PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842464

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842464

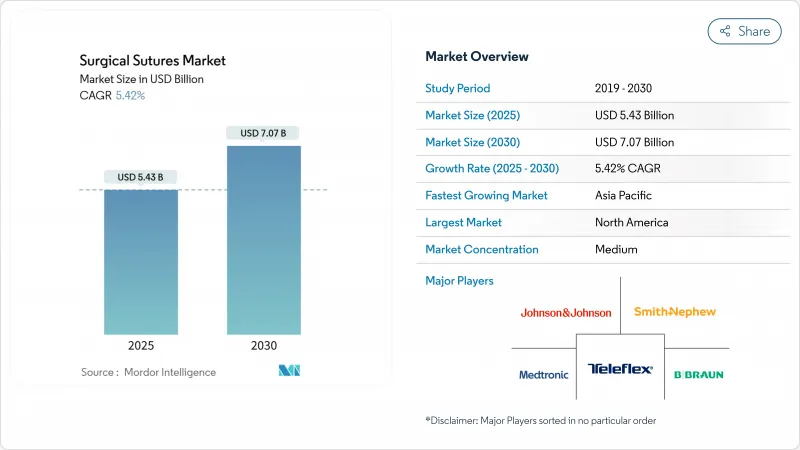

Surgical Sutures - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The surgical sutures market size stands at USD 5.43 billion in 2025 and is on track to reach USD 7.07 billion by 2030, advancing at a 5.42% CAGR.

Rising global surgical volumes, the growing footprint of ambulatory surgical centers and rapid uptake of knotless barbed sutures are reinforcing demand across specialties. Product innovation is shifting toward synthetic absorbable materials with embedded antimicrobials, while Healthcare 4.0 initiatives are integrating digital supply-chain tracking to head off shortages and recall risks. Robot-assisted procedures, now commonplace in high-income countries, are pushing manufacturers to tailor constructions that secure tissue under minimal tactile feedback. Asia-Pacific is accelerating fastest, yet North America remains the single-largest revenue pool thanks to sustained reimbursement support for advanced wound-closure devices.

Global Surgical Sutures Market Trends and Insights

Surging global surgical volumes driven by ageing and chronic-disease burden

Medicare beneficiaries underwent 3.4 million outpatient surgeries in 2024, a 5.7% year-over-year rise that mirrors a wider uptick across advanced economies. Population ageing and rising cardiovascular and oncological case loads are shifting many interventions from last resort to first-line treatment. Sutures for cardiovascular surgery alone is forecast to expand at 5.81% CAGR, requiring sutures that withstand pulsatile stress without compromising hemostasis. Capacity buildouts in emerging Asia are broadening access, channeling additional procedures into the surgical sutures market.

Rise of robot-assisted surgery requiring specialized barbed sutures

Barbed sutures record 7.23% CAGR because their self-anchoring design mitigates knot-tying in robotic environments where tactile feedback is limited. Clinical evaluations of Johnson & Johnson's STRATAFIX line found measurable operating-room time savings alongside reduced blood loss. Continued FDA clearances for microsurgical robotic systems are widening the addressable field, encouraging suppliers to engineer finer gauges and bidirectional barb geometries that anchor tissue evenly.

Growing use of staplers, sealants and MIS techniques reducing suture counts

Stapling platforms now incorporate textured jaws that grip delicate tissue and finish closures in seconds, chipping away at traditional suture volumes. Elastic sealants suitable for meniscus and lung incisions are likewise cutting the number of passes required per closure, particularly in minimally invasive surgery where trocar ports limit needle maneuverability.

Other drivers and restraints analyzed in the detailed report include:

- Rapid material-science advances enabling stronger synthetic absorbable sutures

- Demand for antimicrobial and drug-eluting sutures amid SSI-reduction mandates

- Needle-stick infection and workplace-safety concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Absorbable formats generated 60.46% of surgical sutures market size in 2024, advancing at 5.67% CAGR as hospitals seek products that dissolve post-healing and spare patients follow-up removal. The synthetic sub-segment, led by polyglactin and polydioxanone, benefits from uniform absorption profiles that translate to predictable healing curves. Many of these lines carry antimicrobial triclosan coatings that reduce SSI risk. Non-absorbables remain indispensable in cardiovascular and orthopedic procedures but show slower expansion as sealants encroach on applications once reserved for permanent support. Catgut availability is tightening because of ethical sourcing scrutiny, prompting laboratories to explore albumin-based proteins that break down cleanly without triggering inflammation.

The development pipeline is crowded with electrospun absorbables that integrate antibiotic or growth-factor reservoirs. These fibers deliver a local therapeutic payload while retaining minimum knot-pull strength for up to four weeks, a specification attractive to outpatient centers focused on fast discharge. Though natural silk still finds use in select dentistry cases, its higher bacterial adherence is slowing wider uptake. Premium synthetic lines therefore capture a greater share of the surgical sutures market by positioning on infection reduction, staff convenience and patient comfort.

Multifilament braids controlled 59.38% of the surgical sutures market size in 2024, thanks to superior pliability and knot security. However, barbed formats lead growth at 7.23% CAGR because their self-gripping texture removes the knotting step, lowering operation time in laparoscopic and robot-assisted fields. Early clinical programs validated barbed sutures in plastic surgery, but expanded clearances now cover gynecology and digestive procedures, boosting unit demand. Investment continues in bidirectional barbs that lock tissue from the mid-point outward, spreading tension evenly and cutting foreign-body load.

Monofilaments persist in vascular grafting where low drag and smooth passage are decisive. New surface-treated monofilaments combine nano-scale texturing with antibacterial ions, ensuring microbial resistance without sacrificing flexibility. Collectively these refinements heighten the surgical sutures market appeal of premium constructions that maximize theater efficiency and postoperative outcomes.

The Surgical Sutures Market Report is Segmented by Product Type (Absorbable Sutures [Natural and Synthetic] and More), Construction (Monofilament and More), Application (General Surgery and More), Distribution Channel (Offline and More), Coating (Uncoated and Coated), End-User (Hospitals and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 42.53% of global revenue in 2024 and is forecast to add USD 0.82 billion in incremental value by 2030. Medicare's USD 6.8 billion outlay on ASC services evidences resilient procedural demand, while FDA vigilance over pediatric shortages is prompting dual-sourcing agreements that stabilize supplies. Home-grown giants such as Johnson & Johnson funneled USD 1.3 billion into surgical-instrument R&D during 2025, cementing the region's innovation leadership.

Europe advances at 5.28% CAGR on the back of aging demographics and harmonized CE-mark pathways. Sustainability targets are steering purchasing committees toward biodegradable synthetics that minimize environmental burden. Eastern European expansion programs create uptake for mid-tier products, balancing premium innovation seen in Germany and France.

Asia-Pacific records the highest 6.19% CAGR as health-insurance coverage widens and procedure volumes surge in China and India. Local manufacturers are scaling polypropylene and polyglactin lines to cut import reliance, thereby expanding the addressable surgical sutures market size for regional suppliers. Middle East & Africa's 5.74% CAGR is buoyed by multi-specialty hospital projects, while South America's 5.65% trajectory reflects improving healthcare access in Brazil and Argentina.

- Alfresa Holdings Corporation

- Assut Medical SA

- B. Braun

- Boston Scientific

- CONMED Corp.

- DemeTECH Corp.

- Dolphin Sutures

- Gunze Limited

- Healthium Medtech Ltd

- Integra LifeSciences

- International Fiber Corporation

- Johnson & Johnson

- Kono Seisakusho Co. Ltd.

- Lotus Surgicals Pvt Ltd

- Mani Inc.

- Medtronic

- Mellon Medical

- Orion Sutures India Pvt Ltd

- Peters Surgical

- Shanghai Pudong Jinhuan Medical Products Co., Ltd.

- Smiths Group

- Surgical Specialties Corp.

- Teleflex

- Unisur Lifecare

- Weigao Meidcal international Co., Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging global surgical volumes driven by ageing & chronic-disease burden

- 4.2.2 Expansion of healthcare facilities in emerging economies is driving high-volume day surgeries

- 4.2.3 Rise of robot-assisted / image-guided surgery requiring specialized barbed sutures

- 4.2.4 Rapid material science advances enabling stronger synthetic absorbable sutures

- 4.2.5 Demand for antimicrobial & drug-eluting sutures amid SSI-reduction mandates

- 4.2.6 Favorable reimbursement & device-approval pathways in key markets

- 4.3 Market Restraints

- 4.3.1 Growing use of staplers, sealants & MIS techniques reducing suture counts

- 4.3.2 ESG-driven shortages of catgut/silk & specialty polymers

- 4.3.3 Recalls & stricter quality-system audits raising compliance costs

- 4.3.4 Needle-stick infection & workplace-safety concerns

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Absorbable Sutures

- 5.1.1.1 Natural

- 5.1.1.1.1 Catgut

- 5.1.1.1.2 Collagen

- 5.1.1.2 Synthetic

- 5.1.1.2.1 Vicryl

- 5.1.1.2.2 Polyglycolic acid (PGA)

- 5.1.1.2.3 Other Absorbable Synthetic Sutures

- 5.1.2 Non-absorbable Sutures

- 5.1.2.1 Nylon

- 5.1.2.2 Polypropylene

- 5.1.2.3 Polyester

- 5.1.2.4 Silk

- 5.1.2.5 Other Non-absorbable Sutures

- 5.1.1 Absorbable Sutures

- 5.2 By Construction

- 5.2.1 Monofilament

- 5.2.2 Multifilament

- 5.2.3 Barbed Sutures

- 5.3 By Application

- 5.3.1 General Surgery

- 5.3.2 Cardiovascular Surgery

- 5.3.3 Orthopedic Surgery

- 5.3.4 Ophthalmic Surgery

- 5.3.5 Neurological Surgery

- 5.3.6 Obstetrics & Gynecology

- 5.3.7 Dental & Oral Surgery

- 5.3.8 Plastic & Cosmetic Surgery

- 5.3.9 Other Applications

- 5.4 By Distribution Channel

- 5.4.1 Direct Tender / GPO

- 5.4.2 Offline

- 5.4.3 Online

- 5.5 By Coating

- 5.5.1 Uncoated

- 5.5.2 Coated

- 5.6 By End-User

- 5.6.1 Hospitals

- 5.6.2 Ambulatory Surgical Centers

- 5.6.3 Other End-Users

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Spain

- 5.7.2.6 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 India

- 5.7.3.3 Japan

- 5.7.3.4 Australia

- 5.7.3.5 South Korea

- 5.7.3.6 Rest of Asia-Pacific

- 5.7.4 Middle East and Africa

- 5.7.4.1 GCC

- 5.7.4.2 South Africa

- 5.7.4.3 Rest of Middle East and Africa

- 5.7.5 South America

- 5.7.5.1 Brazil

- 5.7.5.2 Argentina

- 5.7.5.3 Rest of South America

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Competitive Benchmarking

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Alfresa Holdings Corporation

- 6.4.2 Assut Medical SA

- 6.4.3 B. Braun Melsungen AG

- 6.4.4 Boston Scientific Corp.

- 6.4.5 CONMED Corp.

- 6.4.6 DemeTECH Corp.

- 6.4.7 Dolphin Sutures

- 6.4.8 Gunze Limited

- 6.4.9 Healthium Medtech Ltd

- 6.4.10 Integra LifeSciences Corporation

- 6.4.11 International Fiber Corporation

- 6.4.12 Johnson & Johnson Services, Inc.

- 6.4.13 Kono Seisakusho Co. Ltd.

- 6.4.14 Lotus Surgicals Pvt Ltd

- 6.4.15 Mani Inc.

- 6.4.16 Medtronic plc

- 6.4.17 Mellon Medical BV

- 6.4.18 Orion Sutures India Pvt Ltd

- 6.4.19 Peters Surgical

- 6.4.20 Shanghai Pudong Jinhuan Medical Products Co., Ltd.

- 6.4.21 Smith & Nephew plc

- 6.4.22 Surgical Specialties Corp.

- 6.4.23 Teleflex Incorporated

- 6.4.24 Unisur Lifecare Pvt. Ltd.

- 6.4.25 Weigao Meidcal international Co., Ltd

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment