PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842492

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842492

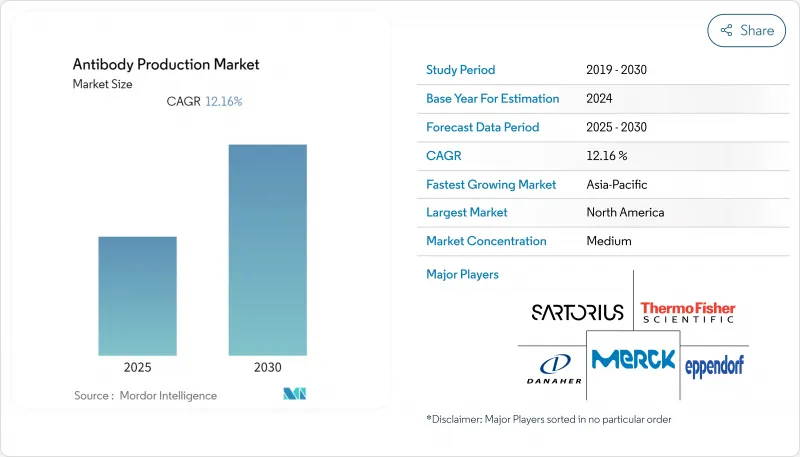

Antibody Production - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Antibody Production Market size is estimated at USD 19.17 billion in 2025, and is expected to reach USD 31.83 billion by 2030, at a CAGR of 12.16% during the forecast period (2025-2030).

Rising adoption of targeted biologics, the rapid uptake of bispecific formats, and wider diagnostic use cases are expanding demand across therapeutics, research, and clinical laboratories. Continuous investments in single-use bioreactors are pushing production flexibility, while artificial-intelligence tools are shortening cell-line development cycles and improving batch consistency. Regulatory agencies are supporting innovation through expedited pathways for biosimilars and novel antibody constructs, enabling smaller firms and contract manufacturers to scale rapidly. Competitive dynamics are intensifying as full-service suppliers acquire specialist capabilities and contract development and manufacturing organizations (CDMOs) differentiate through proprietary bispecific platforms.

Global Antibody Production Market Trends and Insights

Accelerated Clinical Pipelines for Antibody-Drug Conjugates (ADCs) in the United States & China

More than 600 ADC candidates are in clinical trials, and at least 10 new approvals are expected by 2027, underscoring sustained momentum in oncology-focused pipelines. The January 2025 FDA approval of AstraZeneca and Daiichi Sankyo's Datroway reduced disease-progression risk in HR-positive, HER2-negative breast cancer by 37% compared with chemotherapy AstraZeneca. Expansion of capacity is following suit; AstraZeneca committed USD 1.5 billion for an end-to-end ADC facility in Singapore that comes online in 2029 AstraZeneca. Similar large-scale investments in China support accelerated timelines under National Medical Products Administration priorities. These moves raise demand for high-potency conjugation suites, viral-vector containment, and advanced analytics. As regulatory agencies refine guidance for complex conjugates, manufacturers adopting modular cleanroom designs and high-throughput purification systems are positioned to capture emerging clinical needs.

Rapid Scale-up of Single-Use Bioreactor Capacity

Single-use bioreactors (SUBs) lower cross-contamination risk and enable faster changeovers, key for multi-product facilities. Samsung Biologics' Plant 5, will add flexible SUB volumes while shortening build time by 30% compared with earlier stainless-steel facilities Samsung Biologics . Continuous processing integration with SUBs is delivering 25-30% productivity gains and shrinking facility footprints by 40% Pharma Focus America. Sensor miniaturization, single-use probes, and closed-loop control now permit real-time quality adjustments, driving wider adoption beyond clinical lots into commercial, high-titer programs. The trajectory supports strong demand for gamma-sterilized reactor bags, drive units, and disposable ancillary flow-paths, reinforcing supplier growth.

High Up-front CAPEX for GMP-Grade Biomanufacturing Facilities

Constructing a state-of-the-art antibody plant can exceed USD 200 million, with cleanrooms and specialized utilities accounting for 60% of expenditure BioProcess International. Capital recovery stretches across 3-5 years when permitting, validation, and licensure are included. Emerging-market entrants face steeper financing hurdles and interest-rate volatility, curbing greenfield projects. Modular prefabricated facilities can cut construction time by 30-50%, yet the higher cost of imported modules offsets some savings Pharma Focus Asia. Consequently, demand for CDMO capacity rises as innovators defer ownership in favor of fee-for-service models, marginally slowing facility-linked revenue expansion.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Fast-Tracking of Biosimilar mAbs

- AI-Enabled Cell-Line Development Reducing Titer Variability in Europe

- Intellectual-Property Barriers for Novel Bispecific Formats in Japan

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Consumables commanded 62.54% of antibody production market share in 2024, reflecting the constant demand for media, resins, buffers, and filters that support every production batch. High recurring volumes create predictable cashflows for suppliers but add operational expense for manufacturers working to improve cost-of-goods. Instrument-bioreactors are the fastest-growing category, forecast to advance at an 11.98% CAGR as single-use designs displace stainless-steel systems and enable multi-product agility. Integrated sensors, disposable flow-paths, and gamma-ready plastics mitigate cross-contamination risk and shorten changeovers, aligning with facilities that host diverse bispecific and ADC programs.

Upstream scale-out strategies rely on parallel SUB trains paired with continuous capture, reducing facility footprint while supporting titers beyond 10 g/L. Consumable advances, including smart tubing assemblies with embedded RFID tags, streamline material traceability and aid compliance. As resin lifecycles extend through novel alkaline-tolerant chemistries, operators reduce buffer volumes and lower waste, strengthening environmental metrics that are increasingly tracked within ESG reporting.

Upstream operations held 58.15% of the antibody production market size in 2024, underlining how cell-line productivity and bioreactor performance drive overall economics. Titer improvements emanate from engineered CHO hosts delivering >10 g/L yields and optimized fed-batch strategies that mitigate nutrient depletion. These gains shift the bottleneck to downstream purification, which is therefore growing faster at an 11.67% CAGR through 2030. Multi-modal chromatography resins tailored for bispecific antibodies improve resolution and loading capacities, while next-generation depth filtration couples with flocculation reagents to clarify high-density harvests from 2,000 L SUBs.

Process intensification incorporates continuous viral inactivation and single-pass tangential-flow filtration, creating straight-through purification trains that cut processing time by 30%. Buffer-management skids equipped with inline dilution curb water consumption and floor-space needs. Manufacturers pursuing operational excellence are integrating real-time mass-balance models and PAT-enabled feedback control, yielding consistent glycosylation profiles-a critical parameter for regulatory comparability. The convergence of upstream and downstream intensification unlocks cost savings and accelerates batch release, reinforcing competitiveness in the antibody production market.

The Antibody Production Market Report Segments the Industry Into by Product (Consumable and Instruments). By Antibody Type (Monoclonal Antibodies, Polyclonal Antibodies, and More), by Process (Upstream Processing, Downstream Processing, and More), by End User (Pharmaceutical and Biotechnology Companies, Research Laboratories, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America dominated the antibody production market with a 39.87% share in 2024, supported by strong capital markets, a dense cluster of biopharmaceutical companies, and advanced regulatory frameworks. The FDA's continued refinement of accelerated pathways fosters innovation in bispecifics and biosimilars, sustaining market expansion. Artificial-intelligence integration into production analytics is becoming mainstream, enabling real-time release strategies that cut inventory costs.

Asia-Pacific delivers the fastest 13.01% CAGR, propelled by expanding manufacturing ecosystems in China and India and supportive government policies. Biocon's US approval for Jobevne underscores India's rising quality credentials GaBIOnline. Regional CDMOs ramp continuous processing and modular plant builds to satisfy domestic and export needs. Japan's cautious stance on intellectual-property protection for bispecific formats slows local launches but encourages inventive structural workarounds.

Europe retains significant weight through its mature biosimilar landscape, with 64 approvals reflecting early regulatory leadership. Emphasis on sustainability drives uptake of continuous manufacturing and solvent-reduction initiatives. The European Shortages Monitoring Platform and revised GMP guidelines for AI signal regulatory vigilance toward supply security and digital oversight ISPE.

List of Companies Covered in this Report:

- Thermo Fisher Scientific

- Merck KGaA (MilliporeSigma)

- Danaher Corp. (Cytiva & Pall)

- Sartorius Stedim Biotech SA

- Lonza Group

- AGC Biologics

- Wuxi Biologics

- Charles River

- Abcam

- Bio-Rad Laboratories

- Eppendorf

- Boehringer Ingelheim BioXcellence

- Samsung Group

- Genscript

- Polpharma Biologics

- Rentschler Biopharma SE

- KBI Biopharma

- Selexis

- Biocon Biologics

- AGC Biologics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated Clinical Pipelines for Antibody-Drug Conjugates (ADCs) in the United States & China

- 4.2.2 Rapid Scale-up of Single-Use Bioreactor Capacity

- 4.2.3 Regulatory Fast-Tracking of Biosimilar mAbs

- 4.2.4 AI-Enabled Cell-Line Development Reducing Titer Variability in Europe

- 4.2.5 Surging Demand for Antibody Fragments in Cell & Gene Therapy Tooling

- 4.2.6 Shift Toward Serum-free Media to Meet ESG Objectives in North America

- 4.3 Market Restraints

- 4.3.1 High Up-front CAPEX for GMP-grade Biomanufacturing Facilities

- 4.3.2 Intellectual-Property Barriers for Novel Bispecific Formats in Japan

- 4.3.3 Quality-by-Design (QbD) Compliance Complexity for Small & Mid-size Biotechs

- 4.3.4 Chronic Supply Shortages of Recombinant Protein-free Media Components

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Consumables

- 5.1.1.1 Media & Sera

- 5.1.1.2 Reagents & Supplements

- 5.1.1.3 Buffers & Chemicals

- 5.1.2 Instruments

- 5.1.2.1 Bioreactors

- 5.1.2.2 Chromatography Systems

- 5.1.2.3 Filtration & Separation Devices

- 5.1.2.4 Supporting Lab Equipment

- 5.1.1 Consumables

- 5.2 By Process

- 5.2.1 Upstream Processing

- 5.2.1.1 Cell-Line Development

- 5.2.1.2 Culture Expansion & Expression Systems

- 5.2.2 Downstream Processing

- 5.2.2.1 Clarification & Capture

- 5.2.2.2 Purification

- 5.2.2.3 Formulation & Fill-Finish

- 5.2.1 Upstream Processing

- 5.3 By Antibody Type

- 5.3.1 Monoclonal Antibodies

- 5.3.2 Polyclonal Antibodies

- 5.3.3 Bispecific Antibodies

- 5.3.4 Antibody Fragments

- 5.4 By End User

- 5.4.1 Pharmaceutical & Biotechnology Companies

- 5.4.2 Contract Manufacturing / Research Organizations (CMOs/CROs)

- 5.4.3 Academic & Government Research Institutes

- 5.4.4 Diagnostic Laboratories

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Thermo Fisher Scientific Inc.

- 6.4.2 Merck KGaA (MilliporeSigma)

- 6.4.3 Danaher Corp. (Cytiva & Pall)

- 6.4.4 Sartorius Stedim Biotech SA

- 6.4.5 Lonza Group AG

- 6.4.6 AGC Biologics

- 6.4.7 Wuxi Biologics

- 6.4.8 Charles River Laboratories

- 6.4.9 Abcam plc

- 6.4.10 Bio-Rad Laboratories, Inc.

- 6.4.11 Eppendorf SE

- 6.4.12 Boehringer Ingelheim BioXcellence

- 6.4.13 Samsung Biologics

- 6.4.14 GenScript Biotech Corporation

- 6.4.15 Polpharma Biologics

- 6.4.16 Rentschler Biopharma SE

- 6.4.17 KBI Biopharma

- 6.4.18 Selexis SA

- 6.4.19 Biocon Biologics

- 6.4.20 AGC Biologics

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment