PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836722

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836722

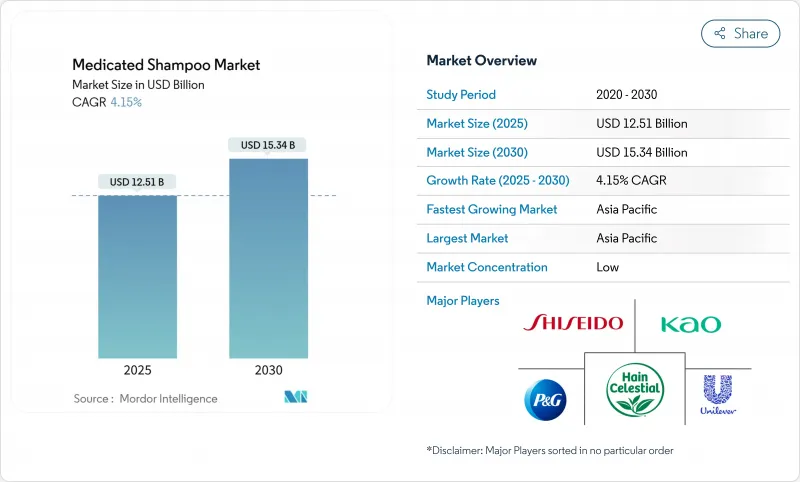

Medicated Shampoo - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global medicated shampoo market stands at USD 12.51 billion in 2025 and is projected to reach USD 15.34 billion by 2030, growing at a CAGR of 4.15% during the forecast period.

This growth trajectory reflects a market responding to increasing consumer sophistication regarding scalp health, with Asia-Pacific emerging as both the largest and fastest-growing region. The conventional/synthetic segment dominates the market, while natural/organic formulations are gaining momentum, signaling a pivotal shift in consumer preferences toward cleaner ingredients. The market's relatively fragmented competitive landscape creates opportunities for innovative entrants to disrupt established players through specialized formulations. Specialty stores currently lead distribution, but online retail channels are rapidly expanding, reshaping how consumers discover and purchase medicated hair care products. Regulatory developments, particularly the FDA's Modernization of Cosmetics Regulation Act of 2022 (MoCRA), are creating compliance hurdles while simultaneously validating product efficacy claims, effectively raising barriers to entry while enhancing consumer trust in scientifically-backed formulations.

Global Medicated Shampoo Market Trends and Insights

Rising awareness of scalp health

The rising awareness of scalp health is a significant driver in the medicated shampoo market. Consumers are increasingly recognizing the importance of maintaining a healthy scalp to prevent issues such as dandruff, dryness, itchiness, and hair loss. highlighting the growing demand for effective scalp care solutions. Furthermore, Psoriasis impacts approximately 7.5 million individuals in the U.S., with over half of them grappling with scalp psoriasis, as reported by the American Academy of Dermatology further driving the need for medicated shampoos designed to address such conditions. This heightened awareness is further fueled by increasing consumer education through digital platforms, dermatological campaigns, and government health initiatives aimed at promoting personal hygiene and scalp care. The availability of targeted products, including those with active ingredients like ketoconazole, salicylic acid, and zinc pyrithione, is expected to propel market growth during the forecast period.

Influence of social media and celebrity endorsements

Social media and celebrity endorsements significantly influence the medicated shampoo market by shaping consumer preferences and driving purchasing decisions. Platforms like Instagram, Facebook, and TikTok allow brands to reach a broader audience, leveraging influencers and celebrities to promote their products. For instance, a celebrity endorsing a medicated shampoo for dandruff treatment can create a strong impact on consumers dealing with similar issues, encouraging them to purchase the product. Endorsements from well-known personalities enhance brand credibility and trust, encouraging consumers to try medicated shampoos. Additionally, social media campaigns enable companies to showcase product benefits, address consumer concerns, and engage directly with their target audience, further boosting market growth. For example, brands often collaborate with influencers to create tutorial videos or testimonials highlighting the effectiveness of medicated shampoos, which resonate with potential buyers and drive sales.

Strong competition from conventional shampoo

Market growth faces a notable challenge due to the merging lines between standard and medicated shampoo formulations. Mainstream brands are now infusing active ingredients, once exclusive to medicated products, into their offerings. This trend is most pronounced in the anti-dandruff segment. According to the American Academy of Dermatology Association (AAD), the use of anti-fungal and anti-inflammatory agents in shampoos has been increasingly recommended for managing scalp conditions. Here, conventional shampoos are increasingly incorporating mild doses of these agents. A prime example of this shift is CeraVe's Anti-Dandruff Shampoo. Drawing on its skincare expertise, CeraVe has crafted a product that not only banishes flakes but also prioritizes scalp health, deftly straddling the line between traditional and medicated shampoos.

Other drivers and restraints analyzed in the detailed report include:

- Cultural preference for herbal and medicinal hair care shampoo

- Shift towards natural ingredients

- Price sensitivity hindering the market growth

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, conventional/synthetic medicated shampoos dominated the market, holding a commanding 77.25% share. This strong position is largely attributed to the proven efficacy of active ingredients, such as ketoconazole and coal tar, both of which have garnered broader regulatory endorsements. These shampoos are widely used to treat various scalp conditions, including dandruff, seborrheic dermatitis, and psoriasis, due to their therapeutic properties. The inclusion of active ingredients like ketoconazole, known for its antifungal properties, and coal tar, recognized for its ability to reduce scaling and itching, has significantly enhanced their effectiveness.

Yet, the natural/organic segment is gaining momentum, boasting a 5.24% CAGR for 2025-2030, as consumers increasingly voice concerns over prolonged synthetic chemical exposure. This trend is especially evident in the premium tier, where brands are pivoting to botanical alternatives, achieving similar efficacy while enhancing sustainability. Innovation is now gravitating towards hybrid formulations, melding clinically validated synthetic actives with natural soothing agents, effectively tackling efficacy and side effect apprehensions. Regulatory shifts, notably the FDA's Modernization of Cosmetics Regulation Act , are hastening this evolution by instituting stringent safety benchmarks that lean towards naturally-derived ingredients with proven safety.

The Global Medicated Shampoo Report is Segmented by Ingredient (Conventional/Synthetic and Natural/Organic), End User (Kids and Adults), Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online Retail Stores, and Other Distribution Channel), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific, accounting for 31.26% of global revenue, is set to lead with a forecasted CAGR of 5.73%. In urban areas of China, India, and Japan, residents cite pollution, hard water, and high humidity as culprits for scalp irritation, spurring the frequent use of therapeutic cleansers. Beauty-tech apps in these countries are now integrating scalp-scanner accessories, offering regimen-specific product recommendations. This not only boosts domestic demand but also paves the way for cross-border exports. In South Korea, government-endorsed awareness campaigns emphasize routine scalp check-ups as integral to holistic health, further embedding the use of medicated shampoos into daily life.

North America stands as the second-largest market in terms of value. The region reaps benefits from ongoing dermatological innovations, an insurance framework that offers partial reimbursements for prescription-strength shampoos, and online dermatology services that deliver pharmacist-compounded blends directly to consumers. Major retailers are now dedicating specific sections for medicated hair-care products, placing them strategically alongside mainstream shampoos. A growing "skinification" trend sees consumers treating their scalp with the same importance as facial skin, leading established facial-care brands to adapt ingredients like niacinamide and salicylic acid for scalp applications.

Europe showcases high per-capita spending on hair-care, but its growth rate lags due to already deep market penetration. While the EU's harmonized Cosmetics Regulation streamlines market entry for compliant formulations across member states, stringent preservative rules inflate Research and Development costs. Consequently, natural and organic products are gaining traction in Germany, Italy, and the Nordics, where ethical sourcing and vegan claims drive purchases. South America, the Middle East, and Africa, though generating lesser revenue, are witnessing promising mid-single-digit growth. Increased internet access and the rise of social commerce are shedding light on niche issues, from pregnancy-related scalp sensitivities to seborrheic conditions linked to hijab use.

- Procter & Gamble Company

- Unilever PLC

- Hain Celestial Group Inc.

- Shiseido Company

- Kao Corporation

- Pierre Fabre Group

- Maruho Co.Ltd

- Sanofi

- Sun Pharmaceutical Industries Ltd.

- Himalaya Wellness Company

- Dabur India Ltd.

- Dr. Reddy's Laboratories

- Zoic Cosmetics

- Denajee Health Care Products

- New Moon Cosmetics Private Limited

- Kamicka Organic

- Nizoral (Kramer Laboratories Inc.)

- The Honest Company

- VLCC Personal Care Ltd.

- Summer Laboratories

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising awareness of scalp health

- 4.2.2 Influence of social media and celebrity endorsements

- 4.2.3 Shift towards natural ingredients

- 4.2.4 Regulatory approvals for new formulations

- 4.2.5 Aggressive marketing and celebrity endorsements

- 4.2.6 Cultural preference for herbal and medicinal hair care shampoo

- 4.3 Market Restraints

- 4.3.1 Strong competition from conventional shampoo

- 4.3.2 Price sensitivity

- 4.3.3 Presence of counterfeit products

- 4.3.4 Limited market penetration

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Ingredient

- 5.1.1 Conventional/Synthetic

- 5.1.2 Natural/Organic

- 5.2 By End User

- 5.2.1 Kids

- 5.2.2 Adult

- 5.3 By Distribution Channel

- 5.3.1 Supermarkets/Hypermarket

- 5.3.2 Specialty Stores

- 5.3.3 Online Retail Stores

- 5.3.4 Others Distribution Channel

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Netherlands

- 5.4.2.7 Sweden

- 5.4.2.8 Poland

- 5.4.2.9 Belgium

- 5.4.2.10 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Indonesia

- 5.4.3.7 Thailand

- 5.4.3.8 Singapore

- 5.4.3.9 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Chile

- 5.4.4.4 Columbia

- 5.4.4.5 Peru

- 5.4.4.6 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 Morocco

- 5.4.5.7 Turkey

- 5.4.5.8 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Procter & Gamble Company

- 6.4.2 Unilever PLC

- 6.4.3 Hain Celestial Group Inc.

- 6.4.4 Shiseido Company

- 6.4.5 Kao Corporation

- 6.4.6 Pierre Fabre Group

- 6.4.7 Maruho Co.Ltd

- 6.4.8 Sanofi

- 6.4.9 Sun Pharmaceutical Industries Ltd.

- 6.4.10 Himalaya Wellness Company

- 6.4.11 Dabur India Ltd.

- 6.4.12 Dr. Reddy's Laboratories

- 6.4.13 Zoic Cosmetics

- 6.4.14 Denajee Health Care Products

- 6.4.15 New Moon Cosmetics Private Limited

- 6.4.16 Kamicka Organic

- 6.4.17 Nizoral (Kramer Laboratories Inc.)

- 6.4.18 The Honest Company

- 6.4.19 VLCC Personal Care Ltd.

- 6.4.20 Summer Laboratories

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK