PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851000

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851000

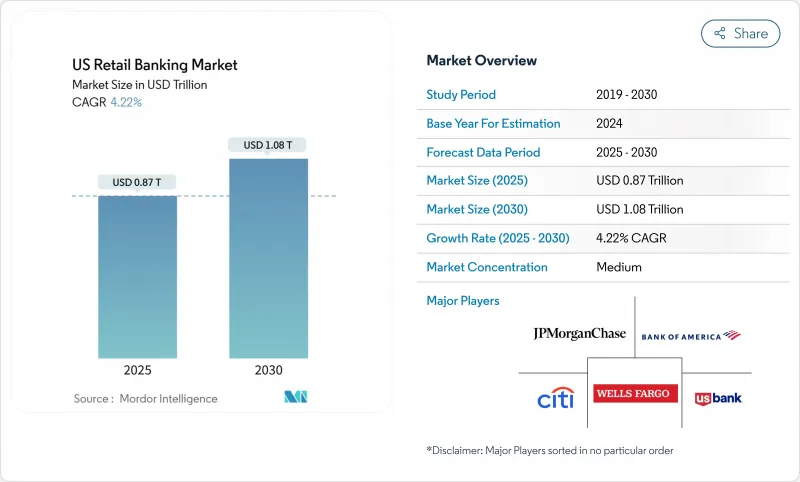

US Retail Banking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The United States retail banking market is valued at USD 0.87 trillion in 2025 and is forecasted to reach USD 1.08 trillion by 2030, reflecting a 4.22% CAGR during 2025-2030.

Steady loan demand, a resilient deposit base, and the rapid consumer shift to digital banking support growth. Banks are expanding fee-free mobile products to match evolving customer expectations while using artificial intelligence to trim operating costs and launch new services quickly. Competitive pressure from specialist fintech firms is compressing interest margins, yet national institutions continue to leverage scale to defend profitability. Regulatory developments around overdraft fees and fair-lending standards are forcing banks to diversify revenue streams into advisory-led products and subscription models.

US Retail Banking Market Trends and Insights

Rising Household Debt Fueling Loan Demand

Household debt reached USD 18.20 trillion in Q1 2025, a 0.9% quarterly rise, and mortgage balances alone expanded by USD 199 billion. Despite restrictive monetary policy, consumers continue borrowing for housing, autos, and education, encouraged by credit scoring models that better gauge repayment capacity. Banks are deploying machine-learning risk tools to extend loans to underserved borrowers without materially elevating default ratios. The United States retail banking market is therefore leveraging this debt upswing to widen net interest income while growing ancillary insurance and advisory offerings tied to credit products.

Surge in Mobile-Wallet Adoption Among Gen Z Accelerating Digital Account Openings

The number of digital wallet users worldwide is expected to witness significant growth during the forecast period. Gen Z customers exhibit three times higher adoption of alternative payments than older cohorts, prioritizing biometric authentication and instant onboarding. Leading banks now approve and fund checking accounts within minutes, gaining early influence over the financial lives of digital natives. The intensifying preference for mobile deposits and person-to-person payments is raising the digital share of new retail accounts, reinforcing the omni-channel pivot of the United States retail banking market.

Fintech-Driven Rate Compression Squeezing Net-Interest Margins

Fast-growing digital lenders deliver lean cost structures and algorithmic pricing, enabling higher deposit yields and lower loan rates. Traditional banks must match offers or risk share erosion, yet this response narrows spreads and limits profit growth. The constraint is most severe in metropolitan areas where fintech adoption is highest and where interest-sensitive households move balances quickly through online channels.

Other drivers and restraints analyzed in the detailed report include:

- Competitive Deposit Rates Amid Fed Tightening Boosting Savings Balances

- Embedded-Finance Retail Partnerships Expanding Point-of-Sale Credit Card Issuance

- Proposed CFPB Overdraft-Fee Caps Threatening Non-Interest Income

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Loans accounted for 29.3% of the United States retail banking market share in 2024, reflecting robust mortgage and auto demand. The United States retail banking market size tied to credit cards is projected to rise at a 6.4% CAGR to 2030 as issuers roll out experiential rewards and instant virtual provisioning. Rapid uptake of flexible repayment plans and early wage access features is keeping revolving balances buoyant even with elevated interest rates. Transactional accounts remain foundational for customer retention, yet growth moderates as multi-banking becomes mainstream. Savings products enjoy renewed appeal where digital-only players advertise yields above 2%, though margin pressures cap long-run contribution.

The Consumer Financial Protection Bureau has cautioned consumers about retail-store card costs that exceed those of general-purpose cards, spurring issuers to introduce clearer pricing disclosures. Debit cards continue to dominate day-to-day payments but lose relative share to mobile wallets and contactless credit. Banks are therefore designing integrated ecosystems that let users move seamlessly among checking, saving, pay-later, and credit card functions within a single application.

Online banking captured 58.2% of the United States retail banking market in 2024. Lower cost per transaction, estimated at cents rather than dollars, reinforces further migration. Mobile log-ins account for three-quarters of digital traffic, led by peer-to-peer payments and mobile check deposits. The United States retail banking market size tied to branch networks remains relevant for complex advice, yet branch formats are shifting toward lounge-style consultative hubs rather than traditional teller lines.

AI-powered chatbots handle routine queries around the clock, and voice recognition tools authenticate clients in seconds, lifting customer satisfaction scores. Banks blend channels by allowing video appointments scheduled in-app and concluded in branches, an approach that retains the trust advantage of human counsel while preserving digital convenience. Compliance standards require documented consent across channels, making robust data synchronization an operational imperative.

The US Retail Banking Market is Segmented by Product (Transactional Accounts, Savings Accounts, and More), by Channel (Online Banking and Offline Banking), by Customer Age Group (18-28 Years, 29-44 Years, and More), by Bank Type (National Banks, Regional Banks, and Neobanks & Others). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- JPMorgan Chase & Co.

- Bank of America Corp.

- Wells Fargo & Co.

- Citigroup Inc.

- U.S. Bancorp

- Truist Financial Corp.

- PNC Financial Services Group Inc.

- TD Group US Holdings LLC

- Capital One Financial Corp.

- Fifth Third Bancorp

- KeyCorp

- Regions Financial Corp.

- Citizens Financial Group

- First Citizens BancShares

- Synchrony Financial

- Ally Financial Inc.

- Discover Financial Services

- SoFi Technologies Inc.

- Chime Financial Inc.

- Navy Federal Credit Union

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Household Debt Fueling Loan Demand

- 4.2.2 Surge in Mobile-Wallet Adoption Among Gen Z Accelerating Digital Account Openings

- 4.2.3 Competitive Deposit Rates Amid Fed Tightening Boosting Savings Balances

- 4.2.4 Embedded-Finance Retail Partnerships Expanding Point-of-Sale Credit Card Issuance

- 4.2.5 FHA Policy Updates Stimulating First-Time-Homebuyer Mortgage Growth

- 4.2.6 Cloud-Native Core Upgrades Enabling Faster Product Launch Cycles

- 4.3 Market Restraints

- 4.3.1 Fintech-Driven Rate Compression Squeezing Net-Interest Margins

- 4.3.2 Proposed CFPB Overdraft-Fee Caps Threatening Non-Interest Income

- 4.3.3 Branch-Rationalization Costs Limiting Rural Reach

- 4.3.4 Rising Cyber-Fraud Driving Compliance Spend & Slowing Digital Rollouts

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Transactional Accounts

- 5.1.2 Savings Accounts

- 5.1.3 Debit Cards

- 5.1.4 Credit Cards

- 5.1.5 Loans

- 5.1.6 Other Products

- 5.2 By Channel

- 5.2.1 Online Banking

- 5.2.2 Offline Banking

- 5.3 By Customer Age Group

- 5.3.1 18-28 Years

- 5.3.2 29-44 Years

- 5.3.3 45-59 Years

- 5.3.4 60 Years and Above

- 5.4 By Bank Type

- 5.4.1 National Banks

- 5.4.2 Regional Banks

- 5.4.3 Neobanks & Others

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 JPMorgan Chase & Co.

- 6.4.2 Bank of America Corp.

- 6.4.3 Wells Fargo & Co.

- 6.4.4 Citigroup Inc.

- 6.4.5 U.S. Bancorp

- 6.4.6 Truist Financial Corp.

- 6.4.7 PNC Financial Services Group Inc.

- 6.4.8 TD Group US Holdings LLC

- 6.4.9 Capital One Financial Corp.

- 6.4.10 Fifth Third Bancorp

- 6.4.11 KeyCorp

- 6.4.12 Regions Financial Corp.

- 6.4.13 Citizens Financial Group

- 6.4.14 First Citizens BancShares

- 6.4.15 Synchrony Financial

- 6.4.16 Ally Financial Inc.

- 6.4.17 Discover Financial Services

- 6.4.18 SoFi Technologies Inc.

- 6.4.19 Chime Financial Inc.

- 6.4.20 Navy Federal Credit Union

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment