PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836615

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836615

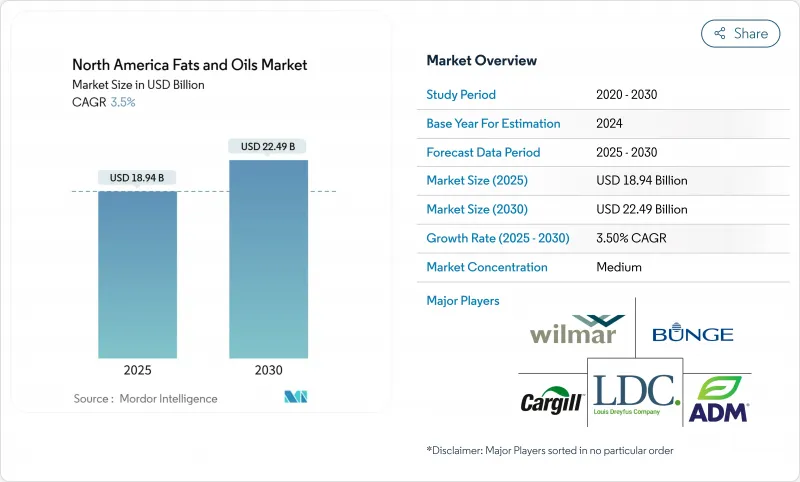

North America Fats And Oils - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The North American Fats and Oils Market stands at USD 18.94 billion in 2025 and is projected to reach USD 22.49 billion by 2030, growing at a CAGR of 3.50% during the forecast period.

The fats and oils market is demonstrating growth driven by increasing consumer demand for plant-based and health-focused foods, combined with sustained demand from the food processing and biofuel industries. Market dynamics indicate evolving consumer preferences, particularly in regions that emphasize clean-label and low-saturated-fat products. Government policies supporting biofuel production maintain industrial demand for vegetable oils and animal fats, resulting in price stability across downstream segments. Manufacturing companies are allocating capital toward crushing, refining, and pretreatment facilities to mitigate potential feedstock limitations, indicating strong market fundamentals and strategic focus on operational optimization and capacity growth.

North America Fats And Oils Market Trends and Insights

Growing Demand for Organic Products

The North American organic fats and oils market demonstrates higher growth rates than the conventional market, driven by consumer demand for traceable, pesticide-free, and sustainable products. This market development has prompted farmers to expand certified organic oilseed production, leading to increased small-scale, premium-grade operations. Regional mills and medium-sized cooperatives benefit from decentralized processing operations, which provide enhanced supply chain flexibility and product customization options. While conventional markets operate through bulk logistics systems, the organic fats and oils segment allows small-scale crushers to maintain profitable operations by fulfilling specific market requirements through local distribution networks. This market development enhances supply chain transparency, supports clean label requirements, and strengthens regional agricultural operations. The market structure prioritizes supply chain efficiency, sustainability, and local market adaptability.

Surge in Vegan and Health-Conscious Lifestyle

The increasing consumer preference for plant-based diets is driving manufacturers to enhance fat functionality, shifting the market from basic commodity supply to specialized solutions. Manufacturers now develop complex formulations, such as cocoa butter spreads and palm-free shortenings, by combining multiple oils to match the performance of animal fats. These formulations require extensive testing and refinement to achieve the desired texture, melting point, and stability characteristics comparable to traditional animal-based fats. The high research and development costs required for these products create significant market entry barriers, enabling innovative companies to maintain premium pricing. Food service businesses using these specialized fats gain greater menu flexibility, as these alternatives perform consistently across various cooking methods and temperature ranges. This versatility has led to increased demand for customized oil blends, particularly in bakery, confectionery, and processed food applications. The market is also witnessing growing interest from global food manufacturers seeking to reformulate their products with plant-based fat alternatives while maintaining familiar taste and texture profiles.

Health Concerns Regarding Saturated Trans Fats

The Food and Drug Administration's removal of partially hydrogenated oils from the Generally Recognized As Safe list required manufacturers to reformulate their products to reduce trans-fat content. This regulatory change prompted extensive research and development efforts across the food industry to find suitable alternatives while maintaining product quality and taste. Companies that implemented these changes early maintained better customer retention, indicating that rapid compliance affected brand perception and market position.

The adoption of interesterification and alternative structuring technologies enabled new fat textures, which influenced consumer preferences regarding spreadability and mouthfeel. These technological advancements also allowed manufacturers to develop products that meet both regulatory requirements and consumer expectations for taste and functionality. The industry's transition to new fat formulations demonstrated the significant impact of regulatory changes on product development and market dynamics.

Other drivers and restraints analyzed in the detailed report include:

- Widespread Adoption of High-Oleic Oil in Processed Food Industry

- Increasing Use in Industrial Utilization

- Stringent Labeling and Food Safety Regulation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Oils hold a 55.34% share of the North American Fats and Oils market in 2024, with an expected CAGR of 5.74% through 2030. This market dominance results from their widespread use in food preparation, dressings, and biodiesel production. Consumer preference for liquid oils strengthens their market value share. The broad application range across food and industrial sectors provides market stability and maintains consistent crusher utilization rates. Producers are expanding crushing capacity, supported by the sustained dual-use nature of oils, independent of potential biofuel mandate changes.

The specialty fats segment, while smaller in volume, demonstrates notable innovation in confectionery coatings and bakery laminates. Manufacturers are creating advanced multi-fat systems that match premium chocolate characteristics, advancing beyond basic cocoa butter alternatives. The growing emphasis on sustainable cocoa sourcing increases the appeal of these alternatives, especially in ethically conscious food products. This development may lead to a gradual shift in capital investment from bulk oil production to specialized fat processing facilities, affecting resource allocation among integrated processors.

The North America Fats and Oils Market is Segmented by Product Type (Fats and Oils), Application (Food, Industrial, and Animal Feed), Source (Plant-Based and Animal-Based), and Country (United States, Canada, Mexico, and Rest of North America). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Cargill Inc.

- Archer Daniels Midland Company

- Bunge Limited

- Wilmar International Ltd.

- Louis Dreyfus Company

- AAK AB

- CHS Inc.

- Richardson International Ltd.

- Ag Processing Inc.

- Olam International

- Arista Industries Inc.

- Batory Foods

- SD Guthrie International (Sime Darby Oils)

- Kerry Group plc

- Darling Ingredients Inc.

- Associated British Foods plc (ACH Food)

- Fuji Oil Co., Ltd.

- Musim Mas Group.

- Mewah International Inc

- Alami Commodities Sdn. Bhd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand for Organic Products

- 4.2.2 Increasing Use in Industrial Utilization

- 4.2.3 Widespread Adoption of High-Oleic Oil in Processed Food Industry

- 4.2.4 Technological Advancements in Processing

- 4.2.5 Surge in Vegan and Health-Conscious Lifestyle

- 4.2.6 Increasing Consumption of Processed and Convenience Products

- 4.3 Market Restraints

- 4.3.1 Health Concerns Regarding Saturated Trans Fats

- 4.3.2 Stringent Labeling and Food Safety Regulation

- 4.3.3 Volatility in Raw Material Prices

- 4.3.4 Supply Chain Disruptions and Trade Policies

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Fats

- 5.1.1.1 Butter

- 5.1.1.2 Tallow

- 5.1.1.3 Lard

- 5.1.1.4 Specialty Fats

- 5.1.2 Oils

- 5.1.2.1 Soybean Oil

- 5.1.2.2 Rapeseed Oil

- 5.1.2.3 Palm Oil

- 5.1.2.4 Coconut Oil

- 5.1.2.5 Olive Oil

- 5.1.2.6 Cotton Seed Oil

- 5.1.2.7 Sunflower Seed Oil

- 5.1.2.8 Others

- 5.1.1 Fats

- 5.2 By Application

- 5.2.1 Food

- 5.2.1.1 Confectionary

- 5.2.1.2 Bakery

- 5.2.1.3 Dairy Products

- 5.2.1.4 Others

- 5.2.2 Industrial

- 5.2.3 Animal Feed

- 5.2.1 Food

- 5.3 By Source

- 5.3.1 Plant-based

- 5.3.2 Animal-based

- 5.4 By Country

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Mexico

- 5.4.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Cargill Inc.

- 6.4.2 Archer Daniels Midland Company

- 6.4.3 Bunge Limited

- 6.4.4 Wilmar International Ltd.

- 6.4.5 Louis Dreyfus Company

- 6.4.6 AAK AB

- 6.4.7 CHS Inc.

- 6.4.8 Richardson International Ltd.

- 6.4.9 Ag Processing Inc.

- 6.4.10 Olam International

- 6.4.11 Arista Industries Inc.

- 6.4.12 Batory Foods

- 6.4.13 SD Guthrie International (Sime Darby Oils)

- 6.4.14 Kerry Group plc

- 6.4.15 Darling Ingredients Inc.

- 6.4.16 Associated British Foods plc (ACH Food)

- 6.4.17 Fuji Oil Co., Ltd.

- 6.4.18 Musim Mas Group.

- 6.4.19 Mewah International Inc

- 6.4.20 Alami Commodities Sdn. Bhd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK