PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836602

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836602

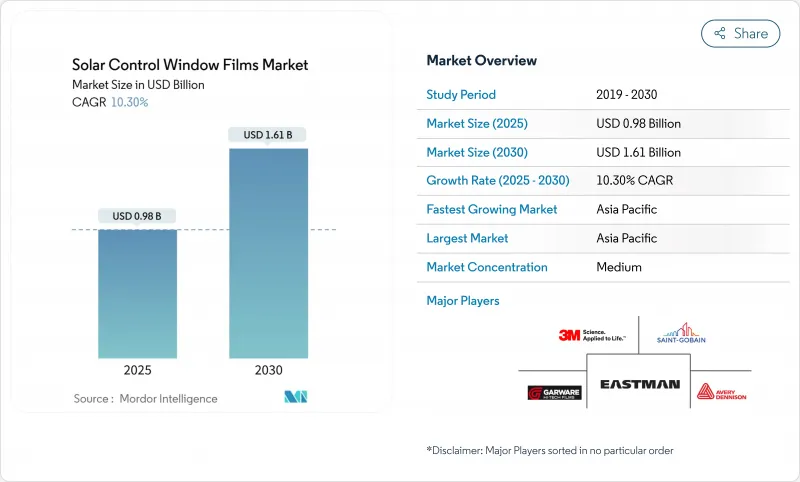

Solar Control Window Films - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Solar Control Window Films Market size is estimated at USD 0.98 billion in 2025, and is expected to reach USD 1.61 billion by 2030, at a CAGR of 10.30% during the forecast period (2025-2030).International decarbonization rules, rising utility costs, and proven payback periods below three years keep demand resilient.

Vacuum-coated reflective products dominate current specifications because they combine high infrared rejection with neutral aesthetics, while ceramic-metallic hybrids push performance thresholds in climates with extreme temperature swings. Asia Pacific construction booms, EU net-zero mandates, and US fiscal incentives all converge to keep volumes expanding even when raw-material costs fluctuate. These forces collectively reinforce the solar control window films market as a pivotal lever in the wider energy-efficiency value.

Global Solar Control Window Films Market Trends and Insights

Growing Emphasis on Reducing Carbon Footprints

Corporate climate pledges elevate the solar control window films market because films shave 5-15% cooling loads and qualify for science-based emission targets. Peak-demand trimming aligns neatly with grid-resilience objectives in hot regions. Real-estate investment trusts also treat glazing upgrades as accretive to asset value rather than as deferred maintenance. As renewable penetration accelerates, demand-side solutions such as films gain prestige for stabilizing load profiles. This positioning solidifies procurement budgets even during capex slowdowns.

Net-Zero Building Codes in Europe Driving Low-E Film Adoption

Key Highlights

- The EU's recast Energy Performance of Buildings Directive compels member states to renovate 3% of public-sector floor area annually and to meet zero-emission standards by 2050. Retro-orientated targets elevate window films by boosting thermal performance without costly frame replacement. Multinationals now replicate the same envelope standards in Asia and North America, exporting European benchmarks worldwide. Lifecycle-carbon clauses also favor thin-film retrofits over high-embodied-carbon glazing swaps. Consequently, suppliers see longer order visibility in public tenders.

Substitution Risk from Dynamic Smart Glazing in Premium Commercial Towers

Key Highlights

- Electrochromic and thermochromic units dynamically tint glass, providing glare mitigation that static films cannot match. As manufacturing costs fall, facade consultants increasingly specify these systems for double-skin or unitized curtain walls in prestige projects. Although price premiums remain 3-5 times film installations, long-term energy simulations often favor dynamic controls. Film suppliers respond by sharpening mid-market pitches and expanding retrofit channels where smart glass paybacks extend beyond 12 years.

Other drivers and restraints analyzed in the detailed report include:

- Upsurge in the Asia-Pacific Construction Industry

- Awareness of UV Protection and Health Concerns

- Warranty-Linked Liability for Delamination in Hot-Humid Climates

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Vacuum-coated reflective products captured 43% of 2024 revenue, and their 10.62% CAGR keeps the solar control window films market size for this segment well ahead of dyed and clear alternatives. Architects value the micro-thin metallic stack that selectively reflects near-infrared while admitting visible light.

Film manufacturers now deploy sputter chambers using silver, indium, and nickel alloys that achieve emissivity below 0.20. In mass-housing retrofits, dyed polyester films still appeal for initial affordability, yet energy-code tightening steadily redirects volume to reflective constructions.

Ceramic absorbers held 46% of 2024 revenue, reflecting their color stability, high melting point, and negligible radio-frequency interference. Automotive OEMs favor nano-ceramic layers because they avoid signal attenuation for telematics antennas. The solar control window films market share advantage may narrow, however, as refined metallic nanoparticle dispersions cut manufacturing costs and restore conductivity benefits for defogger grids.

Metallic-only films are marching at 10.56% CAGR, aided by sputter stack refinements that curb iridescence. Hybrid architectures now deposit alumina or silica atop silver seed layers, creating composite optical stacks that combine low reflectance with steep infrared rejection. Such progress blurs historic boundaries and pushes the category toward function-specific formulations, glare suppression, anti-graffiti, or photovoltaic overlay.

The Solar Control Window Films Market Report Segments the Industry by Film Type (Clear, Dyed, Vacuum Coated, and More), Absorber Type (Organic, Inorganic/Ceramic, and Metallic), Installation (New-Build and Retrofit), End-User Industry (Construction, Automotive, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD)

Geography Analysis

Asia Pacific commanded 45% of 2024 revenues and is expanding at a 10.78% CAGR, ensuring it remains the gravitational center of the solar control window films market. China's Green Building Evaluation Standard GB/T 50378 and India's Eco-Niwas mandate solar-heat-gain coefficients that accelerate high-selectivity film uptake.

Retrofit incentives anchor North America. The Inflation Reduction Act's enhanced tax deduction accelerates envelope upgrades across federal and private portfolios, and California's Title 24 revisions elevate exterior-shade coefficient thresholds that thin films meet without altering facade appearance.

Europe maintains mature penetration yet enjoys a second wave of demand tied to the 2030 "Fit-for-55" climate package.

- 3M

- Avery Dennison Corporation

- Decorative Films, LLC

- Eastman Chemical Company

- Garware Hi-Tech Films

- Johnson Window Films, Inc.

- LINTEC Corporation

- Madico

- Polytronix, Inc.

- Purlfrost

- Saint-Gobain

- Sharpline Converting, Inc.

- SOLAR CONTROL FILMS INC

- Thermolite, LLC

- TintFit Window Films Ltd.

- TORAY INDUSTRIES, INC.

- Ziebart International

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Study Deliverables

- 1.3 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Emphasis on Reducing Carbon Footprints

- 4.2.2 Net-Zero Building Codes in Europe Driving Low-E Film Adoption

- 4.2.3 Upsurge in the Asia-Pacific Construction Industry

- 4.2.4 Awareness of UV Protection and Health Concerns

- 4.2.5 Rapid E-Commerce Warehouse Construction Requiring Day-Lighting Control in APAC

- 4.3 Market Restraints

- 4.3.1 Substitution Risk from Dynamic Smart Glazing in Premium Commercial Towers

- 4.3.2 Warranty-Linked Liability for Delamination in Hot-Humid Climates

- 4.3.3 Volatile Polyester and Nano-Ceramic Raw Material Prices

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Rivalry

- 4.6 Pricing Analysis

5 Market Size and Growth Forecasts (Value)

- 5.1 By Film Type

- 5.1.1 Clear (Non-reflective)

- 5.1.2 Dyed (Non-reflective)

- 5.1.3 Vacuum-Coated (Reflective)

- 5.1.4 High Performance Films

- 5.1.5 Other Film Types

- 5.2 By Absorber Type

- 5.2.1 Organic

- 5.2.2 Inorganic / Ceramic

- 5.2.3 Metallic

- 5.3 By Installation Stage

- 5.3.1 New-Build

- 5.3.2 Retrofit

- 5.4 By End-user Industry

- 5.4.1 Construction

- 5.4.2 Automotive

- 5.4.3 Marine

- 5.4.4 Design

- 5.4.5 Other End-user Industry

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 Italy

- 5.5.3.4 Spain

- 5.5.3.5 France

- 5.5.3.6 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 3M

- 6.4.2 Avery Dennison Corporation

- 6.4.3 Decorative Films, LLC

- 6.4.4 Eastman Chemical Company

- 6.4.5 Garware Hi-Tech Films

- 6.4.6 Johnson Window Films, Inc.

- 6.4.7 LINTEC Corporation

- 6.4.8 Madico

- 6.4.9 Polytronix, Inc.

- 6.4.10 Purlfrost

- 6.4.11 Saint-Gobain

- 6.4.12 Sharpline Converting, Inc.

- 6.4.13 SOLAR CONTROL FILMS INC

- 6.4.14 Thermolite, LLC

- 6.4.15 TintFit Window Films Ltd.

- 6.4.16 TORAY INDUSTRIES, INC.

- 6.4.17 Ziebart International

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Growing Concerns Regarding UV Protection