PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836675

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836675

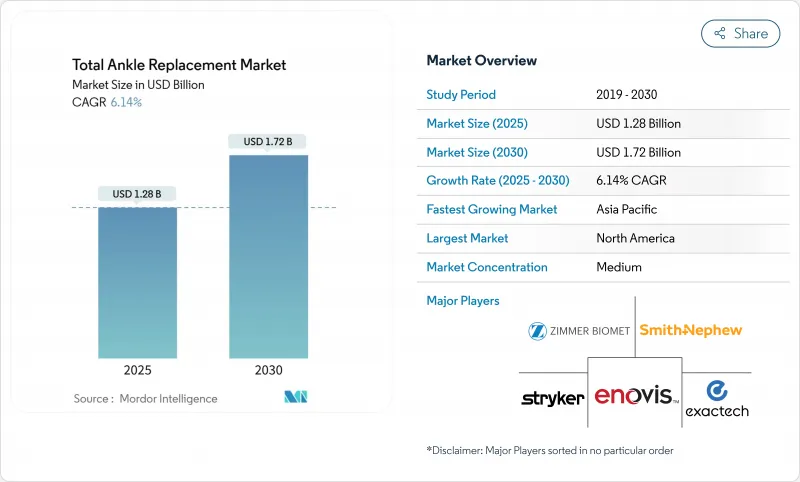

Total Ankle Replacement - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Total Ankle Replacement Market size is estimated at USD 1.28 billion in 2025, and is expected to reach USD 1.72 billion by 2030, at a CAGR of 6.14% during the forecast period (2025-2030).

This growth shows the procedure's transformation from a niche therapy to a mainstream option for end-stage ankle arthritis as fourth-generation implants extend survivorship, reduce revision risk, and allow surgeons to select designs that mimic native ankle biomechanics. Adoption is rising as patient-specific 3D-printed components, smart instrumentation, and robotic guidance improve accuracy, while clinical guidelines now recommend motion-preserving surgery for younger and more active cohorts. Outpatient migration advances because CMS removed total ankle arthroplasty from the inpatient-only list in 2024, prompting hospitals and ambulatory surgical centers to re-organize care pathways around same-day discharge protocols. Competitive pressure remains high after Zimmer Biomet's USD 1.1 billion acquisition of Paragon 28 in 2025, and manufacturers continue to bundle implants with digital planning software, artificial-intelligence-enabled sensors, and value-based service agreements to protect share. Reimbursement remains a critical factor; although commercial payers increasingly recognize the procedure's cost-utility versus fusion, emerging markets still wrestle with high device prices, limited surgeon training, and inconsistent insurance coverage.

Global Total Ankle Replacement Market Trends and Insights

Rising Prevalence of Ankle Osteoarthritis & Aging Population

The demographic shift toward older, more active adults elevates the incidence of ankle osteoarthritis and fuels the total ankle replacement market. Trauma is the leading etiology, so the disease burden grows as sports participation and road traffic injuries increase. Clinical studies show postoperative return-to-sport rates climbing from 31.1% to 85.4%, confirming that modern implants maintain mobility and independence among seniors. Multinational health systems, therefore, position total ankle arthroplasty as a quality-of-life intervention rather than a last resort, embedding it into arthritis care pathways and driving long-term demand.

Surge in Minimally-Invasive, Image-Guided & Robotic TAR Procedures

Navigation and robotic platforms translate lessons from knee arthroplasty to the ankle by improving resection accuracy, minimizing soft-tissue disruption, and shortening learning curves. About 13% of United States knee replacements already use robotics, and leading orthopedic centers now deploy similar workflows for ankles. Robotics supports lateral approaches that conserve bone and mitigate subsidence, while intraoperative sensors quantify implant alignment in real time. These advantages widen candidacy to deformity cases previously slated for fusion and enhance the appeal of outpatient protocols, together accelerating the total ankle replacement market.

Surgical-Site Complications & Revision Burden

Long-term datasets reveal 10-year revision rates near 10.9% and 20-year rates at 13.5%, materially higher than hip or knee arthroplasty. Periprosthetic infection risks run from 1% to 14%, and ankle soft-tissue envelopes complicate wound healing. The FDA flagged the Hintermann H3 system in 2024 for failure rates exceeding 16.1%, underscoring vigilance requirements. Surgeons respond by tightening indications, extending preoperative optimization, and limiting bilateral cases, all of which temper procedure volume growth within the total ankle replacement market.

Other drivers and restraints analyzed in the detailed report include:

- Favourable Reimbursement Expansion

- Additive-Manufactured, Patient-Specific Ankle Implants Gain FDA Clearances

- High Device & Procedure Costs Limit Adoption in Emerging Markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

INBONE II and INFINITY platforms combined for a 33.74% revenue share in 2024, giving them the most significant stake in the total ankle replacement market. Their modular tibial stems provide customizable fixation ranging from short metaphyseal posts to long intramedullary segments, an approach that improves initial stability in revision and osteoporotic cases. Seven-year survivorship of 95.9% underscores dependable mid-term performance, and global users passed 48,000 implants by 2024. Competitive differentiation centers on integrated patient-specific guides and streamlined instrumentation sets that cut setup time and radiation exposure, advantages prized in ambulatory settings. Parallel clinical programs collect fluoroscopic kinematic data that illustrate near-native sagittal and coronal plane motion, bolstering evidence packages for payer submissions and further fortifying leadership in the total ankle replacement market.

CADENCE rose on an 8.96% CAGR trajectory through 2030, propelled by breakthroughs in polyethylene formulation, talar dome curvature, and streamlined lateral approach instrumentation. Early outcome registries show 98% patient satisfaction at two years, and surgeons report simplified bone resections that trim learning curves for community hospitals. VANTAGE, STAR, and SALTO Talaris retain loyal followings, each leveraging distinct bearing philosophies and regional reimbursement footholds. Paragon 28's 3D-printed APEX system adds porous trabecular surfaces and vitamin E stabilized liners to resist oxidation and wear. Over the forecast, design innovations will hinge on smart sensor integration and MRT-compatible alloys that let clinicians monitor implant health remotely, fueling repeat procedures and secondary revenue streams for manufacturers.

The Total Ankle Replacement Market Report is Segmented by Design (HINTEGRA, STAR, SALTO / SALTO Talaris, and More), Bearing Type (Mobile-Bearing Systems, Fixed-Bearing Systems, Hybrid / Semi-Constrained), End User (Hospitals, Ambulatory Surgical Centers, and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 43.24% of revenue in 2024 and anchors global clinical guideline development, driven by CMS coverage, high surgeon density, and consumer willingness to pay for premium implants. United States physicians perform more than 11,000 ankle replacements annually and frequently combine procedures such as ligament reconstruction to optimize alignment. Canada contributes through publicly funded specialist centers in Ontario and Alberta, whereas Mexico's private sector captures medical tourists from Central America seeking motion-preserving procedures.

Europe remains the second-largest cluster, with Germany, France, and the United Kingdom leading volumes under stringent CE-mark requirements and cost-utility thresholds. National health systems conduct health-technology assessments that scrutinize long-term revision rates, encouraging manufacturers to publish peer-reviewed survivorship data. Scandinavian countries share registry insights that influence broader European reimbursement negotiations.

Asia-Pacific is the fastest-growing region at a 10.92% CAGR to 2030 as aging populations and rising disposable income heighten demand for advanced orthopedic care. China ramps fellowship programs in Shanghai and Beijing, Japan leverages universal insurance to cover select technologies, and India's tier-1 hospitals attract domestic medical tourists. The combination of heavy trauma incidence and large diabetes populations increases arthritis burden, creating a fertile expansion corridor for the total ankle replacement market. Middle East and Africa plus South America show nascent uptake as private hospital chains import expertise, though currency fluctuations and out-of-pocket dynamics temper near-term procedure counts.

- Stryker

- Zimmer Biomet

- Smiths Group

- Paragon 28

- Exactech

- Enovis (DJO)

- Vilex

- restor3d

- Conmed

- Allegra Orthopaedics

- Integra LifeSciences

- Wright Medical Group

- Arthrex

- Medartis

- Johnson & Johnson

- Ossur

- Corin Group

- Zimmer Surgical

- Medtronic

- BioPoly LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Ankle Osteoarthritis & Aging Population

- 4.2.2 Surge in Minimally-Invasive, Image-Guided & Robotic TAR Procedures

- 4.2.3 Favourable Reimbursement Expansion

- 4.2.4 Additive-Manufactured, Patient-Specific Ankle Implants Gain FDA Clearances

- 4.2.5 Growing Demand from Younger, Sports-Injury Cohort Seeking Motion Preservation

- 4.2.6 Outpatient TAR Adoption in ASC Settings after CMS Rule Changes

- 4.3 Market Restraints

- 4.3.1 Surgical-Site Complications & Revision Burden

- 4.3.2 High Device & Procedure Costs Limit Adoption in Emerging Markets

- 4.3.3 Absence of Long-Term Global Implant Registry Data Hampers Surgeon Confidence

- 4.3.4 Joint-Preserving Alternatives Delaying TAR

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Design

- 5.1.1 HINTEGRA

- 5.1.2 STAR

- 5.1.3 SALTO / SALTO Talaris

- 5.1.4 INBONE II / INFINITY

- 5.1.5 CADENCE

- 5.1.6 Other Designs

- 5.2 By Bearing Type

- 5.2.1 Mobile-Bearing Systems

- 5.2.2 Fixed-Bearing Systems

- 5.2.3 Hybrid / Semi-constrained

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Specialty Orthopaedic Clinics

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Stryker Corporation

- 6.3.2 Zimmer Biomet

- 6.3.3 Smith + Nephew

- 6.3.4 Paragon 28

- 6.3.5 Exactech

- 6.3.6 Enovis (DJO)

- 6.3.7 Vilex

- 6.3.8 restor3d

- 6.3.9 CONMED

- 6.3.10 Allegra Orthopaedics

- 6.3.11 Integra LifeSciences

- 6.3.12 Wright Medical

- 6.3.13 Arthrex

- 6.3.14 Medartis

- 6.3.15 DePuy Synthes (Johnson & Johnson)

- 6.3.16 Ossur

- 6.3.17 Corin Group

- 6.3.18 Zimmer Surgical

- 6.3.19 Medtronic

- 6.3.20 BioPoly LLC

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment