PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842494

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842494

China Retail Banking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

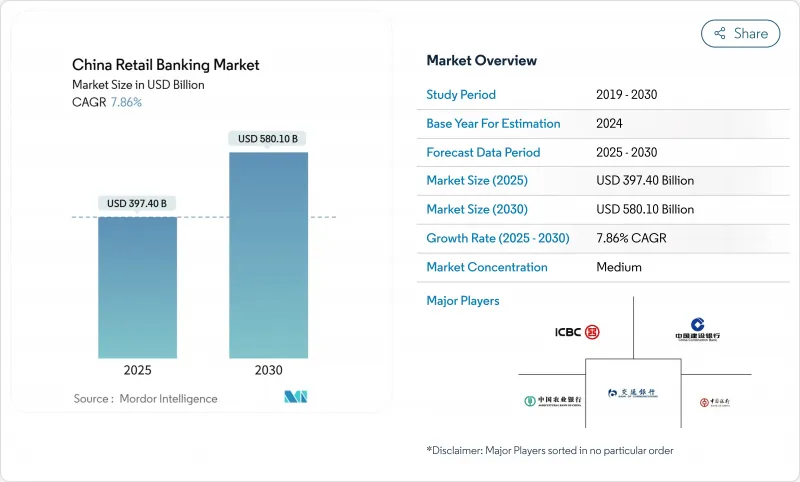

China's retail banking market size is USD 397.4 billion in 2025 and is estimated to reach USD 580.1 billion by 2030, reflecting a 7.86% CAGR.

The expansion quickens as mobile payments, open-banking APIs, and biometric onboarding push traditional institutions to re-architect service delivery around digital channels. Government mandates on rural inclusion increase the addressable base, while green finance programs create fresh lending categories. Competition from super-apps compresses fee margins, so banks lean on data-driven cross-selling to defend profitability. Intensifying capital standards encourage a pivot toward fee income and asset-light advisory services, and the rising mass-affluent population supports demand for higher-yield investment products.

China Retail Banking Market Trends and Insights

Rise in Mobile Payment Ecosystem Integration

Transaction volumes on mobile platforms surpassed USD 12.8 trillion in 2024, and Alipay plus WeChat Pay captured 90% of that flow. Banks that embed current-account, lending, and investment functions into these super-apps gain access to granular spending data that improves risk scoring and personalization. QR payments now dominate Tier-1 city point-of-sale environments, so branch and ATM usage continue to decline. Institutions unable to plug into these ecosystems risk losing visibility, prompting accelerated partnership activity and white-label wallet launches. The shift positions smartphones as the default branch for China's retail banking market and compresses legacy interchange revenues.

Regulatory Push for Rural Financial Inclusion

Village banks backed by large institutions extend basic deposit and micro-credit services deep into rural counties, aided by low-bandwidth mobile interfaces and biometrics that simplify know-your-customer compliance. Digital benefit disbursement platforms streamline welfare payments, raising household income stability and thus loan eligibility. While provincial gaps persist in fiber and 5G coverage, targeted infrastructure subsidies aim to narrow the divide by 2027. The initiative adds millions of new customers to China's retail banking market, though profitability hinges on low-cost digital servicing models that offset smaller ticket sizes.

Intensifying Competition from Super-Apps

Alipay and WeChat Pay surround users with embedded wealth, micro-loan, and insurance tabs that displace bank mobile apps. Banks face a strategic crossroads: partner and pay referral fees or invest heavily in standalone digital experiences. The distraction pulls fee income away from card interchange, remittances, and FX spreads. Younger customers open accounts passively within super-apps, never setting foot in a physical branch. Defensive strategies include loyalty programs that tie rate boosts to broader product bundling, but margins tighten across China's retail banking market.

Other drivers and restraints analyzed in the detailed report include:

- High Disposable Income Growth Propelling Mass Affluent Segment

- Emergence of Open Banking APIs Facilitating Collaboration

- Stringent Capital Adequacy Reforms

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The loans segment contributed 31.8% to China's retail banking market share in 2024 and remains the primary earnings engine even as digital competition rises. Mortgage growth cooled with property-sector stress, yet mortgages still anchor relationship banking by generating stable funding and cross-sell flows. Rural revitalization policies push consumption and agricultural loans, while green lending balances jumped to CNY 30.1 trillion in 2024. Major banks package carbon-reduction mortgages that offer rate discounts when homes meet efficiency benchmarks, aligning product design with national sustainability goals.

Credit cards, though smaller in absolute volume, are projected to record a 9.2% CAGR, making them the fastest expanding line within China's retail banking market. Digital-issuance journeys now take under five minutes with near-instant biometric verification, sharply reducing acquisition costs. Revolving-credit margins offset interchange pressure from super-apps, and gamified cashback schemes resonate with digital natives. Savings and current accounts continue to anchor deposit franchises but face leakage to money-market funds marketed inside super-apps. As yields stay compressed, fee-bearing bundles that include wealth portals and lifestyle perks maintain account stickiness.

Online channels captured 64.6% of the market share in 2024, and mobile sessions eclipse desktop use by a five-to-one ratio. Industrial and Commercial Bank of China reported 260 million active mobile users, showing the centrality of handheld devices to customer engagement. Branch networks are being retooled into advisory lounges that focus on complex wealth and SME financing discussions rather than routine cash handling. Self-service kiosks and AI chatbots migrate simple service tasks out of branches, lowering cost-to-serve across China's retail banking market.

Offline distribution still matters for trust-building in high-ticket wealth or mortgage consultations. Large state-owned banks deploy smaller "light" outlets in remote towns to satisfy inclusion targets while avoiding full-service overhead. Fintech adoption has created a substitution effect for teller-based transactions in saturated metros and a complementary role in under-banked counties, illustrating a nuanced geographic interplay. The hybrid model balances digital convenience with human reassurance, keeping retention high among older customers and mass affluent segments.

The China Retail Banking Market is Segmented by Product (Transactional Accounts, Savings Accounts, Debit Cards, Credit Cards, Loans, and Other Products), by Channel (Online Banking and Offline Banking), by Customer Age Group (18-28 Years, 29-44 Years, 45-59 Years, and 60 Years and Above), and by Bank Type (National Banks, Regional Banks, and Neobanks & Others). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Industrial and Commercial Bank of China Ltd.

- China Construction Bank Corp.

- Agricultural Bank of China Ltd.

- Bank of China Ltd.

- Bank of Communications Co., Ltd.

- Postal Savings Bank of China Co., Ltd.

- China Merchants Bank Co., Ltd.

- Ping An Bank Co., Ltd.

- China CITIC Bank Corp. Ltd.

- China Minsheng Banking Corp., Ltd.

- Shanghai Pudong Development Bank Co., Ltd.

- Industrial Bank Co., Ltd.

- China Everbright Bank Co., Ltd.

- Hua Xia Bank Co., Ltd.

- Bank of Beijing Co., Ltd.

- Bank of Shanghai Co., Ltd.

- Chongqing Rural Commercial Bank

- HSBC Bank (China) Company Limited

- Standard Chartered Bank (China) Limited

- DBS Bank (China) Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in Mobile Payment Ecosystem Integration with Retail Banking Services in Tier-1 Cities

- 4.2.2 Regulatory Push for Rural Financial Inclusion via Village Banks and Digital Channels

- 4.2.3 High Disposable Income Growth Propelling Mass Affluent Investment Product Uptake

- 4.2.4 Emergence of Open Banking APIs Facilitating Third-Party Fintech Collaboration

- 4.2.5 Accelerated Adoption of Biometric Authentication Reducing On-boarding Friction

- 4.2.6 Green Finance Mandates Driving Demand for Sustainable Retail Lending Products

- 4.3 Market Restraints

- 4.3.1 Intensifying Competition from Super-Apps (Alipay, WeChat Pay) Cannibalizing Traditional Bank Fee Income

- 4.3.2 Stringent Capital Adequacy Reforms Limiting Retail Loan Growth

- 4.3.3 Aging Population Dampening Long-Term Mortgage Demand in Lower-Tier Cities

- 4.3.4 Cybersecurity Breach Incidents Undermining Consumer Trust in Digital Channels

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Transactional Accounts

- 5.1.2 Savings Accounts

- 5.1.3 Debit Cards

- 5.1.4 Credit Cards

- 5.1.5 Loans

- 5.1.6 Other Products

- 5.2 By Channel

- 5.2.1 Online Banking

- 5.2.2 Offline Banking

- 5.3 By Customer Age Group

- 5.3.1 18-28 Years

- 5.3.2 29-44 Years

- 5.3.3 45-59 Years

- 5.3.4 60 Years and Above

- 5.4 By Bank Type

- 5.4.1 National Banks

- 5.4.2 Regional Banks

- 5.4.3 Neobanks & Others

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for Key Companies, Products & Services, Recent Developments)

- 6.4.1 Industrial and Commercial Bank of China Ltd.

- 6.4.2 China Construction Bank Corp.

- 6.4.3 Agricultural Bank of China Ltd.

- 6.4.4 Bank of China Ltd.

- 6.4.5 Bank of Communications Co., Ltd.

- 6.4.6 Postal Savings Bank of China Co., Ltd.

- 6.4.7 China Merchants Bank Co., Ltd.

- 6.4.8 Ping An Bank Co., Ltd.

- 6.4.9 China CITIC Bank Corp. Ltd.

- 6.4.10 China Minsheng Banking Corp., Ltd.

- 6.4.11 Shanghai Pudong Development Bank Co., Ltd.

- 6.4.12 Industrial Bank Co., Ltd.

- 6.4.13 China Everbright Bank Co., Ltd.

- 6.4.14 Hua Xia Bank Co., Ltd.

- 6.4.15 Bank of Beijing Co., Ltd.

- 6.4.16 Bank of Shanghai Co., Ltd.

- 6.4.17 Chongqing Rural Commercial Bank

- 6.4.18 HSBC Bank (China) Company Limited

- 6.4.19 Standard Chartered Bank (China) Limited

- 6.4.20 DBS Bank (China) Limited

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment