PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836674

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836674

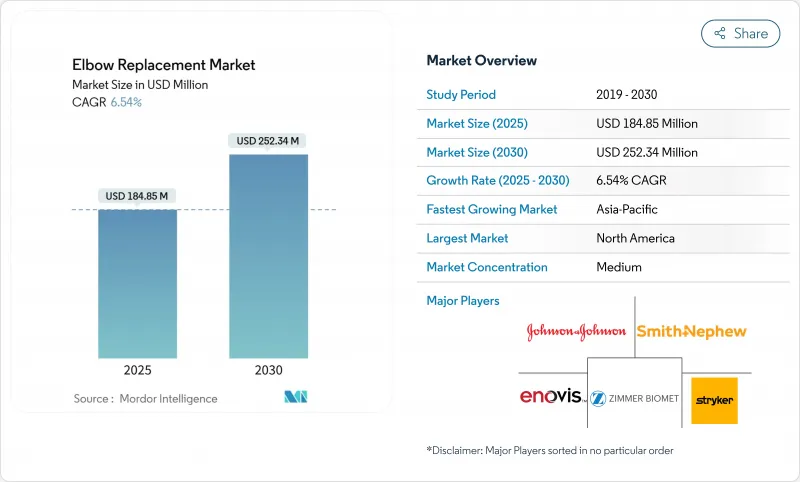

Elbow Replacement - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Elbow Replacement Market size is estimated at USD 184.85 million in 2025, and is expected to reach USD 252.34 million by 2030, at a CAGR of 6.54% during the forecast period (2025-2030).

Escalating end-stage elbow arthritis cases, wider surgeon familiarity with total elbow arthroplasty, and steady improvements in 3D-printed, patient-matched implants anchor this expansion. Rapid gains in outpatient surgical infrastructure, coupled with favorable reimbursement adjustments for complex extremity procedures, further widen patient access. Linked-hinge prostheses are outperforming earlier designs on revision-free survival, while antimicrobial surface technologies cut deep infection risk and drive long-term implant success. The elbow replacement market also benefits from rising procedure volumes in Asia-Pacific as hospitals modernize orthopedic theaters and local manufacturers secure regulatory clearances.

Global Elbow Replacement Market Trends and Insights

Growing Burden of Arthritis

Widespread osteo- and rheumatoid arthritis continues to swell the surgical waitlist for elbow reconstruction. Clinical registries show Mayo Elbow Performance Scores improving from 39 to 95 after total arthroplasty, validating surgery as a durable pain-relief strategy. Population aging and higher activity expectations among seniors lock in a steady flow of candidates over the long term. New exposure-sparing techniques such as the anconeus-reflected triceps tongue approach lessen soft-tissue disruption, supporting faster rehabilitation. These advances collectively sustain procedure volumes in all key geographies and reinforce the elbow replacement market trajectory.

Rapid Adoption of Linked-Hinge Designs

Semi-constrained linked-hinge prostheses deliver greater varus-valgus stability than earlier unconstrained devices, especially for elbows with extensive bone loss. Meta-analyses report lower loosening and higher 10-year survivorship in inflammatory arthritis cases relative to non-linked systems. As clinical curricula integrate these techniques, surgeon preference is shifting, boosting implant demand across referral centers in North America and Western Europe. Manufacturers are refining modular stems and tapered flanges that ease intraoperative alignment while safeguarding native kinematics.

Availability of Alternatives

Minimally invasive arthroscopy offers cartilage debridement and synovectomy that defers definitive joint replacement, especially attractive to younger athletes. Elbow fusion remains a fallback for gross instability or infection, achieving fusion rates above 90% at set positions optimal for daily tasks. Regenerative injections using platelet-rich plasma and stem cells have also carved a niche in early-stage degeneration. These substitute pathways, though serving selected indications, collectively divert a measurable slice of surgical candidates away from the elbow replacement market.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advances in 3-D Printed Implants

- Shift Toward Outpatient/ASC Settings

- High Procedure & Device Cost

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Total elbow replacement generated 68.17% of 2024 revenue, underlining its role as a comprehensive solution for severe articular destruction. This dominance reflects decades of outcome data showing median Mayo scores jumping from the low 40s to the mid-90s post-surgery. Partial systems, covering hemi-arthroplasty and radial head prostheses, are climbing at a 6.80% CAGR through 2030 as they better suit younger trauma patients. Surgeons increasingly reserve total systems for inflammatory or end-stage degenerative conditions while opting for bone-preserving partial options in complex fractures, expanding the elbow replacement market addressable base.

Clinical registries corroborate these trends, noting partial implants achieve 17% reoperation rates-acceptable given the elbow's demanding biomechanics-when postoperative weight limits are respected. Both categories benefit from intraoperative 3D navigation that sharpens component alignment. In parallel, modular ulnar stems let surgeons upsize fixation when encountering osteoporotic canals, further reducing early loosening. This blend of versatility and evidence retention secures steady volume growth across both product lines within the elbow replacement market.

Cobalt-chrome retained 51.59% share owing to its proven wear resistance, yet titanium alloys are notching a 7.13% CAGR. Threaded titanium stems boost cancellous purchase and reduce stress shielding, qualities that resonate with surgeons focused on long-term bone preservation. Novel porous tantalum sleeves and PEEK composites continue in niche roles but command interest for revision cases with compromised bone stock.

Laser-textured surfaces and hydroxyapatite coatings amplify titanium's osteoconductivity, enabling earlier functional loading. Concurrently, antimicrobial film deposition targets periprosthetic infection, a pivotal failure mode. As these enhancements mature, material mix is likely to tilt incrementally toward titanium without displacing chrome-cobalt's seat in high-demand applications. The elbow replacement market size for titanium-based systems is therefore expected to climb meaningfully yet progressively over the forecast horizon.

The Elbow Replacement Market Report is Segmented by Product Type (Partial Elbow Replacement, Total Elbow Replacement), Implant Material (Titanium Alloys, Cobalt-chrome Alloys, Tantalum & Others), Fixation Technique (Cemented, Cement-Less), End User (Hospitals, and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America preserved leadership with 39.81% of 2024 turnover, thanks to robust reimbursement frameworks and a dense network of fellowship-trained upper-extremity surgeons. Medicare fee stability and clearly defined CPT codes underpin steady procedural uptake. Europe follows, buoyed by stringent MDR standards that reassure clinicians of implant safety while still encouraging innovation through fast-track 3D printing approvals.

Asia-Pacific is the fastest riser, projected at 7.55% CAGR, as China, India, and South Korea broaden social insurance and cultivate domestic implant fabrication. National procurement drives lower unit prices, expanding hospital budgets for complex reconstructions. Latin America and the Middle East & Africa trail but show meaningful upside where urban private hospitals install advanced imaging and laminar-flow theaters. Collectively, these patterns support geographically diversified growth for the elbow replacement market.

- Zimmer Biomet

- Stryker

- Smiths Group

- DJO Global / Enovis

- Johnson & Johnson

- Lima Corporate

- Corin Group

- Exactech

- Medacta Group

- Aesculap (B. Braun)

- Arthrex

- Evolutis

- Implantcast GmbH

- Acumed

- United Orthopedic Corp.

- Peter Brehm GmbH

- Biotechni

- An-Trauma

- Stryker

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Burden of Arthritis

- 4.2.2 Rapid Adoption of Linked-Hinge Designs

- 4.2.3 Technological Advances in 3-D Printed Implants

- 4.2.4 Shift Toward Outpatient/ASC Settings

- 4.2.5 Expanding Reimbursement in Emerging Markets

- 4.2.6 Antimicrobial Coating Breakthroughs

- 4.3 Market Restraints

- 4.3.1 Availability of Alternatives (Arthroscopy, Fusion)

- 4.3.2 High Procedure & Device Cost

- 4.3.3 Post-Operative Complications and Implant Longevity

- 4.3.4 Limited Availability of Specialized Surgeons

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product Type

- 5.1.1 Partial Elbow Replacement

- 5.1.2 Total Elbow Replacement

- 5.2 By Implant Material

- 5.2.1 Titanium Alloys

- 5.2.2 Cobalt-Chrome Alloys

- 5.2.3 Tantalum & Others

- 5.3 By Fixation Technique

- 5.3.1 Cemented

- 5.3.2 Cement-less

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Orthopedic & Specialty Centers

- 5.4.3 Ambulatory Surgical Centers

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Zimmer Biomet

- 6.3.2 Stryker Corp.

- 6.3.3 Smith & Nephew plc

- 6.3.4 DJO Global / Enovis

- 6.3.5 Johnson & Johnson (DePuy Synthes)

- 6.3.6 Lima Corporate

- 6.3.7 Corin Group

- 6.3.8 Exactech

- 6.3.9 Medacta Group

- 6.3.10 Aesculap (B. Braun)

- 6.3.11 Arthrex

- 6.3.12 Evolutis

- 6.3.13 Implantcast GmbH

- 6.3.14 Acumed LLC

- 6.3.15 United Orthopedic Corp.

- 6.3.16 Peter Brehm GmbH

- 6.3.17 Biotechni

- 6.3.18 An-Trauma

- 6.3.19 Stryker Corporation

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment