PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836657

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836657

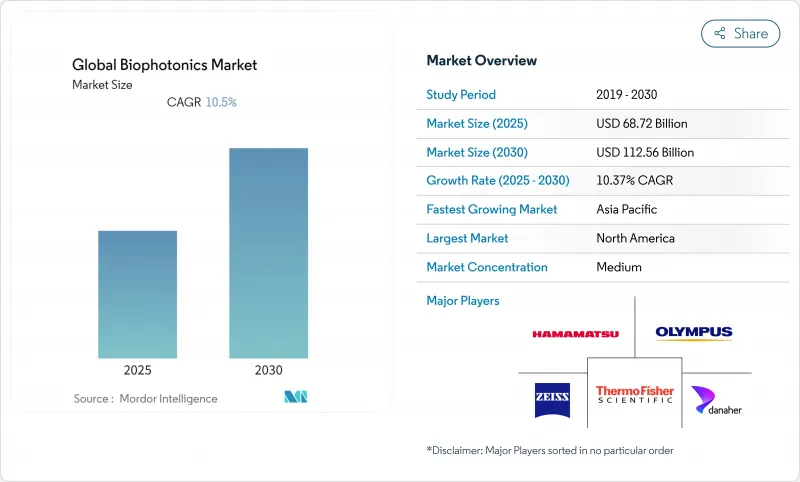

Global Biophotonics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The biophotonics market size is USD 68.72 billion in 2025 and is forecast to reach USD 112.56 billion by 2030, advancing at a 10.37% CAGR.

Strong growth stems from the convergence of artificial intelligence with optical technologies, where AI-enabled spectroscopy delivers 98.8% accuracy in non-invasive glucose monitoring. Nanotechnology paired with photoacoustic tomography now supports real-time stroke assessment, signaling a shift beyond conventional imaging toward precision therapeutic guidance. Asia-Pacific records the fastest expansion as China's USD 4.17 billion 2024 investment in biomanufacturing and Japan's USD 307 million program in optical chips build regional momentum. Lasers hold the leading product position due to precision surgical adoption, while imaging systems outpace other product groups through 2030. Hospitals continue to anchor demand, yet academic institutes move quickly as governments prioritize R&D initiatives.

Global Biophotonics Market Trends and Insights

Increasing Use of Biophotonics in Diagnostics

Surface-enhanced Raman spectroscopy improved with machine learning reaches 87% balanced accuracy for head and neck cancer detection using ear wax samples. Photoacoustic tomography supplies real-time vascular monitoring during stroke treatment. Smartphone spectrometers delivering 1 nm resolution across 440-1,300 nm open field diagnostics. The FDA created Class II special controls for near-infrared hematoma detectors, validating optical approaches. Integration with 6G networks offers ultra-low latency transmission for instant clinical decisions.

Growing Geriatric Population

Individuals aged 65 plus require three to four times more diagnostic procedures than younger cohorts, elevating long-term demand. Near-infrared spectroscopy enables continuous glucose monitoring, addressing 537 million diabetes cases. Autofluorescence imaging secures 97% tumor-free margins in oral cancer surgery. Photobiomodulation supports Alzheimer's management. Aging trends align with precision medicine to sustain biophotonic platform adoption.

Lack of Awareness & Skilled Personnel

Interdisciplinary expertise gaps slow adoption because staff must unite optics, biology, and data science skills. Clinicians unfamiliar with optical diagnostics hesitate to integrate new tools. Universities struggle to offer targeted curricula, limiting ready talent. Regulatory navigation adds complexity. Dedicated laboratories at the University of Central Florida reflect early institutional responses.

Other drivers and restraints analyzed in the detailed report include:

- Emergence of Nanotechnology in Biophotonics

- Advancements in Photo-acoustic Tomography (PAT)

- High Cost of Biophotonic Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Lasers contributed 36.29% to the biophotonics market share in 2024, reflecting their role in precise photodynamic therapy and surgical work. Imaging systems are forecast to register an 11.56% CAGR, the highest among products, as surgeons seek real-time tissue characterization during operations. Fiber optics benefit from miniaturization trends, powering wearable biosensors. Hybrid quantum sensing improves single-molecule detection. Carl Zeiss consolidated capabilities by forming photonics business units. Manufacturers invest in automated lines to curb costs and meet growing volume. Greater component standardization speeds device certification. Collaborative R&D between optics firms and AI start-ups accelerates platform convergences. Environmental monitoring devices reuse core imaging modules, widening the addressable demand across agriculture and water safety.

Market participants refine beam quality and pulse stability to support emerging photoimmunotherapy protocols. Component vendors expand gallium arsenide wafer capacity for higher-power diode lasers. Imaging system suppliers integrate cloud-based analytics to cut interpretation time. The combined effect sustains product leadership while anchoring the broader biophotonics market.

In-vitro platforms maintained 61.38% of the biophotonics market size in 2024, thanks to established lab workflows. In-vivo systems are predicted to rise at a 10.89% CAGR as clinicians favor minimally invasive surgical guidance systems that provide real-time tissue assessment without specimen removal. Photoacoustic tomography now visualizes cerebral vessels through intact skulls. Optical guidance achieves 100% diagnostic success in single-insertion brain biopsies. Regulatory agencies outline streamlined pathways for real-time devices, aiding commercialization. Wearable monitors connect to IoT networks for continuous data feeds. Energy-efficient light sources extend device operating times. Hospitals integrate in vivo outputs into electronic health records, enhancing longitudinal care. Start-ups target ambulatory surgery centers with compact consoles. Emerging transdermal probes enable metabolic tracking, reinforcing expansion prospects for the biophotonics market.

The Biophotonics Market Report is Segmented by Product Type (Imaging Systems and More), Technology (In-Vitro and In-Vivo), Application (Surface Imaging, Inside Imaging, and More), Usage (Tests and Components, Medical Therapeutics, and More), End-User (Hospitals & Clinics and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 37.62% of biophotonics market share in 2024, supported by a mature healthcare system and an FDA framework that now classifies radiological optimization systems under Class II for faster clearance. Thermo Fisher allocated USD 2 billion for domestic expansion, reinforcing analytical instrument supply. Medicare reimbursement gaps limit some diagnostic rollouts. Specialist centers gain coverage for optical cervical screening, sustaining demand. Research grants underpin AI-photonics convergence, while the region's rare-earth policies aim to secure laser diode inputs. Competition intensifies as start-ups commercialize handheld imaging, adding depth to the biophotonics market.

Europe posts a steady 10.14% CAGR, driven by a EUR 124.6 billion photonics ecosystem. Carl Zeiss advances ophthalmic portfolios by absorbing DORC and investing 15% of revenue back into R&D. The Medical Device Regulation harmonizes standards yet raises compliance costs for small firms. Horizon Europe funding prioritizes precision agriculture, lifting uptake of optical sensors. Cross-border academic consortia enhance technology validation, aligning with regional sustainability goals. Semiconductor laboratories in Dresden accelerate industrial microscopy solutions, extending market depth.

Asia-Pacific is the fastest-growing region at 11.20% CAGR. China leads with a USD 4.17 billion biomanufacturing infusion in 2024. Pilot photonic chip lines in Shanghai Jiao Tong University boost AI and quantum applications. Japan's USD 307 million optical chip program seeks semiconductor leadership. India invests in quantum photonics despite infrastructure gaps. Local firms emphasize low-cost laser sources to satisfy price-sensitive healthcare providers. Government incentives lower import taxes on diagnostic optics, while telehealth efforts spread mobile spectrometers to underserved zones. Rapid clinic construction across Southeast Asia accelerates demand, supporting expansion of the biophotonics market.

- Agilent Technologies

- Beckton Dickinson

- Bruker

- Canon

- Carl Zeiss

- Danaher

- FUJIFILM

- GE Healthcare

- Glenbrook Technologies, Inc.

- Hamamatsu Photonics

- IDEX

- IPG Photonics

- LUMICKS

- Olympus

- Oxford Instruments

- Revvity, Inc.

- Thermo Fisher Scientific

- Thorlabs

- Toshiba

- Zenalux Biomedical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing use of biophotonics in diagnostics

- 4.2.2 AI-enabled spectroscopy for rapid PoC testing

- 4.2.3 Growing geriatric population

- 4.2.4 Emergence of nanotechnology in biophotonics

- 4.2.5 Advancements in photo-acoustic tomography (PAT)

- 4.2.6 Precision-agriculture demand for biophotonic sensors

- 4.3 Market Restraints

- 4.3.1 Lack of awareness & skilled personnel

- 4.3.2 High cost of biophotonic systems

- 4.3.3 Stringent reimbursement frameworks

- 4.3.4 Rare-earth supply risk for laser diodes

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Imaging Systems

- 5.1.2 Lasers

- 5.1.3 Fiber Optics

- 5.1.4 Others

- 5.2 By Technology

- 5.2.1 In-Vitro

- 5.2.2 In-Vivo

- 5.3 By Application

- 5.3.1 Surface Imaging

- 5.3.2 Inside Imaging

- 5.3.3 See-through Imaging

- 5.3.4 Microscopy

- 5.3.5 Biosensors

- 5.3.6 Analytics Sensing

- 5.3.7 Spectromolecular

- 5.3.8 Light Therapy

- 5.3.9 Optical Coherence Tomography

- 5.4 By Usage

- 5.4.1 Tests and Components

- 5.4.2 Medical Therapeutics

- 5.4.3 Medical Diagnostics

- 5.4.4 Non-Medical Application

- 5.5 By End-User

- 5.5.1 Hospitals & Clinics

- 5.5.2 Academic & Research Institutes

- 5.5.3 Biotechnology & Pharma Companies

- 5.5.4 Food-Quality Labs

- 5.5.5 Other End-Users

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Competitive Benchmarking

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Agilent Technologies, Inc.

- 6.4.2 Becton, Dickinson and Company

- 6.4.3 Bruker Corporation

- 6.4.4 Canon Medical Systems Corporation

- 6.4.5 Carl Zeiss AG

- 6.4.6 Danaher Corporation

- 6.4.7 FUJIFILM Corporation

- 6.4.8 GE Healthcare

- 6.4.9 Glenbrook Technologies, Inc.

- 6.4.10 Hamamatsu Photonics KK

- 6.4.11 IDEX Corporation

- 6.4.12 IPG Photonics Corporation

- 6.4.13 LUMICKS

- 6.4.14 Olympus Corporation

- 6.4.15 Oxford Instruments PLC

- 6.4.16 Revvity, Inc.

- 6.4.17 Thermo Fisher Scientific Inc.

- 6.4.18 Thorlabs, Inc.

- 6.4.19 Toshiba Corporation

- 6.4.20 Zenalux Biomedical Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment