PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844518

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844518

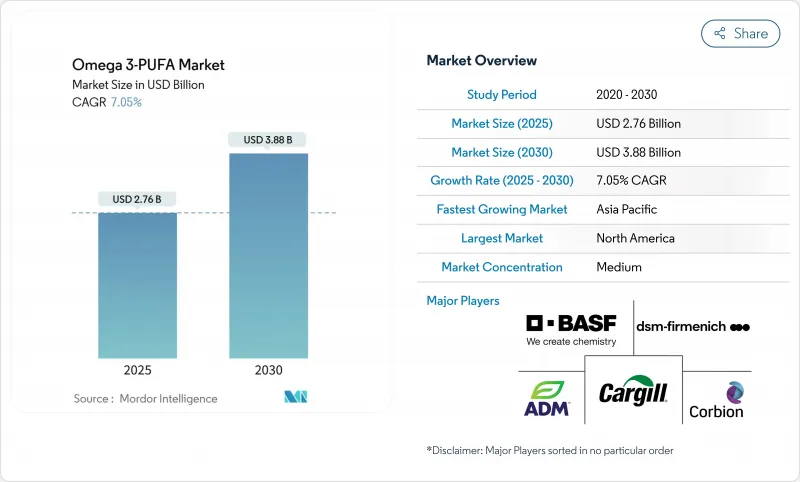

Omega 3-PUFA - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The omega-3 PUFA market size was valued at USD 2.76 billion in 2025 and is forecast to reach USD 3.88 billion by 2030, advancing at a steady 7.05% CAGR.

This growth is driven by increasing consumer awareness of the health benefits associated with omega-3 fatty acids, including their role in reducing inflammation and supporting overall well-being. Heightened concerns over cardiovascular and cognitive health, backed by expanding clinical evidence and favorable regulations, solidify consumer trust in omega-3 fortified products. While marine oils continue to dominate, there's a swift rise in plant-based alternatives, driven by sustainability considerations. Key economies, particularly China and the European Union, are modernizing regulations, hastening product development cycles and raising quality standards. Additionally, advancements in extraction technologies and the development of innovative delivery formats, such as gummies and soft gels, are further fueling market expansion.

Global Omega 3-PUFA Market Trends and Insights

Growth of Omega-3 Enriched Food and Beverage Products to Support Cardiovascular Health

The increasing demand for omega-3-enriched food and beverage products is a significant driver of the global omega-3 PUFA market. These products are widely recognized for their role in supporting cardiovascular health, as omega-3 fatty acids help reduce triglyceride levels, lower blood pressure, and improve overall heart health. According to the American Heart Association (AHA), omega-3 fatty acids, particularly EPA and DHA, are essential for maintaining cardiovascular health and reducing the risk of heart disease. Governments and health organizations worldwide are actively promoting the consumption of omega-3-rich diets. For instance, the Dietary Guidelines for Americans recommend regular consumption of seafood, a primary source of omega-3 fatty acids, to meet nutritional requirements. Furthermore, the European Food Safety Authority (EFSA) has approved health claims linking omega-3 fatty acids to heart health, further driving consumer awareness and demand for enriched products.

Rising Consumer Shift Towards Preventive Healthcare

Consumers are increasingly prioritizing preventive healthcare measures, which is fueling the market growth. Preventive healthcare focuses on maintaining health and preventing diseases rather than treating them after they occur. According to the World Health Organization (WHO), non-communicable diseases (NCDs), such as cardiovascular diseases and diabetes, account for 74% of all global deaths . This has led to a growing awareness among consumers about the importance of incorporating essential nutrients, like Omega-3 PUFAs, into their diets to reduce the risk of such conditions. Additionally, the U.S. Department of Health and Human Services highlights the role of Omega-3 fatty acids in supporting heart health and reducing inflammation, further encouraging their adoption. This shift in consumer behavior is expected to significantly contribute to the market's growth during the forecast period.

Unpleasant Odor and Taste in Marine Derived Omega-3s

The unpleasant odor and taste associated with marine-derived omega-3 products pose a significant challenge in the global omega-3 PUFA market. These sensory issues often result from the oxidation of omega-3 fatty acids, which can lead to a fishy smell and taste, making the products less appealing to consumers. This restraint impacts the adoption of omega-3 supplements, particularly among individuals sensitive to such sensory attributes. Manufacturers are investing in advanced encapsulation technologies and flavor-masking techniques to address this issue, but the challenge persists as a critical factor influencing consumer preferences and market growth. The taste and odor challenge creates market opportunities for algae-based alternatives, though marine sources maintain cost advantages and established supply chains that complicate rapid substitution across price-sensitive segments. Overcoming this restraint is essential for expanding the market penetration of marine-derived omega-3 products.

Other drivers and restraints analyzed in the detailed report include:

- High Adoption in Dietary Supplements and Functional Nutrition

- Surge in Cognitive Health Supplement Among Aging Population

- Stringent Regulatory Approvals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Marine-derived oils held a dominant 75.11% share of the omega-3 PUFA market in 2024. This dominance is attributed to their well-established supply chains, competitive cost structures, and high concentrations of EPA and DHA, which are critical for various health benefits. The market size for marine oils is expected to grow in line with the increasing global demand for omega-3 PUFAs. However, their relative market share is anticipated to decline as plant-based alternatives continue to gain traction, driven by shifting consumer preferences and sustainability concerns.

Plant-based omega-3 solutions are experiencing rapid growth, with a robust CAGR of 8.48%. This growth is fueled by the rising adoption of vegan lifestyles and increasing awareness of environmental sustainability. A notable development in this segment is DSM-Firmenich's introduction of life'sOMEGA, the first plant-based ingredient to deliver both EPA and DHA, effectively addressing a longstanding nutritional gap in the market. The innovation and expanding availability of plant-based alternatives are expected to significantly influence the competitive dynamics of the omega-3 PUFA market in the coming years.

The Omega-3 PUFA Market Report is Segmented by Product Type (Plant and Marine), Type (Docosahexanoic Acid, Eicosapentanoic Acid and More ), Application (Food and Beverage, Dietary Supplements, Pharmaceutical, Animal Feed, and Others), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2024, North America holds a dominant 31.22% share of the market, bolstered by its advanced regulatory frameworks, a well-entrenched culture of supplements, and a robust clinical research infrastructure that underscores the health benefits of omega-3s. The region enjoys a favorable market landscape, thanks to the FDA's progressive approach towards qualified health claims and its revised definition of "healthy" labeling, which now encompasses omega-3-rich foods. These regulatory advancements not only encourage product innovation but also enhance consumer confidence and adoption, creating a thriving environment for omega-3 products.

Meanwhile, the Asia-Pacific region is on a rapid ascent, projected to grow at a 9.04% CAGR through 2030. This surge is fueled by an uptick in health consciousness, a move towards regulatory harmonization, and a burgeoning middle class in pivotal markets. China's recent move to include DHA in its Health Food Raw Materials Directory, stipulating a daily intake limit of 200-1000mg for adults, underscores a maturing regulatory landscape that's poised to bolster market growth. Additionally, Japan and South Korea continue to lead with the highest global omega-3 index scores, reflecting their strong consumer awareness and established consumption patterns. In contrast, Chinese consumers are increasingly showing interest in fish oils, signaling a growing market potential despite their historically lower baseline consumption levels.

Europe is witnessing consistent growth, driven by initiatives centered on sustainability and the approval of novel foods. The EFSA's recent guidance updates have further smoothed the path for innovative omega-3 sources to enter the market. These measures align with the region's focus on environmental responsibility and consumer safety, ensuring steady market expansion. Meanwhile, South America and the Middle East and Africa are emerging as promising frontiers. In Brazil, ANVISA has rolled out updates to food supplement regulations, aimed at improving product standards and market accessibility. Similarly, Saudi Arabia is advancing its nutritional labeling standards, which could significantly enhance omega-3 market access and consumer awareness in the region. Both regions present untapped opportunities for growth, driven by evolving regulatory landscapes and increasing consumer interest in health and wellness products.

- BASF SE

- DSM-Firmenich AG

- Cargill, Incorporated

- Archer Daniels Midland Company

- Corbion N.V.

- Croda International Plc

- Aker BioMarine AS

- Epax Norway AS

- KD Pharma Group

- Omega Protein Corporation

- Solutex GC

- Neptune Wellness Solutions Inc.

- Algarithm Ingredients Inc.

- Stepan Company

- Novotech Nutraceuticals

- Clover Corporation Limited

- Qualitas Health

- Nordic Naturals, Inc.

- Lonza Group

- Arista Industries, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth of Omega-3 Enriched Food and Beverage Products to Support Cardiovascular Health

- 4.2.2 Rising Consumer shift Towards Preventive Heathcare

- 4.2.3 High Adoption in Dietary Supplements and Functional Nutrition

- 4.2.4 Surge in Cognitive Health Supplemnt Among Aging Population

- 4.2.5 Increased Application in Animal and Pet Feed

- 4.2.6 Widespread Adoption in Functional Bakery and Dairy Products

- 4.3 Market Restraints

- 4.3.1 Unpleasant Odor and Taste in marine Derived Omega-3s

- 4.3.2 Stringent Regulatory Approvals

- 4.3.3 Concern Regarding Overfishing and Marine Ecosystem Damage

- 4.3.4 Complexity in Bioavailability and Absorption Among Different Types

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Plant

- 5.1.2 Marine

- 5.2 By Type

- 5.2.1 Docosahexanoic acid (DHA)

- 5.2.2 Eicosapentanoic acid (EPA)

- 5.2.3 Alpha-Linolenic Acid (ALA)

- 5.2.4 Others

- 5.3 By Application

- 5.3.1 Food and Beverages

- 5.3.2 Dietary Supplements

- 5.3.3 Pharmaceutical

- 5.3.4 Animal Feed

- 5.3.5 Others

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 Italy

- 5.4.2.4 France

- 5.4.2.5 Spain

- 5.4.2.6 Poland

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 BASF SE

- 6.4.2 DSM-Firmenich AG

- 6.4.3 Cargill, Incorporated

- 6.4.4 Archer Daniels Midland Company

- 6.4.5 Corbion N.V.

- 6.4.6 Croda International Plc

- 6.4.7 Aker BioMarine AS

- 6.4.8 Epax Norway AS

- 6.4.9 KD Pharma Group

- 6.4.10 Omega Protein Corporation

- 6.4.11 Solutex GC

- 6.4.12 Neptune Wellness Solutions Inc.

- 6.4.13 Algarithm Ingredients Inc.

- 6.4.14 Stepan Company

- 6.4.15 Novotech Nutraceuticals

- 6.4.16 Clover Corporation Limited

- 6.4.17 Qualitas Health

- 6.4.18 Nordic Naturals, Inc.

- 6.4.19 Lonza Group

- 6.4.20 Arista Industries, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK