PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836575

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836575

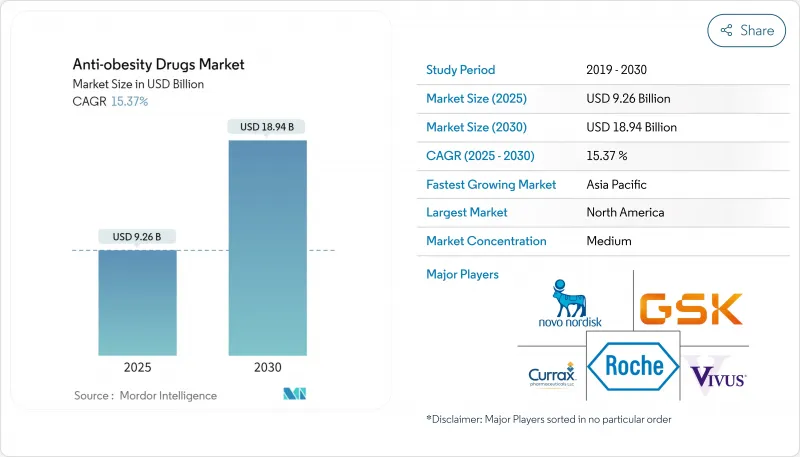

Anti-obesity Drugs - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The anti-obesity drugs market is valued at USD 25.93 billion in 2025 and is forecast to grow to USD 100.97 billion by 2030, advancing at a 31.24% CAGR.

Growth pivots on the dramatic efficacy gains delivered by GLP-1 receptor agonists, increasing recognition of obesity as a chronic disease, and expanding reimbursement in high-income countries. Rapid pipeline progress is shortening development timelines, while investment is flowing into oral and multi-agonist formulations that promise comparable efficacy to injectables. Manufacturers are scaling capacity in anticipation of strong demand, yet near-term supply tightness persists. Competition is sharpening as large firms defend share with lifecycle extensions and smaller biotechs seek white-space opportunities in novel mechanisms.

Global Anti-obesity Drugs Market Trends and Insights

High burden of obesity and related comorbidities

Escalating prevalence has doubled since 1990, and 35 million children under 5 were overweight in 2024. The World Obesity Atlas projects more than 750 million children will live with overweight or obesity by 2035. Comorbid conditions amplify the clinical and financial imperative: hypertension affects up to 89.4% of older adults with obesity, adding USD 131 billion to annual spending. The scale of unmet need is accelerating drug adoption, particularly where cardiovascular risk reduction data now support pharmacologic intervention.

Increasing R&D initiatives for innovative drugs

More than 116 compounds were in clinical development in 2025, a 30% increase versus 2023. Momentum stems from dual- and triple-agonist programs such as CagriSema, which recorded 22.7% weight loss in the REDEFINE 1 trial novonordisk.com, and MariTide, which achieved up to 20% weight loss at week 52. The focus is shifting toward oral GLP-1 agents like orforglipron, registering up to 14.7% weight loss in Phase II data. Venture funding and strategic licensing deals underscore confidence in next-generation mechanisms.

High treatment cost creates access barriers

Monthly therapy costs of leading GLP-1 agonists near USD 1,000 in the United States. Only 21% of state Medicaid plans cover at least one obesity medication, and unrestricted access is below 15%. Economic modeling shows annual system costs could surpass USD 100 billion if widespread uptake occurs. Affordability gaps are wider in low-income countries, dampening uptake despite rising obesity prevalence.

Other drivers and restraints analyzed in the detailed report include:

- Increased patient awareness and shift toward non-surgical options

- Growing public and private benefit programs

- Regulatory hurdles and safety concerns impede expansion

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Peripherally acting drugs contributed 60.10% of 2024 revenue, underpinned by established safety and lower CNS exposure. Yet gut-hormone incretins are growing fastest at a 33.15% CAGR, outpacing every other class in the anti-obesity drugs market. GLP-1 analogs deliver 15-22.5% average weight reductions compared with single-digit results from older therapies. Dual- and triple-agonist strategies leverage complementary pathways to amplify satiety and energy expenditure, pushing efficacy toward bariatric-surgery territory.

The widening efficacy gap drives strong physician preference for incretins despite premium pricing. Manufacturers are bundling digital coaching to mitigate gastrointestinal side effects and extend time on therapy. As new entrants such as GIP/GLP-1/glucagon tri-agonists progress, the anti-obesity drugs market size for gut-hormone-based products is expected to exceed USD 70 billion by 2030. Competitive intensity will hinge on differentiating durability of response, cardiovascular benefit claims, and delivery innovations.

Prescription products held 84.20% share in 2024 and will sustain leadership with a projected 32.56% CAGR. Clinicians manage dose titration, monitor cardiometabolic markers, and coordinate adjunct lifestyle programs, reinforcing medical oversight. In SURMOUNT-1, tirzepatide 15 mg delivered 25% body-weight reduction for one-third of participants, underscoring the clinical rationale for physician-directed therapy.

Over-the-counter formulations remain limited to orlistat generics and fiber-based supplements that underperform on efficacy and tolerability. As multi-agonists gain approval, labeling complexity and risk-management programs will further entrench prescription dominance. However, a small consumer niche persists for OTC aids bundled with personalized nutrition apps, creating modest diversification in the anti-obesity drugs industry.

The Anti-Obesity Drugs Market Report is Segmented by Mechanism of Action (Peripherally Acting Drugs, Centrally Acting Drugs, and Gut Hormone Incretins), Drug Type (Prescription Drugs and OTC Drugs), Route of Administration (Oral and Injectable), Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and More), and Geography (North America, Europe, and More). The Market and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 65.90% of 2024 revenue, supported by 40.3% adult obesity prevalence. The FDA's cardiovascular-risk indication for semaglutide broadens payor acceptance, and draft policy guidance signals further reimbursement expansion. The region's robust specialist network accelerates uptake of novel agents and supports real-world evidence generation critical for long-term reimbursement decisions.

Asia-Pacific is the fastest-growing region at a 33.65% CAGR. Rising disposable income, urban diets, and sedentary lifestyles fuel obesity incidence. A 2024 economic study estimated obesity-related medical outlays at USD 23.3 billion in India and USD 10.2 billion in Thailand, with potential savings of USD 3.0 billion and USD 2.2 billion respectively from a 10% weight reduction. Governments are integrating pharmacotherapy into non-communicable disease strategies, accelerating approvals and localized manufacturing.

Europe maintains significant volume despite heterogeneous reimbursement. The EMA cleared Wegovy in 2022 and Mounjaro the same year, yet country-level access varies. Central and Eastern European markets generally restrict reimbursement to type 2 diabetes, limiting growth potential. Long-term cardiovascular data and health-economic models could shift payer stances, creating incremental upside for the anti-obesity drugs market.

Middle East and Africa and South America remain nascent but promising. Urbanization and fast-food proliferation are driving double-digit obesity growth. Limited specialist density, restricted payor budgets, and supply chain constraints cap near-term penetration. Strategic focus on high-income Gulf states and private insurance segments in Latin America may unlock earlier adoption ahead of broader public-sector engagement.

- Novo Nordisk

- Eli Lilly and Company

- Roche

- Pfizer

- GlaxoSmithKline

- Currax Pharmaceuticals

- Boehringer Ingelheim Intl. GmbH

- Amgen

- AstraZeneca

- Merck

- Bayer

- Takeda Pharmaceuticals

- Rhythm Pharmaceuticals, Inc.

- Vivus LLC

- Zydus Lifesciences Ltd.

- Gelesis Holdings Inc.

- Teva Pharmaceuticals Company Limited

- Hanmi Pharm.Co.,Ltd.

- Verdiva

- HK inno.N Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High Burden of Obesity and Realted Comorbidities Due to Growing Sedentary Lifestyle

- 4.2.2 Increasing Research and Development Initiatives for Innovative Drugs

- 4.2.3 Increased Patient Awarness and Shift Towards Non Surgical Treatment Options

- 4.2.4 Growing Inititaives Taken By Public and Private Organizations for Benefit Programs

- 4.2.5 Accelerated commercialization of next-generation oral GLP-1 receptor agonists

- 4.2.6 Integration of prescription anti-obesity drugs into employer-sponsored digital weight-management platforms and telehealth services

- 4.3 Market Restraints

- 4.3.1 High Treatment Cost and Limited Reimbursement

- 4.3.2 Regulatory Cahllenges Coupled with Safety and Side Effects

- 4.3.3 Availability of Alternative Therapies and Long-Term Cost Effectiveness Concerns

- 4.3.4 Manufacturing-capacity bottlenecks for complex peptide APIs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory andTechnological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value -USD)

- 5.1 By Mechanism of Action

- 5.1.1 Peripherally Acting Drugs

- 5.1.2 Centrally Acting Drugs

- 5.1.3 Gut-Hormone Incretins

- 5.2 By Drug Type

- 5.2.1 Prescription Drugs

- 5.2.2 OTC Drugs

- 5.3 By Route of Administration

- 5.3.1 Oral

- 5.3.2 Injectable

- 5.4 By Distribution Channel

- 5.4.1 Hospital Pharmacies

- 5.4.2 Retail Pharmacies

- 5.4.3 Online Pharmacies

- 5.4.4 Weight-Loss Clinics

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Novo Nordisk A/S

- 6.4.2 Eli Lilly and Company

- 6.4.3 F. Hoffmann-La Roche AG

- 6.4.4 Pfizer Inc.

- 6.4.5 GSK plc

- 6.4.6 Currax Pharmaceuticals LLC

- 6.4.7 Boehringer Ingelheim Intl. GmbH

- 6.4.8 Amgen Inc.

- 6.4.9 AstraZeneca plc

- 6.4.10 Merck & Co., Inc.

- 6.4.11 Bayer AG

- 6.4.12 Takeda Pharmaceutical Co. Ltd

- 6.4.13 Rhythm Pharmaceuticals, Inc.

- 6.4.14 Vivus LLC

- 6.4.15 Zydus Lifesciences Ltd.

- 6.4.16 Gelesis Holdings Inc.

- 6.4.17 Teva Pharmaceuticals Company Limited

- 6.4.18 Hanmi Pharm.Co.,Ltd.

- 6.4.19 Verdiva

- 6.4.20 HK inno.N Corp.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment