PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842442

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842442

Global Gout Therapeutics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

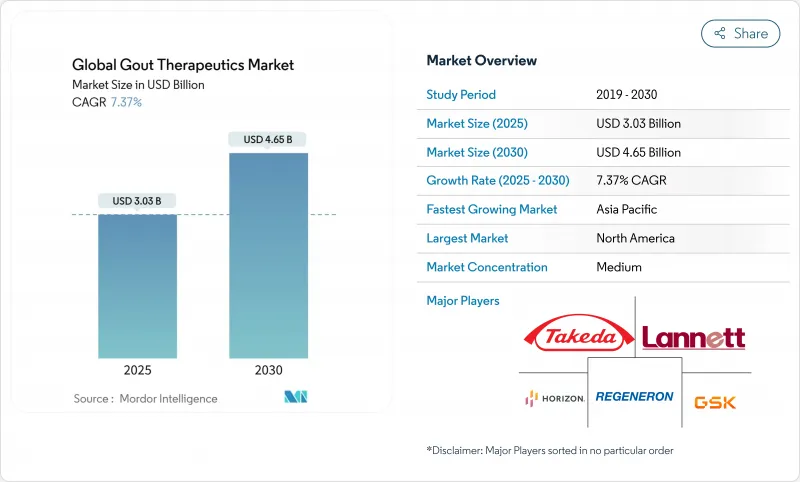

The gout therapeutics market generated USD 3.03 billion in 2024 and is forecast to reach USD 4.65 billion by 2030, advancing at a 7.37% CAGR during 2025-2030.

Rising disease prevalence tied to aging populations, metabolic syndrome, and obesity continues to enlarge the treated patient pool, while precision approaches such as pharmacogenomic testing and real-time serum-urate wearables are lifting diagnosis and treatment rates. Regulatory catalysts-including multiple Fast Track designations and an accelerating approval cycle for biologics-shorten time-to-market for novel agents, and companies are using these pathways to expand indications or launch next-generation URAT1 inhibitors. Supply-chain disruptions around febuxostat and lingering NSAID safety concerns are reshaping prescriber preferences toward alternative mechanisms, especially in cardiovascular-risk cohorts. Against this backdrop, the gout therapeutics market is benefiting from growing payer recognition that aggressive serum-urate control averts costly complications, which is supporting coverage for combination therapy, biologics, and companion diagnostics.

Global Gout Therapeutics Market Trends and Insights

Rising prevalence of gout driven by aging & obesity

Global cases climbed to more than 53 million in 2024, a 22.4% jump in age-standardized rates since 1990, and the trend is most pronounced among men older than 55 where prevalence exceeds 2,500 per 100,000 individuals. Aging populations in high-income nations combine with escalating obesity in urbanizing Asia-Pacific economies, broadening the base eligible for long-term urate-lowering therapy. Pacific Island communities illustrate genetically driven hyperuricemia compounded by rapid dietary westernization, a pattern expected to replicate across emerging markets. Persistent demand growth underpins steady expansion of the gout therapeutics market in both established and nascent healthcare systems.

Treat-to-target adoption of urate-lowering guidelines

Guidance from European and US rheumatology societies recommending serum urate below 6 mg/dL has recast gout management from episodic flare control to proactive disease modification. Health insurers increasingly reimburse serial serum-urate testing, combination therapy, and specialist visits because evidence shows that achieving target levels mitigates cardiovascular events. Although only 28.9% of US gout patients receive urate-lowering therapy today, compliance is expected to rise as digital adherence tools and pharmacist-led programs scale. Wider guideline adherence boosts average treatment duration per patient, directly enlarging the gout therapeutics market.

Boxed-warning safety issues for febuxostat & long-term NSAID use

The February 2023 FDA boxed warning that links febuxostat to greater cardiovascular mortality restricted its use to allopurinol-intolerant patients, cutting addressable volume by 70-80% fda.gov. Takeda's decision to withdraw branded Uloric in January 2025 underscores the commercial fallout. Similar cardiovascular and renal risk profiles limit extended NSAID courses, prompting prescribers to favor costlier but safer mechanisms such as URAT1 inhibition or biologics, which elevates therapy costs and complicates formulary access.

Other drivers and restraints analyzed in the detailed report include:

- Biologics & next-gen URAT1 approvals (e.g., AR882, SEL-212)

- Fast-track FDA programs for refractory gout therapies

- Poor adherence owing to chronic dosing & flare paradox

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Xanthine oxidase inhibitors captured 46.34% of gout therapeutics market share in 2024 on the strength of inexpensive generic allopurinol and brand-loyal febuxostat users. The segment still expands, but its 4% CAGR lags behind URAT1 inhibitors, whose 8.12% rate is redefining the gout therapeutics market size for uricosurics. Clinical data show that URAT1 inhibition retains efficacy even when ABCG2 polymorphisms blunt allopurinol response in over 50% of patients. These genetic insights dovetail with payer interest in precision medicine, pushing formulary committees to re-evaluate step-therapy rules that historically favored xanthine oxidase inhibition.

Pipeline dynamism favors innovators. AR882 and dotinurad headline a cohort of small-molecule URAT1 agents designed for once-daily oral dosing without oxypurinol accumulation, offering renal-safe profiles and fewer drug-drug interactions. Recombinant uricase biologics hold their niche in chronic refractory gout where tophi burden is high; pegloticase revenues rose 33% year-on-year before Amgen's acquisition of Horizon Therapeutics consolidated the category reuters.com. Meanwhile, IL-1 inhibitors such as canakinumab earned an adult-flare indication in December 2023, signaling expansion of anti-inflammatory biologics that complement urate-lowering backbones. Collectively, these evolving classes continue to broaden the gout therapeutics market by offering differentiated options matched to genetic, renal, and cardiovascular profiles.

The Gout Therapeutics Market is Segmented by Drug Class (Xanthine Oxidase Inhibitors, Uricosurics, Recombinant Uricase and More), by Route of Administration (oral and Injection), Application (Acute Gout, Chronic Refractory Gout and More), and Geography (North America, Europe, Asia-Pacific and More). The Report Offers the Value (in USD Million) for the Above Segments.

Geography Analysis

North America generated 41.72% of 2024 revenue owing to early biologic adoption, broad insurance coverage, and widespread specialist availability. Treat-to-target guidelines enjoy strong professional-society endorsement, and payers often reimburse serial serum-urate tests, sustaining higher per-patient spending. The region's dominance is reinforced by active clinical-trial networks that accelerate access to investigational URAT1 inhibitors and IL-1 biologics. Nevertheless, boxed-warning fallout and febuxostat discontinuation are reshaping formularies and nudging prescribers toward emerging mechanisms.

Europe contributes steady growth as universal coverage and stringent price controls temper margins. Uptake of biosimilars is higher, and health-technology assessment bodies require robust real-world data, slowing diffusion of new entrants. Yet the continent's aging demographics and rising obesity sustain underlying demand, and centers of excellence in rheumatology produce influential guideline updates that ripple globally.

Asia-Pacific posts the highest 9.34% CAGR as rapid urbanization escalates metabolic syndrome prevalence. China's gout prevalence is climbing alongside insurance expansion, prompting local firms such as LG Chem and JW Pharmaceutical to launch URAT1 programs that combine competitive pricing with tailored genetic screening. Pacific Island nations display some of the world's highest serum-urate levels due to genetic predisposition, spurring public-health campaigns that could translate into pharmaceutical uptake once budget allocations rise. Tele-rheumatology and e-pharmacy platforms facilitate outreach to rural populations, amplifying product reach and strengthening the gout therapeutics market across diverse income strata.

South America and the Middle East/Africa together account for a smaller share today but exhibit double-digit unit growth as generics become more accessible and governments invest in non-communicable disease management. Sub-Saharan initiatives to train primary-care physicians in gout diagnosis, plus donor-funded screening programs, foreshadow future volume gains. Multinationals that localize manufacturing or deploy tiered-pricing models can capture early-mover advantages as these healthcare ecosystems mature.

- Horizon Therapeutics (Amgen)

- Takeda Pharmaceutical Co.

- AstraZeneca (Ardea Biosciences)

- Novartis

- UCB

- Sobi

- Pfizer

- Regeneron Pharmaceuticals

- Selecta Biosciences

- Arthrosi Therapeutics

- XORTX Therapeutics

- Mitsubishi Tanabe Pharma

- JW Pharmaceutical

- Atom Bioscience

- Protalix BioTherapeutics

- Teijin Pharma

- Sanofi

- Hanmi Pharmaceutical

- Horizon Biosciences (Verinurad)

- Boehringer Ingelheim

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising prevalence of gout driven by aging & obesity

- 4.2.2 Treat-to-target adoption of urate-lowering guidelines

- 4.2.3 Biologics & next-gen URAT1 approvals (e.g., AR882, SEL-212)

- 4.2.4 Fast-track FDA programs for refractory gout therapies

- 4.2.5 Pharmacogenomics & wearable sUA monitoring enable personalization

- 4.2.6 Tele-rheumatology & e-pharmacy expansion in emerging markets

- 4.3 Market Restraints

- 4.3.1 Boxed-warning safety issues for febuxostat & long-term NSAID use

- 4.3.2 Poor adherence owing to chronic dosing & flare paradox

- 4.3.3 Branded-drug withdrawals causing price erosion & lower R&D ROI

- 4.3.4 Regulatory scrutiny on purine-rich food advertising dampening demand

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Drug Class (Value)

- 5.1.1 Xanthine Oxidase Inhibitors

- 5.1.2 Uricosurics

- 5.1.3 Recombinant Uricase

- 5.1.4 Colchicine

- 5.1.5 NSAIDs

- 5.1.6 Corticosteroids

- 5.1.7 IL-1 Inhibitors

- 5.1.8 Others

- 5.2 By Route of Administration (Value)

- 5.2.1 Oral

- 5.2.2 Injectable

- 5.3 By Disease Type (Value)

- 5.3.1 Acute Gout

- 5.3.2 Chronic Refractory Gout

- 5.3.3 Tophaceous Gout

- 5.4 By Geography (Value)

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Competitive Benchmarking

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Overview, Market Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Horizon Therapeutics (Amgen)

- 6.4.2 Takeda Pharmaceutical Co.

- 6.4.3 AstraZeneca (Ardea Biosciences)

- 6.4.4 Novartis AG

- 6.4.5 UCB Pharma

- 6.4.6 Sobi

- 6.4.7 Pfizer Inc.

- 6.4.8 Regeneron Pharmaceuticals

- 6.4.9 Selecta Biosciences

- 6.4.10 Arthrosi Therapeutics

- 6.4.11 XORTX Therapeutics

- 6.4.12 Mitsubishi Tanabe Pharma

- 6.4.13 JW Pharmaceutical

- 6.4.14 Atom Bioscience

- 6.4.15 Protalix BioTherapeutics

- 6.4.16 Teijin Pharma

- 6.4.17 Sanofi

- 6.4.18 Hanmi Pharmaceutical

- 6.4.19 Horizon Biosciences (Verinurad)

- 6.4.20 Boehringer Ingelheim

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment