PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836565

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836565

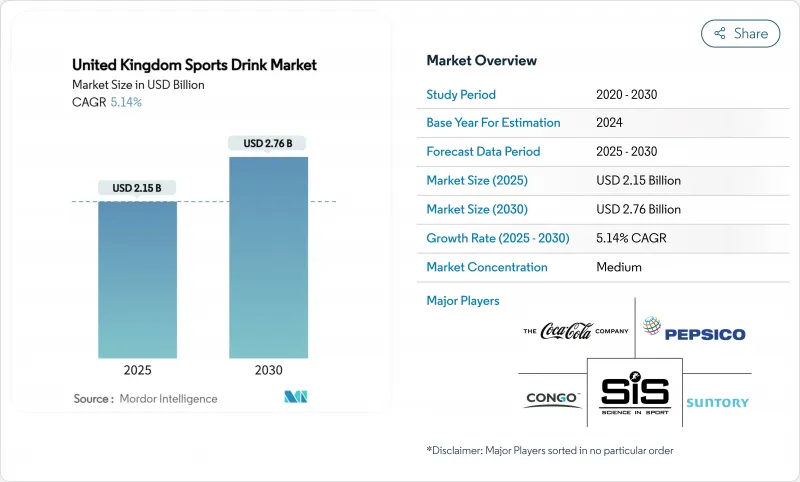

United Kingdom Sports Drink - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

By 2025, the United Kingdom sports drinks market is estimated to be USD 2.15 billion, with forecasts indicating a rise to USD 2.76 billion by 2030, marking a steady CAGR of 5.14%.

This growth is largely driven by consumers increasingly prioritizing functional hydration that enhances performance, boosts immunity, and promotes overall wellness. While isotonic formulations dominate the market, a growing awareness of nutrition is steering attention towards hypotonic alternatives, known for their rapid fluid absorption. Disruptors, often backed by celebrities, are challenging established brands, leveraging social media clout and direct-to-consumer strategies. Meanwhile, supermarkets maintain their volume leadership, using strategic in-store visibility programs that align sports drinks with fitness products. In response to impending advertising restrictions on high-sugar items, brands are hastening their reformulation efforts, pivoting towards low- or zero-sugar, electrolyte-rich profiles that align with health objectives and meet regulatory standards

United Kingdom Sports Drink Market Trends and Insights

Adoption of Sports Drinks Among Gym-Goers and Fitness Enthusiasts

In the UK, a burgeoning fitness culture is reshaping how consumers view sports drinks, pivoting the focus from mere performance enhancement to hydration as a lifestyle choice. Health-conscious individuals-ranging from casual gym-goers and wellness aficionados to active seniors-are on the lookout for hydration solutions that align with broader health objectives like boosting immunity, enhancing energy, and aiding recovery. This shift has sparked heightened interest in beverages enriched with vitamins, minerals, adaptogens, and nootropics. Data from Sport England reveals a notable uptick in fitness class participation in England, with about 6.7 million attendees between November 2023 and November 2024, a rise from the previous 6.2 million . Furthermore, there is growing consumer preference for low- or zero-sugar options, natural ingredients, and plant-based formulations in the clean-label segment. Companies are repositioning from sports performance to wellness solutions providers, driven by increased demand for ingredient transparency and sourcing information. The market application of sports drinks has expanded beyond exercise recovery to daily consumption during work and commuting. Companies have adjusted their market strategy to emphasize cognitive benefits, sustained energy, and hydration. Product innovation has increased, particularly among new market entrants combining hydration with wellness benefits. Companies leveraging digital channels to communicate product benefits and clean-label attributes are gaining market share.

Rise in Endurance Event Across the Country

The UK endurance sports market shows substantial growth, driving increased demand for sports hydration products. IRONMAN 2025 data positions the UK as the second-largest market globally for triathlon participation, with a 39% increase in new participants since 2019. This market expansion creates opportunities in the sports hydration segment, particularly among recreational and semi-professional athletes implementing structured hydration protocols. Additionally, market demand focuses on products delivering specific electrolyte balance, carbohydrate content, and absorption efficiency for both competition and training needs. Research indicates the requirement for hydration solutions adapted to exercise intensity and environmental factors. The UK's variable weather conditions necessitate products suitable for different climate scenarios. Besides, market offerings include temperature-adaptive formulations and varying concentrations for different exercise durations. Companies developing specialized products for specific athletic applications demonstrate strong potential in the UK sports hydration market, supported by continuous growth in endurance sports participation.

Adulteration and Mislabeling to Impact the Market

Concerns over product integrity are causing ripples in the sports drinks market. Scientific investigations have unveiled a gap between what labels claim and the actual formulations. A study on isotonic beverages revealed that 33% of the products, despite being marketed as isotonic, didn't meet the osmolality standards of 270-330 mOsm/kg. This mislabeling not only highlights a significant oversight but also erodes consumer trust. The issue isn't limited to osmolality; many products boast functional claims, yet contain sugars like glucose and fructose. While these sugars can traverse cell membranes, they influence the product's tonicity, even if the technical osmolality standards are met. This growing skepticism, especially among informed athletes, is stunting market growth. As these athletes become more discerning about efficacy claims, brands that prioritize rigorous testing and transparently communicate scientifically validated benefits stand to gain a competitive edge. This advantage becomes even more pronounced as the market matures and regulatory scrutiny tightens.

Other drivers and restraints analyzed in the detailed report include:

- Product Innovation with Functional Additives

- Brand Endosements by Professional Athletes and Sports Celebrities Fueling Demand

- Regulatory Compliance Requirements

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, PET bottles command a dominant 73.44% market share, owing to their consumer-friendly design, convenience, and broad acceptance in retail. Their ergonomic and resealable features cater perfectly to today's on-the-go consumers. Yet, this segment grapples with sustainability hurdles. UK retailers, responding to consumer demand and regulatory pressures, are ramping up climate initiatives to curb plastic waste. The British Retail Consortium, with its ambitious roadmap, targets a net-zero retail industry by 2040. This push for sustainable packaging practices could reshape the dominance of PET bottles in the sports drinks arena.

Pouches and sachets are set to outpace all other formats, boasting a projected CAGR of 7.01% from 2025 to 2030. Their rise is attributed to a commendable sustainability profile and distinct functional advantages. Bioplastics, with global production capacity projected to surge from 2.1 million tonnes in 2019 to 6.3 million tonnes by 2027, promise material innovations bolstering the environmental appeal of pouches as per European Bioplastics (EUBP). These pouches, championing a significant material reduction over rigid containers, resonate with Greenpeace's call for UK supermarkets to slash plastic packaging by 50% by 2025. Beyond sustainability, pouches offer tangible benefits: lighter shipping weights, better product-to-packaging ratios, and enhanced portability for the active consumer.

The Report Covers UK Sports Drink Companies and It is Segmented by Product Type (Isotonic and Hypertonic/Hypotonic), Packaging Type (PET Bottles, Cans, Tetra Packs, and Pouches/Sachets), and Distribution Channel (Supermarkets/Hypermarkets, Pharmacy/Health Stores, Online Retail Stores, and Other Distribution Channels). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- The Coca-Cola Company (Powerade)

- PepsiCo Inc. (Gatorade)

- Congo Brands (Prime Hydration LLC)

- SiS (Science in Sport) PLC

- OSHEE Polska Sp. z o.o.

- A.G. Barr p.l.c

- Wow Hydrate Ltd.

- iPro Hydrate Ltd.

- Mondelez International, Inc. (Grenade)

- T.C. Pharmaceutical Industries Company Limited.

- Carabao Group Public Co., Ltd.

- Applied Nutrition Ltd.

- Suntory Holdings Limited

- Blu Steel Beverages Ltd

- Kingsley Beverage FZCO

- Amacx Sports Nutrition.

- Mas+ Next Generation Beverage Co

- High5 Sports Nutrition Ltd.

- Hornell Brewing Co., Inc.

- Ready Nutrition

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Adoption of Sports Drinks Among Gym-goers and Fitness Enthusiasts

- 4.2.2 Rise in Endurance Events Across the Country

- 4.2.3 Product Innovation with Functional Additives

- 4.2.4 Brand Endorsements by Professional Athletes and Sports Celebrities Fueling Demand

- 4.2.5 Growing Demand for Natural and Organic Ingredients in Sports Drinks

- 4.2.6 Rising Disposable Incomes Leading to Increased Spending on Premium Products

- 4.3 Market Restraints

- 4.3.1 Adulteration and Mislabeling to Impact the Market

- 4.3.2 Regulatory Compliance Requirements

- 4.3.3 Concerns Over Sugar Content Driving Demand for Low-sugar Options

- 4.3.4 Seasonal Demand Fluctuations

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Isotonic

- 5.1.2 Hypertonic/Hypotonic

- 5.2 By Packaging Type

- 5.2.1 PET Bottles

- 5.2.2 Cans

- 5.2.3 Tetra Packs

- 5.2.4 Pouches/Sachets

- 5.3 By Distribution Channel

- 5.3.1 Supermarkets/Hypermarkets

- 5.3.2 Pharmacy/Health Stores

- 5.3.3 Online Retail Stores

- 5.3.4 Other Distribution Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 The Coca-Cola Company (Powerade)

- 6.4.2 PepsiCo Inc. (Gatorade)

- 6.4.3 Congo Brands (Prime Hydration LLC)

- 6.4.4 SiS (Science in Sport) PLC

- 6.4.5 OSHEE Polska Sp. z o.o.

- 6.4.6 A.G. Barr p.l.c

- 6.4.7 Wow Hydrate Ltd.

- 6.4.8 iPro Hydrate Ltd.

- 6.4.9 Mondelez International, Inc. (Grenade)

- 6.4.10 T.C. Pharmaceutical Industries Company Limited.

- 6.4.11 Carabao Group Public Co., Ltd.

- 6.4.12 Applied Nutrition Ltd.

- 6.4.13 Suntory Holdings Limited

- 6.4.14 Blu Steel Beverages Ltd

- 6.4.15 Kingsley Beverage FZCO

- 6.4.16 Amacx Sports Nutrition.

- 6.4.17 Mas+ Next Generation Beverage Co

- 6.4.18 High5 Sports Nutrition Ltd.

- 6.4.19 Hornell Brewing Co., Inc.

- 6.4.20 Ready Nutrition

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK