PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836633

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836633

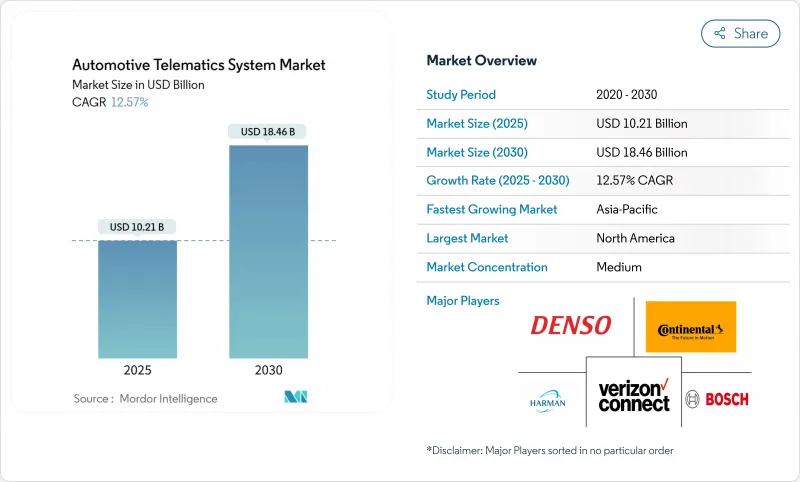

Automotive Telematics System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The automotive telematics market stood at USD 10.21 billion in 2025 and is forecast to reach USD 18.46 billion by 2030, advancing at a 12.57% CAGR.

Rising regulatory requirements for in-vehicle emergency calls, falling connectivity costs, and the shift toward software-defined vehicles are expanding baseline connectivity across model ranges. Commercial operators are turning to telematics to offset fuel volatility and driver shortages, which lifts demand for fleet-management platforms capable of double-digit fuel savings and crash reduction. Growth opportunities also stem from electric-vehicle charging optimization, vehicle-to-grid services, and emerging API marketplaces that let third parties purchase anonymised data streams.

Global Automotive Telematics System Market Trends and Insights

Government eCall & Similar Mandates Drive Baseline Connectivity

Mandatory emergency-call systems under the EU eCall regulation and comparable rules in Russia and Brazil have made cellular modules standard equipment in new passenger cars, laying a foundation for added paid services. Countries in Asia-Pacific are drafting alike frameworks, ensuring the automotive telematics market keeps a minimum penetration rate even in budget segments. Automakers leverage this compulsory hardware for value-added remote diagnostics and stolen-vehicle recovery, which lifts average revenue per unit. Tier-1 suppliers respond with integrated 5G TCUs that meet both accident notification and over-the-air-update needs. The resulting installed base expedites scale economies, pushing unit costs down and facilitating wider mass-market deployment.

Fleet-Optimization Demand Intensifies Amid Fuel-Price Volatility

Diesel and gasoline price swings continue to pressure logistics margins, prompting fleets to adopt real-time telematics that cut idle time and penalize aggressive driving. Studies show 10-15% fuel-cost reduction when advanced routing and driver coaching modules are enabled. Insurer analyses covering US and UK fleets find crash and claim frequencies fall more than 70% once telematics data is fused with driver-training programs. Utilities, construction firms, and municipal services now embed telematics in procurement policies, broadening the end-user base beyond long-haul trucking. Artificial-intelligence add-ons that predict maintenance further improve uptime, increasing the platform's payback and accelerating adoption in mixed-asset fleets.

High Device & Data-Plan Costs Limit Entry-Level Market Penetration

Low-margin vehicle segments in India, Brazil and Southeast Asia face consumer price sensitivity that squeezes optional connectivity features. Data-plan fees constitute a larger share of household spending in these markets, making subscription renewals particularly challenging. Local mobile operators rarely provide pan-regional M2M tariffs, adding complexity to exports. Hardware makers are miniaturizing chipsets and system-on-modules to cut bill-of-materials costs, yet inflationary headwinds in 2025 offset part of the gain. Flexible pay-per-use plans and government incentives for road-safety solutions could mitigate the barrier but are unevenly implemented.

Other drivers and restraints analyzed in the detailed report include:

- Usage-Based-Insurance Adoption Accelerates Insurer Digital Transformation

- EV Charging-Network Integration Creates New Service Paradigms

- Semiconductor Shortages Disrupt Telematics Hardware Supply Chains

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fleet-management services generated the largest revenue slice in 2024, capturing 25.22% of the automotive telematics market. Logistics, utilities, and field-service fleets rely on routing optimization, fuel monitoring, and driver coaching to maintain margins amid volatile diesel prices. Safety and security modules remain a staple, and predictive-maintenance dashboards help defer costly roadside breakdowns. Diagnostics APIs that integrate with enterprise resource-planning systems are now standard in Western fleets and are gaining traction in Southeast Asia. The automotive telematics market size for V2X & OTA services is projected to expand at 32.31% CAGR, propelled by software-defined vehicle architectures that demand continuous feature deployment. Automakers use dual-radio modules to support both cellular-V2X and 5.9 GHz ITS-G5, unlocking cooperative perception, traffic-signal priority, and over-the-air firmware upgrades that keep vehicles compliant with evolving safety standards.

Second-order demand sources include insurer partnerships that add crash-AI reconstruction to V2X data feeds, improving liability assessments. Infotainment vendors also see an upgraded pathway from one-way streaming to bi-directional cloud gaming, creating incremental data-plan usage. Policy initiatives such as the U.S. DOT's 5G Roadmap encourage transportation-infrastructure owners to enable lane-level warnings, fostering an ecosystem where public and private datasets converge. Consequently, telematics platforms bundle edge-computing resources and virtualized network functions to meet varying latency and bandwidth requirements across service tiers.

Factory-installed telematics controlled 67.23% of 2024 revenue as automakers seized data ownership and ensured seamless human-machine interface integration. European eCall mandates and proliferating EV remote-management features further support embedded adoption at the assembly line. The automotive telematics market share of aftermarket boxes, however, is set to escalate as legacy fleets and private owners retrofit non-connected vehicles, a segment growing at 19.84% CAGR. Aftermarket suppliers differentiate through rapid installation, device-agnostic cloud dashboards, and pay-as-you-go contracts.

Ride-hailing operators rely on aftermarket solutions to standardize data across mixed vehicle makes, enabling unified fleet analytics. Yet OEMs are countered by exposing freemium APIs to entice developers, which may cannibalize aftermarket add-ons over the medium term. Regulatory scrutiny over data portability under the EU Data Act could tip bargaining power toward third-party service providers, potentially reshaping channel economics.

The Automotive Telematics Market Report is Segmented by Service (Infotainment & Navigation, Fleet Management and More), Sales Channel Type (OEM-Fitted and Aftermarket), Connectivity Solution (Embedded, Integrated-Smartphone and More), Vehicle Type (Two-Wheelers, Passenger Cars, LCV and More), End-User (Private Consumers, Fleet Operators and More) and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained leadership with 27.26% of 2024 revenue, supported by dense 4G/5G coverage, mature fleet-management adoption, and early migration to usage-based insurance. Federal crash-data standards encourage open APIs that simplify insurer and law-enforcement access, while carrier sunsets of 3G networks drove a wave of hardware upgrades across long-haul carriers and delivery fleets. Strong aftermarket penetration complements factory-fit growth because mixed-brand enterprise fleets require uniform dashboards for compliance reporting.

Asia-Pacific is the fastest-growing territory at a 21.47% CAGR, propelled by China's connected-vehicle mandates and India's commercial-vehicle digitization rules that make AIS-140 telematics units compulsory. Local automakers pre-install 4G modules in new-energy vehicles to comply with MIIT data-sharing requirements, generating a large, embedded base for value-added apps. Japan and South Korea run V2X corridor pilots that showcase low-latency safety messages, while Southeast Asian ride-hailing fleets rely on smartphone-centric solutions that are beginning to migrate toward embedded hardware as electric-vehicle warranties demand deeper battery analytics. Regional telecom operators are forming cross-border roaming alliances to cut data costs, a move likely to lift small-fleet adoption in 2026-2027.

Europe delivers steady growth underpinned by universal eCall compliance and emerging CO2-emission monitoring schemes that use telematics payloads for real-world verification. GDPR and the forthcoming EU Data Act raise operating complexity but also create new market space for privacy-preserving analytics vendors. The Middle East and Africa, though still nascent, gain momentum from Gulf smart-city corridors and South African insurers piloting mileage-based premiums, with satellite-IoT and low-power networks extending reach beyond urban centers. Harmonized UNECE cybersecurity rules apply across these regions, guiding procurement toward compliant hardware and making secure over-the-air update capability a non-negotiable feature for both premium and entry-level vehicles.

- Continental AG

- Robert Bosch GmbH

- Denso Corporation

- Visteon Corporation

- Aptiv plc

- Harman International (Samsung)

- Panasonic Automotive

- Valeo SA

- Marelli SpA

- Mitsubishi Electric Corp.

- LG Electronics

- Verizon Connect

- Octo Telematics

- Geotab Inc.

- Trimble Transportation

- ACTIA Group

- Samsara Inc.

- HERE Technologies

- Teltonika IoT Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government eCall & similar mandates

- 4.2.2 Fleet-optimization demand amid fuel-price volatility

- 4.2.3 Usage-based-insurance (UBI) adoption by insurers

- 4.2.4 EV charging-network integration with telematics platforms

- 4.2.5 Monetization of in-vehicle data via OEM API marketplaces

- 4.2.6 Upcoming UNECE OTA-cyber-security regulations (R155/R156)

- 4.3 Market Restraints

- 4.3.1 High device & data-plan cost for entry-level vehicles

- 4.3.2 Persistent global automotive semiconductor shortages

- 4.3.3 Consumer data-privacy & cross-border data-sovereignty laws

- 4.3.4 Country-specific telematics service taxation complexity

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Service

- 5.1.1 Infotainment and Navigation

- 5.1.2 Fleet Management

- 5.1.3 Safety & Security

- 5.1.4 Diagnostics and Prognostics

- 5.1.5 Insurance Telematics

- 5.1.6 V2X and OTA Updates

- 5.2 By Sales Channel Type

- 5.2.1 OEM-fitted

- 5.2.2 Aftermarket

- 5.3 By Connectivity Solution

- 5.3.1 Embedded

- 5.3.2 Integrated-smartphone

- 5.3.3 Tethered / Portable

- 5.4 By Vehicle Type

- 5.4.1 Two-Wheelers

- 5.4.2 Passenger Cars

- 5.4.2.1 Hatchbacks

- 5.4.2.2 Sedans

- 5.4.2.3 SUVs and MPVs

- 5.4.3 Light Commercial Vehicles

- 5.4.4 Medium and Heavy Commercial Vehicles

- 5.5 By End-User

- 5.5.1 Private Consumers

- 5.5.2 Fleet Operators

- 5.5.3 Insurance and Leasing Firms

- 5.5.4 Car-Sharing and Mobility Providers

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Egypt

- 5.6.5.2 Turkey

- 5.6.5.3 Saudi Arabia

- 5.6.5.4 United Arab of Emirates

- 5.6.5.5 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products & Services, and Recent Developments)

- 6.4.1 Continental AG

- 6.4.2 Robert Bosch GmbH

- 6.4.3 Denso Corporation

- 6.4.4 Visteon Corporation

- 6.4.5 Aptiv plc

- 6.4.6 Harman International (Samsung)

- 6.4.7 Panasonic Automotive

- 6.4.8 Valeo SA

- 6.4.9 Marelli SpA

- 6.4.10 Mitsubishi Electric Corp.

- 6.4.11 LG Electronics

- 6.4.12 Verizon Connect

- 6.4.13 Octo Telematics

- 6.4.14 Geotab Inc.

- 6.4.15 Trimble Transportation

- 6.4.16 ACTIA Group

- 6.4.17 Samsara Inc.

- 6.4.18 HERE Technologies

- 6.4.19 Teltonika IoT Group

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment