PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836583

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836583

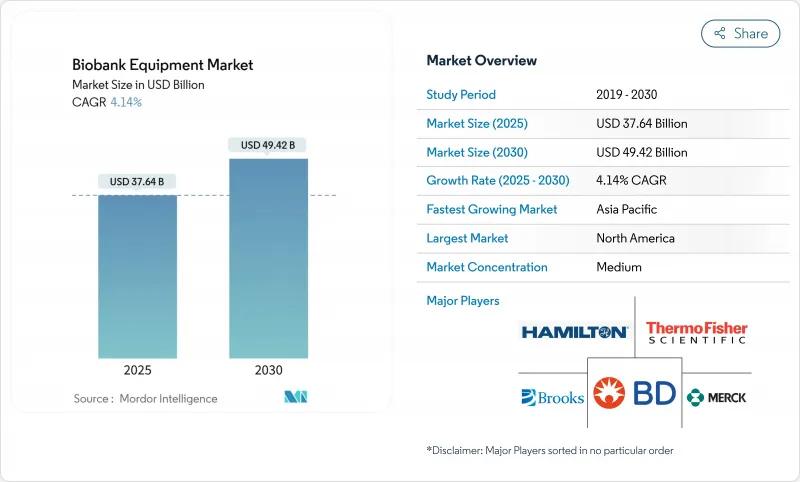

Biobank Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Biobank Equipment Market size is estimated at USD 37.64 billion in 2025, and is expected to reach USD 49.42 billion by 2030, at a CAGR of 4.14% during the forecast period (2025-2030).

Demand concentrates on ultra-low temperature systems that hold 52.58% share in 2024, reflecting their role in preserving advanced-therapy samples. Growth also comes from alarm and monitoring platforms that secure distributed biorepositories, the rise of regenerative-medicine pipelines, and regulatory moves that standardize quality across borders. North America leads spending, but Asia-Pacific shows the strongest momentum as regional reforms ease genetic-resource controls and boost precision-medicine programs. Competitive dynamics hinge on energy-efficient designs, AI-driven inventory tools, and acquisition campaigns by global suppliers that want scale and regulatory depth.

Global Biobank Equipment Market Trends and Insights

Progress in Stem-Cell and Regenerative Medicine

Regulatory approvals for CAR-T and other cell therapies are lifting the bar for storage precision, prompting biobank operators to adopt ultra-low freezers able to hold viability over extended timelines. Projects such as the UK Biobank's proteomics study, which profiles 5,400 proteins from 600,000 samples, confirm the volume and diversity of material now entering repositories. Manufacturers respond with integrated systems that bundle temperature control, automated pick-and-place robotics, and audit-ready data footprints. The shift from research-grade to GMP-compliant storage widens margins for suppliers that combine hardware and software into a single validated package. As commercial cell-therapy plants scale, demand for redundant power and monitoring also rises, locking in multi-year service contracts.

Rising Prevalence of Chronic Diseases

Longitudinal diabetes, oncology, and cardiovascular cohorts require archiving of millions of aliquots for multi-omics tracking, visible in India's first diabetes biobank launched in Chennai. The model favours modular equipment that expands capacity without disturbing legacy samples. IoT sensors now flag micro-temperature drifts to protect metabolomic integrity, while predictive maintenance reduces unplanned downtime. Suppliers that offer flexible racking, rapid LN2 refill, and cloud dashboards gain preference among public-health programs tasked with decades-long follow-up. The trend also supports regional-satellite banks that shorten sample transport times and lower cold-chain risk.

Complex & Divergent Regulations

Operators managing cross-border repositories face inconsistent consent rules, biosample export limits, and refrigeration safety codes. China's relaxation of genetic-resource controls, while positive long-term, forces a near-term compliance overhaul for multinational studies. Meanwhile, FDA enforcement actions against device makers illustrate the penalties for quality lapses. Smaller suppliers struggle to finance the documentation and auditing workload, favouring incumbents with dedicated regulatory affairs staff. Fragmented rules also delay roll-outs of innovative low-GWP refrigerants because certification pathways differ by region.

Other drivers and restraints analyzed in the detailed report include:

- Increased Funding from Governments and NGOs

- Growing Demand for Precision-Medicine Samples

- Environmental Regulations and F-Gas Phase-Down Mandates

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cryogenic storage systems captured 52.58% of the biobank equipment market in 2024, underscoring their centrality to advanced-therapy preservation. Demand centres on ultra-low freezers that balance -80 °C stability with 20% lower power draw, reducing operating expense at scale. The PHC VIP ECO SMART line illustrates this shift through variable-speed compressors and cloud telemetry that log every door opening. Freezers also lead growth at a 5.70% CAGR to 2030 as contract development and manufacturing organizations multiply satellite repositories near manufacturing suites. Refrigerators maintain traction for short-cycle sample prep, while ice machines remain niche tools for transport pods. Alarm and monitoring modules rise in parallel, winning orders from operators that retrofit compliance capability onto installed fleets.

Energy legislation is shaping design, prompting vendors to adopt natural refrigerants and foam-in-place insulation that boosts hold-time during power outages. Haier Biomedical's CryoBio series layers dual controllers and RFID-tagged racks to enhance redundancy. Vendors also modularize hardware so that users can swap compressors or add cameras without disrupting storage. Integration with laboratory information-management systems creates data continuity, letting researchers query inventory in real time. Service contracts now bundle annual calibration, firmware updates, and energy audits, expanding annuity revenue streams. Suppliers that deliver open APIs and cybersecurity certification win preference from hospital IT teams seeking single-pane-of-glass oversight.

The Biobank Equipment Market Report is Segmented by Product (Cryogenic Storage Systems [Refrigerators, and More], Alarm & Monitoring Systems), Application (Regenerative Medicine, and More), End User (Biobanks & Biorepositories, and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 37.61% of the biobank equipment market in 2024 as established NIH and FDA frameworks reward suppliers that meet rigorous validation rules. Programs such as All of Us keep freezer procurement steady, while Canada's cell-therapy corridor around Hamilton attracts investment in liquid-nitrogen repositories. US climate-policy shifts also accelerate upgrades toward low-GWP platforms, favouring vendors with natural-refrigerant portfolios. Mexico's growing pharmaceutical export base sparks demand for mid-scale biobanks that support batch release testing, though infrastructure gaps still limit automation uptake.

Europe records consistent expansion on the back of cross-border data-sharing initiatives that push standardization. The UK Biobank remains a flagship customer, trialling robotic picker arms and AI-powered inventory analytics. Germany's life-sciences clusters, such as North Rhine-Westphalia, create showroom demand, evidenced by Bio-Techne's new Dusseldorf experience centre opening in 2026. EU Green Deal targets reinforce purchases of energy-efficient freezers, and regional grant calls now award extra points to ACT-labelled units.

Asia-Pacific is the fastest-growing region at 7.36% CAGR through 2030 as precision-medicine pilots scale. China's relaxation of genetic-resource approvals unlocks foreign sourcing of hardware while local factories ramp up production of consumables. Australia's Genomics Health Futures Mission injects long-term capital into national biobanking capacity, boosting orders for automated archives. India's disease-specific repositories, starting with diabetes, push suppliers to develop rugged, power-stable systems for tier-2 cities. Mature markets in Japan and South Korea sustain replacement cycles and favour equipment that integrates with advanced hospital IT stacks.

- Azenta Life Sciences (Brooks)

- Thermo Fisher Scientific

- Hamilton Company

- PHC

- Beckton Dickinson

- Merck

- Lonza Group

- Bio-Techne

- QIAGEN

- Stem Cell Technologies

- Tecan Group

- Eppendorf

- Haier Biomedical

- Cryoport Inc.

- Chart Industries

- BioLife Solutions

- BioCision

- Micronic BV

- So-Low Environmental

- Taylor-Wharton

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Progress in Stem-Cell and Regenerative Medicine

- 4.2.2 Rising Prevalence of Chronic Diseases

- 4.2.3 Increased Funding from Governments and NGOs

- 4.2.4 Growing Demand for Precision-Medicine Samples

- 4.2.5 Expansion of Decentralized and Near-Patient Biobanks

- 4.2.6 AI-Enhanced Inventory and Access Management

- 4.3 Market Restraints

- 4.3.1 Complex & Divergent Regulations

- 4.3.2 High Capex for Ultra-Low Temperature Assets

- 4.3.3 Environmental Regulations and F-Gas Phase-Down Mandates

- 4.3.4 Lack of Data Standardization and LIMS Interoperability

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product

- 5.1.1 Cryogenic Storage Systems

- 5.1.1.1 Refrigerators

- 5.1.1.2 Freezers

- 5.1.1.3 Ice Machines

- 5.1.2 Alarm & Monitoring Systems

- 5.1.1 Cryogenic Storage Systems

- 5.2 By Application

- 5.2.1 Regenerative Medicine

- 5.2.2 Drug Discovery

- 5.2.3 Disease & Epidemiology Research

- 5.2.4 Life-Science & Genomic Research

- 5.3 By End User

- 5.3.1 Biobanks & Biorepositories

- 5.3.2 Pharma & Biotech Companies

- 5.3.3 Academic & Research Institutes

- 5.3.4 Hospitals & Diagnostic Centres

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Azenta Life Sciences (Brooks)

- 6.3.2 Thermo Fisher Scientific

- 6.3.3 Hamilton Company

- 6.3.4 PHC Corporation

- 6.3.5

Becton, Dickinson and Company

- 6.3.6 Merck KGaA

- 6.3.7 Lonza Group

- 6.3.8 Bio-Techne

- 6.3.9 QIAGEN

- 6.3.10 Stemcell Technologies

- 6.3.11 Tecan Group

- 6.3.12 Eppendorf AG

- 6.3.13 Haier Biomedical

- 6.3.14 Cryoport Inc.

- 6.3.15 Chart Industries

- 6.3.16 BioLife Solutions

- 6.3.17 BioCision LLC

- 6.3.18 Micronic BV

- 6.3.19 So-Low Environmental

- 6.3.20 Taylor-Wharton

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment