PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836695

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836695

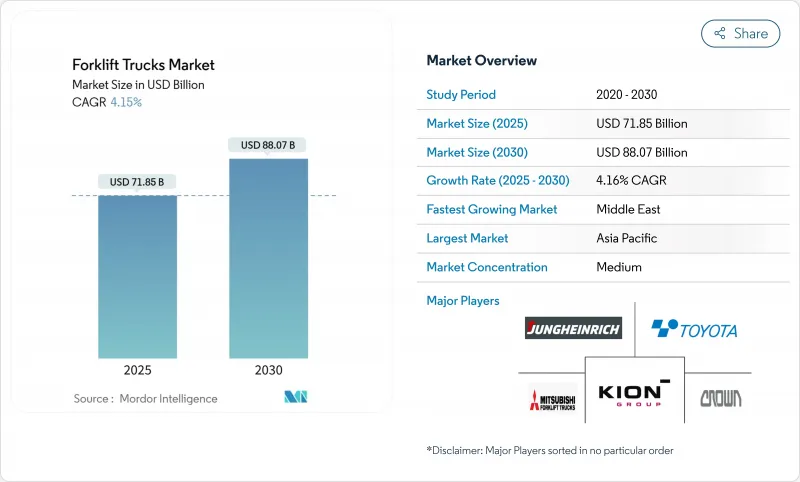

Forklift Trucks - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The forklift trucks market size stands at USD 71.85 billion in 2025 and is forecast to reach USD 88.07 billion by 2030 at a 4.16% CAGR.

Healthy capital spending on warehouse automation, stricter emission rules, and a steady replacement cycle for aging fleets underpin this advance even as macro-economic sentiment remains mixed. Within the forklift trucks market, the pivot from internal-combustion to electric and hydrogen fuel-cell models is the single biggest structural change because it reshapes power-train supply chains, charging infrastructure, and after-sales revenue streams. Lithium-ion batteries are accelerating that shift by delivering multi-shift performance without battery swaps, while hydrogen technology is gaining traction where rapid refueling is critical. In parallel, high-growth geographies such as the Middle East and Southeast Asia are adopting advanced equipment at greenfield logistics hubs, ensuring that the forklift trucks market retains momentum despite slowing economic growth in mature regions.

Global Forklift Trucks Market Trends and Insights

Expansion of Automated & E-commerce Warehouses in North America

Rapid on-line retail growth is fueling record warehouse construction across the United States and Canada. US eCommerce sales stood at $1.19 trillion in 2024, an increase of 8.2% from the previous year Autonomous and semi-autonomous truck demand is rising fastest because these units integrate with warehouse-management software, boost throughput, and mitigate a persistent labor shortage. The result is a technology-led upgrade cycle that keeps unit shipments rising even when headline GDP growth softens.

Rising Adoption of Lithium-ion Forklifts in European Cold-Chain Facilities

Cold-store operators across Germany, France, and the Nordics are switching from lead-acid to lithium-ion powered trucks because lithium cells retain more than 95% capacity at -30 °C, cut charging hours to 1-2, and triple battery life. The cold-chain food & beverage segment already tops 4.9% CAGR, and emissions rules limiting acid-gas exposure inside chilled warehouses are reinforcing the shift. By 2025 lithium-ion units represent 40% of new electric forklift sales in European cold rooms as operators prioritize uptime and reduced battery maintenance . OEMs that bundle battery leasing and telematics support capture higher margins by proving total-cost advantages over legacy solutions.

High Upfront Cost of Electric Forklifts Is Restraining Adoption

Electric models carry a 20-40% purchase premium over comparable ICE units. A Class I electric truck averages USD 36,000 versus USD 28,000 for ICE, limiting take-up among small enterprises . The price gap is steeper in autonomous variants, whose sensor suites can lift installed cost above USD 100,000. Alternative financing, such as battery leasing, pay-per-use contracts, and fleet-as-a-service packages, is gaining traction but remains nascent in regions where credit access is tight.

Other drivers and restraints analyzed in the detailed report include:

- Stringent APAC Emission Mandates Accelerating Electric Forklift Uptake

- Post-pandemic Reshoring of Manufacturing Boosting United States Forklift Demand

- Shortage of Skilled Forklift Operators in Europe & Nordics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hydrogen fuel-cell models are scaling more rapidly than any other power-train, expanding at 10.60% CAGR through 2030. The forklift trucks market benefits because hydrogen refueling takes 3 minutes, matching ICE uptime while offering zero localized emissions. Plug Power has deployed over 60,000 fuel cells across 300 sites, proving commercial viability. Although the 69.20% electric share still dominates the forklift trucks market in 2024, regulatory deadlines in California, China, and the EU accelerate the pivot to electrified fleets.

ICE manufacturers respond with hybrid configurations and alternative fuels, but achieving repeated engine efficiency gains is proving to be cost-prohibitive. Battery cost curves are trending downward, and hydrogen distribution partnerships between fuel suppliers and logistics park operators promise lower dispensing costs by 2027. Consequently, power-train diversification enhances competitive intensity, rewarding brands that secure supplier alliances for cells, stacks, chargers, and software.

Class III pallet movers dominate with 44.70% market share due to last-mile cross-dock networks, but margin pressure is intensifying because these trucks are relatively commoditized. Demand diversification forces OEMs to manage a broad SKU mix ranging from compact three-wheel electrics for micro-fulfilment centers to heavy 18-ton rigs for container yards. Electronics standardization across classes is therefore a key cost-reduction strategy.

Class I electric riders book 4.53% CAGR, propelled by lithium-ion technology that supports multi-shift indoor operations without battery swaps. The forklift trucks market size for narrow-aisle Class II units is also expanding as e-commerce facilities adopt racking systems above 12 m high, demanding trucks with enhanced lift height and stability.

The Forklift Trucks Market Report is Segmented by Power-Train Type (Internal Combustion Engine, Electric and More), Vehicle Class (Class I, Class II and More), Load Capacity (Less Than 5 Tons, 5-15 Tons and More), End-User Industry (Manufacturing, Logistics and Warehousing and More), and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific held 45.10% of the forklift trucks market revenue in 2024 as China, Japan, and India invested heavily in automated warehousing and smart factories. Domestic brands leverage cost advantages and government incentives to expand at home and Southeast Asia, heightening competition for European and U.S. incumbents. Mature fleets in Japan and South Korea are entering mandatory replacement cycles, and strict emission caps tilt new purchases toward lithium-ion or hydrogen units. Freight corridors linked to the Regional Comprehensive Economic Partnership foster cross-border standardization that further enlarges addressable demand.

The Middle East is the fastest-growing region, projected at 6.12% CAGR to 2030, as Saudi Arabia, UAE, and Qatar build ports, rail yards, and desert distribution hubs under long-range national visions. Chinese and Korean OEMs use regional free-trade zones to assemble units locally, while European brands differentiate on after-sales service and autonomous options.

North America remains a technology bellwether. Manufacturing reshoring, e-commerce fulfillment, and California's zero-emission forklift regulation combine to sustain demand for electric Class I and hydrogen Class V machines. The United States also leads telematics adoption, with fleet managers tracking battery health, operator behavior, and maintenance intervals to boost utilization. Canada follows similar patterns, helped by new inland ports in British Columbia and Ontario.

Europe's forklift trucks market continues to transition to zero-emission power-trains amid tight labor availability. Skill shortages exceeding 400,000 certified operators drive automation pilots, especially in the Nordics. Germany leads R&D on lithium-ion battery recycling and second-life applications, supporting a circular equipment economy. Eastern European member states exhibit above-average unit growth as automotive and electronics supply chains migrate closer to the continent's core consumer markets.

- Toyota Industries Corp.

- KION Group AG

- Jungheinrich AG

- Hyster-Yale Materials Handling Inc.

- Mitsubishi Logisnext Co. Ltd.

- Crown Equipment Corp.

- Hangcha Group Co.

- Doosan Industrial Vehicles Co. Ltd.

- Komatsu Ltd.

- Anhui Heli Co. Ltd.

- Clark Material Handling Co.

- Caterpillar Inc. (CAT Lift Trucks)

- Hyundai Material Handling

- Lonking Holdings Ltd.

- Manitou Group

- Godrej & Boyce Mfg. Co.

- EP Equipment Co.

- Liugong Machinery Co.

- UniCarriers Corp.

- SANY Group Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of Automated & E-commerce Warehouses in North America

- 4.2.2 Rising Adoption of Lithium-ion Forklifts in European Cold-Chain Facilities

- 4.2.3 Stringent APAC Emission Mandates Accelerating Electric Forklift Uptake

- 4.2.4 Post-pandemic Reshoring of Manufacturing Boosting U.S. Forklift Demand

- 4.2.5 Infrastructure Investments Across GCC Creating Greenfield Logistics Hubs

- 4.2.6 Aging Forklift Fleet Replacement Cycle in Japan & South Korea

- 4.3 Market Restraints

- 4.3.1 High Upfront Cost of Electric Forklift Is Restraining Adoption

- 4.3.2 Shortage of Skilled Forklift Operators in Europe & Nordics

- 4.3.3 Intense Rental-Fleet Competition Compressing OEM Margins

- 4.3.4 Supply Chain Disruptions Affecting Component Availability

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory & Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Power-train Type

- 5.1.1 Internal Combustion Engine (ICE)

- 5.1.2 Electric

- 5.1.2.1 Lead-acid

- 5.1.2.2 Li-ion

- 5.1.3 Hydrogen Fuel-cell Vehicle (HFCV)

- 5.2 By Vehicle Class

- 5.2.1 Class I (Electric Rider Trucks)

- 5.2.2 Class II (Electric Narrow-Aisle)

- 5.2.3 Class III (Electric Pallet)

- 5.2.4 Class IV (ICE Cushion-Tire)

- 5.2.5 Class V (ICE Pneumatic-Tire)

- 5.3 By Load Capacity

- 5.3.1 Less than 5 Tons

- 5.3.2 5-15 Tons

- 5.3.3 Above 15 Tons

- 5.4 By End-user Industry

- 5.4.1 Manufacturing

- 5.4.2 Logistics & Warehousing

- 5.4.3 Construction & Infrastructure

- 5.4.4 Retail & Wholesale

- 5.4.5 Food & Beverage Cold-Chain

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Middle East

- 5.5.4.1 GCC

- 5.5.4.1.1 Saudi Arabia

- 5.5.4.1.2 United Arab Emirates

- 5.5.4.1.3 Rest of GCC

- 5.5.4.2 Turkey

- 5.5.4.3 Rest of Middle East

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Rest of Africa

- 5.5.6 Asia Pacific

- 5.5.6.1 China

- 5.5.6.2 India

- 5.5.6.3 Japan

- 5.5.6.4 South Korea

- 5.5.6.5 Rest of Asia Pacific

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, JVs, Product Launches)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Toyota Industries Corp.

- 6.4.2 KION Group AG

- 6.4.3 Jungheinrich AG

- 6.4.4 Hyster-Yale Materials Handling Inc.

- 6.4.5 Mitsubishi Logisnext Co. Ltd.

- 6.4.6 Crown Equipment Corp.

- 6.4.7 Hangcha Group Co.

- 6.4.8 Doosan Industrial Vehicles Co. Ltd.

- 6.4.9 Komatsu Ltd.

- 6.4.10 Anhui Heli Co. Ltd.

- 6.4.11 Clark Material Handling Co.

- 6.4.12 Caterpillar Inc. (CAT Lift Trucks)

- 6.4.13 Hyundai Material Handling

- 6.4.14 Lonking Holdings Ltd.

- 6.4.15 Manitou Group

- 6.4.16 Godrej & Boyce Mfg. Co.

- 6.4.17 EP Equipment Co.

- 6.4.18 Liugong Machinery Co.

- 6.4.19 UniCarriers Corp.

- 6.4.20 SANY Group Co.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment