PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836625

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836625

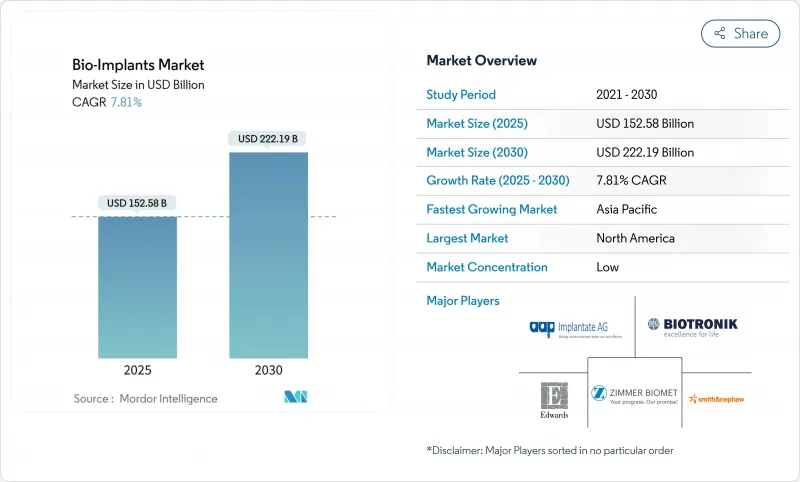

Bio-Implants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global bio-implants market stood at USD 152.58 billion in 2025 and is forecast to reach USD 222.19 billion by 2030, advancing at a 7.81% CAGR.

Rapid uptake is driven by population aging, surging chronic-disease prevalence, and the routine use of sensor-enabled devices that transmit real-time clinical data to care teams. Demand is reinforced by 3-D-printed patient-specific constructs that shorten theatre time and enhance post-operative outcomes, while bioresorbable materials eliminate follow-up extraction surgeries. Health-system moves toward value-based reimbursement are accelerating adoption in emerging economies where providers focus on total-episode cost rather than device price alone. Competitive intensity is rising as major suppliers acquire niche innovators to assemble complete musculoskeletal and cardiovascular portfolios.

Global Bio-Implants Market Trends and Insights

Rising Burden of Chronic & Lifestyle Diseases

Diabetes, cardiovascular disease, and musculoskeletal disorders are reshaping demand patterns. Genentech's Susvimo received United States Food and Drug Administration (FDA) approval in 2025 as the first continuous ocular drug-delivery implant needing only twice-yearly refills, underscoring how multifunctional devices now address chronic pathologies with fewer interventions. Healthcare systems in high-income countries are pivoting toward proactive management, favoring long-lasting implants that reduce rehospitalization.

Growing Preference for Minimally-Invasive Surgeries

Ambulatory surgery centers performed 44 million procedures in 2024 and will keep expanding as payers reimburse outpatient joint replacements. Implant manufacturers respond by creating devices optimized for shorter operative windows and same-day discharge protocols, increasing the addressable bio-implants market well beyond traditional hospital theatres.

High Upfront Cost of Advanced Implants

Premium sensor-based devices remain expensive, making payers hesitate in regions where capital budgets are constrained. Suppliers are developing tiered portfolios so health systems can match functionality to economic reality without halting innovation.

Other drivers and restraints analyzed in the detailed report include:

- Aging Population Accelerating Joint-Replacement Volumes

- Surge in 3-D-Printed, Patient-Specific Implants

- Unfavorable / Fragmented Reimbursement Pathways

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Orthopedic devices represented the single-largest revenue block in 2024, contributing 28.12% of the bio-implants market share. Cardiovascular implants, however, deliver the highest momentum with an 8.54% CAGR, powered by transcatheter valves and implantable hemodynamic sensors. The segment benefits from FDA breakthrough-device designations such as BiVACOR's total artificial heart that target end-stage failure. Over the forecast horizon, smart pacemakers integrated with remote telemetry will further enlarge the cardiovascular footprint within the bio-implants market.

Orthopedic innovation stays robust through robotic guidance and improved tribology that extends bearing life. Neuro-stimulators leverage adaptive algorithms to recalibrate in response to patient feedback, while cochlear implants inch toward fully implantable form factors; the category is projected to reach USD 940.1 million by 2030. Ophthalmic platforms like Susvimo re-shape treatment frequency expectations, reinforcing steady demand across all implant lines.

Metals and alloys accounted for 44.34% of 2024 revenue thanks to titanium's unmatched strength-to-weight ratio, but composites will grow the fastest at 8.43% as polyether-ether-ketone (PEEK) and polylactic acid (PLA) variants mitigate stress shielding. Ceramics doped with antimicrobial silver ions diminish infection risk, and bio-active glass matrices encourage osteogenesis without inflammatory cascade. Gradient builds that shift from rigid cores to compliant outer zones imitate natural tissue and broaden indications for soft-tissue repair.

Global Bio Implants Market is Segmented by Type of Bio-Implants (Cardiovascular Implants, Orthopedic Implants, Spinal Implants, and More), Material (Metals & Alloys, Polymers, and More), Origin (Autograft, Allograft, and More), End User (Hospitals, Ambulatory Surgical Centers, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 48.67% of global revenue in 2024 as reimbursement parity and advanced R&D ecosystems speed adoption of closed-loop neuro-stimulators like Medtronic's BrainSense platform, cleared by the FDA in 2025. Cross-border patient flows from Canada and Mexico further support procedure growth while diversified payer mixes stabilize price realization.

Asia-Pacific is the fastest-moving bio-implants market at an 8.45% CAGR. China supports domestic manufacturing, India aligns its regulatory code with international standards, and Japan's super-aged society prioritizes joint and cardiac devices. Digital health infrastructure in South Korea accelerates remote monitoring uptake, and Australian research hubs host pivotal trials that de-risk regional launches.

Europe wrestles with Medical Device Regulation (MDR) certification bottlenecks-only 43 notified bodies oversee half-a-million devices-slowing market entry. Transition extensions to 2027 grant limited reprieve, yet firms must still meet stringent environmental requirements incorporated into new procurement criteria. Sustainability-minded hospitals increasingly request lifecycle analyses and recyclable packaging as part of tender bids.

- Johnson & Johnson

- Medtronic

- Abbott Laboratories

- Zimmer Biomet

- Stryker

- Boston Scientific

- Edward Lifesciences

- BIOTRONIK

- Smiths Group

- Straumann Group

- Dentsply Sirona

- Cochlear

- Bausch Health

- AAP Implantate

- Endo International

- MiMedx Group

- LifeNet Health

- Arthrex

- Globus Medical

- NuVasive

- Exactech

- Conmed

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Burden of Chronic & Lifestyle Diseases

- 4.2.2 Growing Preference for Minimally-invasive Surgeries

- 4.2.3 Aging Population Accelerating Joint-replacement Volumes

- 4.2.4 Surge in 3-D-printed, Patient-specific Implants

- 4.2.5 Commercialization of Bioresorbable & Smart Sensor-enabled Implants

- 4.2.6 Value-based-care Bundles Boosting Implant Uptake in EMs

- 4.3 Market Restraints

- 4.3.1 High Upfront Cost of Advanced Implants

- 4.3.2 Unfavorable/Fragmented Reimbursement Pathways

- 4.3.3 Supply-chain Vulnerability for Specialty Biomaterials

- 4.3.4 ESG & Lifecycle-impact Scrutiny Delaying Approvals

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value - USD)

- 5.1 By Type of Bio-Implants

- 5.1.1 Cardiovascular Implants

- 5.1.2 Orthopedic Implants

- 5.1.3 Spinal Implants

- 5.1.4 Dental Implants

- 5.1.5 Ophthalmic Implants

- 5.1.6 Neurological & Cochlear Implants

- 5.1.7 Other Implants

- 5.2 By Material

- 5.2.1 Metals & Alloys

- 5.2.2 Polymers

- 5.2.3 Ceramics & Bio-active Glass

- 5.2.4 Composite & Hybrid Biomaterials

- 5.2.5 Other Materials

- 5.3 By Origin

- 5.3.1 Autograft

- 5.3.2 Allograft

- 5.3.3 Xenograft

- 5.3.4 Synthetic / Prosthetic

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Ambulatory Surgical Centers

- 5.4.3 Specialty Clinics

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Johnson & Johnson (DePuy Synthes)

- 6.4.2 Medtronic PLC

- 6.4.3 Abbott Laboratories

- 6.4.4 Zimmer Biomet

- 6.4.5 Stryker Corporation

- 6.4.6 Boston Scientific Corporation

- 6.4.7 Edwards Lifesciences

- 6.4.8 BIOTRONIK

- 6.4.9 Smith & Nephew

- 6.4.10 Straumann Holding AG

- 6.4.11 Dentsply Sirona

- 6.4.12 Cochlear Limited

- 6.4.13 Bausch & Lomb

- 6.4.14 aap Implantate AG

- 6.4.15 Endo International PLC

- 6.4.16 MiMedx Group

- 6.4.17 LifeNet Health

- 6.4.18 Arthrex Inc.

- 6.4.19 Globus Medical

- 6.4.20 NuVasive

- 6.4.21 Exactech

- 6.4.22 Conmed Corporation

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment