PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906862

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906862

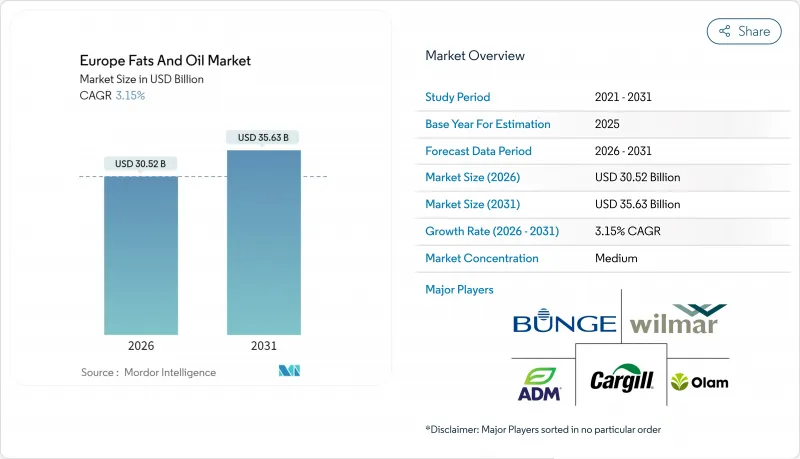

Europe Fats And Oil - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Europe fats and oil market was valued at USD 29.59 billion in 2025 and estimated to grow from USD 30.52 billion in 2026 to reach USD 35.63 billion by 2031, at a CAGR of 3.15% during the forecast period (2026-2031).

The market's momentum is driven by a diverse product mix, harmonizing traditional animal fats with an expanding selection of plant-based oils, which have increasingly taken center stage on supermarket shelves. The growing consumer preference for healthier and sustainable food options has significantly influenced the shift toward plant-based oils. Additionally, the rising demand for specialty oils, such as olive oil, avocado oil, and coconut oil, is further propelling market growth. Innovations in product formulations, including the development of fortified oils enriched with vitamins and omega-3 fatty acids, are also contributing to the market's expansion. The market is shaped by evolving dietary trends, regulatory frameworks promoting healthier alternatives, and the increasing adoption of plant-based diets across the region. Furthermore, the food processing industry plays a crucial role in driving demand, as fats and oils are essential ingredients in various processed food products, including baked goods, snacks, and confectionery.

Europe Fats And Oil Market Trends and Insights

Growing Demand for Speciality Fats in Bakery and Confectionay

The growing demand for specialty fats is a significant driver of the market. Specialty fats are increasingly used in bakery and confectionery products due to their functional benefits, such as enhancing texture, improving shelf life, and providing a better mouthfeel. Additionally, the confectionery segment in Europe is witnessing steady growth, with chocolate consumption per capita in countries like Switzerland and Germany among the highest globally. ITC Trade Map reports that Europe's cocoa bean imports surged from USD 8.98 billion in 2022 to a projected USD 20.59 billion in 2024 , highlighting the increasing demand for cocoa-based products, which directly drives the need for specialty fats in chocolate production. This trend is expected to bolster the adoption of specialty fats as manufacturers aim to meet consumer preferences for premium-quality products. Furthermore, the rising demand for clean-label and plant-based ingredients in bakery and confectionery products is driving innovation in specialty fats. These factors collectively contribute to the robust growth of the specialty fats segment within the Europe Fats and Oil Market.

Advancement in Fat Modification Technology

Advancements in fat modification technology are driving the growth of the European fats and oils market. These technological innovations enable manufacturers to produce fats and oils with improved functionality, stability, and nutritional profiles. Enhanced fat modification techniques, such as interesterification, fractionation, and hydrogenation, allow for the customization of fats to meet specific consumer and industrial demands. For instance, interesterification helps in creating trans-fat-free products, addressing health concerns and regulatory requirements. Additionally, fractionation processes are being utilized to separate fats into components with distinct melting points, catering to applications in confectionery, bakery, and other food industries. The continuous development of these technologies is not only improving product quality but also expanding the application scope of fats and oils across various sectors, further propelling market growth in Europe.

Stringent EU Regulations on Labeling and Food Safety Standards

The European fats and oils market faces significant restraints due to increasing regulatory complexities. European regulators have tightened their grip, rolling out a series of overlapping frameworks that limit market flexibility and drive up compliance costs. The European Commission's directive on Regulation (EU) No 1169/2011 mandates detailed allergen labeling and nutritional disclosures, a move that has significant implications for the fats and oils sector, especially those with intricate ingredient compositions. These requirements demand manufacturers to invest in advanced labeling systems and ensure precise ingredient tracking, further escalating operational expenses. Additionally, regulations surrounding mineral oil hydrocarbons are adding to the compliance challenges. The EU has set contamination thresholds that vary based on fat content, requiring sophisticated testing protocols to meet these standards. Collectively, these regulatory measures are constraining market growth by imposing higher costs and operational complexities on industry players.

Other drivers and restraints analyzed in the detailed report include:

- Rising Popularity of Clean-Label and Natural Ingredients

- Shift Toward Plant-Based Diets

- Health Concerns with Animal Fats

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, oils accounted for 59.10% of the European Fats and Oils market, underscoring their critical role in shaping the market's overall dynamics. The segment is projected to grow at a strong CAGR of 5.62% through 2031, outpacing the growth of the overall market. This growth trajectory highlights the versatility and indispensability of oils across a wide range of applications, including food, industrial processes, and animal feed. These oils are not only essential for culinary purposes but also play a significant role in industrial applications, such as biofuel production and cosmetics, further solidifying their importance in the European market.

Within the oils category, sunflower oil has emerged as a standout performer, particularly in Eastern Europe, where it has gained a significant market share. This growth is largely attributed to the region's strong local production capabilities, which ensure a consistent supply and competitive pricing compared to imported alternatives. Fats, the other segment of the market, continue to play a vital role in the region's food industry. They are extensively used in bakery products, confectionery, and processed foods, catering to the evolving preferences of consumers. Fats are also integral to the production of margarine and shortening, which are widely utilized in both household and commercial baking. The demand for specialty fats, such as those used in chocolate production and other premium applications, is also on the rise, driven by the growing focus on product quality and innovation in the food sector.

The Europe Fats and Oil Market Report is Segmented by Product Type (Fats and Oils), Application (Food, Industrial, and Animal Feed), Source (Plant-Based and Animal-Based), and Geography (United Kingdom, Germany, France, Italy, Spain, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Cargill, Incorporated

- Bunge Limited

- Archer Daniels Midland Company

- Wilmar International Limited

- Olam International Ltd.

- AAK AB

- Fuji Oil Holdings Inc.

- Louis Dreyfus Company B.V.

- Avril Group (Saipol)

- Associated British Foods plc

- Mewah International Inc.

- Musim Mas Holdings

- Deoleo S.A.

- Aveno NV

- Vandeputte Group

- KTC Edibles Ltd.

- Aigremont NV

- Anglo Eastern Plantations PLC

- SD Guthrie International

- M.P. Evans

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand for Speciality Fats in Bakery and Confectionay

- 4.2.2 Advancement in Fat Modification Technology

- 4.2.3 Rising Popularity of Clean-Label and Natural Ingredients

- 4.2.4 Increse in Demand for Organic and Non-GMO Ingredients

- 4.2.5 Technological Advancements in Processing

- 4.2.6 Shift Toward Plant-Based Diets

- 4.3 Market Restraints

- 4.3.1 Stringent EU Regulations on Labeling and Food Safety Standards

- 4.3.2 Health Concerns with Animal Fats

- 4.3.3 Environmental Concerns Over Palm Oil

- 4.3.4 Allergen and Nutritional Limitations

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Fats

- 5.1.1.1 Butter

- 5.1.1.2 Tallow

- 5.1.1.3 Lard

- 5.1.1.4 Specialty Fats

- 5.1.2 Oils

- 5.1.2.1 Soybean Oil

- 5.1.2.2 Rapeseed Oil

- 5.1.2.3 Palm Oil

- 5.1.2.4 Coconut Oil

- 5.1.2.5 Olive Oil

- 5.1.2.6 Cotton Seed Oil

- 5.1.2.7 Sunflower Seed Oil

- 5.1.2.8 Others

- 5.1.1 Fats

- 5.2 By Application

- 5.2.1 Food

- 5.2.1.1 Confectionary

- 5.2.1.2 Bakery

- 5.2.1.3 Dairy Products

- 5.2.1.4 Others

- 5.2.2 Industrial

- 5.2.3 Animal Feed

- 5.2.1 Food

- 5.3 By Source

- 5.3.1 Plant-based

- 5.3.2 Animal-based

- 5.4 By Country

- 5.4.1 Germany

- 5.4.2 United Kingdom

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Spain

- 5.4.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Cargill, Incorporated

- 6.4.2 Bunge Limited

- 6.4.3 Archer Daniels Midland Company

- 6.4.4 Wilmar International Limited

- 6.4.5 Olam International Ltd.

- 6.4.6 AAK AB

- 6.4.7 Fuji Oil Holdings Inc.

- 6.4.8 Louis Dreyfus Company B.V.

- 6.4.9 Avril Group (Saipol)

- 6.4.10 Associated British Foods plc

- 6.4.11 Mewah International Inc.

- 6.4.12 Musim Mas Holdings

- 6.4.13 Deoleo S.A.

- 6.4.14 Aveno NV

- 6.4.15 Vandeputte Group

- 6.4.16 KTC Edibles Ltd.

- 6.4.17 Aigremont NV

- 6.4.18 Anglo Eastern Plantations PLC

- 6.4.19 SD Guthrie International

- 6.4.20 M.P. Evans

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK