PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836639

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836639

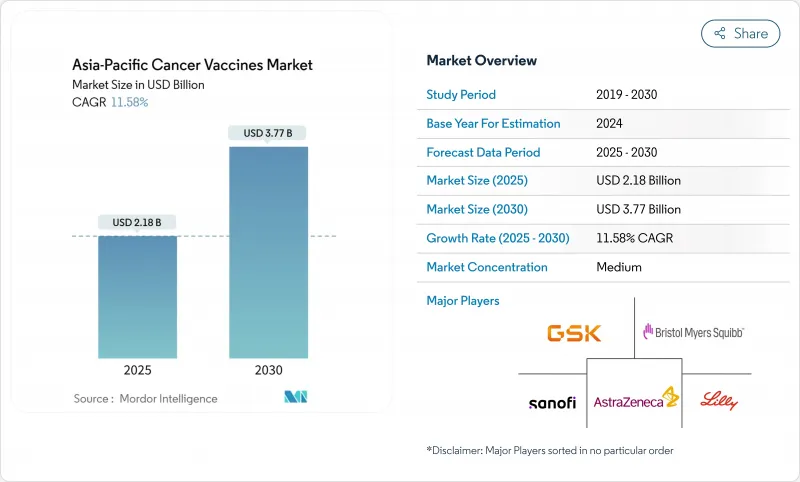

Asia-Pacific Cancer Vaccines - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Asia-Pacific cancer vaccines market was valued at USD 2.18 billion in 2025 and is forecast to reach USD 3.77 billion by 2030, advancing at an 11.58% CAGR.

Sustained growth rests on the region's escalating cancer burden, policy-backed HPV immunisation roll-outs, and rapid breakthroughs in personalised mRNA-neoantigen platforms. Governments prioritise cervical-cancer prevention, while investors funnel capital into biotech clusters that shorten clinical timelines for new therapeutic vaccines. Contract development and manufacturing organisations (CDMOs) in China, India, and South Korea add capacity for viral-vector and mRNA production, flattening supply-chain risk and lowering unit costs. Intensifying competition from immune checkpoint inhibitors, CAR-T therapies, and emerging combination regimens tempers the speed of therapeutic uptake, yet economic analyses still favour vaccination over treatment for many tumour types. Together, these factors underpin double-digit annual expansion of the Asia-Pacific cancer vaccines market.

Asia-Pacific Cancer Vaccines Market Trends and Insights

Growing Burden of Cancer Across APAC Drives Market Expansion

Asia-Pacific now shoulders 60% of global cancer cases, a figure driven by urbanisation, dietary shifts, and rapid population ageing. China reports 4.57 million new diagnoses annually, while cervical cancer incidence in India exceeds 23 per 100,000 women in several states. Region-specific malignancies-nasopharyngeal, hepatocellular, and gastric cancers-raise unique prevention needs. Economic modelling shows that vaccination can cut cervical cancer incidence by 20-76% across Vietnam, Thailand, and Indonesia, making prophylaxis more cost-effective than treatment. These dynamics sustain long-term demand for both preventive and therapeutic cancer vaccines.

HPV-Vaccination National Roll-Outs Accelerate Market Penetration

China's Healthy China 2030 agenda places HPV immunisation at the centre of women's-health policy, even though coverage among girls aged 9-14 stands at just 2.24% . Japan reversed its decade-long suspension of proactive HPV recommendations, Australia already tops 90% coverage, and Indonesia's campaigns show 54-82% declines in HPV-related disease. Incremental cost-effectiveness ratios range from USD 166 to USD 450 per QALY in Mongolia, Indonesia, and Thailand, giving finance ministries confidence to fund large-scale procurement. Predictable demand volumes allow suppliers to negotiate long-term contracts and ramp regional output.

Competition from Immune-Checkpoint Inhibitors & CAR-T Therapies

PD-1/PD-L1 inhibitors could generate USD 4 billion in China by 2025, with domestic firms moving beyond lung and liver cancer into broader solid-tumour pipelines. Claudin18.2 CAR-T protocols report 38.8% objective response and 91.8% disease-control rates in early-phase gastrointestinal trials. Acceptable safety profiles-96.1% of adverse events graded mild or moderate-bolster clinician confidence and may divert patients from vaccine based therapeutics. Combination regimens such as efti plus pembrolizumab post 32.8% response versus 26.7% for monotherapy, further crowding the immuno-oncology landscape.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward Personalised Neo-Antigen Vaccine Platforms

- Rapid Scale-Up of Regional CDMO Capacity for mRNA/Viral-Vector Vaccines

- Low Adult-Immunisation Acceptance in Several Southeast-Asian Nations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Recombinant products held 48.41% of 2024 revenue, anchoring the Asia-Pacific cancer vaccines market with proven safety records and well-established GMP lines. The mRNA/neoantigen class is set to rise at 12.23% CAGR, reshaping the competitive grid as cost-efficient Chinese playersrapidly commercialise personalised candidates. Viral-vector and DNA modalities post stable mid-single-digit trajectories, serving as bridges between legacy constructs and next-generation therapies. Whole-cell and dendritic-cell vaccines remain niche, yet they retain clinical relevance for advanced solid tumours that require multi-antigen responses.

The mRNA upswing is powered by AI-driven target discovery and flexible production cycles that compress sequence-to-clinic timelines. Likang Life Sciences' LK-101 and StemiRNA's lipid-polyplex system illustrate cost-engineering advantages, enabling six-dose regimens at one-hundredth of prevailing Western prices. Regional CDMO build-outs further widen the gap by eliminating transcontinental freight and customs delays. As a result, mRNA lines are forecast to absorb a sizeable share of future approvals, particularly in cancers with high mutational loads such as melanoma and lung adenocarcinoma.

Preventive formulations controlled 91.21% of 2024 revenue, reflecting government-funded HPV programmes and broad public-health messaging. Therapeutic candidates, however, are tracking a 12.31% CAGR on rising demand for patient-specific regimens that augment checkpoint inhibitors. The Asia-Pacific cancer vaccines market size for therapeutic injections is projected to expand from USD 192 million in 2025 to roughly USD 344 million by 2030, underscoring the shift toward integrated care pathways.

Economic models continue to favour prophylaxis, with HPV programmes costing below USD 450 per QALY in multiple low- and middle-income settings. Yet second-line data for agents like BVAC-C, which delivered 19.2% objective response and 53.8% disease control in refractory cervical cancer, validate therapeutic relevance. As neoantigen selection tools mature, therapeutic cycles are expected to integrate seamlessly with standard chemoradiation, redefining downstream revenue pools.

The Asia-Pacific Cancer Vaccines Market is Segmented by Technology (Recombinant Vaccines, and More), Treatment Method (Preventive Vaccines and Therapeutic Vaccines), Cancer Type (Cervical Cancer (HPV), Melanoma and More), Delivery Route (Intramuscular, Intravenous, and More), and Geography (China, Japan, India, and More). The Market and Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Astellas Pharma

- AstraZeneca

- BioNTech

- Bristol-Myers Squibb

- CanSino BIO

- Daiichi Sankyo Co. Ltd.

- Eli Lilly and Company

- Genexine Inc.

- GlaxoSmithKline

- Imugene Ltd.

- Kanghong Pharmaceutical

- Merck

- Moderna

- Ono Pharmaceutical Co. Ltd.

- Pfizer

- Sanofi

- Serum Institute of India Pvt Ltd.

- Shenzhen Baiyi Bio-Pharma

- Takara Bio

- Vaccitech Plc

- Likang Life Sciences

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing burden of cancer across APAC

- 4.2.2 HPV-vaccination national roll-outs

- 4.2.3 Shift toward personalised neo-antigen vaccine platforms

- 4.2.4 Rapid scale-up of regional CDMO capacity for mRNA/viral-vector vaccines

- 4.2.5 Government price-support for locally-made HPV vaccines

- 4.2.6 Oncology-focused VC funding surge into APAC biotech clusters

- 4.3 Market Restraints

- 4.3.1 Competition from immune-checkpoint inhibitors & CAR-T therapies

- 4.3.2 Low adult-immunisation acceptance in several Southeast-Asian nations

- 4.3.3 Supply-chain fragility for ultra-cold-chain mRNA vaccines

- 4.3.4 Heightened regulatory scrutiny after safety-signal incidents

- 4.4 Regulatory Landscape

- 4.5 Porters Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Market Value, USD)

- 5.1 By Technology

- 5.1.1 Recombinant Vaccines

- 5.1.2 Viral Vector & DNA Vaccines

- 5.1.3 mRNA/Neoantigen Personalised Vaccines

- 5.1.4 Whole-cell & Dendritic Cell Vaccines

- 5.1.5 Other Technologies

- 5.2 By Treatment Method

- 5.2.1 Preventive Vaccines

- 5.2.2 Therapeutic Vaccines

- 5.3 By Cancer Type

- 5.3.1 Cervical Cancer (HPV)

- 5.3.2 Prostate Cancer

- 5.3.3 Melanoma

- 5.3.4 Other Cancers

- 5.4 By Delivery Route

- 5.4.1 Intramuscular

- 5.4.2 Intradermal / Sub-cutaneous

- 5.4.3 Intravenous

- 5.5 By Geography

- 5.5.1 China

- 5.5.2 Japan

- 5.5.3 India

- 5.5.4 South Korea

- 5.5.5 Australia

- 5.5.6 Rest of Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Astellas Pharma Inc.

- 6.3.2 AstraZeneca Plc

- 6.3.3 BioNTech SE

- 6.3.4 Bristol-Myers Squibb Co.

- 6.3.5 CanSino BIO

- 6.3.6 Daiichi Sankyo Co. Ltd.

- 6.3.7 Eli Lilly and Co.

- 6.3.8 Genexine Inc.

- 6.3.9 GlaxoSmithKline Plc

- 6.3.10 Imugene Ltd.

- 6.3.11 Kanghong Pharmaceutical

- 6.3.12 Merck & Co., Inc.

- 6.3.13 Moderna Inc.

- 6.3.14 Ono Pharmaceutical Co. Ltd.

- 6.3.15 Pfizer Inc.

- 6.3.16 Sanofi

- 6.3.17 Serum Institute of India Pvt Ltd.

- 6.3.18 Shenzhen Baiyi Bio-Pharma

- 6.3.19 Takara Bio Inc.

- 6.3.20 Vaccitech Plc

- 6.3.21 Likang Life Sciences

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment