PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842460

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842460

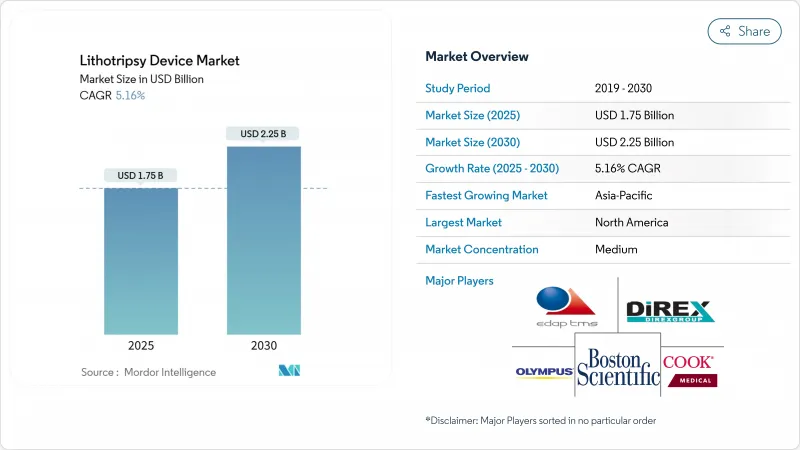

Lithotripsy Device - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The lithotripsy device market size is estimated at USD 1.75 billion in 2025, and is expected to reach USD 2.25 billion by 2030, at a CAGR of 5.16% during the forecast period (2025-2030).

The value trajectory signals an industry pivot from traditional extracorporeal shock-wave systems toward precision-guided, minimally invasive platforms that simplify workflows and raise stone-clearance rates. Growth is reinforced by advanced imaging integration, the commercial rollout of thulium-fiber and other next-generation lasers, and expanding ultrasound-based technologies that permit anesthesia-free treatment. Portable solutions are broadening point-of-care capacity, while favorable reimbursement revisions in large economies continue to shift volumes from inpatient suites to ambulatory surgical centers. Asia Pacific's infrastructure build-out, combined with regulatory modernization, is unlocking new demand pockets and diversifying geographic revenue streams within the lithotripsy device market.

Global Lithotripsy Device Market Trends and Insights

Growing Global Incidence of Kidney and Urinary Tract Stones

Stone disease prevalence is climbing across every major region due to diet shifts, sedentary habits, and dehydration patterns that potentiate mineral crystallization in urinary tracts. Shock-wave lithotripsy still posts 50-75% success among eligible patients, yet its limitations open room for modern devices that can address harder stones and wider patient profiles. Clinical trials report 88% fragmentation and nearly 49% stone-free status with burst-wave ultrasound, illustrating efficacy gains over legacy systems. Market demand consequently favors solutions that secure higher clearance in fewer sessions, reinforcing steady volume growth within the lithotripsy device market.

Continuous Technology Evolution Toward Non-Invasive, High-Precision Platforms

Thulium-fiber lasers, vortex-beam ultrasound, and optimized energy-delivery algorithms are rewriting device specifications and clinical protocols. Olympus's SOLTIVE platform lowers procedure time by 20% and boosts fragmentation efficiency by 33% compared with Holmium YAG lasers. Boston Scientific's MOSES 2.0 reduces retropulsion by 50% and enables 90% same-day discharge, making it attractive for outpatient workflows. Academic prototypes such as Lithovortex showcase low-cost ultrasound designs that promise non-invasive fragmentation for broader patient cohorts. These advances help providers elevate outcomes while trimming anesthesia use, fueling premium-priced system demand across the lithotripsy device market.

Adverse Post-ESWL Complications

Stone street formation and other side effects from shock-wave therapy remain clinical concerns, especially for lower-pole renal stones where flexible ureteroscopy achieves 90.2% stone-free rates versus ESWL's 61.5%. Manufacturer exits from the ESWL segment and clinician shifts toward endoscopic modalities illustrate growing selectivity. Although burst-wave refinements may revitalize extracorporeal offerings, safety perceptions continue to cap ESWL spend within the lithotripsy device market.

Other drivers and restraints analyzed in the detailed report include:

- Rising Adoption of Day-Care/Ambulatory Stone-Management Procedures

- Expansion of Healthcare Infrastructure and Surgical Capacity in Emerging Economies

- High Upfront and Lifecycle Costs of Lithotripsy Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Extracorporeal shock-wave units captured 53.16% of lithotripsy device market share in 2024, yet intracorporeal platforms are forecast to rise at 5.89% CAGR through 2030. Laser-based systems, especially thulium-fiber models, fragment stones twice as quickly at half the power of earlier lasers, a performance win that has shifted hospital investment priorities. Electromagnetic ESWL devices keep traction in high-volume centers because of their procedural familiarity, while piezoelectric variants carve out specialized niches where precise energy targeting is essential.

Intracorporeal advances dovetail with the broader surgical trend toward precision and minimal tissue insult. Laboratory evidence shows 92% fragmentation under optimized settings, widening clinical acceptance of these tools. Ultrasonic lithotrites with aspiration enhance percutaneous workflows, and pneumatic devices persist in difficult cases needing mechanical impact. Collectively, these dynamics lift the intracorporeal portion of the lithotripsy device market while pushing vendors to diversify portfolios beyond legacy extracorporeal units.

Stand-alone suites held 65.42% of the lithotripsy device market size in 2024, anchored by well-equipped hospital units handling complex cases with integrated imaging. Yet portable and tabletop designs are pacing the modality race with a 6.25% CAGR. Break Wave ultrasound shows how mobility and anesthesia-free performance can broaden access to emergency departments and rural clinics. The Lithovortex prototype amplifies this shift by packaging vortex-beam capability into an affordable footprint suited for budget-restricted settings.

Operational flexibility is critical. Portable systems shorten room turnover, fit multi-department use, and lower facility overhead, making them popular with ASC administrators aiming for strong throughput. Vendors are thus engineering hybrid configurations-compact enough for transport yet robust enough to integrate with fluoroscopy-ensuring continued relevance across multiple care environments within the lithotripsy device market.

The Lithotripsy Devices Market Report is Segmented by Device Type (Extracorporeal Shock-Wave Lithotripters and Intracorporeal Lithotripters), Modality (Stand-Alone Systems and Portable / Table-Top Systems), Application (Kidney Stones, Ureteral Stones, and More), End User (Hospitals, Ambulatory Surgical Centers, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 32.56% of lithotripsy device market share in 2024, supported by transparent reimbursement pathways and a dense ASC network. Hospitals exploit Medicare coding stability to justify equipment refresh cycles, while vendors enjoy receptive early-adopter physician bases. The region's robust after-sales service networks further safeguard utilization uptime, sustaining replacement demand.

Europe follows with mature yet steadily modernizing health systems. National health funds encourage minimally invasive interventions, accelerating adoption of newer lasers and portable ultrasound. Cross-border purchasing frameworks support multicountry tenders that often favor vendors offering comprehensive training and maintenance, a factor strengthening pan-regional product footprints.

Asia Pacific is forecast to grow at 7.53% CAGR thanks to infrastructure expansion, regulatory reforms, and rising per-capita income. Japan's USD 40 billion medical-device sector is investing heavily in IoT-enabled equipment that maximizes operating-room productivity. China's debt-relief strategy is unblocking hospital CAPEX budgets, and India's conduct code is fostering market transparency. Middle East & Africa plus South America trail in absolute value but are accelerating as new private hospitals and public-sector projects equip operating theaters, broadening the global footprint of the lithotripsy device market.

- Advanced MedTech (Dornier MedTech)

- Boston Scientific

- Siemens Healthineers

- Olympus Corp.

- EDAP TMS

- Storz Medical

- Karl Storz

- Beckton Dickinson

- Cook Group

- DirexGroup

- EMS Electro Medical Systems

- Lumenis

- Richard Wolf

- WIKKON (Guangzhou)

- Allengers Medical Systems

- Teleflex

- Nidhi Meditech Systems

- SonoMotion

- Elmed Medical Systems

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing global incidence of kidney and urinary tract stones

- 4.2.2 Continuous technology evolution toward non-invasive, high-precision lithotripsy platforms

- 4.2.3 Rising adoption of day-care/ambulatory stone-management procedures

- 4.2.4 Expansion of healthcare infrastructure and surgical capacity in emerging economies

- 4.2.5 Broadening reimbursement coverage for stone-fragmentation treatments across major markets

- 4.2.6 Integration of advanced imaging and navigation systems enhancing procedural success

- 4.3 Market Restraints

- 4.3.1 Adverse post-ESWL complications

- 4.3.2 Availability of URS / PCNL alternatives

- 4.3.3 High upfront and lifecycle costs of lithotripsy systems limiting capital purchases

- 4.3.4 Reimbursement disparities and budget constraints in cost-sensitive regions

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power - Buyers

- 4.6.3 Bargaining Power - Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Device Type

- 5.1.1 Extracorporeal Shock-Wave Lithotripters

- 5.1.1.1 Electrohydraulic ESWL

- 5.1.1.2 Electromagnetic ESWL

- 5.1.1.3 Piezoelectric ESWL

- 5.1.2 Intracorporeal Lithotripters

- 5.1.2.1 Laser Lithotripters

- 5.1.2.2 Ultrasonic Lithotripters

- 5.1.2.3 Pneumatic/Ballistic Lithotripters

- 5.1.2.4 Electrohydraulic Intracorporeal

- 5.1.1 Extracorporeal Shock-Wave Lithotripters

- 5.2 By Modality

- 5.2.1 Stand-alone Systems

- 5.2.2 Portable / Table-top Systems

- 5.3 By Application

- 5.3.1 Kidney Stones

- 5.3.2 Ureteral Stones

- 5.3.3 Bladder Stones

- 5.3.4 Bile-duct Stones

- 5.3.5 Pancreatic Stones

- 5.3.6 Salivary-gland Stones

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Ambulatory Surgical Centers

- 5.4.3 Specialty Clinics

- 5.4.4 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Advanced MedTech (Dornier MedTech)

- 6.3.2 Boston Scientific Corp.

- 6.3.3 Siemens Healthineers AG

- 6.3.4 Olympus Corp.

- 6.3.5 EDAP TMS

- 6.3.6 Storz Medical AG

- 6.3.7 Karl Storz SE & Co. KG

- 6.3.8 Becton, Dickinson and Co.

- 6.3.9 Cook Medical LLC

- 6.3.10 DirexGroup

- 6.3.11 EMS Electro Medical Systems

- 6.3.12 Lumenis Be Ltd.

- 6.3.13 Richard Wolf GmbH

- 6.3.14 WIKKON (Guangzhou)

- 6.3.15 Allengers Medical Systems

- 6.3.16 Teleflex Incorporated

- 6.3.17 Nidhi Meditech Systems

- 6.3.18 SonoMotion

- 6.3.19 Elmed Medical Systems

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment