PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836681

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836681

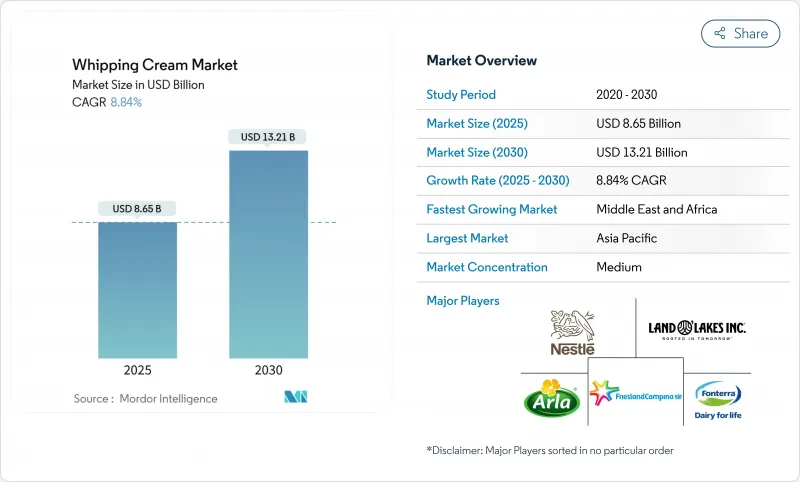

Whipping Cream - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global whipping cream market is projected to grow from USD 8.65 billion in 2025 to USD 13.21 billion by 2030, at a CAGR of 8.84%.

The rising consumer demand for plant-based diets and lactose-free products has driven market expansion in the whipping cream industry, compelling manufacturers to develop alternatives using coconut cream, almond milk, and soy-based formulations. These plant-based whipping creams address the requirements of vegan and health-conscious consumers across bakery, confectionery, and foodservice segments. Research and development investments focus on achieving comparable texture and whipping properties to dairy cream through natural stabilizers and clean-label ingredients, while extending product shelf life through packaging innovations.

Global Whipping Cream Market Trends and Insights

Rising Home-Baking Culture Drives Retail Demand

The expansion of home baking activities has driven increased whipping cream consumption, notably in the premium segment where consumers select high-quality ingredients regardless of cost implications. According to Puratos's Taste Tomorrow research, sourdough baking interest is projected to increase by 40% and culinary fusion pastries by 10% by 2025, generating additional market opportunities for whipping cream across various recipe applications. The market demand for international desserts and traditional baking methods has strengthened whipping cream's position as an essential ingredient. Manufacturers have implemented product innovations, including enhanced packaging designs, stabilized formulations, and measured portion options, to address domestic consumption requirements while minimizing product waste.

Growth of Dairy-free/Plant-based Whipping Alternatives

The plant-based segment in the whipping cream market demonstrates an 11.20% CAGR, attributed to increased consumer awareness regarding health and sustainability factors. According to the Good Food Institute, 59% of United States households purchased plant-based foods in 2024, with nearly 80% demonstrating repeat purchase behavior . This market trend indicates sustained demand for dairy-free whipping alternatives, particularly plant-based creams derived from coconut, oat, or soy. Technological developments in plant-based formulations have enhanced the stability, texture, and whipping properties of these products to align with conventional dairy standards. Manufacturers are implementing product development strategies to address the rising demand for plant-based whipped creams, focusing on optimizing texture, taste, and functionality. The industry utilizes base ingredients such as coconut, soy, and almond to develop products for multiple applications. For instance, in October 2024, Puratos launched a plant-based chocolate-flavored whipping cream for bakery applications, expanding the product portfolio for professional bakers and food manufacturers. This product development illustrates the industry's response to market demand for plant-based alternatives that maintain the performance standards of traditional dairy whipping cream.

Health Concerns over Saturated Fat and Calorie Content

Rising consumer awareness about health risks associated with high-fat diets has created significant challenges for traditional whipping cream manufacturers, driving the development of healthier alternatives. Studies on hydrocolloids in whipping cream demonstrate that additives such as pectin and carrageenan enhance foaming properties while reducing lipid digestion rates. The incorporation of these hydrocolloids helps maintain product stability and texture while addressing health concerns. Carrageenan demonstrates superior effectiveness compared to pectin in decreasing lipid digestion, enabling the development of whipped cream products with improved nutritional profiles. These developments address consumer demand for products that combine indulgence with health benefits. Manufacturers are investing in research and development to create innovative formulations that maintain the desired taste and texture while reducing fat content. The market shows increasing acceptance of these modified whipping cream products, particularly among health-conscious consumers who seek alternatives to traditional dairy products.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Ready-to-Use and Shelf-Stable Variants

- E-commerce Enabling Direct-to-Consumer Cream Brands

- Raw-milk Price Volatility and Supply Shortfalls

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Liquid whipping cream holds a dominant market position with a 62.23% share in 2024, due to its wide application across the retail and food service sectors. The versatility of liquid whipping cream makes it essential for bakeries, cafes, restaurants, and household consumers who use it for various culinary applications, from dessert toppings to sauce bases. The aerosol segment is growing at 9.12% CAGR (2025-2030), supported by consumer demand for convenience and advancements in product stability and sustainability. The market players are launching new products, leveraging this demand. For instance, in July 2023, Lactalis launched a line of gourmet-style whipped cream under its brand, President. The products were available in original and extra creamy formats.

Powdered and frozen whipping cream formats, categorized under the "Others" segment, cater to specific applications requiring longer shelf life or minimal storage space. These formats have increased adoption in regions with limited cold chain infrastructure, where liquid cream distribution presents challenges. The powdered format offers advantages in tropical climates and remote locations, while frozen options provide consistency for large-scale food service operations. Product diversification continues through innovations in nitrogen-infused aerosols and shelf-stable formulations, as manufacturers respond to market requirements and usage patterns. The development of new preservation techniques and packaging solutions further enhances the appeal of these alternative formats across different market segments.

Dairy-based whipping cream commands an 84.01% market share in 2024, supported by its traditional taste profile and established performance in culinary applications. The product's versatility in both commercial and household settings, combined with its superior texture and mouthfeel, maintains its market leadership. The non-dairy/plant-based segment exhibits an 11.20% CAGR during 2025-2030, surpassing the overall market growth rate. This expansion results from improvements in plant-based fat systems that effectively mimic dairy fat characteristics, particularly in terms of whipping stability and texture. In February 2023, Alamance Foods launched dairy-free vegan whipped cream variants in oat, coconut, and almond bases, providing gluten-free options for consumers with dietary restrictions or preferences.

The dairy segment maintains its position through advances in cream processing technology, emphasizing improved stability and extended shelf life while maintaining traditional taste. Innovations in packaging solutions and cold chain management have further strengthened the dairy segment's market presence. The market shows sustained growth across both dairy and alternative segments, albeit at different rates, driven by distinct consumer preferences and increasing demand for product diversity.

The Whipping Cream Market Report is Segmented by Source (Dairy-Based, and Non-Dairy/Plant-based), Product Form (Liquid, Aerosol, and Others), Fat Content (Heavy, Light, and Double Cream), Distribution Channel (Off Trade and On Trade), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific holds 33.21% of the global whipping cream market in 2024. This growth results from urbanization, Western dietary patterns, and retail and foodservice channel expansion. China, Japan, India, South Korea, and Australia represent the key markets, with substantial demand for both dairy-based products and non-dairy/plant-based alternatives. The region's whipped cream consumption is concentrated in foodservice operations, bakeries, and residential baking activities. Market demand for healthier alternatives has increased the development of low-fat, sugar-free, and lactose-free products, driving manufacturers to expand their product portfolios.

Europe maintains its market strength through traditional culinary applications of cream in dishes and desserts, with the United Kingdom, Germany, and France as primary markets. European consumers demonstrate a growing preference for organic, grass-fed, and locally sourced whipping cream products. Arla Foods demonstrated market confidence with a USD 401.12 million investment in its United Kingdom facility in May 2024. Besides, North America's mature market focuses on health-conscious and plant-based product development, with manufacturers introducing alternatives made from oats, almonds, and other plant sources.

Moreover, the Middle East and Africa region exhibits the highest growth rate at 8.20% CAGR (2025-2030), supported by higher disposable incomes, retail network development, and Western culinary influences. The tourism and foodservice industry, specifically in the United Arab Emirates and Saudi Arabia, contributes substantial market value through hotels, cafes, and restaurants that incorporate whipping cream in their food and beverage offerings. The market is projected to expand as tourism recovers and international cuisine adoption increases across the region, primarily in premium and hospitality segments. According to the World Tourism Organization (UN Tourism), the UAE and Saudi Arabia recorded the highest international tourist arrivals among Middle Eastern countries, with 28.15 million and 27.4 million visitors respectively in 2023 .

- Arla Foods amba

- Fonterra Co-operative Group

- FrieslandCampina N.V.

- Conagra Brands Inc.

- Nestle S.A.

- Land O'Lakes Inc.

- Rich Products Corporation

- Lactalis Group

- Saputo Inc.

- Danone S.A.

- Morinaga Milk Industry Co. Ltd

- Tatua Co-operative Dairy Company Ltd

- Gay Lea Foods Co-operative Ltd

- Califia Farms LLC

- Megmilk Snow Brand Co. Ltd

- Tropilite Foods Pvt Ltd

- Granarolo S.p.A.

- Hanan Products Company Inc.

- Wilton Brands LLC

- Gujarat Cooperative Milk Marketing Federation (GCMMF) (Amul)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising home-baking culture among people

- 4.2.2 Rapid food-service chain expansion

- 4.2.3 Premium dessert demand in tourism hubs

- 4.2.4 Growth of dairy-free/plant-based alternatives

- 4.2.5 Expansion of ready-to-use variants

- 4.2.6 E-commerce enabling D2C cream brands

- 4.3 Market Restraints

- 4.3.1 Health concerns over saturated fat and calorie content

- 4.3.2 Raw-milk price volatility and supply shortfalls

- 4.3.3 Cold-chain infrastructure gaps

- 4.3.4 Intensifying competition from non-dairy toppings and whipped aerosols

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook (UHT, Aseptic, Nitrogen-Infused Aerosol)

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE, USD)

- 5.1 By Source

- 5.1.1 Dairy-based

- 5.1.2 Non-Dairy/Plant-based

- 5.2 By Product Form

- 5.2.1 Liquid

- 5.2.2 Aerosol

- 5.2.3 Others

- 5.3 By Fat Content

- 5.3.1 Heavy (More than 36% fat)

- 5.3.2 Light (30-35% fat)

- 5.3.3 Double Cream (≈48% fat)

- 5.4 By Distribution Channel

- 5.4.1 Off-Trade

- 5.4.1.1 Supermarkets/Hypermarkets

- 5.4.1.2 Convenience Stores

- 5.4.1.3 Specialist Retailers

- 5.4.1.4 Online Stores

- 5.4.1.5 Other Distribution Channels

- 5.4.2 On-Trade

- 5.4.1 Off-Trade

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 France

- 5.5.2.3 United Kingdom

- 5.5.2.4 Spain

- 5.5.2.5 Netherlands

- 5.5.2.6 Italy

- 5.5.2.7 Sweden

- 5.5.2.8 Poland

- 5.5.2.9 Belgium

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Indonesia

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Chile

- 5.5.4.4 Colombia

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 South Africa

- 5.5.5.3 Nigeria

- 5.5.5.4 Saudi Arabia

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Arla Foods amba

- 6.4.2 Fonterra Co-operative Group

- 6.4.3 FrieslandCampina N.V.

- 6.4.4 Conagra Brands Inc.

- 6.4.5 Nestle S.A.

- 6.4.6 Land O'Lakes Inc.

- 6.4.7 Rich Products Corporation

- 6.4.8 Lactalis Group

- 6.4.9 Saputo Inc.

- 6.4.10 Danone S.A.

- 6.4.11 Morinaga Milk Industry Co. Ltd

- 6.4.12 Tatua Co-operative Dairy Company Ltd

- 6.4.13 Gay Lea Foods Co-operative Ltd

- 6.4.14 Califia Farms LLC

- 6.4.15 Megmilk Snow Brand Co. Ltd

- 6.4.16 Tropilite Foods Pvt Ltd

- 6.4.17 Granarolo S.p.A.

- 6.4.18 Hanan Products Company Inc.

- 6.4.19 Wilton Brands LLC

- 6.4.20 Gujarat Cooperative Milk Marketing Federation (GCMMF) (Amul)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK