PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836669

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836669

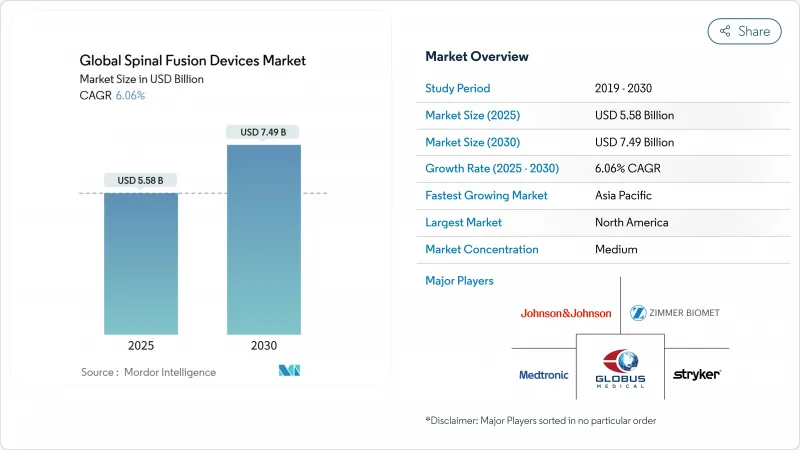

Global Spinal Fusion Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The spinal fusion devices market size is estimated at USD 5.58 billion in 2025 and is projected to climb to USD 7.49 billion by 2030, delivering a 6.06% CAGR.

Robust demand stems from demographic aging, rising degenerative spine disorders, and accelerating adoption of minimally invasive and AI-enabled surgical platforms. Hospitals and ambulatory surgery centers (ASCs) are scaling procedure volumes as Medicare has more than quadrupled the number of fusion procedures reimbursed in outpatient settings, reinforcing steady case-mix migration. Rapid FDA clearances for 3-D-printed patient-specific cages and the 96.99% screw-placement accuracy achieved by contemporary robotic systems are intensifying competitive differentiation. In parallel, payers' shift toward bundled payments is pressuring pricing but is also catalyzing the development of value-driven implants, stimulating technological innovation across every product class.

Global Spinal Fusion Devices Market Trends and Insights

Shift toward minimally invasive fusion techniques

Minimally invasive spine surgery is overturning long-standing open procedures by delivering shorter hospital stays, smaller incisions, and lower complication rates while maintaining equal fusion success. Meta-analyses of transforaminal lumbar interbody fusion confirm fewer transfusions and a 4.83% complication rate versus 14.97% for open surgery. Robotic navigation drives screw accuracy beyond 96%, prompting device manufacturers to bundle implants, navigation, and intra-operative imaging. Fellowship programs now prioritize these techniques, ensuring a pipeline of surgeons fluent in robot-assisted workflows. Hospitals also leverage the faster patient recovery to improve bed turnover, directly aligning clinical performance with value-based purchasing.

Escalating prevalence of degenerative spine disorders

Sedentary lifestyles, obesity, and greater diagnostic scrutiny have raised lumbar disc degeneration incidence to more than 90% in individuals past 60 years. Earlier imaging enables timely surgical referral, averting progression to multilevel disease. Health-economic analyses prove that early fusion lowers chronic pain expenditure, and payers are expanding coverage accordingly. Clinical registries confirm that early single-level lumbar fusion reduces re-operation frequency and boosts quality-adjusted life years. Device makers respond by broadening portfolios of expandable cages and biologics optimized for single-level pathology.

High implant costs vs. value-based-care payment models

Bundled-payment pilots cap total episode cost, forcing providers to weigh implant performance against price. Cervical fusion intra-operative expenses reach USD 7,574, with 69% tied to hardware. Hospitals renegotiate volume contracts, favoring platforms that minimize re-operation liability. Manufacturers now issue evidence dossiers showing cost per quality-adjusted life year below USD 100,000 to defend premium tags. Firms unable to articulate value risk share erosion in the spinal fusion devices market.

Other drivers and restraints analyzed in the detailed report include:

- Growing geriatric population & life-expectancy gains

- Increasing reimbursement coverage for outpatient spine procedures

- Rising scrutiny on adjacent-segment disease outcomes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Lumbar fusion devices generated 43.68% of the 2024 spinal fusion devices market share, cementing their role as workhorse solutions for spondylolisthesis and disc degeneration. The spinal fusion devices market size for lumbar instrumentation is projected to expand at a 5.8% CAGR as demand persists across both inpatient and outpatient channels. Interbody cages stand out with a 7.02% growth rate thanks to 3-D-printed titanium lattices that secure 97% fusion success. Surgeons favor expandable cages that restore disc height and sagittal balance without excessive nerve retraction. Cervical plates and screws maintain consistent uptake for anterior cervical discectomy and fusion, underscored by their long safety record. Thoracic systems meet niche trauma and deformity needs but are turning to modular constructs for inventory efficiency. Pedicle screw innovation now focuses on navigated insertion and torque-limiting drivers, reducing mal-position. Biologic graft substitutes, including cellular bone allografts, realize 98.5% fusion, narrowing reliance on iliac crest autografts.

Continued material science advances exploit porous PEEK and magnesium alloys that encourage osteointegration while dampening stress shielding. Patient-specific implants, produced in days, personalize endplate coverage and load-sharing characteristics. Vendors increasingly package cage-graft bundles, simplifying logistics for ASCs. Still, value-analysis committees scrutinize unit price, steering hospitals toward platforms demonstrating both clinical superiority and cost-effectiveness, a balance that will define winners across the spinal fusion devices market.

Minimally invasive procedures held 62.37% spinal fusion devices market size in 2024, posting a 6.34% CAGR through 2030 as imaging, navigation, and tubular retractors converge to curtail tissue disruption. Open surgery retains a role in severe deformity corrections yet faces shrinking share as robotic guidance abbreviates learning curves. Real-time 3-D imaging permits percutaneous pedicle screw trajectories with sub-2 mm deviation, lessening neurologic risk. Meanwhile, single-position spine techniques limit patient flips, shaving anesthesia time. Hospitals harness these efficiencies to qualify more cases for outpatient discharge, buoying ASC adoption and reshaping reimbursement dynamics.

The spinal fusion devices market responds with compact instrument suites, sterile-packed implants, and disposable navigation arrays tailored to ASC throughput. Training centers augment cadaveric labs with mixed-reality simulators, accelerating surgeon competency. Payers reward minimally invasive pathways via bundled reimbursement uplift for low complication incidence. As evidence matures, regulators may green-light shorter clearance paths for kits demonstrably improving safety, further embedding minimally invasive approaches into mainstream spine care.

The Spinal Fusion Devices Market Report is Segmented by Product Type (Cervical Fusion Devices, Thoracic Fusion Devices, and More), Type of Surgery (Open Spine Surgery and Minimally Invasive Spine Surgery), Surgical Approcah (TLIF, PLF, and Other Approaches), End-User (Hospitals and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 46.23% to global revenue in 2024 and should grow at 5.37% CAGR through 2030 as premium robotics and 3-D-printed implants penetrate both inpatient and outpatient settings. Medicare's 58 ASC-eligible spine codes have catalyzed a 15.7% annual procedure rise in ambulatory centers, underpinning the spinal fusion devices market trend toward lower-cost sites of care. FDA breakthrough designations expedite commercialization, reinforcing the region's innovation leadership.

Asia-Pacific is the swiftest climber with a 6.95% CAGR to 2030, leveraging hospital infrastructure upgrades, rising disposable incomes, and an expanding base of fellowship-trained spine surgeons. China's Class III registration requirements are lengthy, yet local partnerships ease market access, and provincial tenders often favor cost-effective, yet technologically advanced, domestically produced implants. Japan and South Korea add volume through aging demographics, while India's private hospital chains import navigated systems to capture medical tourism.

Europe's 5.80% CAGR reflects balanced growth moderated by MDR compliance costs that slightly slow new-product launches. National health services encourage outpatient migration, particularly in the Nordics and Germany, but pricing controls challenge premium device margins. South America advances at 6.12% CAGR as Brazil and Argentina upgrade tertiary centers and adopt minimally invasive techniques. Middle East and Africa post 6.46% CAGR on the back of Gulf States' specialist hospital investments, although surgeon shortages restrain broader regional uptake. Overall, the spinal fusion devices market is expanding worldwide, yet growth vectors differ markedly by reimbursement climate, surgeon density, and regulatory velocity.

- Alphatec Spine

- B. Braun

- Baumer S.A.

- Camber Spine

- CoreLink Surgical

- Globus Medical

- HighRidge Inc.

- Johnson & Johnson

- KYOCERA Medical Technologies, Inc.

- Matrix Meditec

- Medacta International

- Medtronic

- NAKASHIMA HEALTHFORCE CO., LTD.

- Orthofix

- RTI Surgical

- SpineWave

- Stryker

- Vincula Biomedica

- Xtant Medical

- Zimmer Biomet

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shift toward minimally invasive fusion techniques

- 4.2.2 Escalating prevalence of degenerative spine disorders

- 4.2.3 Growing geriatric population & life-expectancy gains

- 4.2.4 Increasing reimbursement coverage for outpatient spine procedures

- 4.2.5 AI-guided robotic navigation improves fusion accuracy

- 4.2.6 Emerging 3-D printed patient-specific cages boost adoption

- 4.3 Market Restraints

- 4.3.1 High implant costs vs. value-based-care payment models

- 4.3.2 Rising scrutiny on adjacent-segment disease outcomes

- 4.3.3 Stringent FDA & MDR approval timelines

- 4.3.4 Shortage of fellowship-trained spine surgeons in emerging markets

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers/Consumers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Cervical Fusion Devices

- 5.1.2 Thoracic Fusion Devices

- 5.1.3 Lumbar Fusion Devices

- 5.1.4 Interbody Cages

- 5.1.5 Pedicle Screw Systems

- 5.1.6 Bone Graft Substitutes and Others

- 5.2 By Type of Surgery

- 5.2.1 Open Spine Surgery

- 5.2.2 Minimally Invasive Spine Surgery

- 5.3 By Surgical Approach

- 5.3.1 Transforaminal Lumbar Interbody Fusion (TLIF)

- 5.3.2 Posterolateral Fusion (PLF)

- 5.3.3 Other Approaches

- 5.4 By End-User

- 5.4.1 Hospitals

- 5.4.2 Ambulatory Surgery Centers (ASCs)

- 5.4.3 Specialty & Orthopedic Clinics

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Competitive Benchmarking

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Alphatec Spine

- 6.4.2 B. Braun Melsungen AG

- 6.4.3 Baumer S.A.

- 6.4.4 Camber Spine

- 6.4.5 CoreLink Surgical

- 6.4.6 Globus Medical

- 6.4.7 HighRidge Inc.

- 6.4.8 Johnson & Johnson Services, Inc.

- 6.4.9 KYOCERA Medical Technologies, Inc.

- 6.4.10 Matrix Meditec Pvt Ltd

- 6.4.11 Medacta International

- 6.4.12 Medtronic plc

- 6.4.13 NAKASHIMA HEALTHFORCE CO., LTD.

- 6.4.14 Orthofix Medical Inc.

- 6.4.15 RTI Surgical

- 6.4.16 SpineWave

- 6.4.17 Stryker Corporation

- 6.4.18 Vincula Biomedica

- 6.4.19 Xtant Medical

- 6.4.20 Zimmer Biomet Holdings

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment