PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836643

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836643

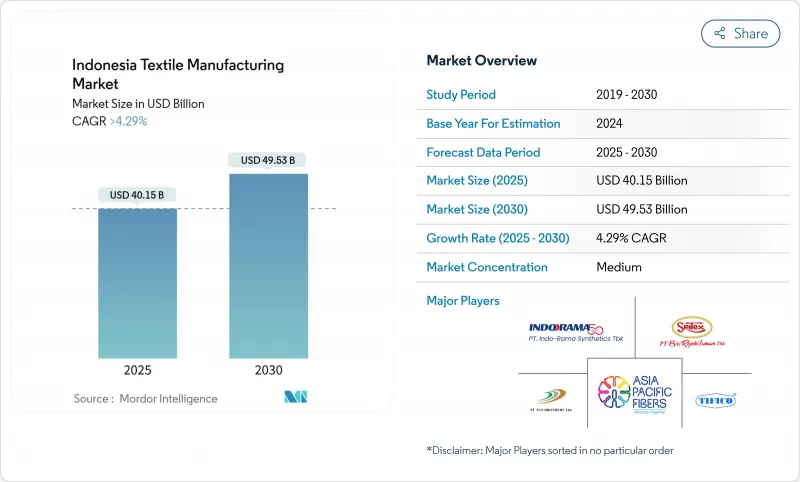

Indonesia Textile Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Indonesia Textile Manufacturing Market is valued at USD 40.15 billion in 2025 and is projected to reach USD 49.53 billion by 2030, expanding at a 4.29% CAGR.

Robust policy backing through the Making Indonesia 4.0 roadmap, a large pool of skilled labor, and resurging foreign orders position the country as a vital sourcing hub for brands looking to diversify Asian supply chains. Java's mature industrial ecosystem, together with rising factory automation and petrochemical integration, sustains cost competitiveness even as wage pressures inch up. Expanding demand for modest wear and technical textiles continues to lift output quality, while the shift toward recycled fibers signals growing alignment with global sustainability standards. Despite logistics bottlenecks and import-led price competition, proactive tax incentives, green-industry certifications, and regional development programs underpin medium-term growth prospects.

Indonesia Textile Manufacturing Market Trends and Insights

Rising Near-Shoring of Activewear Orders from US & EU Brands to Java Clusters

Labor cost escalation in legacy Asian hubs and the need for faster replenishment bring Western labels to Java's large-scale plants. Pan Brothers, with annual capacity of 117 million pieces, has secured incremental contracts for performance knitwear, underscoring the pivot toward Indonesia. Close proximity among yarn, fabric, and garment units inside the island's industrial estates compresses lead times and lowers handling expenses. Nevertheless, uncertainty over potential US tariff hikes remains a watchpoint for producers.

Boom in Muslim Fashion Exports Driving Value-Added Garment Production

Indonesia leverages cultural affinity and design talent to supply the expanding global modest-fashion segment, estimated at USD 361 billion in 2023. Showcases at New York Fashion Week have raised international visibility, allowing local brands to command higher price points. Value-added lines create stickier customer relationships and require advanced embellishment techniques, prompting mills to invest in specialty machinery and skilled artisans.

Illegal Low-Priced Imports Eroding SME Weaving Margins

Unlawful inflows undercut local price points and have triggered factory closures and layoffs, pushing the government to tighten import permits and step up inspections. Even with 200% safeguard tariffs, weak enforcement lets counterfeit and sub-standard fabrics slip through ports, leaving community-based weaving clusters unable to recover overheads. The new Permenperin 5/2024 regulation aims to close loopholes by clarifying documentation requirements and synchronizing customs databases.

Other drivers and restraints analyzed in the detailed report include:

- Government "Making Indonesia 4.0" Incentives Accelerating Textile Automation

- Surge in E-Commerce-Led Domestic Apparel Demand Among Gen-Z Consumers

- Chronic Port & Rail Bottlenecks Inflating Inter-Island Logistics Cost

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Weaving retained a 37.3% share of the Indonesia textile manufacturing market in 2024, anchored by entrenched shuttle and rapier loom capacity across West Java clusters. Output caters mainly to shirtings and denim, segments that still support steady export volumes. Knitting, however, posts a 5.08% CAGR through 2030 as performance apparel and athleisure lines surge. Producers deploy circular knitting machines capable of smaller lot sizes and functional yarn blends, aligning with the short-run model favored by online retailers.

Knitting's growth also reflects rising orders from sportswear labels seeking quick replenishment out of Southeast Asia. Java-based makers leverage co-located dye-houses and print shops to deliver fully packaged garments, capturing greater value than fabric-only suppliers. In the medium term, advanced knitting techniques such as seamless construction are expected to lift productivity and reduce post-production waste, reinforcing Indonesia's competitiveness in comfort apparel.

Garments represented 59.5% of the Indonesia textile manufacturing market share in 2024, testifying to the country's deep sewing expertise and abundant workforce. Producers have moved beyond cut-make-trim to full-package services, offering design input, merchandising, and compliance documentation to brand customers. The fastest expansion occurs in technical and industrial textiles at 5.04% CAGR, reflecting infrastructure spending and automotive OEM localization.

Continued garment leadership also stems from Indonesia's modest-wear niche, where brands merge traditional motifs with modern silhouettes for export markets. Integrated players that control upstream fabric and dyeing steps capture improved margins and ensure quality alignment with brand audits. Meanwhile, fabric-only producers channel more output into protective wear, filtration, and automotive components, reducing reliance on fashion cycles.

The Indonesia Textile Manufacturing Market Report is Segmented by Process Type (Weaving, Knitting, Spinning, and More), by Textile Type (Fabric, Yarn, Fiber, and More), by Material Type (Natural Fibers (Cotton, Silk Etc. ), and More), by Application (Apparel, Home Textiles, and More), and by Region (Java, Sumatra and More). The Report Offers Market Size and Forecasts in Value (USD) for all the Above Segments.

List of Companies Covered in this Report:

- PT Asia Pacific Fibres Tbk

- Indo-Rama Synthetics Tbk

- PT Sri Rejeki Isman Tbk (Sritex)

- PT Tifico Fiber Indonesia Tbk

- PT Pan Brothers Tbk

- PT Ever Shine Tex Tbk

- PT Trisula Textile Industries Tbk

- PT Century Textile Industry Tbk (Toray)

- PT Polychem Indonesia Tbk

- PT Argo Pantes Tbk

- Duniatex Group

- PT Kahatex

- PT Apac Inti Corpora

- PT Eratex Djaja Tbk

- PT Ateja Tritunggal

- PT Sinar Para Taruna

- PT Kewalram Indonesia

- PT Pura Group (Textile Div.)

- PT Multi Garmenjaya

- PT Delami Garment Industries

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government "Making Indonesia 4.0" incentives accelerating textile automation

- 4.2.2 Rising near-shoring of activewear orders from US & EU brands to Java clusters

- 4.2.3 Boom in Muslim fashion exports driving value-added garment production

- 4.2.4 Surge in e-commerce-led domestic apparel demand among Gen-Z consumers

- 4.2.5 Import-substitution push for man-made fibers amid high cotton dependency

- 4.2.6 Investor tax breaks for green dye-house upgrades in Central Java

- 4.3 Market Restraints

- 4.3.1 Illegal low-priced imports eroding SME weaving margins

- 4.3.2 Chronic port & rail bottlenecks inflating inter-island logistics cost

- 4.3.3 Volatile PLN electricity tariffs squeezing energy-intensive spinning

- 4.3.4 Tight labour pool in West Java driving wage inflation vs. Vietnam

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory & Government-Initiative Outlook

- 4.6 Technological Outlook - Industry 4.0 & Digital Transformation Readiness

- 4.7 Industry Attractiveness - Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Recent Global Disruptions on the Indonesia Textile Manufacturing Industry

- 4.9 Sustainability & Circular Economy Trends

5 Market Size & Growth Forecasts (Value, In USD Billion)

- 5.1 By Process Type

- 5.1.1 Spinning

- 5.1.2 Weaving

- 5.1.3 Knitting

- 5.1.4 Finishing

- 5.1.5 Other Processes (non-woven)

- 5.2 By Textile Type

- 5.2.1 Fiber

- 5.2.2 Yarn

- 5.2.3 Fabric

- 5.2.4 Garments

- 5.2.5 Other Textiles

- 5.3 By Material Type

- 5.3.1 Natural Fibers (Cotton, Silk etc.)

- 5.3.2 Synthetic Fibers (Polyester, Nylon etc.)

- 5.3.3 Others (Regenerated & Recycled Fibers, Speciality Fibers)

- 5.4 By Application

- 5.4.1 Apparel

- 5.4.2 Home Textiles

- 5.4.3 Technical/Industrial Textiles

- 5.4.4 Other Applications

- 5.5 By Region (Indonesia)

- 5.5.1 Java

- 5.5.2 Sumatra

- 5.5.3 Others (Kalimantan, Sulawesi, Bali, etc.)

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)}

- 6.4.1 PT Asia Pacific Fibres Tbk

- 6.4.2 Indo-Rama Synthetics Tbk

- 6.4.3 PT Sri Rejeki Isman Tbk (Sritex)

- 6.4.4 PT Tifico Fiber Indonesia Tbk

- 6.4.5 PT Pan Brothers Tbk

- 6.4.6 PT Ever Shine Tex Tbk

- 6.4.7 PT Trisula Textile Industries Tbk

- 6.4.8 PT Century Textile Industry Tbk (Toray)

- 6.4.9 PT Polychem Indonesia Tbk

- 6.4.10 PT Argo Pantes Tbk

- 6.4.11 Duniatex Group

- 6.4.12 PT Kahatex

- 6.4.13 PT Apac Inti Corpora

- 6.4.14 PT Eratex Djaja Tbk

- 6.4.15 PT Ateja Tritunggal

- 6.4.16 PT Sinar Para Taruna

- 6.4.17 PT Kewalram Indonesia

- 6.4.18 PT Pura Group (Textile Div.)

- 6.4.19 PT Multi Garmenjaya

- 6.4.20 PT Delami Garment Industries

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment