PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836580

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836580

Italy Diabetes Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

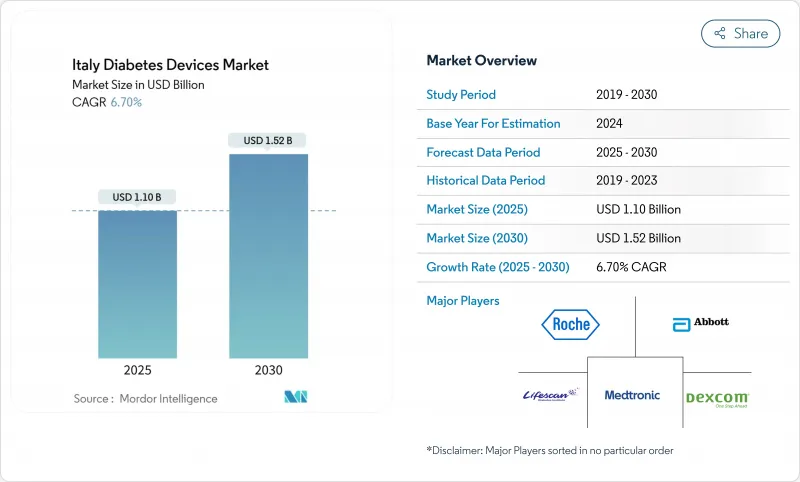

Italy diabetes devices market stood at USD 1.1 billion in 2025 and is forecast to reach USD 1.52 billion by 2030, advancing at a 6.7% CAGR.

The steady rise reflects an aging population, a 92.14% dominance of Type 2 cases, and a policy environment that reimburses continuous glucose monitoring (CGM) for priority groups under the National Health Service. Adoption accelerates further as pharmacies become clinical hubs, telemedicine tools spread to 72% of facilities, and hybrid closed-loop pumps enter reimbursement formularies. Management products enjoy a 7.14% CAGR due to weekly insulin and tubeless automated delivery roll-outs, while monitoring devices retain scale leadership at 58.12% share in 2024. North-South funding gaps and stringent European accuracy rules temper momentum, yet targeted digital spending of EUR 1.6 billion keeps Italy among Europe's most attractive pilots for advanced diabetes technology.

Italy Diabetes Devices Market Trends and Insights

Reimbursement of CGM Sensors for T1 & Pediatric Patients

Parliamentary Law 130/2023 mandates national screening for citizens aged 1-17 years, routing newly diagnosed children swiftly toward CGM adoption . The Ministry of Health already funds FreeStyle Libre for both Type 1 and insulin-intensive Type 2 users, removing a key cost hurdle. Multi-center trials in Lombardy, Emilia Romagna, and Toscana report HbA1c falls of 0.4% at three months and 0.6% at six months with intermittently scanned CGM. Early CGM habituation in childhood is expected to lift lifetime adherence and enlarge long-term sensor revenue. Implementation lags occur in Calabria and Sardegna, yet national reimbursement rules give suppliers a clear demand signal.

Growing Telemedicine Adoption & Home-Care Push Post-PNRR

EUR 1.6 billion from the Recovery Plan modernizes electronic health records, enabling 72% of hospitals to activate tele-consults that directly feed glucose data into clinical portals. Surveys of 600 clinicians show 82% endorse tele-follow-up for routine glycemic reviews, while 80% cite infection-control gains in a post-COVID era. The Connected Care platform and Resilia app allow secure sharing of sensor feeds, though 66% of practitioners caution that digital care cannot replace critical in-person titration visits. Broadband blackspots in inland Basilicata slow real-time uploads, but pharmacy Wi-Fi stations increasingly bridge the gap. Overall, remote monitoring saves travel time for elderly patients and encourages continuous data flow that underpins closed-loop dosing algorithms.

Regional Funding Disparity Between North & South

Seven regions, including Calabria and Sardegna, failed minimum-care benchmarks in 2021, leading to rationed CGM allocations and longer waiting lists. New autonomy legislation of June 2024 allows wealthier regions to self-fund enhanced benefits, potentially widening access gaps. Out-of-pocket drug spending equals 23% of national healthcare costs but weighs heavier on lower-income households prevalent in the South. Clinician migration northward compounds capacity shortages. Device suppliers must therefore calibrate pricing tiers and co-pay support programs to avoid lost volumes in underfunded territories.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Pharmacy-Run Diabetes Clinics

- Rising Prevalence & Earlier Onset of Type 2 Diabetes

- Strict eCGM Accuracy Rules Delaying New Entrants

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The monitoring category retained 58.12% of Italy diabetes devices market share in 2024, underpinned by the country's entrenched self-testing culture and full reimbursement of FreeStyle Libre for intensive insulin users. Italy diabetes devices market size for monitoring solutions was USD 0.64 billion in 2025 and is set to climb at a 5.9% CAGR on the strength of sensor upgrades and wider pediatric coverage. Blood-glucose strips continue to sell because many seniors trust finger-prick verification, yet Libre 2 users showed HbA1c drops of 0.6% after six months in a 2,000-patient Lombardy cohort . Hospitals increasingly deploy professional CGM for in-patient titration, expanding the addressable volume of disposable sensors.

Management devices, valued at USD 0.46 billion in 2025, outpace monitoring with a 7.14% CAGR to 2030 as automated delivery platforms proliferate. Insulet's Omnipod 5 launch in January 2025 introduced the first tubeless system with dual-sensor compatibility, extending choice for the 300,000 Italian Type 1 users eligible for public reimbursement. The weekly insulin Icodec debut in June 2025 slashes injection events by 86%, triggering needle-syringe replacement cycles and encouraging pump trials for dose accuracy. Italian comparative studies reveal MiniMed 780G achieves 71% Time-in-Range, exceeding Tandem Control-IQ's 68% result, influencing endocrinologist prescribing behaviour. Pen-needle makers follow SIMDO guidance favoring 4 mm 32G formats to minimize lipohypertrophy risk. Management innovations thereby cement a higher-growth runway within the Italy diabetes devices market.

The Italy Diabetes Devices Market Report Segments the Industry Into Device Type (Management Devices and Monitoring Devices), End User (Hospital & Clinics, Home-Care Settings, and More), Diabetes Type (Type 1 Diabetes, Type 2 Diabetes, and Gestational & Other Specific Types). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Abbott Laboratories

- Roche

- Lifescan

- Dexcom

- Medtronic

- Arkray

- Ascensia

- Novo Nordisk

- Eli Lilly and Company

- Sanofi

- Insulet

- A. Menarini Diagnostics

- Sinocare

- Terumo

- B. Braun

- Ypsomed

- Tandem Diabetes Care

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Reimbursement of CGM sensors for T1 & pediatric patients

- 4.2.2 Growing telemedicine adoption & home-care push post-PNRR

- 4.2.3 Expansion of pharmacy-run diabetes clinics (Farmacie dei Servizi)

- 4.2.4 Rising Prevalence of Obesity Among Youth Increasing Earlier Onset Diabetes

- 4.2.5 AI-powered decision-support in hybrid-closed-loop pumps

- 4.2.6 Rising prevalence & earlier onset of Type-2 diabetes

- 4.3 Market Restraints

- 4.3.1 Regional funding disparity between North & South

- 4.3.2 Strict eCGM accuracy rules delaying new entrants

- 4.3.3 Supply-chain exposure to single-use plastics legislation

- 4.3.4 Data-privacy constraints on cloud glucose platforms

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Device Type

- 5.1.1 Management Devices

- 5.1.1.1 Insulin Pump

- 5.1.1.1.1 Insulin Pump Device

- 5.1.1.1.2 Insulin Pump Reservoir

- 5.1.1.1.3 Infusion Set

- 5.1.1.2 Insulin Syringes

- 5.1.1.3 Cartridges in Reusable Pens

- 5.1.1.4 Insulin Disposable Pens

- 5.1.1.5 Jet Injectors

- 5.1.2 Monitoring Devices

- 5.1.2.1 Self-Monitoring Blood Glucose

- 5.1.2.1.1 Glucometer Devices

- 5.1.2.1.2 Blood Glucose Test Strips

- 5.1.2.1.3 Lancets

- 5.1.2.2 Continuous Glucose Monitoring

- 5.1.2.2.1 Sensors

- 5.1.2.2.2 Durables

- 5.1.1 Management Devices

- 5.2 By End User

- 5.2.1 Hospitals & Clinics

- 5.2.2 Home-care Settings

- 5.2.3 Specialized Diabetes Centers & Pharmacies

- 5.3 By Patient Type

- 5.3.1 Type-1 Diabetes

- 5.3.2 Type-2 Diabetes

- 5.3.3 Gestational & Other Specific Types

6 Market Indicators

- 6.1 Type-1 Diabetes Population

- 6.2 Type-2 Diabetes Population

7 Competitive Landscape

- 7.1 Market Concentration

- 7.2 Market Share Analysis

- 7.3 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, and Recent Developments)

- 7.3.1 Abbott Diabetes Care

- 7.3.2 Roche Diabetes Care

- 7.3.3 LifeScan Inc.

- 7.3.4 Dexcom

- 7.3.5 Medtronic

- 7.3.6 Arkray Inc.

- 7.3.7 Ascensia Diabetes Care

- 7.3.8 Novo Nordisk A/S

- 7.3.9 Eli Lilly

- 7.3.10 Sanofi

- 7.3.11 Insulet Corporation

- 7.3.12 A. Menarini Diagnostics

- 7.3.13 Sinocare Inc.

- 7.3.14 Terumo Corporation

- 7.3.15 B. Braun Melsungen AG

- 7.3.16 Ypsomed AG

- 7.3.17 Tandem Diabetes Care

8 Market Opportunities & Future Outlook

- 8.1 White-space & Unmet-Need Assessment