PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842521

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842521

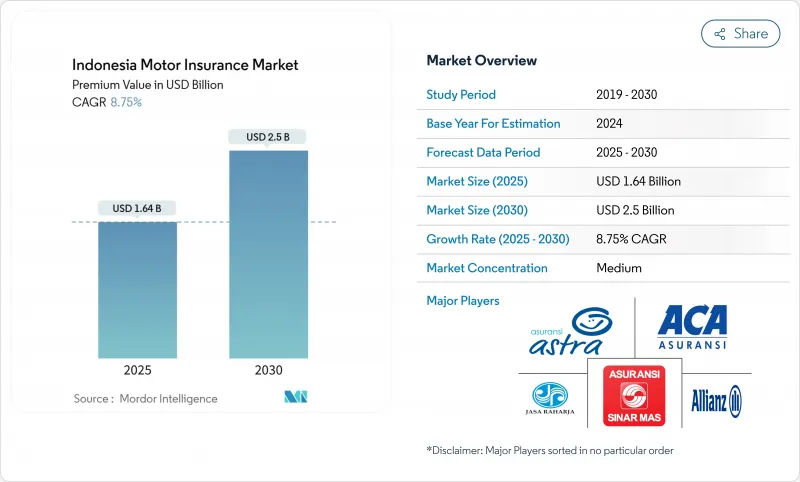

Indonesia Motor Insurance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Indonesia motor insurance market reached USD 1.64 billion in 2025 and is forecast to hit USD 2.50 billion by 2030, expanding at an 8.75% CAGR.

Mandatory third-party liability (TPL) cover is set to draw more than 120 million vehicles into formal protection once delayed, but is still expected within the forecast horizon. Digital distribution is accelerating as insurers adapt to a tech savvy population. At the same time, rising vehicle ownership in Java and Sumatra, the growth of ride-hailing fleets, and a fast growing electric-vehicle parc add fresh premium pools.Moreover, stricter capital regulations, the swift rise of digital-only insurers, and increased tech investments by established players are intensifying competition in Indonesia's motor insurance market. Moving forward, the industry's trajectory hinges on regulatory clarity from the Financial Services Authority and insurers' success in broadening coverage to include uninsured motorcycles and second-hand vehicles, especially in underserved provinces.

Indonesia Motor Insurance Market Trends and Insights

Government Push for Mandatory & Digital Motor Cover in Indonesia

The Financial Services Authority is finalizing rules that will require every motorist to purchase at least TPL cover, creating the single biggest catalyst for the Indonesia motor insurance market. Once enforcement begins, a USD 15.5 annual premium applied to even 75% of the registered fleet would almost double the premium pool, pushing insurers to overhaul distribution and claims workflows to handle mass-market volumes. Larger carriers are beta-testing fully digital onboarding journeys that link police databases, payment gateways, and e-registration certificates, while smaller firms seek white-label platforms to remain compliant. Early pilots in Java confirm strong demand when premiums can be paid in monthly instalments.

Rising Automotive Sales among Middle-Class Consumers in Java & Sumatra

A growing middle class continues to buy cars and motorcycles despite a temporary dip in wholesale deliveries. Astra retained 56% share in car sales and 78% in motorcycles, putting insurers linked to the Astra ecosystem in a favourable underwriting position. New vehicle purchases commonly bundle multi-year comprehensive coverage, prompting higher average premiums than renewals. Banks and multi-finance firms that provide vehicle loans are tightening covenants that require full-risk protection, adding incremental premium inflow. As household disposable income rises outside Jakarta, insurers anticipate fresh demand for add-ons such as personal-accident riders and natural disaster extensions. The Indonesia motor insurance market, therefore, benefits directly from each uptick in showroom traffic and consumer credit disbursements.

High Price-Sensitivity & Policy Lapse Rates in the Motorcycle Segment

Motorcycles dominate Indonesian roads but contribute modestly to premium volume because owners often cancel policies once loan obligations end. Surveys show lapse rates near 30% in rural districts, undermining efforts to broaden the Indonesian motor insurance market. Insurers testing micro-duration policies priced at Rp 500 per day report higher uptake, yet profit margins remain thin. Education campaigns led by industry associations stress post-accident financial risks, but converting awareness into sustained renewals is slow. Without targeted subsidies or embedded cover in fuel or service-station transactions, motorcycles will continue to drag on overall market growth.

Other drivers and restraints analyzed in the detailed report include:

- Ride-Hailing Boom Accelerating Commercial Motor Coverage Demand

- Growth of Usage-Based (Telematics) Policies via Insur-Tech Platforms

- Large Pool of Uninsured Second-Hand Vehicles Outside Java

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The comprehensive class generated 62.0% of the Indonesia motor insurance market size in 2024, reflecting strong demand among higher-income motorists seeking protection against theft, collision, and natural disasters. Premium growth in this class remains stable because vehicle prices, repair costs, and extreme weather risks continue to rise. Yet, regulatory momentum behind mandatory TPL is reshaping product portfolios. Insurers are recalibrating underwriting systems to manage an expected influx of low-ticket policies, while lobbying for actuarially sound tariff bands to remain profitable.

Third-party liability premiums are projected to compound at 19.3% through 2030, well above the overall Indonesia motor insurance market CAGR, once the mandate is fully enforced. Carriers are bundling bodily injury and property damage extensions, anticipating consumer upgrades once compulsory coverage becomes a sunk cost. Collision/own-damage protection retains a niche among middle-income owners who balance cost and risk, but its share is likely to erode as buyers either downshift to basic TPL or step up to all-risk packages. Over time, richer data from centralized accident reporting should allow for more granular pricing, narrowing down loss-ratio gaps across product tiers.

Indonesia Motor Insurance Market is Segmented by Ins pe (Third-Party Liability, Comprehensive, and Collison/Own Damage), Vehicle Type (Passenger Cars, Two Wheelers, Commercial Vehicles and Electric Vehicles), Distribution Channel (Agents/Brokers, Bancassurance, Automotive Dealer, Direct Digital, and Digital Aggregators and Marketplaces), Region. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Asuransi Astra Buana (Garda Oto)

- Zurich Asuransi Indonesia (Adira Insurance)

- PT Jasa Raharja

- Asuransi Central Asia (ACA)

- BCA Insurance

- PT Asuransi Sinarmas

- PT Asuransi Tugu Pratama Indonesia Tbk

- Allianz Utama Indonesia

- AXA Mandiri Financial Services

- Sompo Insurance Indonesia

- MSIG Insurance Indonesia

- PT Asuransi BRI Indonesia (BRINS)

- PT Asuransi Jasaraharja Putera

- Chubb General Insurance Indonesia

- Tokio Marine Indonesia

- PT Mega Insurance

- PT KB Insurance Indonesia

- PT Asuransi Wahana Tata

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government Push for Mandatory & Digital Motor Cover in Indonesia

- 4.2.2 Rising Automotive Sales among Middle-Class Consumers in Java & Sumatra

- 4.2.3 Ride-Hailing Boom Accelerating Commercial Motor Coverage Demand

- 4.2.4 Jakarta Flood Events Fueling Uptake of Comprehensive Add-ons

- 4.2.5 Growth of Usage-Based (Telematics) Policies via Insur-Tech Platforms

- 4.2.6 Expansion of Takaful Motor Insurance Aligned with Halal Finance

- 4.3 Market Restraints

- 4.3.1 High Price-Sensitivity & Policy Lapse Rates in Motorcycle Segment

- 4.3.2 Large Pool of Uninsured Second-hand Vehicles Outside Java

- 4.3.3 Fraudulent Claims & Spare-Part Cost Inflation

- 4.3.4 Absence of Centralised Accident Database Limiting Risk Pricing

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape Impacting the Market

- 4.6 Regulatory or Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD Million)

- 5.1 By Insurance Type

- 5.1.1 Third-Party Liability

- 5.1.2 Comprehensive

- 5.1.3 Collision / Own-Damage

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Two-Wheelers

- 5.2.3 Commercial Vehicles (LCV & HCV)

- 5.2.4 Electric Vehicles

- 5.3 By Distribution Channel

- 5.3.1 Agent / Broker Channel

- 5.3.2 Bancassurance

- 5.3.3 Automotive Dealer-Led

- 5.3.4 Direct Digital (Insurer Web / Mobile)

- 5.3.5 Digital Aggregators & Marketplaces

- 5.4 By Region (Indonesia)

- 5.4.1 Western

- 5.4.2 Central

- 5.4.3 Eastern

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Asuransi Astra Buana (Garda Oto)

- 6.4.2 Zurich Asuransi Indonesia (Adira Insurance)

- 6.4.3 PT Jasa Raharja

- 6.4.4 Asuransi Central Asia (ACA)

- 6.4.5 BCA Insurance

- 6.4.6 PT Asuransi Sinarmas

- 6.4.7 PT Asuransi Tugu Pratama Indonesia Tbk

- 6.4.8 Allianz Utama Indonesia

- 6.4.9 AXA Mandiri Financial Services

- 6.4.10 Sompo Insurance Indonesia

- 6.4.11 MSIG Insurance Indonesia

- 6.4.12 PT Asuransi BRI Indonesia (BRINS)

- 6.4.13 PT Asuransi Jasaraharja Putera

- 6.4.14 Chubb General Insurance Indonesia

- 6.4.15 Tokio Marine Indonesia

- 6.4.16 PT Mega Insurance

- 6.4.17 PT KB Insurance Indonesia

- 6.4.18 PT Asuransi Wahana Tata

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment