PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836724

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836724

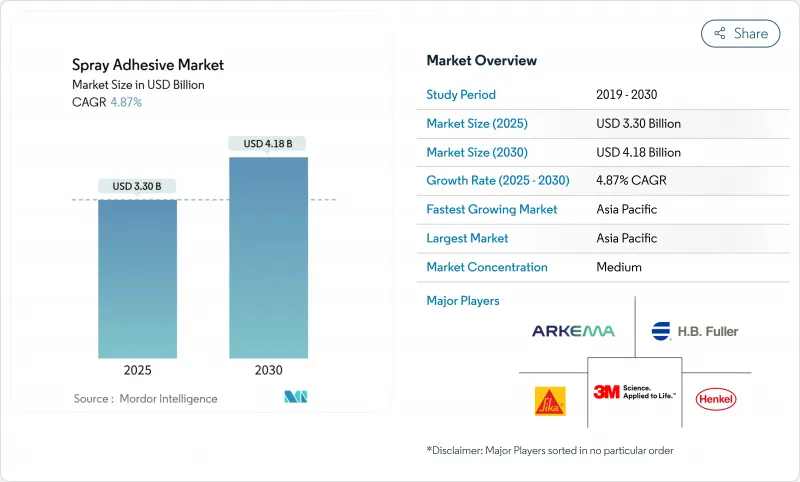

Spray Adhesive - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The spray adhesive market is valued at USD 3.30 billion in 2025 and is forecast to climb to USD 4.18 billion by 2030 on a steady 4.87% CAGR.

Demand holds firm despite tightening VOC rules because producers continue to refine water-based and hot-melt chemistries that match the bonding strength of legacy solvent products. Growth concentrates in Asia-Pacific, where large-scale infrastructure programs, expanding furniture export hubs, and a deep automotive supply chain all require fast-tack, high-volume bonding solutions. Momentum also comes from global e-commerce logistics, which pushes fulfillment centers to specify aerosol and hot-melt variants that shorten pack-out time. Competitive pressure stays moderate, yet price-sensitive buyers have new choices from regional suppliers that replicate premium chemistries at lower cost while multinational leaders differentiate through sustainable performance upgrades. Structural drivers such as vehicle lightweighting, prefab construction, and hygienic food packaging keep end-use diversity wide, shielding the spray adhesive market from volatility in any single sector.

Global Spray Adhesive Market Trends and Insights

Rapid Growth of Construction in Emerging Economies

Surging public and private infrastructure investment across China, India, Indonesia, and the Gulf states is driving relentless volume growth for construction chemicals, including spray adhesives. Prefabricated wall panels, acoustic boards, and insulation sheathing all rely on high-performance bonding to withstand temperature swings and seismic loading. Several municipal housing programs specify low-VOC adhesives to meet green-building codes, nudging contractors toward water-based spray systems. Modular builders favor portable canister rigs that reduce overspray and labor time, increasing throughput on large projects. As urbanization accelerates, local firms adopt hot-melt spray lines that cure instantly, allowing rapid assembly of kitchen cabinets and interior fixtures inside high-rise developments. These combined forces keep the spray adhesive market deeply tied to building activity, particularly in Asia-Pacific's fast-growing megacities.

Transition to Water-Based, Low-VOC Formulations Adhesives

Regulators on three continents have enacted lower emission ceilings, prompting adhesive formulators to launch waterborne systems with comparable tack and heat resistance to solvent grades. The Texas Commission on Environmental Quality amended rules that will eliminate 3.12 tons per day of VOCs around Houston, while California's Department of Toxic Substances Control placed spray adhesives on its 2024-2026 priority product work plan. Dow's PRIMAL CA 750 and 3M's Fastbond 1049 demonstrate that water-based polymers can meet industrial throughput targets without costly ventilation upgrades. Large buyers, especially furniture exporters shipping into the EU, now embed low-VOC requirements in purchase contracts, accelerating penetration of waterborne chemistries. As curing ovens consume less energy with these formulations, users realize direct savings on utility expenses and scope-2 emissions.

Concerns Due to VOC Emissions

Air-quality agencies have tightened product-category caps, placing immediate compliance burdens on brands that still rely on strong-solvent carriers. The California Air Resources Board lowered limits on web-spray and special-purpose formulations. New Jersey's draft rule aims to cut allowable VOCs in construction adhesives by more than half. Every new limit triggers relabeling, re-qualification, and sometimes forklift upgrades for explosive-atmosphere zones. Global producers must juggle multiple jurisdictional thresholds, fragmenting volume runs and trimming economies of scale. Firms unable to finance rapid reformulation risk losing shelf space, temporarily suppressing growth in the spray adhesive market.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Utilization from the Automotive Industry

- Increasing Demand for Hygienic Food Packaging

- Competition from Alternative Products

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Water-based grades held the largest 42.78% portion of 2024 revenue, confirming industry commitment to low-emission chemistries. The segment benefits from regulatory support and from upgrades in polymer design that give water dispersions heat resistance above 120 °C, widening their application window. Asia-Pacific converters adopted canister spray systems that minimize cleaning downtime, advancing penetration across plywood lamination lines. In parallel, the hot-melt category is charting the quickest 5.16% CAGR, driven by automated furniture lines that value instant handling strength and zero drying ovens. Solvent products still occupy niche spaces such as aerospace composite repair, but their spray adhesive market size is set to shrink as environmental levies rise.

A second boost to water-based adoption comes from portable equipment developments that extend pot life and reduce overspray. Worthington Enterprises collaborated with 3M to deliver lightweight pressurized canisters that maintain uniform spray patterns for the full charge, lifting in-plant transfer efficiency to 80%. These improvements help the category defend its spray adhesive market share against entrenched solvent users, positioning water-based lines for sustained leadership through 2030.

The Spray Adhesive Market Report Segments the Industry by Type (Solvent-Based, Water-Based, and Hot Melt), Resin Type (Epoxy, Polyurethane, Synthetic Rubber, and More), Application (Building and Construction, Packaging, Furniture, Transportation, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD Million)

Geography Analysis

Asia-Pacific dominates with 46.76% revenue in 2024 and exhibits the fastest 5.91% CAGR outlook. China's stimulus for affordable housing and India's highway corridor projects ensure consistent demand for panel lamination sprays and tile adhesives. Local converters boost capacity to satisfy furniture export orders to the United States and the European Union, embedding low-VOC metrics that align with destination regulations. Japan's electronics assemblers champion high-solids water-based sprays that reduce condensation risk on printed-circuit boards, spurring local compounders to scale formulations for subcontract partners. South Korea's battery vertical integrates polyurethane spray lines to secure vibration isolation in high-density EV packs.

North America relies on strong residential remodeling, commercial reroofing, and resurgent domestic auto production. The Utah Department of Environmental Quality estimates a potential 4,000-ton annual VOC cuts once its consumer-product rule takes effect. This sets a compliance clock that already shifts purchase preference toward water-based canisters. Mexico's export-oriented upholstery factories invest in automated hot-melt spray booths that boost throughput for theater seating and hospitality furniture destined for the United States. Canadian prefab home plants specify flame-retardant sprays that meet stringent provincial codes, underpinning regional diversification within the spray adhesive market.

Europe shows a mature yet innovation-driven profile. Germany's premium auto OEMs require odor-free cockpit adhesives, steering suppliers to tailor monomer-free polyurethane dispersions. The United Kingdom's retrofit insulation drive deploys low-emission spray foam panels secured with construction-grade water-based sprays. Sika's CHF 11.8 billion global sales, with 7.3% growth in EMEA construction chemicals, evidence adhesive demand resilience. Italian and Polish furniture clusters automate spray lines to meet shorter lead-time expectations from online retailers. EU Green Deal policies accelerate solvent replacement, ensuring that Europe remains a reference market for sustainability in the spray adhesive market.

- 3M

- AFT Aerosols

- Arkema Group (Bostik)

- Avery Dennison Corporation

- BASF SE

- Blu-Sky UK Ltd

- Casa Adhesive Inc.

- Chemique Adhesives & Sealants Ltd

- Dow Inc.

- Gemini Adhesives Ltd

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Illinois Tool Works Inc.

- Kissel + Wolf GmbH

- Philips Manufacturing

- Powerbond

- Quin Global

- Sika AG

- Soudal NV

- Spray-Lock Inc.

- The Kroger Co.

- Westech Aerosol Corporation

- Worthen Industries

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapidly Growth of Construction Sector in Emerging Economies

- 4.2.2 Transition to Water-based, Low-VOC Formulations Adhesives

- 4.2.3 Increasing Utilization from the Automotive Industry

- 4.2.4 Increasing Demand for Hygienic Food Packaging

- 4.2.5 Growth of E-Commerce Fulfilment Centers Requiring Fast-Tack Packaging Adhesives

- 4.3 Market Restraints

- 4.3.1 Concerns due to VOC Emissions

- 4.3.2 High Production Costs of Advanced Formulations

- 4.3.3 Competitions from Alternative Products

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Solvent-based

- 5.1.2 Water-based

- 5.1.3 Hot-Melt

- 5.2 By Resin Type

- 5.2.1 Epoxy

- 5.2.2 Polyurethane

- 5.2.3 Synthetic Rubber

- 5.2.4 Vinyl Acetate-Ethylene

- 5.3 By Application

- 5.3.1 Building and Construction

- 5.3.2 Packaging

- 5.3.3 Furniture

- 5.3.4 Transportation

- 5.3.5 Textile

- 5.3.6 Other Applications

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 3M

- 6.4.2 AFT Aerosols

- 6.4.3 Arkema Group (Bostik)

- 6.4.4 Avery Dennison Corporation

- 6.4.5 BASF SE

- 6.4.6 Blu-Sky UK Ltd

- 6.4.7 Casa Adhesive Inc.

- 6.4.8 Chemique Adhesives & Sealants Ltd

- 6.4.9 Dow Inc.

- 6.4.10 Gemini Adhesives Ltd

- 6.4.11 H.B. Fuller Company

- 6.4.12 Henkel AG & Co. KGaA

- 6.4.13 Illinois Tool Works Inc.

- 6.4.14 Kissel + Wolf GmbH

- 6.4.15 Philips Manufacturing

- 6.4.16 Powerbond

- 6.4.17 Quin Global

- 6.4.18 Sika AG

- 6.4.19 Soudal NV

- 6.4.20 Spray-Lock Inc.

- 6.4.21 The Kroger Co.

- 6.4.22 Westech Aerosol Corporation

- 6.4.23 Worthen Industries

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment