PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836603

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836603

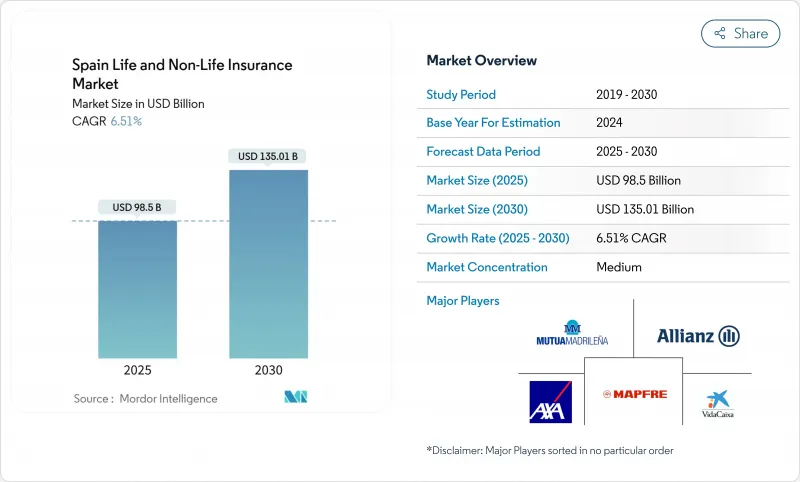

Spain Life And Non-Life Insurance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Spain life and non-life insurance market is valued at USD 98.50 billion in 2025 and is forecast to reach USD 135.01 billion by 2030, supported by a 6.51% CAGR.

Strong premium growth signals deeper insurance penetration, rising disposable income, and a steady migration from savings products to protection and retirement solutions. Mandatory coverages in motor, rapid uptake of private health policies, and a spike in property-catastrophe demand underpin the non-life momentum, while pension reforms and longevity trends channel fresh capital toward annuities. Digitalization is redrawing distribution economics, with bancassurance widening reach and mobile platforms improving price transparency. Scale advantages, robust risk-pricing engines, and access to granular customer data are emerging as the decisive competitive levers in the Spain life and non-life insurance market.

Spain Life And Non-Life Insurance Market Trends and Insights

Aging Population Driving Demand for Pension & Annuity Products in Spain

One in five Spaniards is already older than 65, and that share will pass 26% by 2035. The demographic swing is pushing life insurers to prioritize retirement products, with pension and annuity premiums expanding at a 5.86% CAGR between 2025 and 2030. CaixaBank's "Generation+" suite bundles annuities, senior protection, and equity-release mortgages into a single advisory pitch, tapping a cohort that controls close to 40% of household wealth. Revised mortality tables (PER2020) sharpen pricing accuracy and highlight longevity risk hedging needs. Insurers able to match long-dated liabilities with higher-yielding assets are set to gain a share in the Spain life and non-life insurance market.

Growth of Digital Bancassurance Partnerships Accelerating Policy Sales

In 2024, banks accounted for 14.2% of domestic profits from insurance, highlighting the integral role of bancassurance in daily banking. This channel commands 44.1% of total written premiums and is now enhancing its mobile apps with features like robo-advice, data-driven cross-selling, and instant policy issuance. SegurCaixa Adeslas showcases the power of scale by seamlessly integrating CaixaBank's 21 million retail clients with timely health, home, and motor insurance offers. With reduced acquisition costs and improved conversion rates, bancassurance is becoming more productive, driving growth in Spain's life and non-life insurance sectors.

Persistently Low Interest Rate Environment Compressing Life Insurance Margins

Guaranteed-return savings blocks still sit on many life balance sheets, and ultra-low yields compress spread income. Although the European Central Bank began tightening in 2024, reinvestment rates lag minimum credited rates on legacy policies. Life players are pivoting to unit-linked contracts that transfer investment risk, but transition costs weigh on near-term profitability across the Spain life and non-life insurance market.

Other drivers and restraints analyzed in the detailed report include:

- Mandatory Motor Insurance Regulations Boosting Non-Life Premiums

- Rising Climate-Related Catastrophes Increasing Demand for Property and Crop Covers

- High Combined Ratios in Motor Line Limiting Profitability for Non-Life Insurers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Non-life generated 62.1% of total written premiums in 2024, a position reinforced by the compulsory motor cover, climate-linked property demand, and a 30% health insurance penetration rate in several urban provinces. The Spain life and non-life insurance market continues to rely on the motor for volume, yet property and crop lines are rising steadily after the October 2024 Valencia floods. Life products captured the remaining 38% of premium income, with pension and annuity contracts rising 5.8% per year to 2030 as households seek predictable post-retirement cash flows. Revised PER2020 mortality tables raise capital for longevity risk but give pricing accuracy that supports new annuity issuance.

Growth in life savings has shifted toward unit-linked schemes that insulate insurers from investment-guarantee drag while meeting clients' appetite for equity exposure. Meanwhile, whole-life policies remain a niche wealth-transfer tool for high-net-worth individuals in Madrid and Catalonia. The Spain life and non-life insurance market size tied to non-life still dwarfs life, yet the margin contribution from pension contracts is climbing, aided by solvency-friendly reinsurance. Carriers that can balance capital-intensive traditional reserves with fee-based asset-light products should widen ROE spreads. Claims automation and behavioral pricing in motor and household lines further enhance expense ratios, giving diversified groups a structural advantage.

Bancassurance wrote 44.3% of premiums in 2024, leveraging 30,000+ Spanish bank branches and the trust halo of incumbent lenders. The Spain life and non-life insurance market depends on these alliances to reach mass-market savers, especially for pension plans sold alongside current accounts. Embedded application-programming-interface (API) links now let bank mobile apps issue instant quotes, cross-sell hospital cash policies, and push renewal prompts that cut lapse rates below 3%.

Still, online and mobile direct platforms are scaling at a 12.24% CAGR through 2030, the fastest of any channel, as comparison sites and digital aggregators encourage price-first shopping. Agents and brokers retain an advisory edge in complex liability and marine covers for exporters, though fee pressure mounts. As omnichannel behavior takes hold, insurers with seamless hand-offs from the web to branch to call center report higher Net Promoter Scores and lower churn. The Spain life and non-life insurance market share mix is therefore migrating to digital, but bancassurance will likely remain core in life products because of bank deposit stickiness and big-data underwriting.

The Spain Life and Non-Life Insurance Market is Segmented by Insurance Type (Life Insurance, Non-Life Insurance), by Distribution Channel (Agents & Brokers, Bancassurance, Direct (Tied) Sales, and More), by End-User (Individuals, Corporates, and Public Sector), and Region (Madrid, Catalonia, Andalusia, and More). The Market Forecasts are Provided in Value (USD).

List of Companies Covered in this Report:

- Mapfre S.A.

- VidaCaixa (CaixaBank Group)

- Mutua Madrilena

- AXA Seguros S.A.

- Allianz Seguros

- Zurich Insurance plc Spain

- Generali Seguros

- Santander Seguros y Reaseguros

- BBVA Seguros

- Grupo Catalana Occidente

- Santalucia Seguros

- Reale Seguros

- Linea Directa Aseguradora

- DKV Seguros

- Aegon Seguros

- Caser Seguros

- Liberty Seguros

- SegurCaixa Adeslas

- Pelayo Mutua de Seguros

- Arag SE Espana

- MEDVIDA Partners

- Chubb Espana

- Plus Ultra Seguros

- Markel Espana

- Prima Seguros

- SegurCaixa Adeslas

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Ageing Population Driving Demand for Pension & Annuity Products in Spain

- 4.2.2 Growth of Digital Bancassurance Partnerships Accelerating Policy Sales

- 4.2.3 Mandatory Motor Insurance Regulations Boosting Non-Life Premiums

- 4.2.4 Rising Climate-Related Catastrophes Increasing Demand for Property & Crop Covers

- 4.2.5 Integration of Health Insurance with Private Healthcare Networks Expanding Penetration

- 4.2.6 EU Solvency II Reforms Enabling Capital Optimization for Spanish Carriers

- 4.3 Market Restraints

- 4.3.1 Persistently Low Interest Rate Environment Compressing Life Insurance Margins

- 4.3.2 High Combined Ratios in Motor Line Limiting Profitability for Non-Life Insurers

- 4.3.3 Increasing Competition from Insurtechs Eroding Traditional Agents' Share

- 4.3.4 Stricter IFRS 17 Reporting Requirements Raising Compliance Costs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Insurance Type (Gross Written Premium, USD Billion)

- 5.1.1 Life Insurance

- 5.1.1.1 Term Life

- 5.1.1.2 Endowment

- 5.1.1.3 Whole Life / Universal

- 5.1.1.4 Pension & Annuities

- 5.1.2 Non-Life Insurance

- 5.1.2.1 Motor

- 5.1.2.2 Property & Casualty

- 5.1.2.3 Health

- 5.1.2.4 Liability

- 5.1.2.5 Credit & Surety

- 5.1.2.6 Marine, Aviation & Transport

- 5.1.1 Life Insurance

- 5.2 By Distribution Channel

- 5.2.1 Agents & Brokers

- 5.2.2 Bancassurance

- 5.2.3 Direct (Tied) Sales

- 5.2.4 Online & Mobile

- 5.2.5 Affinity & Partnerships

- 5.3 By End-user

- 5.3.1 Individuals

- 5.3.1.1 Mass Market

- 5.3.1.2 High-Net-Worth Individuals

- 5.3.2 Corporates

- 5.3.2.1 SMEs

- 5.3.2.2 Large Enterprises

- 5.3.3 Public Sector

- 5.3.1 Individuals

- 5.4 By Region (Spain)

- 5.4.1 Madrid

- 5.4.2 Catalonia

- 5.4.3 Andalusia

- 5.4.4 Valencia Community

- 5.4.5 Basque Country

- 5.4.6 Rest of Spain

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Mapfre S.A.

- 6.4.2 VidaCaixa (CaixaBank Group)

- 6.4.3 Mutua Madrilena

- 6.4.4 AXA Seguros S.A.

- 6.4.5 Allianz Seguros

- 6.4.6 Zurich Insurance plc Spain

- 6.4.7 Generali Seguros

- 6.4.8 Santander Seguros y Reaseguros

- 6.4.9 BBVA Seguros

- 6.4.10 Grupo Catalana Occidente

- 6.4.11 Santalucia Seguros

- 6.4.12 Reale Seguros

- 6.4.13 Linea Directa Aseguradora

- 6.4.14 DKV Seguros

- 6.4.15 Aegon Seguros

- 6.4.16 Caser Seguros

- 6.4.17 Liberty Seguros

- 6.4.18 SegurCaixa Adeslas

- 6.4.19 Pelayo Mutua de Seguros

- 6.4.20 Arag SE Espana

- 6.4.21 MEDVIDA Partners

- 6.4.22 Chubb Espana

- 6.4.23 Plus Ultra Seguros

- 6.4.24 Markel Espana

- 6.4.25 Prima Seguros

- 6.4.26 SegurCaixa Adeslas

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment