommodates enhanced product information through smart-label features, such as QR codes linking to product origin information, increasing consumer interaction both in-store and digitally. Premium preserve manufacturers continue to utilize glass packaging to emphasize artisanal quality, product consistency, and gift-giving appeal, creating distinct market segments within the US jam, jelly, and preserves industry. Manufacturers are exploring alternative solutions, including PET jars that combine transparency with durability, though adoption remains limited. The market for pouches shows potential for additional growth, particularly if retailers expand their refrigerated grab-and-go breakfast offerings.

The US Jam Jelly and Preserves Market Report is Segmented by Product Type (Jam and Jellies, Marmalade, and Preserves), Packaging Type (Bottles/Jars, Pouches/Sachets, Others), Category (Conventional, and Organic), Distribution Channel (Off-Trade, and On-Trade), Geography (Northeast, Midwest, South, West). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- The J.M. Smucker Company

- Conagra Brands, Inc.

- B&G Foods, Inc.

- F. Duerr & Sons Ltd.

- Andros Group

- The Kraft Heinz Company

- National Grape Cooperative (Welch's) Association

- LunaGrown

- Braswell's

- Stonewall Kitchen, LLC

- Crofter's Food Ltd.

- Rigoni di Asiago USA

- Hero Group

- The Hain Celestial Group, Inc

- Wilkin & Sons Ltd.

- Happy Girl Kitchen Co

- St. Dalfour SAS

- Georgia Jams

- Jackie's Jams

- Trappist Preserves

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Consumption of Spreads As Convenient And Ready-To-Eat Options

- 4.2.2 Product Innovation In Flavors, Textures, And Packaging Boosting Sales

- 4.2.3 Expanding Availability Through Supermarkets, Online, And Specialty Retail Stores

- 4.2.4 Increasing Popularity of Artisan And Gourmet Fruit Spread Varieties

- 4.2.5 Rising Demand For Natural And Organic Fruit-Based Spread Products

- 4.2.6 Long Shelf-Life Drives the Usuage of Products Among Conusmers

- 4.3 Market Restraints

- 4.3.1 Rising Health Concerns Over High Sugar Content In Products

- 4.3.2 Strong Competition From Nut Butters And Healthier Spread Options

- 4.3.3 Seasonal Dependence On Fruit Crops Affecting Supply And Prices

- 4.3.4 Growing Preference For Fresh Fruits Over Processed Fruit Spreads

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Porters Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Jam and Jelly

- 5.1.2 Marmalade

- 5.1.3 Preserves

- 5.2 By Packaging Type

- 5.2.1 Bottles/Jars

- 5.2.2 Pouches/Sachets

- 5.2.3 Others

- 5.3 By Category

- 5.3.1 Conventional

- 5.3.2 Organic

- 5.4 By Distribution Channel

- 5.4.1 On-Trade

- 5.4.2 Off-Trade

- 5.4.2.1 Supermarkets/Hypermarkets

- 5.4.2.2 Convenience/Grocery Stores

- 5.4.2.3 Online Retail Stores

- 5.4.2.4 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 Northeast

- 5.5.2 Midwest

- 5.5.3 South

- 5.5.4 West

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 The J.M. Smucker Company

- 6.4.2 Conagra Brands, Inc.

- 6.4.3 B&G Foods, Inc.

- 6.4.4 F. Duerr & Sons Ltd.

- 6.4.5 Andros Group

- 6.4.6 The Kraft Heinz Company

- 6.4.7 National Grape Cooperative (Welch's) Association

- 6.4.8 LunaGrown

- 6.4.9 Braswell's

- 6.4.10 Stonewall Kitchen, LLC

- 6.4.11 Crofter's Food Ltd.

- 6.4.12 Rigoni di Asiago USA

- 6.4.13 Hero Group

- 6.4.14 The Hain Celestial Group, Inc

- 6.4.15 Wilkin & Sons Ltd.

- 6.4.16 Happy Girl Kitchen Co

- 6.4.17 St. Dalfour SAS

- 6.4.18 Georgia Jams

- 6.4.19 Jackie's Jams

- 6.4.20 Trappist Preserves

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK