PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836610

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836610

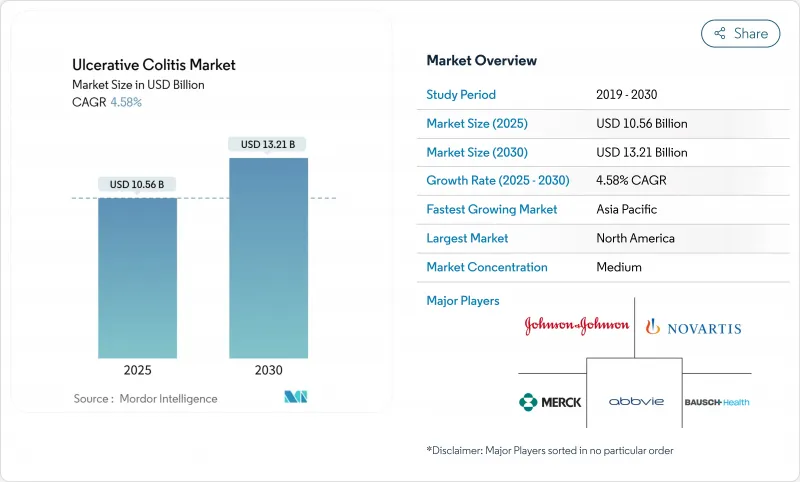

Ulcerative Colitis - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The ulcerative colitis market reached USD 10.56 billion in 2025 and is projected to climb to USD 13.21 billion by 2030, posting a 4.58% CAGR.

This steady trajectory reflects a shift from aging anti-TNF blockbusters to competitively priced biosimilars, even as premium-priced IL-23 and S1P innovations secure rapid uptake. Anti-TNF agents still provide broad clinical familiarity but now lose ground to fast-growing oral JAK inhibitors that expand treatment to ambulatory settings. Rectal formulations gain traction because targeted drug delivery improves tolerance in distal disease, while hospital pharmacies protect their dominant role through specialist oversight of cold-chain biologics. Growing patient advocacy, broader reimbursement caps in the United States, and Asia-Pacific incidence spikes create fresh volume opportunities that partially offset price pressure in mature regions.

Global Ulcerative Colitis Market Trends and Insights

Continuous Launch of Advanced Biologics & Small-Molecule Drugs

IL-23 antagonists such as Tremfya, Skyrizi, and Omvoh captured 10% of advanced systemic prescriptions within 12 months, signalling clinician openness to mechanism diversification. Velsipity became the first S1P modulator to gain FDA approval, reaching 26% 12-week remission versus 11% for placebo, and reinforcing the commercial appeal of once-daily oral solutions. Takeda tripled Entyvio output at its Japanese plant, demonstrating manufacturers' race to secure capacity ahead of expected demand growth. Johnson & Johnson reported 63.5% clinical response in Phase 2b testing of oral icotrokinra, underlining the strong pipeline depth. Collectively, these launches raise therapeutic ceilings, shorten treatment sequences, and enlarge the ulcerative colitis market by attracting previously undertreated patients.

Rising Global Incidence & Prevalence of UC

Asia-Pacific incidence multiplied sixfold over two decades as dietary Westernization and urban stressors emerged, pushing previously low-burden countries toward parity with Western markets. Population growth and earlier diagnosis swell the addressable pool even as life-long management lengthens treatment duration. Wearables such as Apple Watch and Fitbit can pre-emptively flag flares, enabling earlier physician intervention and reducing severe hospitalization risk. Payers monitor these epidemiologic and technology trends to refine cost-containment strategies, yet higher caseloads still translate to incremental biologic volumes. Rising prevalence therefore enlarges both volume opportunity and healthcare resource stress, sustaining medium-term expansion of the ulcerative colitis market.

Serious Adverse Events & Safety Warnings Limiting Uptake

The ORAL Surveillance study linked JAK inhibitors with elevated major adverse cardiac events and malignancies, triggering FDA directives to reserve the class for anti-TNF failures and prompting EMA caution in higher-risk patients. Updated guidelines emphasize risk-benefit assessment, infection screening, and dose tailoring, increasing physician workload and slowing initial uptake. EULAR data show no broad cancer spike versus biologic DMARDs except keratinocyte tumors, but regulators remain vigilant. Heightened pharmacovigilance therefore tempers near-term prescriptions despite clinical convenience advantages.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Patient-Assistance & Reimbursement Programs

- Growing Use of Tele-Health & Remote Monitoring in IBD Care

- Loss of Exclusivity for Blockbuster Biologics Driving Price Erosion

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Anti-TNF biologics preserved leadership with 38.35% share in 2024, underpinned by a robust evidence base and physician familiarity. Yet biosimilar pressure and safety-driven laddering redirect growth to JAK inhibitors, which post a 14.25% CAGR through 2030. Upadacitinib shows rapid onset and durable remission, while tofacitinib retains a foothold despite boxed warnings. The ulcerative colitis market size for JAK inhibitors is projected to rise sharply as oral convenience appeals to both patients and payers seeking home-based regimens.

IL-23 antagonists deliver differentiated efficacy, enabling 10% advanced systemic uptake inside a year, and their less frequent dosing targets quality-of-life advantages. S1P modulators introduce a first-in-class lymphocyte egress blockade, widening oral options. Anti-integrin vedolizumab sustains gut-selective appeal, while calcineurin inhibitors remain niche rescue agents. Drug-class diversification illustrates the ulcerative colitis industry pivot to precision medicine, where biomarker-guided selection narrows responder cohorts and maximizes lifetime value per patient.

Pancolitis secured 30.53% of 2024 revenue, reflecting its extensive colonic involvement that justifies early biologic escalation and combination therapy. The ulcerative colitis market size for pancolitis will expand steadily with guideline shifts endorsing proactive biologic initiation.

Fulminant colitis, though clinically uncommon, shows the fastest 8.85% CAGR as updated rescue algorithms employ high-dose steroids, infliximab, cyclosporine, and emergent JAK inhibitors to defer colectomy. International Delphi consensus on acute severe trial design accelerates new asset development, fostering specialized hospital demand. Heterogeneous disease presentation underscores why companies package portfolio breadth, ensuring each phenotype meets an optimized mechanism.

The Ulcerative Colitis Market Report is Segmented by Drug Type (Aminosalicylates, Immunosuppressants, Anti-TNF Biologics, and More), Disease Type (Ulcerative Proctitis, Proctosigmoiditis, Left-Sided Colitis, and More), Route of Administration (Oral, Parenteral, and Rectal), Distribution Channel (Hospital Pharmacies and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 43.82% of global revenue in 2024 due to early biologic adoption, rich specialist density, and comprehensive reimbursement ceilings that drop annual patient costs to USD 2,000 from 2025. US gastroenterologists expect near-term volume growth for Entyvio, Simponi, and infliximab biosimilars, sustaining competitive churn yet enlarging treated patient pools. FDA pediatric guidance encourages expanded trials, promising future label extensions and continued ulcerative colitis market expansion.

Asia-Pacific records a 7.61% CAGR through 2030 as incidence rises alongside economic development, healthcare spending, and IBD awareness campaigns. China's age-standardized incidence now ranks at 2.1 per 100,000 and rising, with payer prioritization still favoring cost-effective 5-aminosalicylate pathways before biologic escalation. Regional governments negotiate volume-based procurements to widen biologic access, while private insurers proliferate in urban centers, enhancing affordability for mid-income populations. These tailwinds lift both volume and value within the ulcerative colitis market.

Europe posts stable yet moderated growth amid HTA scrutiny and rapid biosimilar rollout. EMA approved four ustekinumab biosimilars in 2024, strengthening discount pools that widen access but squeeze absolute revenue. NICE's ongoing etrasimod appraisal underscores strict comparative-effectiveness thresholds before national uptake. Despite pressure, EU markets embrace mechanism diversity, maintaining a balanced landscape that offers predictable albeit modest expansion for the ulcerative colitis market.

- Abbvie

- Bausch Health

- Janssen Biotech (Johnson & Johnson)

- Merck

- Takeda Pharmaceuticals

- Teva Pharmaceutical Industries

- Pfizer

- Eli Lilly and Company

- Novartis

- Bristol-Myers Squibb

- Mitsubishi Tanabe Pharma Corp.

- Sun Pharmaceuticals Industries

- Gilead Sciences

- Celltrion Healthcare Co., Ltd.

- Roche

- Boehringer Ingelheim Intl. GmbH

- Ferring Pharmaceuticals

- Sandoz Group

- Amgen

- Seres Therapeutics

- Vedanta Biosciences Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Global Incidence & Prevalence of UC

- 4.2.2 Continuous Launch of Advanced Biologics & Small-Molecule Drugs

- 4.2.3 Expansion of Patient-Assistance & Reimbursement Programs

- 4.2.4 Growing Use of Tele-Health & Remote Monitoring In IBD Care

- 4.2.5 Rapid Progress In Microbiome-Based Therapeutics (E.G., Lbps, FMT)

- 4.3 Market Restraints

- 4.3.1 Serious Adverse Events & Safety Warnings Limiting Uptake

- 4.3.2 High Treatment Costs In Emerging Economies

- 4.3.3 Loss Of Exclusivity For Blockbuster Biologics Driving Price Erosion

- 4.4 Porter's Five Forces

- 4.4.1 Bargaining Power of Buyers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Drug Type

- 5.1.1 Aminosalicylates

- 5.1.2 Corticosteroids

- 5.1.3 Immunosuppressants

- 5.1.4 Anti-TNF Biologics

- 5.1.5 Anti-Integrin Biologics

- 5.1.6 JAK Inhibitors

- 5.1.7 S1P Receptor Modulators

- 5.1.8 Calcineurin Inhibitors

- 5.1.9 Other Drug Types

- 5.2 By Disease Type

- 5.2.1 Ulcerative Proctitis

- 5.2.2 Proctosigmoiditis

- 5.2.3 Left-sided Colitis

- 5.2.4 Pancolitis / Universal Colitis

- 5.2.5 Fulminant Colitis

- 5.3 By Route of Administration

- 5.3.1 Oral

- 5.3.2 Parenteral

- 5.3.3 Rectal

- 5.4 By Distribution Channel

- 5.4.1 Hospital Pharmacies

- 5.4.2 Retail Pharmacies

- 5.4.3 Online Pharmacies

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 AbbVie Inc.

- 6.3.2 Bausch Health Companies Inc.

- 6.3.3 Janssen Biotech (Johnson & Johnson)

- 6.3.4 Merck & Co., Inc.

- 6.3.5 Takeda Pharmaceutical Company Ltd.

- 6.3.6 Teva Pharmaceutical Industries Ltd.

- 6.3.7 Pfizer Inc.

- 6.3.8 Eli Lilly and Company

- 6.3.9 Novartis AG

- 6.3.10 Bristol Myers Squibb

- 6.3.11 Mitsubishi Tanabe Pharma Corp.

- 6.3.12 Sun Pharmaceutical Industries Ltd.

- 6.3.13 Gilead Sciences Inc.

- 6.3.14 Celltrion Healthcare Co., Ltd.

- 6.3.15 Roche Holding AG

- 6.3.16 Boehringer Ingelheim Intl. GmbH

- 6.3.17 Ferring Pharmaceuticals

- 6.3.18 Sandoz International GmbH

- 6.3.19 Amgen Inc.

- 6.3.20 Seres Therapeutics

- 6.3.21 Vedanta Biosciences Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment