PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836685

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836685

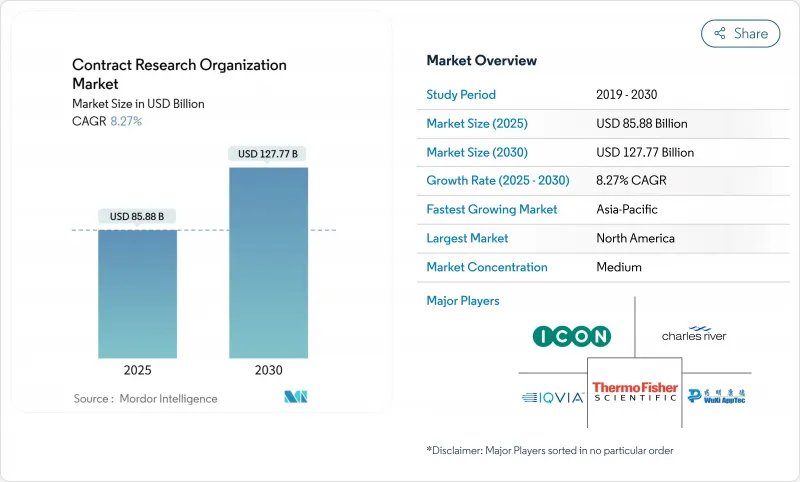

Contract Research Organization - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Contract Research Organization Market size is estimated at USD 85.88 billion in 2025, and is expected to reach USD 127.77 billion by 2030, at a CAGR of 8.27% during the forecast period (2025-2030).

Robust expansion stems from rising biopharmaceutical R&D budgets, the shift toward asset-light operating models, and demand for flexible outsourcing frameworks that let sponsors manage growing development costs. Oncology programs dominate revenue, while infectious-disease studies accelerate as governments fund pandemic-readiness initiatives. Large sponsors are standardizing digital trial platforms, and small biotechs are pushing precision-medicine protocols that rely on niche CRO capabilities. Asia-Pacific is registering double-digit growth as streamlined regulations and lower operating costs attract global sponsors, though North America still delivers the largest contribution to fee revenue. Functional Service Provider (FSP) contracts are gaining ground because they offer clearer cost visibility, yet full-service engagements remain indispensable for complex global trials. Rising talent shortages, particularly among Clinical Research Associates (CRAs), and escalating data-governance costs linked to ICH E6(R3) could temper near-term operating margins.

Global Contract Research Organization Market Trends and Insights

Growing R&D Activities by Biopharmaceutical Companies

Global biopharma R&D outlays rose to USD 288 billion in 2024, despite macroeconomic headwinds. Top drug makers channel record budgets toward pipeline renewal as patent expirations approach, and the hunt for higher-margin assets increases reliance on external development partners. CROs benefit as sponsors off-load early safety studies and late-phase operational logistics. Precision-medicine projects require sophisticated biomarker strategies, steering demand to providers with integrated laboratory and data-science services. The sustained investment cycle signals a stable long-term backlog that supports pricing power for differentiated service lines.

Increasing Number of Clinical Trials

Completed industry-sponsored trials climbed 10.7% year over year to 4,295 in 2024. Oncology retained leadership, but China's share of cancer studies surged to 60% in 2023. Sponsors gravitate to emerging markets for faster enrollment and lower costs, prompting CROs to scale operations in Asia-Pacific. Expanded trial volume drives demand for data-management platforms and remote-monitoring technologies that improve site performance. Providers capable of mobilizing multilingual project teams and navigating diverse regulatory regimes attract recurring business from global clients looking to de-risk timelines.

Global CRA Talent Shortage

The clinical research industry confronts an acute talent crisis, with 95% of cancer research centers reporting staffing issues that compromise trial quality and delay therapy development. Unfilled positions inflate labor budgets and delay site-initiation milestones. Some CROs deploy accelerated training academies and pre-qualified candidate pools that trim onboarding costs by USD 10,000-50,000 per month. Yet the talent gap persists because academic curricula rarely highlight clinical-research careers. Shortages limit capacity growth and may constrain the pace at which providers can accept new studies.

Other drivers and restraints analyzed in the detailed report include:

- Growing Trend of Outsourcing and Cost Savings

- Increasing Prevalence of Chronic and Complex Diseases

- Data Security and Confidentiality Risks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The clinical research organization market size for Clinical Research Services stood at 61.45% of total revenue in 2024, confirming the importance of late-stage execution expertise. However, Early-Phase Development revenue is projected to rise at a 10.72% CAGR to 2030, the fastest among service categories. Sponsors lean on Phase I specialists to generate first-in-human safety data that de-risk asset progression. Digital trial simulators and adaptive protocol designs shorten cycle times, while integrated bioanalytical labs provide real-time PK/PD readouts that support early-stage decision making.

Leading CROs completed more than 250 Phase I studies during the past five years, reflecting heightened demand for micro-dosing, food-effect, and drug-drug interaction assessments. Providers offering seamless transition from preclinical toxicology to Phase I clinics capture incremental revenue and strengthen client retention. AI-driven tools such as Trial Pathfinder identify eligible subjects within electronic health-record networks, cutting enrollment timelines by up to 30%. These efficiencies underpin the segment's strong growth trajectory and reinforce its strategic importance within the broader clinical research organization market.

Oncology accounted for 21.43% of the clinical research organization market in 2024, underpinned by more than 10,000 active studies. Precision-oncology protocols require genomic sequencing, companion diagnostics, and decentralized specimen collection that elevate operational complexity. CROs with oncology-specific data lakes and molecular-profiling labs secure repeated projects from big-pharma pipelines advancing checkpoint inhibitors and next-generation CAR-T therapies.

Infectious-disease trials are forecast to register a 10.81% CAGR as sponsors respond to antimicrobial resistance and pandemic-preparedness funding. Providers with BSL-3 laboratories and vaccine-trial experience attract multinational partnerships. Central Nervous System and cardiovascular studies post mid-single-digit growth, while rare-disease portfolios driven by gene-therapy innovations offer high-margin opportunities for CROs that can navigate orphan-designation incentives. The shift in therapeutic mix encourages investment in therapeutic-area excellence programs that consolidate medical, regulatory, and operational subject-matter experts under one governance model.

The Contract Research Organization Market Report is Segmented by Service Type (Early-Phase Development Services, Clinical Research Services, and More), Therapeutic Area (Oncology, Infectious Diseases, and More), End User (Pharmaceutical and Biopharmaceutical Companies, and More), Delivery Model (Full-Service/Integrated CRO, and More) and Geography (North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 38.92% of global revenue in 2024 thanks to its deep pipeline of high-value biologics and streamlined FDA guidance that de-risks protocol amendments. Advanced site infrastructures and seasoned investigators translate into high data-quality scores, sustaining premium pricing for full-service engagements. Yet cost pressures and recruitment challenges encourage sponsors to expand site networks overseas.

Asia-Pacific is set to record an 11.26% CAGR, the fastest in the world. Regulatory agencies in China and South Korea have adopted accelerated approval frameworks, cutting study-start timelines. Government grants for oncology and vaccine research further tilt the locus of activity eastward. CROs that couple local language proficiency with global-quality data systems capture multicountry mandates. Europe maintains modest growth amid ongoing harmonization under CTR 536/2014, but some sponsors complain of longer start-up deadlines, prompting them to divert early-phase work to Central-Eastern Europe where ethics review boards move faster.

South America presents a cost-effective alternative with diverse patient populations; strengthened pharmacovigilance systems are improving confidence among global sponsors. Middle East & Africa remain nascent but are drawing pilot oncology and rare-disease programs as tertiary centers in the Gulf expand. Overall, geographic diversification mitigates recruitment risk and ensures the clinical research organization market sustains double-digit growth even as established regions face capacity and cost constraints.

- IQVIA

- Fortrea

- ICON

- Charles River

- Parexel International (MA) Corporation

- Syneos Health

- Thermo Fisher Scientific

- MedPace

- WuXi AppTec (WuXi Clinical)

- Pharmaron

- SGS Societe Generale de Surveillance SA

- Eurofins

- PSI

- Syngene International

- Inotiv

- CRITERIUM, INC.

- Evotec

- BioAgile Therapeutics Private Limited

- Tigermed

- Worldwide Clinical Trials

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing R&D Activities by Biopharmaceutical Companies

- 4.2.2 Increasing Number of Clinical Trials

- 4.2.3 Growing Trend of Outsourcing and Cost Savings Enabled by Using CRO Services

- 4.2.4 Increasing Prevalence of Chronic and Complex Diseases

- 4.2.5 Growth in Personalized Medicine

- 4.3 Market Restraints

- 4.3.1 Global CRA Talent Shortage Escalating Labor Costs

- 4.3.2 Regulatory and Ethical Challenges

- 4.3.3 Data Security and Confidentiality Risks

- 4.4 Regulatory Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Industry Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Service Type

- 5.1.1 Early-Phase Development Services

- 5.1.2 Clinical Research Services

- 5.1.2.1 Phase I

- 5.1.2.2 Phase II

- 5.1.2.3 Phase III

- 5.1.2.4 Phase IV

- 5.1.3 Laboratory Services

- 5.1.4 Consulting Services

- 5.2 By Therapeutic Area

- 5.2.1 Oncology

- 5.2.2 Infectious Diseases

- 5.2.3 Central Nervous System (CNS) Disorders

- 5.2.4 Immunological Disorders

- 5.2.5 Cardiovascular Diseases

- 5.2.6 Respiratory Disorders

- 5.2.7 Diabetes

- 5.2.8 Other Therapeutic Areas

- 5.3 By End User

- 5.3.1 Pharmaceutical & Biopharmaceutical Companies

- 5.3.2 Medical Device Companies

- 5.3.3 Other End Users (Academic / Government Institutes)

- 5.4 By Delivery Model

- 5.4.1 Full-Service / Integrated CRO

- 5.4.2 Functional Service Provider (FSP)

- 5.4.3 Hybrid / Modular Model

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global-level Overview, Market-level Overview, Core Business Segments, Financials as available, Headcount, Key Information, Market Rank/Share for Key Companies, Services, and Recent Developments)}

- 6.4.1 IQVIA Holdings Inc.

- 6.4.2 Fortrea

- 6.4.3 ICON plc

- 6.4.4 Charles River Laboratories

- 6.4.5 Parexel International (MA) Corporation

- 6.4.6 Syneos Health

- 6.4.7 Thermo Fisher Scientific Inc. (PPD Inc.)

- 6.4.8 Medpace, Inc.

- 6.4.9 WuXi AppTec (WuXi Clinical)

- 6.4.10 Pharmaron

- 6.4.11 SGS Societe Generale de Surveillance SA

- 6.4.12 Eurofins Scientific

- 6.4.13 PSI

- 6.4.14 Syngene International Limited

- 6.4.15 Inotiv

- 6.4.16 CRITERIUM, INC.

- 6.4.17 Evotec SE

- 6.4.18 BioAgile Therapeutics Private Limited

- 6.4.19 Tigermed

- 6.4.20 Worldwide Clinical Trials

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment