PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842496

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842496

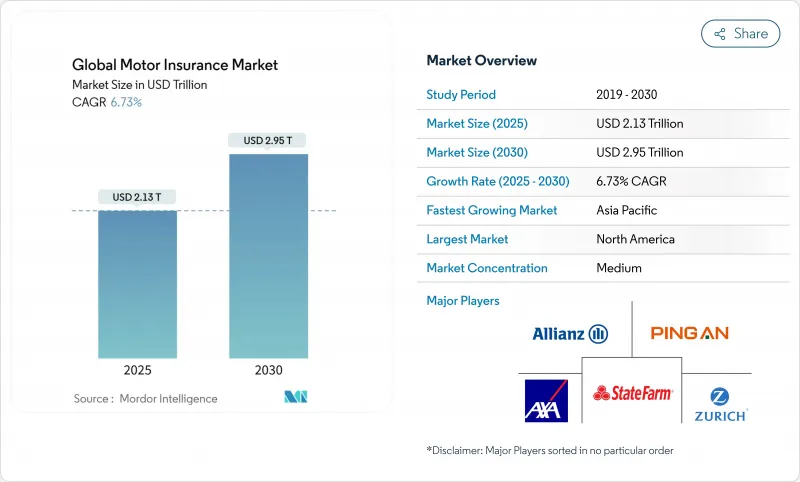

Global Motor Insurance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global motor insurance market stands at USD 2.13 trillion in 2025 and is projected to reach USD 2.95 trillion by 2030, expanding at a 6.73% CAGR.

Robust premium growth reflects rising vehicle ownership, accelerating digital distribution, and sustained regulatory enforcement in every major region. Third-party liability policies retain a 40.5% share because basic coverage remains compulsory in more than 150 jurisdictions. Yet comprehensive policy demand is rising quickly as drivers look for broader protection against weather events, theft, and sophisticated in-vehicle electronics. Insurer profitability is improving where AI automates claims triage and fraud screening, trimming loss-adjustment expense, and supporting sharper pricing. Competitive intensity is heightening as embedded offers from automotive OEMs, and insurtechs reduce friction at the point of sale, compelling incumbents to upgrade telematics capabilities and customer engagement.

Global Motor Insurance Market Trends and Insights

Shift toward Usage-Based Insurance Driven by Telematics Adoption in Asia-Pacific

Smartphone-enabled telematics has reduced hardware costs and helped insurers scale usage-based propositions across China, Singapore, India, and Australia. COVID-19 spurred personal vehicle reliance, while regulators in China and Singapore endorsed data-sharing frameworks that cement confidence in pay-how-you-drive models. As a result, Asia-Pacific is forecast to host more than half of global UBI subscribers by 2025, creating fresh underwriting capacity and lowering accident frequency for engaged drivers. Insurers reply by deploying self-service mobile dashboards that let users monitor driving scores, redeem rewards, and initiate claims-all of which drive retention and tailored pricing.

OEM-Embedded Insurance Partnerships Accelerating Policy Uptake in North America

U.S. car buyers increasingly expect seamless protection bundled inside the vehicle-purchase journey, with 60% stating a preference for connected services that include insurance. Partnerships such as Rivian-Nationwide, Toyota-Farmers, and Root-Hyundai integrate policy issuance into dealership or online checkout flows, shortening decision cycles and lifting bind rates. Analysts estimate that 20% of personal-auto premiums could be sold as embedded cover by 2030, eating into agent commissions and forcing incumbents to refine cross-sell strategies as EV technology shifts liability toward manufacturers.

Profitability Squeezed by Social Inflation & Nuclear Jury Awards in U.S. Auto Liability

In 2023, jury awards surpassing USD 10 million more than doubled the median payout, elevating it to a striking USD 44 million. This surge underscores the mounting financial repercussions of litigation on corporations. At the same time, plaintiff attorneys are leveraging the public's increasing skepticism towards large corporations to secure these inflated settlements, amplifying the financial strain on defendants. As claims grow in severity, liability carriers have responded by hiking their rates. Yet, these premium increases have spurred consumers to hunt for better deals and have contributed to a rise in uninsured driving, exerting pressure on growth and presenting challenges for the insurance market.

Other drivers and restraints analyzed in the detailed report include:

- Mandatory Third-Party Liability Enforcement Intensifying in Emerging African Markets

- Surge in E-commerce Logistics Fueling Commercial Motor Fleet Insurance Demand in South America

- Heightened Parts & Labor Inflation Elevating Claim Severity in Europe

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Comprehensive policies, which cover own damage, theft, and severe weather, are growing at an 11.8% CAGR-significantly above the overall motor insurance market. Drivers embrace wider protection as ADAS and EV components raise average repair bills, while financiers mandate broader covers on leased vehicles. Third-party liability remains foundational, underpinning 40.5% of the 2024 global premium, but its relative share will decline as discretionary add-ons proliferate.

Demand for comprehensive cover is visible in mature markets where the average claim on collision lines rose to USD 5,992 in 2022. Higher deductibles and repair-shop network steering help carriers mitigate severity, yet the motor insurance market size devoted to own damage is forecast to capture more than half of new written premiums by 2028. Regulatory reform in India, lifting liability limits, also nudges customers toward bundled packages, reinforcing momentum.

Agents and brokers still authored 47.4% of global premiums in 2024 due to high-touch consultative selling, especially for fleets and high-value vehicles. However, digital direct channels now grow at 12.6% CAGR, propelled by mobile quoting engines, AI chat, and instant binding. Roughly 47.4% of shoppers used online journeys in 2024, reflecting a structural shift in search behaviors.

Bancassurance retains weight in Latin America and Southeast Asia, where banking relationships drive trust. Yet insurers are accelerating embedded tie-ups with ride-hailing apps, marketplaces, and OEM digital showrooms. These partnerships may account for 20% of personal-auto premiums by 2030, shrinking acquisition costs and reallocating motor insurance market share toward tech-savvy carriers.

The Global Motor Insurance Market is Segmented by Policy Type (Third-Party Liability Insurance, Comprehensive Coverage, and More), Distribution Channel (Insurance Agents/Brokers, Direct Response/Digital, Bancassurance, and More), Vehicle Type (Passenger Cars, Two-Wheelers, and More), Vehicle Age (New Vehicles (< 5 Years) and Used Vehicles (>= 5 Years)), and Region. The Market Forecasts are Provided in Value (USD).

Geography Analysis

North America generated 34.1% of the global premium in 2024, anchored by high per-capita vehicle ownership and strict compulsory insurance statutes. The U.S. segment endured USD 53 billion in underwriting losses during 2022-2023, prompting 14.3% average rate hikes, the highest in 15 years. Profit recovery is expected by 2025 as carriers embed telematics, refined claims automation, and calibrated pricing to mitigate cost inflation. Market leadership remains concentrated, with the top five writers holding 60% of the premium.

Asia-Pacific delivers the fastest 10.4% CAGR through 2030. Expanding middle classes, liberalized motor-tariff regimes, and smartphone penetration fuel telematics adoption. China, Japan, and India headline scale, yet Southeast Asian growth outpace as regulators champion pay-how-you-drive and micro-duration covers. The region will likely exceed 50% of global UBI subscribers by 2025, disrupting legacy pricing pools.

Europe retains deep premium pools, particularly in Germany, the UK, and France. Insurers confront 23% inflation in motor CPI and must factor EV repair complexity and supply-chain friction into loss forecasts. UK premium volume is projected to rise from USD 23.89 billion in 2024 to USD 31.65 billion by 2030 at a 4.8% CAGR. Pan-European carriers accelerate ecosystem partnerships to ensure batteries, chargers, and software LiDAR.

Latin America posts a 3.9% real growth outlook for 2025, supported by open insurance reforms and commercial fleet expansion. Generali's restructuring in Brazil restored profitability, underscoring the appetite for disciplined risk selection and data analytics. Open architecture may cut acquisition costs and diversify choices, enlarging the motor insurance market.

Africa shows latent upside as the enforcement of third-party liability tightens. Mobile money and digital certificates streamline premium collection, promising to narrow the protection gap. South African insurers augment liquidity buffers to weather macro volatility while capturing incremental demand from ride-sharing drivers.

- Allianz SE

- Ping An Insurance

- State Farm Mutual Automobile Insurance Co.

- AXA SA

- Zurich Insurance Group

- Progressive Corporation

- Berkshire Hathaway Inc. (GEICO)

- Tokio Marine Holdings Inc.

- China Pacific Insurance (CPIC)

- PICC Property & Casualty Co. Ltd.

- Assicurazioni Generali S.p.A.

- Liberty Mutual Insurance

- Aviva plc

- Sompo Holdings

- Direct Line Group plc

- Admiral Group plc

- Bajaj Allianz General Insurance

- ICICI Lombard General Insurance

- Intact Financial Corporation

- QBE Insurance Group

- MAPFRE SA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shift toward Usage-Based Insurance Driven by Telematics Adoption in Asia-Pacific

- 4.2.2 OEM-Embedded Insurance Partnerships Accelerating Policy Uptake in North America

- 4.2.3 Mandatory Third-Party Liability Enforcement Intensifying in Emerging African Markets

- 4.2.4 Surge in E-commerce Logistics Fueling Commercial Motor Fleet Insurance Demand in South America

- 4.2.5 Rising EV Penetration Increasing Need for Specialized Battery & Software Coverage in Europe

- 4.2.6 AI-Powered Claims Automation Reducing Loss-Adjustment Expenses Globally

- 4.3 Market Restraints

- 4.3.1 Profitability Squeezed by Social Inflation & Nuclear Jury Awards in U.S. Auto Liability

- 4.3.2 Heightened Parts & Labor Inflation Elevating Claim Severity in Europe

- 4.3.3 Data-Privacy Regulations Restricting Telematics Data Utilization

- 4.3.4 Growing ADAS Penetration Reducing Claim Frequency & Premium Pool

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Policy Type

- 5.1.1 Third-Party Liability Insurance

- 5.1.2 Comprehensive Coverage

- 5.1.3 Collision Coverage

- 5.1.4 Personal Injury Protection

- 5.2 By Distribution Channel

- 5.2.1 Insurance Agents / Brokers

- 5.2.2 Direct Response / Digital

- 5.2.3 Bancassurance

- 5.2.4 Embedded / Platform Partnerships

- 5.2.5 Aggregators & Comparison Portals

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Two-Wheelers

- 5.3.3 Light Commercial Vehicles

- 5.3.4 Medium & Heavy Commercial Vehicles

- 5.4 By Vehicle Age

- 5.4.1 New Vehicles (< 5 Years)

- 5.4.2 Used Vehicles (> 5 Years)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Peru

- 5.5.2.3 Chile

- 5.5.2.4 Argentina

- 5.5.2.5 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.5.3.7 Nordics (Sweden, Norway, Denmark, Finland)

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 South East Asia

- 5.5.4.7 Indonesia

- 5.5.4.8 Rest of Asia-Pacific

- 5.5.5 Middle East & Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle East

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Allianz SE

- 6.4.2 Ping An Insurance

- 6.4.3 State Farm Mutual Automobile Insurance Co.

- 6.4.4 AXA SA

- 6.4.5 Zurich Insurance Group

- 6.4.6 Progressive Corporation

- 6.4.7 Berkshire Hathaway Inc. (GEICO)

- 6.4.8 Tokio Marine Holdings Inc.

- 6.4.9 China Pacific Insurance (CPIC)

- 6.4.10 PICC Property & Casualty Co. Ltd.

- 6.4.11 Assicurazioni Generali S.p.A.

- 6.4.12 Liberty Mutual Insurance

- 6.4.13 Aviva plc

- 6.4.14 Sompo Holdings

- 6.4.15 Direct Line Group plc

- 6.4.16 Admiral Group plc

- 6.4.17 Bajaj Allianz General Insurance

- 6.4.18 ICICI Lombard General Insurance

- 6.4.19 Intact Financial Corporation

- 6.4.20 QBE Insurance Group

- 6.4.21 MAPFRE SA

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment