PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836543

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836543

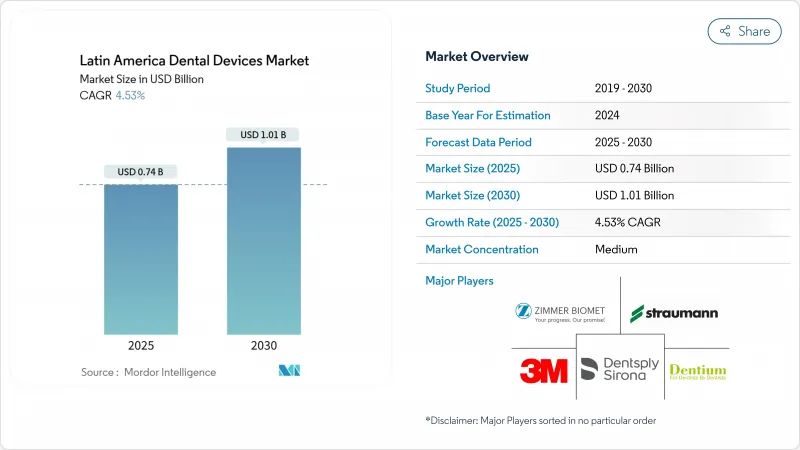

Latin America Dental Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Latin America Dental Devices Market size is estimated at USD 0.74 billion in 2025, and is expected to reach USD 1.01 billion by 2030, at a CAGR of 4.53% during the forecast period (2025-2030).

Demand is underpinned by an expanding private-clinic ecosystem, rising patient preference for digital workflows and supportive regulatory reforms in Brazil that shorten product-approval timelines. Dental service organizations (DSOs) continue consolidating independent practices, placing large multi-site orders and driving manufacturer interest in bundled equipment-and-training contracts. Currency volatility remains the principal cost headwind because most high-end devices are imported and invoiced in US dollars. Nevertheless, the pipeline of digital radiology, chairside CAD/CAM and 3-D printers is strengthening as manufacturers tailor price tiers and financing packages to the Latin American dental equipment market, signalling sustained mid-single-digit growth through 2030.

Latin America Dental Devices Market Trends and Insights

Rise in Dental Tourism in Brazil & Mexico Driving High-end Device Sales

Patient inflows from the United States and Canada are prompting clinics to differentiate through premium intraoral scanners, chairside milling machines and implant surgery units. Annual global dental-tourism volumes reached 3-4 million by 2024, and the Latin American dental equipment market benefits directly because half of these travelers select Brazil or Mexico. Clinics in Bogota and Medellin are replicating this strategy, investing in CBCT scanners that enhance treatment planning accuracy. Equipment acquisitions increasingly emphasize visible, patient-facing technologies that serve as marketing assets as much as clinical tools. The competitive response from manufacturers is to extend deferred-payment schemes linked to tourism seasonality, thereby mitigating foreign-exchange risk for practices. Collectively, tourism-driven spending is lifting the premium sub-segment's contribution to the Latin American dental equipment market.

Expansion of Private DSO Networks Boosting Bulk Equipment Procurement

DSOs use group purchasing contracts to secure double-digit discounts on dental units, imaging suites and sterilization systems. The DSO model accounted for 64% of new-practice openings in 2024, up from 15% a decade earlier, reshaping supplier negotiations. Regional leaders bundle after-sales service and remote-monitoring software to standardize clinical quality across sites, an approach that reduces unplanned downtime and strengthens vendor lock-in. For manufacturers, multi-year framework agreements with DSOs flatten quarterly order volatility and improve volume forecasting. This trend is structurally positive for the Latin American dental equipment market because it raises replacement-cycle predictability and accelerates uptake of digitally-integrated platforms.

Brazil ANVISA Registration Delays (12-18 months)

Although recent reforms target a 60-day fast-track for lower-risk categories, Class III and IV dental devices still face lengthy dossier reviews. Intermediate manufacturers often defer launches because bridging studies and local biocompatibility tests inflate pre-market budgets. Larger multinationals mitigate the delay by parallel filing strategies, yet the inventory cost of holding non-approved stock drags on margins. The bottleneck reduces competitive price pressure in Brazil and slows availability of cutting-edge products, shaving growth from the Latin American dental equipment market.

Other drivers and restraints analyzed in the detailed report include:

- CAD/CAM & 3-D-Printing Lab Rise in Adoption

- Teledentistry Roll-outs Fueling Portable Diagnostic Device Uptake

- FX Volatility Inflating Imported Cone-Beam CT Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Dental consumables led revenue in 2024 owing to their high-frequency usage, yet capital equipment categories are catching up as digital workflows become mainstream. Chairside CAD/CAM systems and polymer-resin 3-D printers recorded a regional shipment jump that translated into a 23% annual sales expansion. Panoramic and cephalometric radiology still dominate imaging spend, but intraoral sensors are closing the gap because cloud-based storage lowers IT overhead for smaller practices. Manufacturers bundle software upgrades with sterilizers and compressors, ensuring that integrated suites remain attractive against piecemeal hardware purchases. Consequently, digital platforms are set to outpace traditional instrumentation, reinforcing the supply-chain pivot toward high-margin service contracts within the Latin American dental equipment market.

Adoption speed varies: Chile and Colombia moved fastest thanks to favorable import-duty structures, while cost-sensitive markets such as Peru focus on refurbished units. Firmware standardization across scanners, milling machines and curing ovens is improving cross-compatibility, reducing chairside errors and raising case throughput. Local assemblers in Brazil are adding open-architecture modules to capture labs seeking vendor-agnostic solutions. Overall, product-level innovation is aligned with the twin goals of shortening treatment timelines and monetizing practice downtime-drivers that keep the Latin American dental equipment market on a steady growth trajectory.

The Latin America Dental Devices Market Report Segments the Industry Into by Product (General and Diagnostic Equipment, Dental Consumables, Other Dental Devices), by Treatment (Orthodontic, Endodontic, and More ), by End User (Dental Hospitals, Dental Clinics, and More) and Geography (North America, Europe and More). The Market Forecasts are Provided in Terms of Value (USD)

List of Companies Covered in this Report:

- Dentsply Sirona

- Straumann Group

- Envista Holdings Corp.

- Align Technology

- Planmeca

- 3M Oral Care

- Ivoclar Vivadent

- Carestream Dental

- A-dec

- GC Corporation

- Coltene Holding

- Vatech Co. Ltd.

- BIOLASE Inc.

- Osstem Implant Co. Ltd.

- Henry Schein

- Dental Morelli Ltda.

- Alliage SA

- Gnatus Equipamentos

- S.I.N. Implant System

- FGM Dental Group

- Bionnovation Biomedical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in Dental Tourism in Brazil & Mexico Driving High-end Device Sales

- 4.2.2 Expansion of Private DSO Networks Boosting Bulk Equipment Procurement

- 4.2.3 CAD/CAM & 3-D-Printing Lab Rise in Adoption

- 4.2.4 Teledentistry Roll-outs Fueling Portable Diagnostic Device Uptake

- 4.2.5 Expansion of Private DSO Networks Boosting Bulk Equipment Procurement

- 4.2.6 Mercosur Tariff Cuts Lowering Import Prices for Digital Radiology

- 4.3 Market Restraints

- 4.3.1 Brazil ANVISA Registration Delays (12-18 months)

- 4.3.2 High After-sales Service Costs

- 4.3.3 FX Volatility Inflating Imported Cone-Beam CT Costs

- 4.3.4 Patchy Implant Reimbursement under Social Security Schemes

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 General and Diagnostics Equipment

- 5.1.1.1 Dental Laser

- 5.1.1.1.1 Soft Tissue Lasers

- 5.1.1.1.2 Hard Tissue Lasers

- 5.1.1.2 Radiology Equipment

- 5.1.1.2.1 Extra Oral Radiology Equipment

- 5.1.1.2.2 Intra-oral Radiology Equipment

- 5.1.1.3 Dental Chair and Equipment

- 5.1.1.4 Other General and Diagnostic equipment

- 5.1.2 Dental Consumables

- 5.1.2.1 Dental Biomaterial

- 5.1.2.2 Dental Implants

- 5.1.2.3 Crowns and Bridges

- 5.1.2.4 Other Dental Consumables

- 5.1.3 Other Dental Devices

- 5.1.1 General and Diagnostics Equipment

- 5.2 By Treatment

- 5.2.1 Orthodontic

- 5.2.2 Endodontic

- 5.2.3 Peridontic

- 5.2.4 Prosthodontic

- 5.3 By End User

- 5.3.1 Dental Hospitals

- 5.3.2 Dental Clinics

- 5.3.3 Academic & Research Institutes

- 5.4 By Country

- 5.4.1 Brazil

- 5.4.2 Mexico

- 5.4.3 Argentina

- 5.4.4 Chile

- 5.4.5 Peru

- 5.4.6 Rest of Latin America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles {(includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)}

- 6.3.1 Dentsply Sirona

- 6.3.2 Straumann Group

- 6.3.3 Envista Holdings Corp.

- 6.3.4 Align Technology Inc.

- 6.3.5 Planmeca Oy

- 6.3.6 3M Oral Care

- 6.3.7 Ivoclar Vivadent AG

- 6.3.8 Carestream Dental LLC

- 6.3.9 A-Dec Inc.

- 6.3.10 GC Corporation

- 6.3.11 COLTENE Holding AG

- 6.3.12 Vatech Co. Ltd.

- 6.3.13 BIOLASE Inc.

- 6.3.14 Osstem Implant Co. Ltd.

- 6.3.15 Henry Schein Inc.

- 6.3.16 Dental Morelli Ltda.

- 6.3.17 Alliage SA

- 6.3.18 Gnatus Equipamentos

- 6.3.19 S.I.N. Implant System

- 6.3.20 FGM Dental Group

- 6.3.21 Bionnovation Biomedical

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment