PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842480

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842480

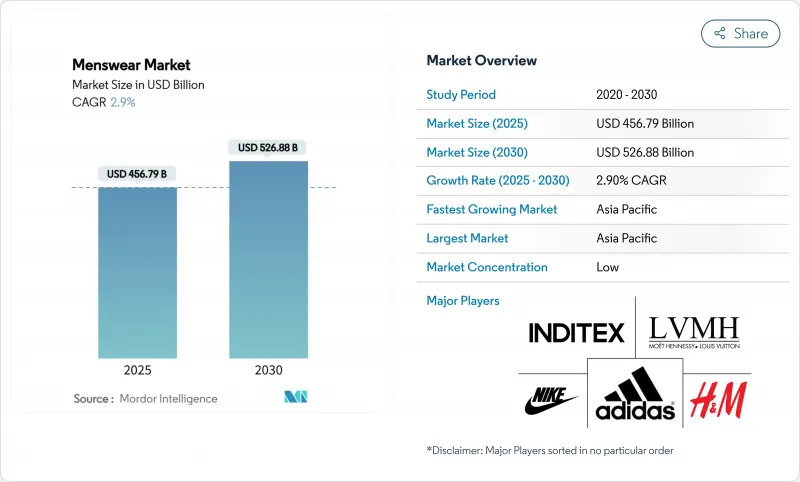

Menswear - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

In 2025, the men's apparel market is estimated to be USD 456.79 billion and is projected to grow to USD 526.88 billion by 2030, reflecting a steady 2.90% CAGR during the forecast period.

Although the growth trajectory is moderate, significant strategic developments are shaping the market landscape. The Asia-Pacific region, driven by robust economic growth and rapid urbanization, is witnessing a shift toward premiumization as consumers increasingly seek higher-quality apparel. Concurrently, the rise of e-commerce is steadily eroding the dominance of traditional retail formats, offering consumers greater convenience and variety. Sustainability, which was once a niche focus, has now become a mainstream priority, with brands integrating eco-friendly practices into their operations. Additionally, advancements in fabric engineering are transforming garments into high-performance products that cater to evolving consumer demands. The competitive landscape is intensifying as direct-to-consumer brands expand rapidly, challenging established players to accelerate their digital transformation efforts and optimize supply chain operations to maintain market relevance.

Global Menswear Market Trends and Insights

Favourable Government Initiatives to Promote Sports Culture

Government initiatives aimed at boosting sports participation are reshaping the landscape of men's apparel. This shift is not just fueling demand for traditional athletic wear but is also infusing everyday fashion with performance attributes. Take Japan, for instance: sports participation surged from 60.4% in 2020 to 66.3% in 2023 . The Tokyo Metropolitan Government's capital allocation in sports infrastructure, community fitness programs, and awareness campaigns has generated substantial market expansion. These investments have increased consumer demand, particularly in athleisure products that integrate performance features with everyday wear. Similarly, South Korea's Ministry of Culture, Sports and Tourism has implemented the "Sport for All" initiative to increase public physical activity, resulting in higher demand for versatile men's apparel. In Europe, government regulations supporting cycling, walking, and other physical activities have generated market demand for breathable, moisture-wicking, and ergonomic clothing suitable for both exercise and daily activities. The incorporation of sportswear into everyday fashion has emerged as a key market segment. Performance materials, including stretchable nylon blends, recycled polyester, and moisture-wicking merino wool, previously restricted to athletic wear, are now standard components in casual clothing like polos, chinos, and outerwear. Manufacturers are implementing UV protection, anti-odor technology, and climate-adaptive materials into standard menswear product lines.

Demand for Sustainable Products

The sustainable fashion market is expanding as consumer environmental consciousness increases. The fashion industry currently accounts for approximately 10% of global carbon emissions and 20% of wastewater production, necessitating brands to optimize growth while maintaining environmental responsibility. Regulatory frameworks are facilitating this transformation, with the European Commission's Circular Economy Action Plan mandating EU Member States to implement separate textile waste collection systems by January 2025. This regulation requires brands to implement circular business models, including resale, rental, and recycling operations. The EU Strategy for Sustainable and Circular Textiles reinforces this transition through eco-design requirements, supply chain transparency measures, and enhanced greenwashing penalties. Companies are implementing alternative materials, including mycelium leather, seaweed fiber, lab-grown textiles, and closed-loop cotton, to minimize water consumption and chemical usage. Companies such as Patagonia, Stella McCartney, and PANGAIA incorporate sustainability across their operations, from research to manufacturing. Major fast fashion retailers H&M and Zara have responded by developing sustainable collections like "Conscious" and "Join Life," though industry analysts indicate that more substantial, systematic changes are required.

Proliferation of Counterfeit Products

Counterfeit products have evolved into major market disruptors, impacting business operations beyond quality control and compliance issues. In emerging markets, consumers purchase counterfeits as cost-effective alternatives and status symbols. This market behavior affects brand equity and product authenticity standards. E-commerce expansion has increased counterfeit distribution through fragmented global supply chains with limited oversight. In FY 2023, U.S. Customs and Border Protection data showed China representing 66% of counterfeit seizures, with 90% identified in international mail and express courier operations, highlighting online marketplace vulnerabilities. Additionally, market monitoring revealed significant counterfeiting activities, exemplified by UK authorities' confiscation of counterfeit football shirts valued at GBP 450,000 (USD 573,000) during Euro 2024. Thus, organizations are implementing technical solutions, including blockchain verification systems, AI-based counterfeit identification, and strategic consumer awareness programs. Addressing counterfeit products requires an integrated approach incorporating technology implementation, consumer behavior analysis, and regulatory framework enhancement.

Other drivers and restraints analyzed in the detailed report include:

- Influence of Social Media Platforms and Celebrity Endorsement

- Technological Advancements in Fabric and Design

- Supply Chain Disruptions, Especially in Sourcing and Logistics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, shirts command an 18.46% share of the men's apparel market, a testament to the evolving workplace dress code that melds formal and casual styles. This evolution has elevated shirts to versatile staples, effortlessly transitioning from boardroom meetings to social gatherings. Innovations in fabric technology-like wrinkle resistance, four-way stretch, and temperature control-have heightened their allure. Moreover, the advent of smart fabrics, which can monitor biometrics or adapt to body temperature, adds a functional edge, drawing in tech-savvy consumers. In response, brands are offering tailored fits, eco-friendly materials such as organic cotton and TENCEL(TM), and digital shopping enhancements like AR-driven size suggestions, solidifying shirts' status as essential modern wardrobe pieces.

Simultaneously, jackets, sweatshirts, and hoodies are set to witness the swiftest growth, projected to rise at a 3.25% CAGR from 2025 to 2030. This surge is fueled by a consumer pivot towards multifunctional, comfortable outerwear that caters to hybrid lifestyles. Benefiting from the trend of casualization in both professional and leisure settings, these garments are crafted for layering, year-round wear, and travel versatility. Sustainability plays a pivotal role in this growth, especially in hoodies, with materials like recycled polyester, hemp blends, bamboo viscose, and organic cotton gaining prominence. Brands are venturing into modular designs, featuring removable linings and convertible attributes, targeting minimalist and eco-aware shoppers. With Gen Z and millennials emphasizing purpose in their purchases, these outerwear pieces are increasingly viewed as not merely fashion statements but as reflections of values centered on comfort, utility, and environmental consciousness.

In 2024, the mass segment dominates the market with a 67.34% share, driven by its ability to achieve economies of scale and offer accessible products to a wide consumer base. Technological advancements have significantly enhanced the segment, enabling mass-market brands to deliver high-quality, well-designed products at affordable price points. Regulatory frameworks, such as the European Commission's Strategy for Sustainable and Circular Textiles, are reshaping the segment by mandating design standards that prioritize durability and recyclability. For example, H&M reported that 89% of the materials used in their 2024 collections were either recycled or sustainably sourced, showcasing the growing integration of sustainability in mass-market offerings. Additionally, brands in this segment are heavily investing in supply chain transparency and ethical manufacturing practices to meet rising consumer expectations and comply with global sustainability goals.

The premium segment, while smaller in size, is poised for faster growth, with a projected CAGR of 3.75% during the 2025-2030 forecast period. This growth reflects a notable shift in consumer preferences toward products that emphasize quality, longevity, and alignment with ethical and sustainable values. Consumers are increasingly willing to pay higher prices for premium products that resonate with their values, particularly as awareness of sustainable and ethical production practices continues to rise. The segment is also benefiting from the expanding global middle class and increasing disposable incomes in emerging markets, where consumers view premium products as both status symbols and long-term investments. Luxury brands are further strengthening their market position by incorporating advanced technologies, such as smart textiles, enhanced performance features, and personalized customization options, which not only justify premium pricing but also create unique value propositions that differentiate them from competitors.

The Global Menswear Market Report Segments the Industry by Product Type (Trousers, Jeans, T-Shirts, Shirts, Shorts, and More), Category (Mass and Premium), Fabric (Cotton, Polyester, Nylon, Denim, and Others), Distribution Channel (Offline Stores and Online Stores), and Geography (North America, South America, Europe, Asia-Pacific, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2024, Asia-Pacific commands a dominant 35.87% share of the global men's apparel market and is set to maintain a vigorous pace with a projected 5.02% CAGR through 2030. This growth momentum is fueled by swift urbanization, the digitalization of retail, and a burgeoning middle class-especially in India, China, and Southeast Asia-craving diverse and affordable apparel. The World Bank data indicates that Macao, Singapore, and Hong Kong maintained fully urbanized populations in 2023, with Japan registering 92.04% urbanization and New Zealand following at 86.99% . Besides, initiatives like India's Production-Linked Incentive (PLI) scheme and the PM MITRA initiative are amplifying domestic manufacturing and boosting apparel exports. China's consumer base is transitioning from basic needs to aspirational and premium choices, bolstering both mass-market and luxury segments. Additionally, Southeast Asia, with its low labor costs, favorable trade policies, and rising FDI-especially in garment hubs like Vietnam and Indonesia-is carving out a significant niche. China, while still a cornerstone of the global apparel supply chain with USD 10.63 billion in U.S. knit or crocheted apparel imports in 2024 as per UN Comtrade, is witnessing a gradual erosion of its dominance.

North America holds a significant market share, driven by high disposable incomes and a strong inclination toward premium and athleisure apparel, with U.S. consumers in particular showing consistent demand for branded jeans, shirts, and jackets. Europe follows closely, benefiting from the region's rich fashion heritage and the prominence of luxury and designer labels that attract both domestic shoppers and international tourists, especially in fashion hubs like Italy, France, and the United Kingdom.

Meanwhile, South America demonstrates a growing appetite for menswear as urbanization and rising middle-class incomes increase spending on modern, Western-style apparel, although economic instability in key markets like Brazil can create fluctuations in demand. In the Middle East and Africa, traditional attire still holds importance, but rapid retail expansion, international brand entries, and shifting cultural norms are accelerating sales of contemporary menswear styles, particularly in Gulf Cooperation Council (GCC) countries, where young male consumers are increasingly seeking premium and trendy clothing options that align with global fashion trends.

- Adidas Group

- Gap Inc.

- Nike Inc.

- PVH Corp.

- Fast Retailing Co., Ltd. (UNIQLO)

- H&M Hennes & Mauritz AB

- Inditex S.A. (Zara Man)

- Kering SA

- LVMH Moet Hennessy Louis Vuitton SE

- Ralph Lauren Corporation

- Levi Strauss & Co. (LS&Co.)

- Under Armour, Inc.

- Lululemon Athletica Inc.

- VF Corporation

- Puma SE

- ASICS Corporation

- American Eagle Outfitters Inc.

- Abercrombie & Fitch Co.

- Pentland Group (JD Sports Fashion)

- Gildan Activewear Inc.

- Carhartt, Inc.

- Valentino S.p.A.

- Oxford Industries, Inc. (Tommy Bahama)

- Punto Fa, S.L. (Mango)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Favorable Government Initiatives to Promote Sports Culture

- 4.2.2 Demand for Sustainable Products

- 4.2.3 Influence of Social Media Platforms and Celebrity Endorsement

- 4.2.4 Technological Advancements in Fabric and Design

- 4.2.5 Globalisation of Fashion Trends

- 4.2.6 Expansion of E-commerce Platforms and Online Shopping

- 4.3 Market Restraints

- 4.3.1 Proliferation of Counterfeit Products

- 4.3.2 Supply Chain Disruptions, Especially in Sourcing and Logistics

- 4.3.3 Rising Raw Material Costs Impacting Profit Margins for Manufacturers

- 4.3.4 Economic Downturns Leading to Reduced Consumer Spending on Apparel

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Trousers

- 5.1.2 Jeans

- 5.1.3 T-Shirts

- 5.1.4 Shirts

- 5.1.5 Shorts

- 5.1.6 Jackets, Sweartshirt and Hoddies

- 5.1.7 Innerwear

- 5.1.8 Other Product Types

- 5.2 By Category

- 5.2.1 Mass

- 5.2.2 Premium

- 5.3 By Fabric Material

- 5.3.1 Cotton

- 5.3.2 Polyester

- 5.3.3 Nylon

- 5.3.4 Denim

- 5.3.5 Other Fabric Types

- 5.4 By Distribution Channel

- 5.4.1 Offline Stores

- 5.4.2 Online Stores

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Colombia

- 5.5.2.4 Chile

- 5.5.2.5 Peru

- 5.5.2.6 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 Italy

- 5.5.3.4 France

- 5.5.3.5 Netherlands

- 5.5.3.6 Poland

- 5.5.3.7 Belgium

- 5.5.3.8 Sweden

- 5.5.3.9 Spain

- 5.5.3.10 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 Australia

- 5.5.4.5 Indonesia

- 5.5.4.6 South Korea

- 5.5.4.7 Thailand

- 5.5.4.8 Singapore

- 5.5.4.9 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Adidas Group

- 6.4.2 Gap Inc.

- 6.4.3 Nike Inc.

- 6.4.4 PVH Corp.

- 6.4.5 Fast Retailing Co., Ltd. (UNIQLO)

- 6.4.6 H&M Hennes & Mauritz AB

- 6.4.7 Inditex S.A. (Zara Man)

- 6.4.8 Kering SA

- 6.4.9 LVMH Moet Hennessy Louis Vuitton SE

- 6.4.10 Ralph Lauren Corporation

- 6.4.11 Levi Strauss & Co. (LS&Co.)

- 6.4.12 Under Armour, Inc.

- 6.4.13 Lululemon Athletica Inc.

- 6.4.14 VF Corporation

- 6.4.15 Puma SE

- 6.4.16 ASICS Corporation

- 6.4.17 American Eagle Outfitters Inc.

- 6.4.18 Abercrombie & Fitch Co.

- 6.4.19 Pentland Group (JD Sports Fashion)

- 6.4.20 Gildan Activewear Inc.

- 6.4.21 Carhartt, Inc.

- 6.4.22 Valentino S.p.A.

- 6.4.23 Oxford Industries, Inc. (Tommy Bahama)

- 6.4.24 Punto Fa, S.L. (Mango)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK