PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842481

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842481

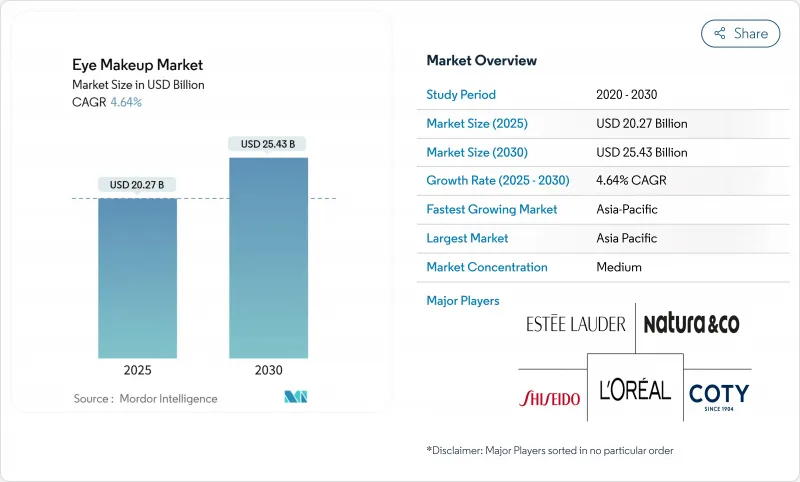

Eye Makeup - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The eye makeup market size is estimated at USD 20.27 billion in 2025, and is expected to reach USD 25.43 billion by 2030, at a CAGR of 4.64% during the forecast period (2025-2030).

Urban living, increased workforce participation by women, and the rise of male grooming habits have transformed eye makeup from an occasional indulgence to a staple for many shoppers. Second, premium SKUs now account for a rising share of the eye makeup market because consumers accept higher ticket prices that bundle hybrid benefits such as skin care actives and 24-hour wear. Third, brands have contained input cost pressure by modular packaging, leaner supplier rosters, and faster product cycles, allowing margin stability even when commodity costs fluctuate. Together, these dynamics create a market in which volume growth and higher average selling prices move in tandem, underpinning robust revenue expansion.

Global Eye Makeup Market Trends and Insights

Growing Emphasis on Personal Grooming and Aesthetics

The growing emphasis on personal appearance has shifted eye makeup from an occasional accessory to a daily necessity for many consumers. This change is particularly pronounced among younger demographics, who perceive makeup as a means of self-expression rather than solely a beauty product. The rise of virtual meetings and online interactions has heightened the relevance of eye makeup, as eyes have become the primary focus of communication during mask-wearing periods. This behavioral shift has proven resilient, with L'Oreal reporting that consumers continue to prioritize eye makeup even after the lifting of mask mandates. Furthermore, the trend is expanding beyond traditional consumer segments, with men's eye makeup emerging as a key growth area, particularly in Asian markets where gender-fluid beauty concepts are gaining widespread acceptance. In response, brands are introducing specialized formulations and launching targeted marketing campaigns to address this growing market segment.

Sustainability and Clean Beauty Preferences

The rising demand for natural pigments and cruelty-free testing protocols is driving growth in the natural/organic sub-segment of the eye makeup market, surpassing historical growth rates. Ingredient transparency dashboards, now a standard feature on brand websites, are bridging the information gap between manufacturers and consumers. Furthermore, regulatory tightening, once viewed as a cost challenge, has become a strategic advantage for early adopters who comply with or exceed regulatory standards. Companies embracing clean beauty practices are also reporting lower product return rates, indicating improved consumer satisfaction. For instance, in January 2022, Maybelline New York launched a new Conscious Together sustainability initiative, under which it just launched its Green Edition makeup line, including an eye makeup range made without animal-derived ingredients and containing 95% bio-based formulations and 70% natural-origin ingredients.

Consumer Concerns Over Product Safety and Ingredients

Heightened safety concerns are emerging as a significant restraint in the eye makeup market, driven by growing consumer awareness of health risks linked to specific ingredients and formulations. The FDA has identified key risks in eye cosmetics, including microbial contamination and the presence of harmful substances such as lead and asbestos. A 2024 FDA survey reported that 8% of eye area cosmetics contained microorganism levels exceeding recommended thresholds, raising questions about the effectiveness of preservation systems, particularly in products marketed as "preservative-free" . Beyond microbial contamination, safety concerns also include allergic reactions and ocular irritation, with studies indicating that eye cosmetics can disrupt tear film stability and contribute to dry eye symptoms. In response to these challenges, the regulatory environment is evolving.

Other drivers and restraints analyzed in the detailed report include:

- Influence of Social Media Platforms and Beauty Influencers

- Innovation in Product Formulation and Applicators

- Counterfeit Products Affecting Brand Reputation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, eye liner captured a dominant 33.61% share of the eye makeup market, underscoring its foundational role across diverse price points. This consistent demand has led brands to prioritize innovations in applicator ergonomics over radical formula changes. Notably, even minor enhancements, like faster-drying vegan formulas, significantly bolster brand loyalty, as consumers tend to stick with their preferred liner once satisfied.

Forecasted to grow at a 4.83% CAGR from 2025 to 2030, eye shadow is set to outpace the broader eye makeup industry's growth. The introduction of cream-to-powder textures addresses fallout concerns, appealing to novice users. Furthermore, the segment's heightened colour intensity suggests a shift in consumer perception: natural aesthetics and bold artistry are no longer seen as opposites. Instead, consumers fluidly navigate between the two, creating a richer palette diversity.

In 2024, mass products will account for 64.71% of the eye makeup market size, driven by extensive supermarket distribution and affordable pricing. Enhanced pigment stability has reduced the performance gap with premium products, enabling mass brands to retain customers who are considering an upgrade. Promotional strategies, such as 'buy-one-get-one' offers, have proven effective in driving unplanned purchases, thereby increasing overall sales during peak holiday periods.

The premium product segment is projected to grow at a 5.32% CAGR through 2030, leveraging experiential retail formats and subscription boxes that lower barriers to product trials. Hybrid formulations combining skincare and color justify higher price points, shifting revenue share toward the premium segment despite a smaller unit share. The segment's accelerated growth reflects a rising trend of consumers spending more on self-reward occasions.

The Eye Makeup Market Report is Segmented by Product Type (Eye Liner, Eye Shadow, Mascara, Other Product Types), Category (Premium and Mass Products), Ingredients (Conventional/Synthetic and Natural/Organics), Distribution Channel (Hypermarket/Supermarket, Specialty Store, and More), and Geography (North America, Europe, Asia-Pacific, and More). Market Sizing is Presented in USD Value Terms for all the Abovementioned Segments.

Geography Analysis

In 2024, Asia-Pacific commands the eye makeup market with a 32.63% share and is set to lead with a projected growth rate of 7.61% CAGR from 2025-2030. This surge is attributed to the region's vast population, rising disposable incomes, and heightened beauty consciousness. China's beauty landscape is rapidly evolving, with domestic brands carving a niche through innovative formulations and culturally attuned marketing. In China, the eye makeup trend leans towards products that not only accentuate natural features but also offer skincare benefits, echoing the nation's longstanding emphasis on skin health. Meanwhile, Japan and South Korea are at the forefront of innovation, especially in product formulations and packaging. Notably, Korean brands are broadening their global reach, capitalizing on distinctive product concepts and savvy digital marketing.

North America, while boasting a mature market, is a hotbed for innovation, especially with premium and masstige products. Digital platforms, especially social media and influencer marketing, are pivotal in shaping product discovery and consumer purchasing habits. As consumers become more discerning about ingredient transparency and corporate environmental practices, sustainability and clean beauty emerge as dominant market drivers. Regulatory changes, like Washington State's Toxic-Free Cosmetics Act set to take effect in January 2025, are reshaping the landscape by banning certain chemicals in cosmetics, potentially altering formulation strategies nationwide.

Europe, bolstered by contributions from both its Western and Eastern regions, remains a key player in the eye makeup arena. The continent's stringent regulatory standards, especially around ingredient safety and sustainability, have hastened the shift towards clean beauty. European consumers' preference for natural ingredients and eco-friendly packaging is spurring innovation. There's also a rising demand for eye makeup that marries skincare benefits with cosmetic appeal. Brands are increasingly turning to augmented reality and virtual try-on technologies, reshaping online shopping experiences. L'Oreal's 2024 growth in Europe, outpacing the broader beauty market, underscores the region's enduring allure for eye makeup products, even amidst economic headwinds.

- Chanel SA

- The Estee Lauder Companies Inc.

- LVMH Moet Hennessy Louis Vuitton

- Coty Inc.

- L'Oreal SA

- Puig SL

- Shiseido Co. Ltd.

- Natura & Co. Holding SA

- Revlon Inc.

- e.l.f. Beauty Inc

- Amorepacific Corp.

- Beiersdorf AG

- Shahnaz Husain Group

- Oriflame Cosmetics AG

- Kering SA (Gucci Beauty)

- Nykaa Cosmetics

- Lotus Herbal

- Kao Corporation

- Bio Veda Action Research

- Unilever Plc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Emphasis on Personal Grooming and Aesthetics

- 4.2.2 Sustainability and Clean Beauty Preferences

- 4.2.3 Influence of Social Media Platforms and Beauty Influencers

- 4.2.4 Innovation in Product Formulation and Applicators

- 4.2.5 Increasing Disposable Income Boosting Premium Product Adoption

- 4.2.6 Growing Popularity of E-commerce Platforms for Beauty Products

- 4.3 Market Restraints

- 4.3.1 Consumer Concerns Over Product Safety and Ingredients

- 4.3.2 Counterfeit products affecting brand reputation

- 4.3.3 High Product Costs Limiting Consumer Adoption

- 4.3.4 Stringent Regulatory Standards Impacting Market Growth

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Eye Shadow

- 5.1.2 Eye Liner

- 5.1.3 Mascara

- 5.1.4 Other Product Types

- 5.2 By Category

- 5.2.1 Premium Products

- 5.2.2 Mass Products

- 5.3 By Ingredient

- 5.3.1 Conventional/Synthetic

- 5.3.2 Natural/Organic

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets/Hypermarket

- 5.4.2 Specialty Stores

- 5.4.3 Online Retail Stores

- 5.4.4 Others Distribution Channel

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Chanel SA

- 6.4.2 The Estee Lauder Companies Inc.

- 6.4.3 LVMH Moet Hennessy Louis Vuitton

- 6.4.4 Coty Inc.

- 6.4.5 L'Oreal SA

- 6.4.6 Puig SL

- 6.4.7 Shiseido Co. Ltd.

- 6.4.8 Natura & Co. Holding SA

- 6.4.9 Revlon Inc.

- 6.4.10 e.l.f. Beauty Inc

- 6.4.11 Amorepacific Corp.

- 6.4.12 Beiersdorf AG

- 6.4.13 Shahnaz Husain Group

- 6.4.14 Oriflame Cosmetics AG

- 6.4.15 Kering SA (Gucci Beauty)

- 6.4.16 Nykaa Cosmetics

- 6.4.17 Lotus Herbal

- 6.4.18 Kao Corporation

- 6.4.19 Bio Veda Action Research

- 6.4.20 Unilever Plc

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK