PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842487

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842487

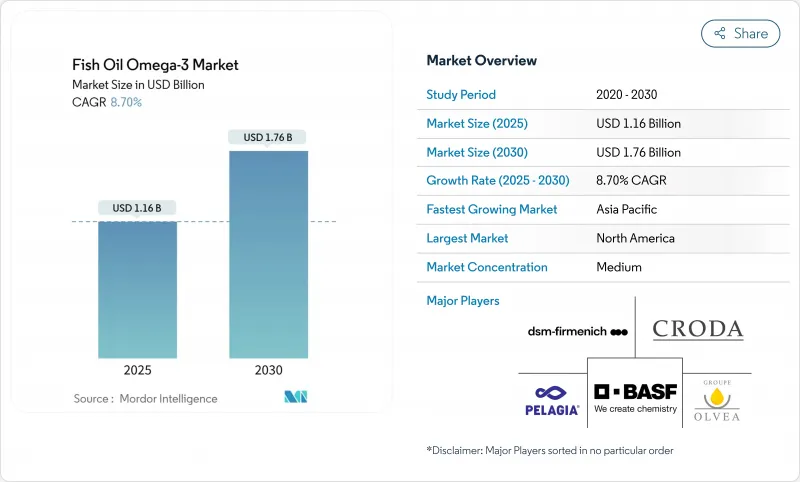

Fish Oil Omega-3 - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The fish oil omega-3 market size is estimated at USD 1.16 billion in 2025, and is projected to reach USD 1.76 billion by 2030, exhibiting a CAGR of 8.70% during the forecast period.

Increased awareness of the health benefits of fish products and dietary supplements has driven consumer demand, boosting the fish oil omega-3 market. For instance, it can increase high-density lipoprotein (good) cholesterol levels and may also lower low-density lipoprotein (bad) cholesterol levels. Even in small doses, it helps reduce blood pressure in people with elevated levels. Health experts worldwide have substantially increased the recommended daily dietary intake of omega-3 fatty acids, increasing fish oil consumption. With this increased demand, manufacturers focus on adding fish oil to different products. Additionally, the fish oil omega-3 market's growth is being supported by the research and development efforts channelled toward improving procurement practices, enhancing the extraction process of omega-3 fatty acids, and sustainably streamlining the entire value chain of the industry.

Global Fish Oil Omega-3 Market Trends and Insights

Increasing Awareness About Cardiovascular Health Benefits

The cardiovascular health narrative for omega-3 fatty acids has gained substantial momentum following recent regulatory endorsements and clinical evidence. The Food and Drug Administration'sapproval of qualified health claims for Eicosapentaenoic acid (EPA) and Decosahexanoic acid (DHA) consumption about reduced risk of hypertension and coronary heart disease represents a pivotal shift in regulatory stance. This paradoxical finding underscores the need for personalized omega-3 recommendations based on individual cardiovascular risk profiles. The American Heart Association's updated position emphasizes prescription omega-3 medications for triglyceride management, with 4 grams per day achieving a 20-30% reduction in triglyceride levels. The growing sophistication of cardiovascular research is driving demand for high-purity, pharmaceutical-grade omega-3 formulations that can deliver specific therapeutic outcomes rather than general health maintenance.

Rising Demand for Omega-3 In Functional Foods and Beverages

Driven by a consumer shift towards nutrition in everyday foods over standalone supplements, the functional foods sector is increasingly embracing omega-3 fortification. Despite declining birth rates, the Global Organization for Eicosapentaenoic acid (EPA) and Decosahexanoic acid (DHA) Omega-3s highlighted a surge in DHA-fortified infant nutrition, underscoring consumers' readiness to pay a premium for omega-3 enhancements. Technological breakthroughs, like microencapsulation and advanced delivery systems, are not only masking omega-3's distinct taste and odor but also facilitating its integration into previously unsuitable products. These advancements have enabled manufacturers to expand their product portfolios, incorporating omega-3 into a wider range of food and beverage categories, including dairy, bakery, and ready-to-eat meals. This growth signals the industry's strategic move towards high-margin, value-added applications, moving away from traditional commodity fish oil sales.

Fluctuating Prices of Fish and Marine Resources Hinders Growth

In 2024, the omega-3 industry grappled with significant challenges stemming from a supply disruption in fish oil. Peru, the world's leading supplier, canceled its first anchovy fishing season due to concerns over juvenile fish. This decision tightened the fish oil supply, driving up costs and extending lead times in the dietary supplement sector. As a result, manufacturers were compelled to either seek alternative sources or reformulate their products. In response, the industry began diversifying its sources, turning to alternatives like salmon, tuna, and algae. Notably, Cargill has taken a proactive step by committing to omega-3 fatty acids derived from algal oil for Norwegian feeds, aiming to lessen the industry's reliance on wild-caught fish. Additionally, the shift toward alternative sources is expected to drive innovation in production methods and supply chain strategies, as companies strive to ensure a stable and sustainable supply of omega-3 fatty acids. This diversification also aligns with growing consumer demand for environmentally friendly and ethically sourced products, further shaping the industry's trajectory.

Other drivers and restraints analyzed in the detailed report include:

- Growth In Dietary Supplement Consumption Worldwide

- Expanding Applications in Infant Nutrition and Pharmaceuticals

- Growing Popularity of Plant-Based Omega-3 Alternatives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, DHA commands a dominant 63.42% market share, underscoring its pivotal role in brain development and cognitive functions. Meanwhile, EPA is on a rapid ascent, boasting a 10.04% CAGR from 2025 to 2030. This divergence in growth rates is attributed to emerging studies spotlighting EPA's unique anti-inflammatory and cardiovascular advantages, setting it apart from DHA's primary focus on neurological benefits. Notably, the American Heart Association underscores the significance of EPA formulations, advocating for prescription omega-3s in managing triglyceride levels.

As the industry shifts towards specialized applications, DHA-550 oil, derived from Schizochytrium sp. and now Europe Food Safety and Authority-approved, can be incorporated into protein products, capped at 1 gram of DHA per 100 grams. This move aligns with the industry's pivot towards precision nutrition, emphasizing tailored fatty acid profiles for specific health outcomes over generic omega-3 supplementation. Innovations in manufacturing are pushing the boundaries of purity, with KinOmega leading the charge, achieving over 97% purity in fish oil via cutting-edge purification methods, and boasting an impressive portfolio of 31 patents in the fish oil domain.

In 2024, anchovy commands a dominant 27.03% market share, predominantly harvested from Peruvian fisheries. These fisheries, bolstered by quota increases, are pivoting towards more sustainable aquaculture practices. Meanwhile, salmon, despite grappling with notable sustainability hurdles, is the fastest-growing segment, boasting a 9.51% CAGR. Yet, the dynamics of omega-3 derived from salmon are intricate. Farmed Atlantic salmon, once rich in omega-3, now shows a decline in content.

This drop is attributed to a dietary shift: fish oil, a traditional staple, is being supplanted by plant oils, which notably lack the essential long-chain omega-3s. Cod liver oil enjoys unwavering demand, celebrated for its vitamin A, D, and omega-3 content. In contrast, menhaden, tuna, and sardine species find their niches, catering to specialized applications dictated by their unique fatty acid profiles and regional availability. The industry's shift towards a broader spectrum of marine sources underscores a dual focus: meeting sustainability goals and ensuring resilient supply chains, all in response to the surging global appetite for omega-3 fatty acids.

The Fish Oil Omega-3 Market is Segmented by Ingredient Type (EPA and DHA), Species (Anchovy, Cod Liver, Menhaden, Tuna, Sardine, and More), Application (Dietary Supplements, Infant Nutrition, Functional Food and Beverages, and Other Applications), End User (Adults, Geriatric, and Children), and Geography (North America and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commands a 34.1% market share in 2024, supported by comprehensive regulatory frameworks and increased consumer understanding of omega-3 health benefits. The region maintains consistent growth through premium product development and expanded pharmaceutical uses. The Food and Drug Administration's support of omega-3 health claims, specifically for EPA and DHA in reducing hypertension and coronary heart disease risks, reinforces the region's market position. The region's market dominance is further strengthened by extensive research and development activities, advanced manufacturing capabilities, and strong distribution networks.

The Asia-Pacific region projects a 10.8% CAGR during 2025-2030. This growth stems from increasing disposable incomes, government initiatives promoting omega-3 consumption, and wider adoption of alternative sources. In 2024, KinOmega Biopharm from China achieved fish oil exports worth 168 million RMB, contributing 84% to Sichuan province's total fish oil exports. The region's growth is further driven by rising health consciousness, expanding aquaculture industry, and increasing adoption of omega-3 supplements in dietary regimens.

Europe, while navigating stringent regulatory waters and championing sustainability, remains a formidable player. With the European Food Safety Authority at the helm, the region is making strides in global novel food approvals and safety evaluations. The region's regulatory framework will introduce new guidelines for novel food applications in February 2025, focusing on safety requirements and simplified application procedures, according to Food Compliance International. The updated regulations aim to enhance the evaluation process for innovative food products while ensuring consumer safety. Other regions such as South America, and Middle East, and Africa are also expanding their presence in the market by partnering with different companies. For example, Evonik Industries offers fish oil omega-3 ingredients in Brazil through its brand, AvailOm.

- DSM-Firmenich

- BASF SE

- Croda International plc

- Omega Protein Corporation

- Corbion NV

- GC Rieber VivoMega

- Pelagia AS

- TripleNine Group A/S

- TASA (Tecnologica de Alimentos S.A.)

- Austevoll Seafood ASA

- Olvea Group

- Lysi hf

- Barlean's Organic Oils

- Nordic Naturals, Inc.

- Cargill Inc. (EWOS)

- AlaskOmega (OmegaSea, LLC)

- Kobyalar Group

- Copeinca ASA

- Solutex GC

- Evonik Industries

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Awareness About Cardiovascular Health Benefits

- 4.2.2 Rising Demand For Omega-3 In Functional Foods And Beverages

- 4.2.3 Growth In Dietary Supplement Consumption Worldwide

- 4.2.4 Expanding Applications In Infant Nutrition And Pharmaceuticals

- 4.2.5 Rising Health Consciousness Among Aging Population

- 4.2.6 Government Support For Omega-3 Fortification Programs

- 4.3 Market Restraints

- 4.3.1 Fluctuating Prices of Fish And Marine Resources Hinders Growth

- 4.3.2 Growing Popularity Of Plant-Based Omega-3 Alternatives

- 4.3.3 Risk of Contaminants Like Mercury And PCBs In Fish Oil

- 4.3.4 Environmental Concerns Over Overfishing And Sustainability

- 4.4 Regulatory Outlook

- 4.5 Technology Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Ingredient Type

- 5.1.1 EPA (Eicosapentaenoic Acid)

- 5.1.2 DHA (Docosahexaenoic Acid)

- 5.2 By Species

- 5.2.1 Anchovy

- 5.2.2 Cod Liver

- 5.2.3 Menhaden

- 5.2.4 Tuna

- 5.2.5 Sardine

- 5.2.6 Salmon

- 5.2.7 Other Species

- 5.3 By Application

- 5.3.1 Dietary Supplements

- 5.3.2 Infant Nutrition

- 5.3.3 Functional Food & Beverage

- 5.3.4 Other Applications

- 5.4 By End-User

- 5.4.1 Adults

- 5.4.2 Geriatric

- 5.4.3 Children

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 DSM-Firmenich

- 6.4.2 BASF SE

- 6.4.3 Croda International plc

- 6.4.4 Omega Protein Corporation

- 6.4.5 Corbion NV

- 6.4.6 GC Rieber VivoMega

- 6.4.7 Pelagia AS

- 6.4.8 TripleNine Group A/S

- 6.4.9 TASA (Tecnologica de Alimentos S.A.)

- 6.4.10 Austevoll Seafood ASA

- 6.4.11 Olvea Group

- 6.4.12 Lysi hf

- 6.4.13 Barlean's Organic Oils

- 6.4.14 Nordic Naturals, Inc.

- 6.4.15 Cargill Inc. (EWOS)

- 6.4.16 AlaskOmega (OmegaSea, LLC)

- 6.4.17 Kobyalar Group

- 6.4.18 Copeinca ASA

- 6.4.19 Solutex GC

- 6.4.20 Evonik Industries

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK