PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836573

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836573

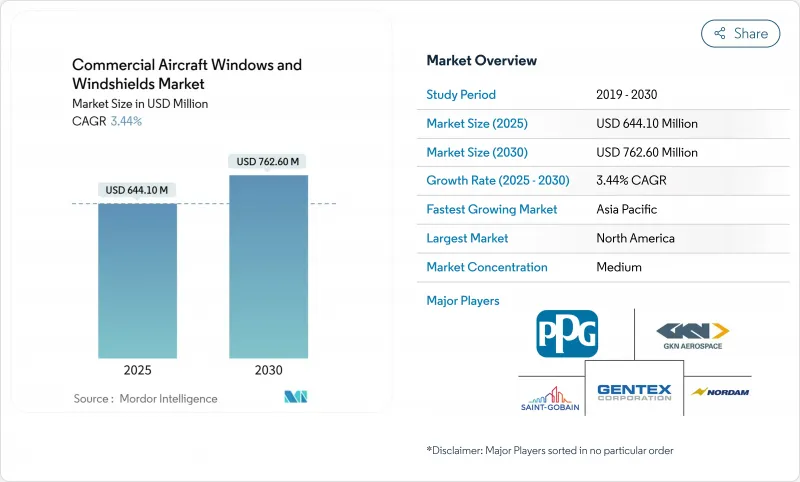

Commercial Aircraft Windows And Windshields - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The commercial aircraft windows and windshields market is valued at USD 644.05 million in 2025 and is forecasted to reach USD 762.65 million by 2030 at a 3.44% CAGR.

Continued fleet growth, rising retrofits, and rapid material innovation sustain demand despite lingering supply-chain constraints. Airlines prioritize lighter windows that help trim fuel burn, while premium carriers install dimmable and panoramic solutions that boost customer experience. Regulatory pressure from the FAA and EASA drives more frequent windshield replacement cycles, and the multi-year production backlogs at Airbus and Boeing incentivize tier-1 suppliers to expand capacity. At the same time, certification costs and shortages of specialty glass and resins limit the pace at which new technologies scale.

Global Commercial Aircraft Windows And Windshields Market Trends and Insights

Growing Demand for Larger Panoramic Cabin Windows

Airlines view larger windows as a brand differentiator that can lift high-yield ticket sales. Airbus integrated oversized apertures on the A350 and redesigned A320 sidewalls to let more daylight flood the cabin, which improves the perception of space and reduces jet-lag-related fatigue. Suppliers have responded with stronger thin-glass laminates that preserve structural integrity at greater dimensions while trimming weight. Tinted coatings and hydrophobic layers keep clarity high even after repeated cleaning cycles. Premium carriers retrofit older widebodies with upgraded window surrounds that support bigger panes and LED mood lighting. These upgrades raise cabin refurbishment costs but extend airframe service life. Consequently, panoramic designs move from novelty to mainstream line-fit options on new single-aisle programs.

Acceleration of Electrochromic Smart Windshield Adoption

Electronically dimmable solutions, once confined to business jets, are entering large commercial platforms. Gentex's latest devices block 99.9% of light and reach full-clear in 90 seconds, a feature now line-fit on the B787 and selected A321XLR deliveries.Laboratory tests show infrared rejection of 77.3% and visible transmittance from 39.2% to 56.4%, which lowers cockpit heat load and cuts air-conditioning draw. Embedding thin-film solar collectors along the windshield perimeter powers tint cycles without tapping aircraft buses. Airlines that install the technology in premium cabins report higher Net Promoter Scores and faster turnarounds because blinds are no longer needed. As certification precedents accumulate, suppliers expect the cost per window to fall, driving wider adoption on narrowbody fleets.

Supply-Chain Constraints in Specialty Materials

Chemically toughened glass substrates and interlayer resins rely on a few plants in North America and Europe. Pandemic-era disruptions still ripple through procurement schedules, limiting batch sizes and driving spot price spikes. Narrowbody ramp-ups have forced tier-2 laminators to juggle allocation across multiple OEM lines, which elongates lead times. Freight bottlenecks add risk when climate-controlled containers are unavailable. Some airlines, therefore, pre-buy replacement panes and hold inventory, tying up working capital. Researchers explore recycled glass cullet and bio-based resins to diversify feedstocks, yet commercial volumes remain small.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Production Backlog at Boeing and Airbus Stimulating Tier-1 Suppliers

- Lightweight Acrylic and Polycarbonate Adoption for Fuel-Burn Reduction

- High Certification and Qualification Costs Hindering New Technologies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The narrowbody segment contributed 62.19% of the market share of commercial aircraft windows and windshields in 2024 and will expand at a 6.45% CAGR through 2030. A320neo and B737 MAX families continue to capture orders from low-cost carriers prioritizing short-haul, point-to-point service. Each single-aisle airframe houses fewer panes than a twin-aisle, yet the fleet's huge installed base secures the bulk of revenue. Retrofits add dimmable solutions on high-yield rows and reinforce frames for larger apertures. Widebody aircraft keep a smaller slice but deliver high value per shipset because the A350 and B787 specify oversized panoramic windows that fetch premium pricing. Regional jets and turboprops leverage lightweight polycarbonate to widen range and improve block-time economics, while freighters opt for rugged glass that resists handling damage. Long-term, conceptual windowless cabins could trim weight further, yet certification complexity suggests a gradual evolution rather than a sudden switch.

Narrowbody momentum benefits the commercial aircraft windows and windshields market size because single-aisle programs dominate order backlogs. Greater shipset volumes incentivize suppliers to automate lamination and coating lines, which lowers unit cost and unlocks smart features for entry-level cabins. Customers weigh marginal fuel savings against acquisition premiums, so adopting electrochromic panes follows a top-down pattern starting with flagship carriers. Still, rising OEM production targets ensure even conservative airlines refresh their inventory. Widebody deliveries concentrate in international hubs where brand positioning matters more, sustaining demand for the largest dimmable windows on ultra-long-range variants.

Cabin windows accounted for 65.31% of the commercial aircraft and windshields market size in 2024 due to a four-to-six-per-row geometry across all seats. Retrofits that install crew-controlled aerBlade shades or embed OLED lighting underline the cabin's importance in brand differentiation. Advancements in anti-smudge coatings keep clarity high despite frequent passenger contact and cleaning cycles. Cockpit windshields post the fastest segment CAGR of 6.8%, given stricter bird-strike tolerance and emerging augmented-reality overlays. Honeywell and NXP's collaboration on large-area cockpit displays increases optical load, pushing window makers to refine conductive coatings for better EMI shielding.UV-blocking technology further protects pilots on high-latitude routes, addressing occupational health mandates.

The replacement interval for cockpit glass narrows when compliance standards tighten, magnifying aftermarket revenue. Certification rules demand redundant heating elements to prevent ice build-up, which raises the bill of materials but enhances operational safety. Airlines balance these costs by synchronizing windshield swaps with scheduled engine overhauls, optimizing downtime. Cabin pane turnover is slower, yet fleet-wide retrofit programs can spur lumpy order spikes. As sustainability metrics gain regulatory teeth, lighter planes emerge as an attractive lever to cut per-trip emissions.

The Commercial Aircraft Windows and Windshields Market Report is Segmented by Aircraft Type (Narrowbody Aircraft, Widebody Aircraft, and More), Application (Cabin Windows, and More), Material (Glass Laminates, Acrylic, Polycarbonate, and More), Technology (Heated/Anti-Ice Windows, and More), End-User (OEM and Aftermarket) and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America controlled 34.78% of the commercial aircraft windows and windshields market in 2024, buoyed by its dense airframe manufacturing ecosystem and extensive MRO capacity. FAA regulations compel quicker windshield replacement, expanding local demand. PPG's aerospace backlog and Gentex's dimmable glass pipeline underscore the region's technology pull. Canada complements the US with composite research hubs that refine polycarbonate bonding techniques.

Asia-Pacific is the fastest mover, advancing at an 8.21% CAGR through 2030. Boeing foresees India and South Asia quadrupling their fleet by 2043, requiring 2,835 new airplanes. Local carriers adopt the latest cabin standards to woo middle-class travelers, so dimmable and panoramic panes see quicker line-fit. Multiple OEMs have site repair centers near Guangzhou, Hyderabad, and Nagoya to shorten turnaround times. Yet, material imports face longer logistics lead times, magnifying the impact of resin shortages.

Europe retains a strong share anchored by Airbus production in Toulouse and Hamburg. The bloc's climate policies accelerate the adoption of lighter materials that shrink per-trip emissions. Suppliers there pioneer resource-efficient glass melting processes and lead recycling standards that could become global benchmarks. Middle Eastern carriers such as Emirates invest in large-scale retrofits that rely on European-built kits, sustaining cross-regional flows. Africa lags in fleet size but offers a greenfield opportunity for local repair stations as intra-continental connectivity rises. Latin America shows steady expansion driven by Brazilian regional jets and MRO clusters around Sao Jose dos Campos.

- PPG Industries Inc.

- GKN Aerospace Services Ltd.

- Gentex Corporation

- Saint-Gobain Aerospace

- NORDAM Group LLC

- Control Logistics Inc.

- Plexiweiss GmbH

- Llamas Plastics Inc.

- Aerospace Plastic Components (APC) Pty. Ltd.

- Lee Aerospace, Inc.

- LP Aero Plastics Inc.

- Tech-Tool Plastics, Inc.

- Triumph Group, Inc.

- Cee Bailey's Aircraft Plastics, Inc.

- Great Lakes Aero Products, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for larger panoramic cabin windows

- 4.2.2 Acceleration of electrochromic smart windshield adoption

- 4.2.3 Increasing production backlog at Boeing and Airbus

- 4.2.4 Stringent FAA and EASA bird-strike and thermal-shock standards

- 4.2.5 Lightweight acrylic and polycarbonate adoption

- 4.2.6 Airline fleet modernization programs in Asia and Middle East

- 4.3 Market Restraints

- 4.3.1 Supply-chain constraints in specialty materials

- 4.3.2 High certification and qualification costs

- 4.3.3 Volatile OEM production rates

- 4.3.4 Limited repair capabilities outside North America and Europe

- 4.4 Value Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Aircraft Type

- 5.1.1 Narrowbody Aircraft

- 5.1.2 Widebody Aircraft

- 5.1.3 Regional Jets

- 5.1.4 Freighter/Converted Freighter Aircraft

- 5.2 By Application

- 5.2.1 Cabin Windows

- 5.2.2 Cockpit Windshields

- 5.3 By Material

- 5.3.1 Glass Laminates

- 5.3.2 Acrylic

- 5.3.3 Polycarbonate

- 5.3.4 Hybrid/Composite Sandwich Structures

- 5.4 By Technology

- 5.4.1 Conventional Multi-Layer Laminates

- 5.4.2 Electrochromic/Dimmable Smart Windows

- 5.4.3 Heated/Anti-Ice Windows

- 5.4.4 UV and IR-Coated Windows

- 5.5 By End Market

- 5.5.1 OEM

- 5.5.2 Aftermarket (MRO and Retrofit)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Russia

- 5.6.3.5 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Qatar

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 PPG Industries Inc.

- 6.4.2 GKN Aerospace Services Ltd.

- 6.4.3 Gentex Corporation

- 6.4.4 Saint-Gobain Aerospace

- 6.4.5 NORDAM Group LLC

- 6.4.6 Control Logistics Inc.

- 6.4.7 Plexiweiss GmbH

- 6.4.8 Llamas Plastics Inc.

- 6.4.9 Aerospace Plastic Components (APC) Pty. Ltd.

- 6.4.10 Lee Aerospace, Inc.

- 6.4.11 LP Aero Plastics Inc.

- 6.4.12 Tech-Tool Plastics, Inc.

- 6.4.13 Triumph Group, Inc.

- 6.4.14 Cee Bailey's Aircraft Plastics, Inc.

- 6.4.15 Great Lakes Aero Products, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment