PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844559

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844559

North America Solar Control Window Films - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

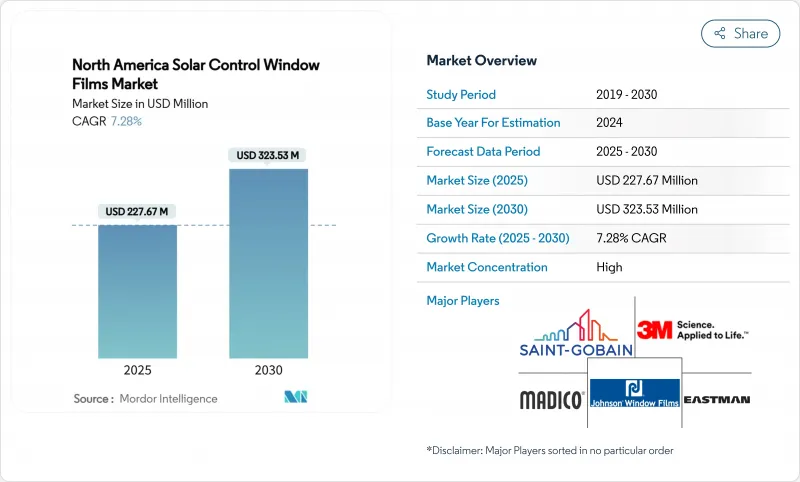

The North America Solar Control Window Films Market size is estimated at USD 227.67 million in 2025, and is expected to reach USD 323.53 million by 2030, at a CAGR of 7.28% during the forecast period (2025-2030).

Growth is supported by tighter building-energy codes, federal and state tax incentives, and expanded use of solar control films by original-equipment automotive manufacturers seeking to reduce air-conditioning loads in electric vehicles. Heightened public awareness of ultraviolet exposure risks, particularly in the Sun Belt, adds a health-protection dimension to purchasing decisions. Corporate ESG retrofits across commercial real estate demonstrate clear operating-expense savings by upgrading existing facades rather than replacing glazing systems outright. Meanwhile, dynamic supply-chain integration under USMCA allows North American producers to serve automotive and construction markets efficiently, reinforcing regional demand resilience.

North America Solar Control Window Films Market Trends and Insights

Stringent Building-Energy Codes & Tax Incentives

The 2024 International Energy Conservation Code lowered allowable air leakage for fixed fenestration from 0.40 cfm/ft2 to 0.35 cfm/ft2, pushing building owners toward cost-effective retrofit solutions such as high-performance films. Concurrently, the Inflation Reduction Act enables homeowners to claim a 30% credit-capped at USD 600-for qualified film purchases, while commercial properties leverage Section 179D deductions to offset installation costs. California Title 24 and New York City Local Law 97 strengthen state-level demand, creating compliance drivers that bypass full window replacement cycles in favor of film retrofits.

Rising OEM Adoption in Automotive to Cut A/C Load

Automakers integrate solar control layers during lamination, lowering cabin heat gain by roughly 20% and extending electric-vehicle range. Pilkington's Galaxsee glazing blocks 65% of solar heat and more than 95% of UV radiation, setting baseline specifications for factory adoption. USMCA simplifies cross-border sourcing, and Mexico's USD 37 billion component-import market provides scale for regional glass and film producers. Demand is particularly strong in electric vehicles, where every reduction in A/C load extends battery range and reduces warranty costs related to thermal degradation.

Smart-Glass Substitution Threat

Electrochromic windows achieve 17-23% building-energy savings through dynamic light and heat control, outperforming static films in optimized management systems. Integration with IoT enables automated tint adjustment, adding functionality beyond the reach of conventional films. Manufacturing scale efficiencies are gradually narrowing cost gaps, bringing smart glass into mainstream commercial budgets. Although high capital costs still limit penetration, accelerating R&D suggests a competitive threat in premium construction segments over the next decade.

Other drivers and restraints analyzed in the detailed report include:

- Heightened UV-Exposure & Skin-Cancer Awareness

- Corporate ESG Retrofits of Existing Glass Facades

- Durability & Discoloration Issues on IGUs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Vacuum-coated reflective films led the North America Solar Control Window Films market with a 46.18% share in 2024, thanks to sputter-deposited metallic layers that cut infrared gain without compromising visible light. These products routinely deliver Solar Heat Gain Coefficient values below 0.30, helping commercial towers meet energy codes in climate zones with high cooling loads. Demand is sustained by facility managers prioritizing operating-expense savings over exterior uniformity concerns. Dyed non-reflective products, however, are catching up by offering neutral aesthetics at lower price points and enjoying a 7.92% CAGR through 2030, propelled by suburban homeowners claiming federal tax credits. Clear non-reflective variants serve hospitals and schools that require daylighting compliance while still blocking ultraviolet exposure. High-performance hybrid films occupy a smaller revenue niche but showcase the direction of future product development through advanced ceramic layering that maintains clarity and durability over multidecade lifetimes.

Laboratory advances highlight the segment's innovation curve. The University of Notre Dame reported quantum-optimized coatings capable of reducing cooling energy by one-third while preserving outward views, signaling potential step-change improvements in film efficacy. Manufacturers such as Eastman deploy proprietary infrared-blocking ceramic coatings combined with pressure-sensitive adhesives to raise the thermal rejection bar further. Organic-based decorative films retain relevance in interior design, yet face mounting competition from integrated low-E glass that arrives pre-tinted from the factory. Still, the retrofit appeal of films-quick installation and minimal tenant disruption-keeps the North America Solar Control Window Films market firmly in play, even as technically superior yet costlier smart glass solutions vie for future specification.

The North America Solar Control Window Films Market Report is Segmented by Film Type (Clear, Dyed, Vacuum-Coated, High Performance Films, Other Film Types), Absorber Type (Organic, Inorganic/Ceramic, Metallic), End-User Industry (Construction, Automotive, Marine, Design, Other End-User Industry), and Geography (United States, Canada, Mexico). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- 3M

- Avery Dennison Corporation

- Decorative Films, LLC

- Eastman Chemical Company

- Garware Hi-Tech Films

- HUPER OPTIK USA

- Johnson Window Films, Inc.

- Madico

- Maxpro Window Films

- Polytronix, Inc.

- Purlfrost

- Saint-Gobain

- SOLAR CONTROL FILMS INC

- Thermolite, LLC

- XPEL

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent building-energy codes and tax incentives

- 4.2.2 Rising OEM adoption in automotive to cut A/C load

- 4.2.3 Heightened UV-exposure and skin-cancer awareness

- 4.2.4 Corporate ESG retrofits of existing glass facades

- 4.2.5 Hybrid-work home-office upgrades for glare control

- 4.3 Market Restraints

- 4.3.1 Smart-glass substitution threat

- 4.3.2 Durability and discoloration issues on IGUs

- 4.3.3 Growing prevalence of low-E coated glazing

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Film Type

- 5.1.1 Clear (Non-reflective)

- 5.1.2 Dyed (Non-reflective)

- 5.1.3 Vacuum-Coated (Reflective)

- 5.1.4 High Performance Films

- 5.1.5 Other Film Types

- 5.2 By Absorber Type

- 5.2.1 Organic

- 5.2.2 Inorganic/Ceramic

- 5.2.3 Metallic

- 5.3 By End-user Industry

- 5.3.1 Construction

- 5.3.2 Automotive

- 5.3.3 Marine

- 5.3.4 Design

- 5.3.5 Other End-user Industry

- 5.4 By Geography

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Mexico

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 3M

- 6.4.2 Avery Dennison Corporation

- 6.4.3 Decorative Films, LLC

- 6.4.4 Eastman Chemical Company

- 6.4.5 Garware Hi-Tech Films

- 6.4.6 HUPER OPTIK USA

- 6.4.7 Johnson Window Films, Inc.

- 6.4.8 Madico

- 6.4.9 Maxpro Window Films

- 6.4.10 Polytronix, Inc.

- 6.4.11 Purlfrost

- 6.4.12 Saint-Gobain

- 6.4.13 SOLAR CONTROL FILMS INC

- 6.4.14 Thermolite, LLC

- 6.4.15 XPEL

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment