PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842509

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842509

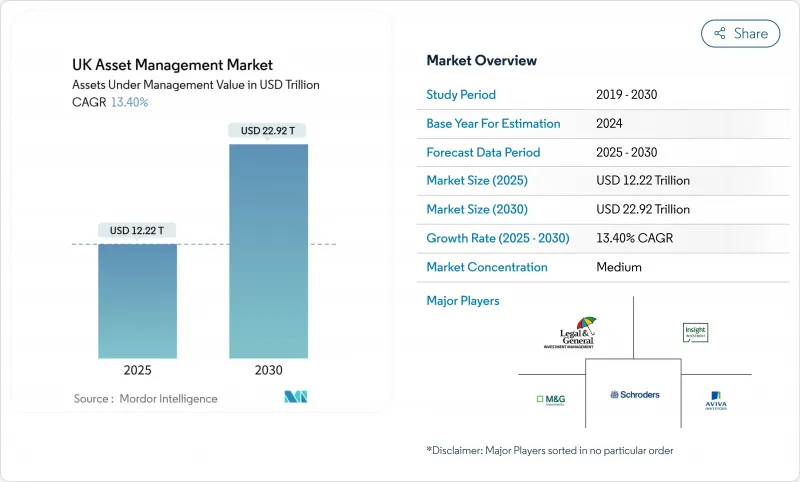

UK Asset Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The UK Asset Management market reached USD 12.22 trillion in 2025 and is forecast to expand to USD 22.92 trillion by 2030, advancing at a 13.40% CAGR.

Growth reflects renewed overseas mandate inflows, steady domestic pension contributions, and an active pipeline of new fund structures under the Long-Term Asset Fund (LTAF) regime. Institutional investors are allocating more to private credit, infrastructure, and unlisted equity, while retail clients gravitate toward digital-first platforms and fractional ownership options. The Financial Conduct Authority's five-year strategy and its Digital Securities Sandbox are accelerating tokenized fund pilots, improving cost efficiency and settlement speed. Fee compression in exchange-traded products continues, but managers with scale or specialist expertise are preserving margins through operating leverage, data analytics, and differentiated service models. Consolidation and selective acquisitions remain prevalent as firms seek talent, alternative capabilities, and technology.

UK Asset Management Market Trends and Insights

Overseas mandates exceed 49% of AuM

Overseas clients now account for nearly half of total UK-managed assets, underscoring the export strength of the UK Asset Management market. International sovereign wealth funds favor UK managers for fixed-income and alternative strategies, taking advantage of the UK's time-zone bridge and robust legal protections. Multinational managers continue to expand distribution hubs in London to secure passport-free access to global capital pools. This steady foreign demand boosts fee-earning assets, diversifies revenue streams, and reinforces the UK's role as Europe's largest cross-border servicing center.

Rapid private markets allocations

The Mansion House Compact encourages pension providers to commit at least 5% of default defined contribution (DC) assets to unlisted equity by 2030, fueling sustained demand for private equity, infrastructure, and private credit. Schroders, Aviva, and Legal & General have introduced multi-asset LTAFs designed for DC schemes, marrying yield potential with long-duration liabilities. As normalized interest rates widen illiquidity premia, institutional investors target the double-digit return profiles offered by private assets. Managers with origination networks and specialist risk controls benefit most from this strategic reallocation.

Fee compression in passive channels

Active managers face shrinking headline fees as exchange-traded funds gain ground and model portfolios scale. Managers without differentiated alpha capabilities or distribution scale are consolidating, exiting sub-scale funds, or partnering to share fixed costs. Operational efficiency programs, automation of middle-office tasks, and data analytics deployments are essential to sustain profitability.

Other drivers and restraints analyzed in the detailed report include:

- Digital-first retail investing

- Accelerating ESG / SDR-labelled fund inflows

- Gilt market volatility and LDI liquidity risk

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Equity remained dominant at 41.5% share of the UK Asset Management market in 2024, but equity's relative weight will gradually decrease as private credit and infrastructure allocations deepen. Strong interest-rate support for private credit and accelerating deal pipelines in energy transition projects widen the return dispersion advantage over public markets. Multi-asset strategies combining listed infrastructure, renewable debt, and unlisted equity suit trustees' risk budgets while maintaining daily-priced liquidity buckets. Managers continue to broaden origination channels, forge co-investment clubs, and adopt distributed-ledger issuance to cut settlement cycles, giving early adopters a structural cost edge. Alternative Assets are projected to grow at a 15.45% CAGR, elevating their slice of the UK Asset Management market share as institutional and DC schemes hunt for illiquidity premia.

Banks held 39.9% of the 2024 UK Asset Management market share, benefiting from integrated distribution and captive balance-sheet co-investments. However, wealth advisory firms are recording the fastest 14.91% CAGR as they capitalize on holistic planning needs, generational wealth transfers, and transparent fee models.

Advisory boutiques employ hybrid human-digital workflows, combining algorithmic portfolio construction with adviser oversight. Banks are enhancing in-house advisory arms, launching digital "guided advice" under restricted architectures, and co-creating multi-asset LTAFs with insurers. Broker-dealers remain relevant in specialist trading and structured notes but face elevated capital charges and are pivoting toward outsourcing back-office functions to focus on client origination and execution alpha.

The UK Asset Management Market is Segmented by Asset Class (Equity, Fixed Income, Alternative Assets, and Other Asset Classes), by Firm Type (Broker-Dealers, Banks, Wealth Advisory Firms, and Other Firm Types), by Mode of Advisory (Human Advisory and Robo-Advisory), by Client Type (Retail and Institutional), and by Management Source (Offshore and Onshore). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Legal & General Investment Management

- Insight Investment

- Schroders

- Aviva Investors

- M&G Investments

- UBS Asset Management UK

- BlackRock UK

- abrdn (Aberdeen Standard)

- State Street Global Advisors UK

- J.P. Morgan Asset Management UK

- Baillie Gifford

- Fidelity International

- HSBC Asset Management

- Columbia Threadneedle

- Invesco UK

- Vanguard Asset Services UK

- Royal London Asset Management

- Goldman Sachs Asset Management UK

- Impax Asset Management

- Jupiter Asset Management

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Overseas mandates now represent a significant portion of UK-managed AuM

- 4.2.2 Rise of private markets & alternatives allocations

- 4.2.3 Digital-first retail investing & fractional shares

- 4.2.4 Accelerating ESG / SDR-labelled fund inflows

- 4.2.5 Tokenised fund structures gaining FCA sandbox slots

- 4.2.6 LTAF regime unlocking DC access to illiquids

- 4.3 Market Restraints

- 4.3.1 Fee compression in passive & model-portfolio channels

- 4.3.2 Post-Brexit regulatory divergence/friction costs

- 4.3.3 Talent drain from rapid M&A consolidation waves

- 4.3.4 Gilt-market volatility exposing LDI liquidity risks

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Asset Class

- 5.1.1 Equity

- 5.1.2 Fixed Income

- 5.1.3 Alternative Assets

- 5.1.4 Other Asset Classes

- 5.2 By Firm Type

- 5.2.1 Broker-Dealers

- 5.2.2 Banks

- 5.2.3 Wealth Advisory Firms

- 5.2.4 Other Firm Types

- 5.3 By Mode of Advisory

- 5.3.1 Human Advisory

- 5.3.2 Robo-Advisory

- 5.4 By Client Type

- 5.4.1 Retail

- 5.4.2 Institutional

- 5.5 By Management Source

- 5.5.1 Offshore

- 5.5.2 Onshore

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for Key Companies, Products & Services, and Recent Developments)

- 6.4.1 Legal & General Investment Management

- 6.4.2 Insight Investment

- 6.4.3 Schroders

- 6.4.4 Aviva Investors

- 6.4.5 M&G Investments

- 6.4.6 UBS Asset Management UK

- 6.4.7 BlackRock UK

- 6.4.8 abrdn (Aberdeen Standard)

- 6.4.9 State Street Global Advisors UK

- 6.4.10 J.P. Morgan Asset Management UK

- 6.4.11 Baillie Gifford

- 6.4.12 Fidelity International

- 6.4.13 HSBC Asset Management

- 6.4.14 Columbia Threadneedle

- 6.4.15 Invesco UK

- 6.4.16 Vanguard Asset Services UK

- 6.4.17 Royal London Asset Management

- 6.4.18 Goldman Sachs Asset Management UK

- 6.4.19 Impax Asset Management

- 6.4.20 Jupiter Asset Management

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment