PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842545

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842545

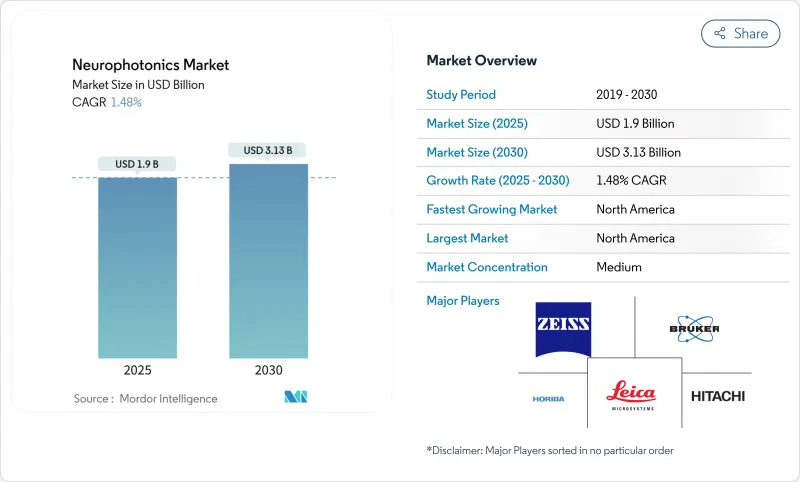

Neurophotonics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The neurophotonics market stands at USD 1.90 billion in 2025 and is forecast to reach USD 3.13 billion by 2030, advancing at a 10.48% CAGR.

Rapid progress in deep-tissue optical imaging, artificial-intelligence-enabled data analytics, and minimally invasive brain interfaces is widening the technology's clinical relevance. Government funding through programs such as the United States BRAIN Initiative and Japan's Moonshot Goal 1 fuels a steady flow of laboratory discoveries that migrate into commercial platforms. Capital inflows from venture investors and strategic acquisitions by large optical equipment makers strengthen the innovation pipeline and shorten product-development cycles. North America keeps its leadership position through an integrated ecosystem of academic centers, medical-device regulators, and reimbursement stakeholders, while Asia-Pacific accelerates on the back of Japan's global photonics manufacturing footprint and rising R&D outlays in China and India.

Global Neurophotonics Market Trends and Insights

Rising Prevalence of Neurological Disorders

Neurodegenerative and psychiatric conditions impose growing social and economic burdens as global life expectancy rises. More than 55 million individuals live with Alzheimer's disease, and incidence continues to rise in aging populations. Functional near-infrared spectroscopy (fNIRS) and photobiomodulation techniques provide real-time cerebral oxygenation data that conventional magnetic resonance imaging cannot deliver cost-effectively . Clinical studies at the University of California San Francisco reported notable gains in Mini Mental State Exam scores following near-infrared light therapy, strengthening the clinical case for optical interventions. Hospitals adopt the technology to monitor cognitive rehabilitation progress, while device makers focus on user-friendly systems suited for outpatient environments. As prevalence expands, the neurophotonics market draws sustained demand from both diagnostic and therapeutic workflows.

Expanding Government Funding for Brain-Mapping R&D

The United States BRAIN Initiative earmarks multiyear grants specifically targeting optical neural-interface innovations such as non-degenerate two-photon microscopy. Similar funding frameworks in Europe and Asia-Pacific bring research labs, device makers, and clinical centers into shared consortia, accelerating technology maturation. Japan's Moonshot Goal 1 forecasts a domestic neurotechnology sector worth USD 520 million in 2025, signaling long-term policy commitment. These programs underwrite high-risk projects, subsidize pilot manufacturing lines, and create open-access data repositories that speed reproducibility. Public-sector support draws matching private investment, allowing startups to scale prototypes into regulatory grade systems without prohibitive dilution. As grants transition from basic science to translational milestones, industry players capture earlier commercial payoffs, reinforcing the upward trajectory of the neurophotonics market.

Limited Penetration Depth in Adult Cortical Imaging

Light scatters in adult brain tissue, restricting two-photon and three-photon modalities to superficial layers roughly 2-3 mm deep. Subcortical targets involved in Parkinson's disease or refractory epilepsy remain out of reach, compelling clinicians to adopt alternative modalities such as deep-brain electrodes or high-field MRI. Extended illumination elevates tissue temperature; PhotoniX reports that cumulative light exposure above 400 mW causes thermal damage, capping imaging duration. To mitigate the issue, researchers explore wavefront-shaping optics and terahertz-photon stimulation, yet commercial readiness sits several years away. Meanwhile, the depth limitation curtails immediate revenue potential for high-end imaging vendors.

Other drivers and restraints analyzed in the detailed report include:

- Miniaturization and Portability of Optical Neuro-Imaging Devices

- Rapid Adoption of Optogenetics and fNIRS in Academic Labs

- Integration with Immersive XR and BCI Platforms

- Growth of Neonatal and Peri-Operative Monitoring Use Cases

- High CAPEX and OPEX of Multiphoton Platforms

- Lack of Data-Format Interoperability Across Vendors

- Phototoxicity and Tissue-Heating Risks in Long-Duration Studies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Microscopy platforms accounted for 45.67% of neurophotonics market share in 2024, consolidating their role as the workhorse modality for circuit-level visualization. The ZEISS FLUOVIEW FV4000MPE and Bruker OptoVolt modules exemplify how fast resonant scanners and adaptive optics yield sub-micron resolution over millimeter-scale fields. Demand for ever finer structural insight sustains a healthy upgrade cycle, especially within core imaging facilities at top neuroscience institutes. Spectroscopy systems record the fastest 11.25% CAGR to 2030 by tackling functional hemodynamic mapping with portable hardware. Multimodal configurations that fuse fluorescence lifetime imaging with Raman spectroscopy attract pharmaceutical customers seeking comprehensive compound-brain interaction profiles. Vendors integrate GPU-accelerated algorithms to deliver near-instantaneous volumetric reconstructions, saving researchers hours of post-acquisition processing. Sustained innovation coupled with rising translational projects keeps the microscopy sub-category at the spine of the broader neurophotonics market.

The neurophotonics market size for spectroscopy solutions is set to rise sharply as hospitals deploy bedside fNIRS for stroke triage. Artificial-intelligence classifiers embedded in acquisition software flag ischemic trends in under three seconds, guiding immediate intervention. Corporate activity intensifies; Hamamatsu's acquisition of NKT Photonics secures an ultrafast-laser supply chain, while Leica Microsystems formalizes a distribution pact with Inscopix to co-market cellular-resolution miniscope kits. Consortia such as the Microscopy Metadata Working Group finalize 3D-imaging metadata standards, promoting data pooling across global cohort studies. Collectively, these moves lower barriers to entry for new research groups, reinforcing microscopy's pre-eminent place in the neurophotonics market.

The Global Neurophotonics Market is Segmented by System Type (Microscopy, Spectroscopy, and More) Application (Research, Diagnostics, and Therapeutics), End User (Academic & Research Institutes, Hospitals & Clinics, and More), and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 42.64% of global revenue in 2024 thanks to deep federal funding pools and a transparent regulatory pathway that accelerates first-in-human studies. The FDA's breakthrough-device designation awarded to Precision Neuroscience and ClearPoint Neuro in 2024 exemplifies swift review for transformative platforms. Favorable reimbursement policies for intraoperative fluorescence guidance further solidify regional demand. Rich venture-capital ecosystems surrounding Boston, San Francisco, and Toronto attract entrepreneurial talent and de-risk early commercial launches. However, high equipment prices and value-based-care mandates compel suppliers to develop robust health-economic dossiers to defend capital budgets.

Asia-Pacific posted the fastest 13.21% CAGR and is poised to erode North American share as local supply chains mature. Japan maintains roughly 30% of global photonics output through more than 180 manufacturers, creating economies of scale that cut bill-of-materials cost for domestic device assemblers. Chinese provincial governments fund neurotechnology parks and offer expedited registrations for Class II medical devices, shortening go-to-market timelines. India's Production-Linked Incentive scheme for medical electronics lures component fabricators, shaping a nascent export hub. Cross-border academic partnerships with Australian neuroscience centers generate translational prototypes, broadening regional expertise.

Europe holds a balanced landscape where established research universities and cohesive data-privacy laws foster collaborative multi-site trials. Germany champions optogenetics standardization through joint industry-academia working groups, while the United Kingdom pilots reimbursement pathways for fNIRS cognitive assessments in stroke follow-up care. Local manufacturers, facing Asian cost competition, pivot to premium service models that emphasize workflow integration and lifecycle support. Regulatory alignment under the EU Medical Device Regulation introduces additional documentation overhead, but also harmonizes product quality expectations, smoothing intra-European distribution for neurophotonics suppliers.

- Carl Zeiss

- Danaher

- Hamamatsu Photonics

- Bruker

- Artinis Medical Systems

- HORIBA

- Hitachi

- Femtonics Ltd.

- Inscopix Inc.

- Cairn Research

- fNIR Devices

- HemoPhotonics

- Thorlabs

- PicoQuant GmbH

- NKT Photonics

- Intelligent Imaging Innovations

- NeuroLight Technologies

- Luxmux Technologies

- Photometrics

- Neuronix Imaging

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence Of Neurological Disorders

- 4.2.2 Expanding Government Funding For Brain-Mapping R&D

- 4.2.3 Miniaturization & Portability Of Optical Neuro-Imaging Devices

- 4.2.4 Rapid Adoption Of Optogenetics & Fnirs In Academic Labs

- 4.2.5 Integration With Immersive Xr & Bci Platforms

- 4.2.6 Growth Of Neonatal/Peri-Operative Monitoring Use-Cases

- 4.3 Market Restraints

- 4.3.1 Limited Penetration Depth In Adult Cortical Imaging

- 4.3.2 High Capex & Opex Of Multiphoton Platforms

- 4.3.3 Lack Of Data-Format Interoperability Across Vendors

- 4.3.4 Phototoxicity & Tissue-Heating Risks In Long-Duration Studies

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By System Type

- 5.1.1 Microscopy

- 5.1.2 Spectroscopy

- 5.1.3 Multimodal Platforms

- 5.1.4 Other System Types

- 5.2 By Application

- 5.2.1 Research

- 5.2.2 Diagnostics

- 5.2.3 Therapeutics

- 5.3 By End-user

- 5.3.1 Academic & Research Institutes

- 5.3.2 Hospitals & Clinics

- 5.3.3 Pharma & Biotech Companies

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Carl Zeiss AG

- 6.3.2 Leica Microsystems

- 6.3.3 Hamamatsu Photonics

- 6.3.4 Bruker Corporation

- 6.3.5 Artinis Medical Systems

- 6.3.6 Horiba Ltd.

- 6.3.7 Hitachi Ltd.

- 6.3.8 Femtonics Ltd.

- 6.3.9 Inscopix Inc.

- 6.3.10 Cairn Research

- 6.3.11 fNIR Devices LLC

- 6.3.12 HemoPhotonics

- 6.3.13 Thorlabs Inc.

- 6.3.14 PicoQuant GmbH

- 6.3.15 NKT Photonics

- 6.3.16 Intelligent Imaging Innovations

- 6.3.17 NeuroLight Technologies

- 6.3.18 Luxmux Technologies

- 6.3.19 Photometrics

- 6.3.20 Neuronix Imaging

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment